S-Corp vs. C-Corp: How They Differ (and How to Choose)

S-corps and C-corps have very different pros and cons when it comes to taxes, formation and who the owners are.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

S-corp vs. C-corp

The main difference between an S-corp vs. C-corp is how they're formed, how they're taxed and their ownership restrictions. A C-corp is subject to corporate tax rates and has no restrictions on ownership. An S-corp is a pass-through entity that reports its profits on the owners' personal taxes, and ownership is restricted to up to 100 shareholders.

If you structure your business as a corporation, you’ll face an important decision: whether to set up an S-corp vs. a C-corp. This choice has big implications for how much you’ll pay in taxes, your ability to raise money and how easily you can expand your business.

This guide explains the differences between an S-corp vs. a C-Corp, the pros and cons of each of these entity types and how you can decide which is right for your business.

Complete your LLC Starting at $0 + State FeesFast 1-Day Processing + 1 Year FREE ComplianceStart now on ZenBusiness' website |

S-corp vs. C-corp, summarized

S-Corp | C-Corp | |

|---|---|---|

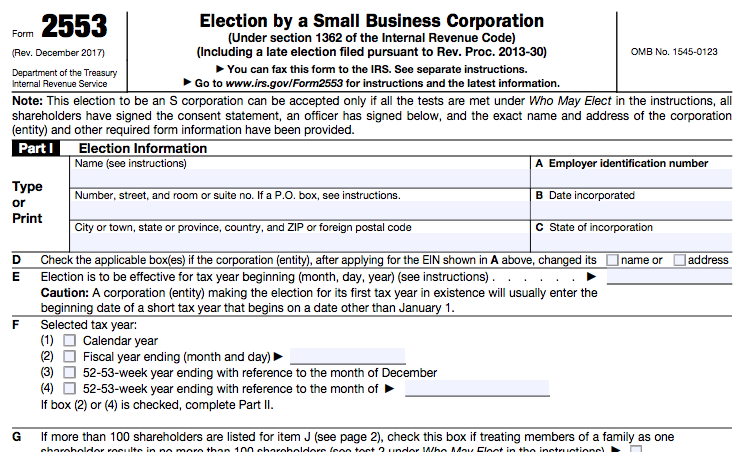

Formation | Elect by filing IRS Form 2553. | Default type of corporation. |

Taxes | Personal income tax on profits (pass-through taxation). | Corporate tax plus personal income tax on dividends. |

Raising Capital | Harder to raise venture capital. | Better for raising venture capital. |

Number of Shareholders and Stock Classes | 100 or fewer shareholders, one class of stock. | Unlimited shareholders, multiple classes of stock. |

Type of Shareholders | Shareholders must be U.S. citizens or residents. | U.S.-based and foreign shareholders okay. |

What are the differences between an S-corp vs. C-corp?

The differences between S-corporations and C-corporations fall into three major categories: formation, taxation and ownership.

Generally, taxes are the biggest and most important difference between S-corps and C-corps. C-corps are subject to corporate tax rates; S-corps allow for pass-through taxation, meaning owners report the business profits and losses on their personal income tax returns.

1. Formation

The most basic difference between S-corporations and C-corporations is formation.

C-corp formation

The C-corp is the default type of corporation. When you file articles of incorporation with your secretary of state to register your business as a corporation, your company will become a standard C-corp.

S-corp formation

To structure your company as an S-corp for federal tax purposes, file IRS Form 2553 (shown below). You might have to file additional forms at the state level to be treated as an S-corp for state taxes.

Whether you structure your company as an S-corp or C-corp, you'll need to file articles of incorporation, appoint a registered agent and create corporate bylaws. For more information, check out our step-by-step guide on how to incorporate.

Complete Your LLC Starting at $0 + State Fees

Fast 1-Day Processing + 1 Year FREE Compliancevia Zenbusiness

2. Taxation

Taxation is the biggie when comparing an S-corp vs. a C-corp. Many business owners structure their companies as S-corps to save money on taxes.

C-corp taxation

C-corps are subject to “double taxation.” First, the C-corp pays taxes on its profits when it files its corporate income tax return (Form 1120). Then, the C-corp owners may pay taxes on those profits again on their personal income tax returns if the corporation distributes those profits to shareholders in the form of dividends.

The only way to avoid double taxation is to not make any profits (i.e. operate at a loss) or reinvest profits back into the business instead of paying dividends. Wages and salaries, including owner salaries, are generally tax-deductible expenses. However, the IRS can "re-label" excessive salaries as taxable dividends.

S-corp taxation

Paying taxes as an S-corp is a bit different. An S-corp is a pass-through entity for tax purposes, which means shareholders report their share of the business’ income and losses on their personal tax returns by filing Form 1120S. Owners pay taxes at their personal income tax rate.

