7 Best-Performing Cheap Stocks This Month

Good cheap stocks do exist, you just need to know how to find them — and that’s exactly what stock screeners are for.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

It's always good to get a bargain, and these stocks certainly are. And while there are some serious risks that come with buying penny stocks, finding good cheap stocks is possible if you know how to look for them.

What is a "cheap" stock, anyways?

By definition, a cheap stock would be one with a low share price. But the amount of money you pay to buy the stock may not reflect its actual value. Another way to describe cheap stocks is with the term "undervalued." For example, an undervalued company may have strong financial fundamentals in place, but perhaps the market hasn't yet caught on, and the current price of the stock doesn't accurately reflect the true, potentially higher value of the company.

In other words, undervalued stocks offer good value for the money, not just a low share price. (You can see our list of the best undervalued stocks here.)

There’s a quick way to begin searching for these stocks, and it’s available at many brokerages: a stock screener. It’ll help you sort stocks by any criteria that you think are important, so you can focus on the most likely candidates for further research.

» Learn more: How to research stocks

The best-performing cheap stocks

If you're just looking for low-priced stocks, the following list shows stocks listed in the S&P 500, Dow Jones Industrial Average, Nasdaq or Russell 2000, priced between $5 and $10, ranked by which stocks have seen the biggest jumps in the last year.

The best-performing cheap stock from the past year is United States Antimony Corp (UAMY), which is up 572.46%. | ||

|---|---|---|

Ticker | Company | Performance (Year) |

UAMY | United States Antimony Corp | 572.46% |

CRML | Critical Metals Corp | 408.90% |

TE | T1 Energy Inc | 284.31% |

NVTS | Navitas Semiconductor Corp | 248.77% |

MASS | 908 Devices Inc | 233.33% |

NUVB | Nuvation Bio Inc | 194.42% |

IBRX | ImmunityBio Inc | 192.71% |

Source: Finviz. Stock data is current as of March 2, 2026, and is intended for informational purposes only. | ||

Brokerage firms | |

|---|---|

How to find cheap stocks

Investing in individual stocks requires a lot of work, and finding candidates is just the start of the process. You’ll also need to:

Understand the various types of stocks.

Investigate the company and its management.

Research the industry.

Evaluate the financials, such as the balance sheet and income statement.

Follow the company’s quarterly reports.

That’s just the minimum that you need to do. So if this isn’t how you want to spend your evenings and weekends, consider buying an index fund instead. Index funds invest in lots of companies at once, making it so you don't have to know the exact details of every company.

However, if you want to try to make individual stocks a potentially lucrative hobby, here’s your guide.

Brokerage firms | |

|---|---|

1. Choose a stock screener

First, find a stock screener. Most online stockbrokers have them (you'll need a brokerage account to invest in stocks anyway, so it's worth opening one). Financial sites such as Yahoo Finance have stock screeners too.

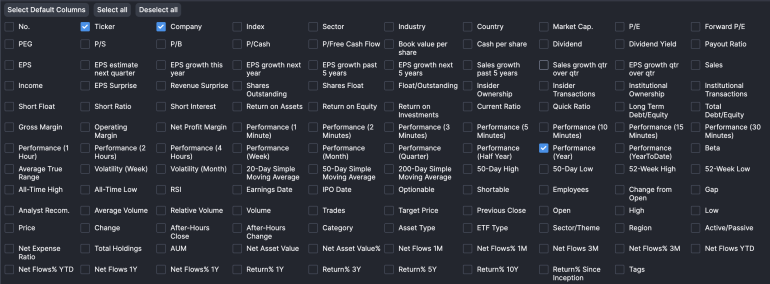

The screener allows you to sort by almost any characteristic you can imagine. You can input traits that you want your results to have, such as annual sales growth above a certain level, say 10%.

Growth rates and value are relatively basic criteria, so the example in this article will screen for stocks on these dimensions. Better screeners will offer more criteria and more customization. Here's what that might look like:

Example of a stock screener in FinViz.

2. Set a target for future earnings growth rate

You can define good companies in many ways, but a typical method is to look at how fast the company is growing. Quick-growing companies tend to be valued more highly by investors, so they’re an attractive place to begin your search for good companies.

On the screener, sort stocks by their future earnings growth rate. A good place to start may be around 10% annually over the next five years; then, try increasing this to 15% or even 20% to see what's available. Earnings growth above 20% is very high.

If the screener doesn’t display future earnings growth, then sort by sales growth. Again, search for companies growing sales (also called revenue) at your preferred growth rate. And if the screener doesn’t have future earnings projections, look in the rearview mirror: find earnings or sales growth for the past five years instead.

3. Use the P/E ratio to find potentially undervalued stocks

Now that you have a list of fast-growing companies, you can add an additional consideration: price.

You'll want to look for inexpensive companies, meaning undervalued stocks and not just stocks with a low share price. There are plenty of stocks that offer a low share price, but in many cases, you may be getting what you paid for.

To evaluate a stock’s value, investors will often divide the current price of one of its shares by its annual earnings per share. The resulting number is called the price-earnings ratio, or P/E ratio.

The lower the P/E, the cheaper the company is. For example, investors might be willing to buy Meta stock at a P/E of 15 this year, while they paid a P/E of 30 last year.

Most screeners can display companies' current P/E ratios so you can compare them alongside other factors.

4. Focus on market cap to screen out risky companies

At this point, you should be left with companies that are relatively cheap and that financial analysts think will grow earnings well into the future.

If you end up with more companies than you need, set the minimum size of the company, as measured by its market capitalization, to avoid some of the smaller, riskier stocks. In general, the smaller the market cap, the riskier the company. Large caps, on the other hand, are companies valued over $10 billion.

If your list is still too long, consider adding a few more criteria:

Increase the minimum growth rate. Try 15% growth instead of 10%, for example.

Narrow down to stocks trading near their 52-week low point, to ferret out those that the market has soured on (for now).

Include only companies that pay dividends, which is often a sign of strong financial health.

5. Research the stocks

Now, with your narrowed list, it's time to research the stocks. For each you consider, you’ll want to figure out:

If this is such an attractive high-growth stock, why does it look cheap?

What does the company do? And does the industry have a future?

How is the management, and is it aligned with shareholders?

How do the company’s balance sheet and other financials appear?

Answering these fundamental questions is a big task, especially if you’re aiming to have a well-diversified portfolio. Plus, after you’ve purchased your stocks, you’ll want to keep up with the companies by analyzing at least the quarterly earnings reports.

If you’re looking to dig into investing in stocks, open an account with a broker that provides good screening and research, including the work of professional analysts that can help you get started.