Additionally, owners of S-corporations and other pass-through entities (like LLCs, sole proprietorships, and partnerships) may be able to deduct up to 20% of qualified business income from their personal tax returns. Businesses in specific service trades or professions, such as consulting, medicine or law may face limits on the deduction at high income levels.

Be sure to consult a qualified lawyer or tax pro to determine how an S-corp could affect your taxes.

S-corp vs. C-corp tax example

Let's look at another example to understand what business taxes may look like for S-corps vs. C-corps.

Suppose your business, a C-corp, has a taxable income of $100,000. A C-corp would first pay the corporate income tax rate (21%, for example). If the remainder is paid out as a dividend, it may be subject to a dividend tax rate, which may be about 15%.

In contrast, an S-corp's taxable income of $100,000 would be reported on the owner's personal income tax return. The tax bill would depend on the owner's other tax deductions and tax credits, as well as their tax bracket.

An S-corp may save owners money on taxes, though that isn't always the case. Certain types of business-level tax deductions, such as charitable donations and fringe benefits, are fully deductible only for a C-corporation. A qualified accountant or business attorney can help you figure out the structure friendliest to your bottom line.

3. Ownership

The last major difference between S-corp vs. C-corp structures is the ownership restriction. C-corporations are more flexible if you’re looking to expand or sell your business.

C-corp ownership

C-corporations have no restrictions on ownership. You can have an unlimited number of shareholders, as well as different classes of shareholders.

Venture capital firms and angel investors prefer to hold preferred stock, which is only an option for C-corps. This makes it much more difficult to fundraise as an S-corp.

Additionally, if you plan to sell your business or spin-off a subsidiary, a C-corp could be a better choice. A C-corp can't own an S-corp; other S-corps, LLCs, general partnerships, or most trusts also can't own S-corps. On the other hand, other corporations, LLCs, or trusts can own C-corps.

S-corp ownership

S-corporations can have only up to 100 shareholders. Shareholders of an S-corp must be United States citizens or resident aliens; C-corps are open to foreign investors.

S-corporations are limited to one class of stock, meaning that there’s only one kind of shareholder. There’s no hierarchy or difference between shareholders of the business, which makes fundraising harder.

What are the similarities between S-corps vs. C-corps?

S-corps and C-corps are similar in a number of ways.

Limited liability protection: Both S-corps and C-corps are legally separate from their owners, meaning their shareholders have limited liability protection. Put simply, this means shareholders are not personally liable for the business's debts or obligations. This is a major selling point of a corporation.

Incorporation: You'll need to complete the proper incorporation documents, file articles of incorporation, appoint a registered agent and create corporate bylaws.

Structure: Although the shareholders of an S-corporation or C-corporation own the business, they don’t make most of the decisions. Management and policy issues are left to the company’s shareholder-elected board of directors. And the normal, day-to-day work of running the business is on the officers of the corporation—like the CEO, COO, and CTO.

Compliance: Both S-corps and C-corps have to meet certain documentation and compliance obligations—such as issuing stock, paying fees and holding shareholder and director meetings.

How to decide between S-corporation vs. C-corporation

Many small business owners opt for S-corp status to save money on taxes. But, if you're planning to raise investor money in the future or have plans to grow into a very large company, a C-corp might be the better option.

Here's another look at the advantages and disadvantages of S-corporations vs. C-corporations.

Advantages of an S-corp

Pass-through taxation: S-corp taxation is undoubtedly its biggest benefit. S-corps don’t have to pay taxes on the business’s income twice. Avoiding double taxation is a huge benefit for smaller businesses.

Deduction of business income: Current law allows owners of most S-corps and other pass-through entities to deduct some of their business income on their personal tax returns. This business tax deduction can significantly reduce your tax burden.

Tax filing requirements: S-corp owners can write off losses on their individual tax returns. This is a benefit for newer corporations that are likely operating at a loss for the first few years.

Advantages of a C-corp

Easier to form: The C-corp is the default type of corporation, so there's no additional paperwork to fill out.

Fringe benefits: C-corporations can deduct fringe benefits to employees, such as disability and health insurance. Shareholders of a C-corporation don’t pay taxes on their fringe benefits, as long as 70% of the corporation receives those same fringe benefits.

Charitable donations: C-corporations are the only type of business entity that can deduct 100% of charitable contributions. The donations can't exceed 10% of the business's total income.

Easier to raise money: It’s easier to raise money for your business if it’s a C-corp because C-corps can issue multiple classes of stock to an unlimited number of shareholders. Plus, investors face no liability for the corporation’s mistakes. Other businesses can own C-corps outright, which might be a better fit for companies looking to be acquired.

No shareholder limit: C-corps can have as many shareholders as they want. Also, C-corps can have foreign (nonresident alien) shareholders, making it an ideal business entity for any company that intends to deal overseas.

Disadvantages of an S-corp

Harder to form: You have to file Form 2553 with the IRS and possibly additional state paperwork to elect S-corp status. You also have to make sure you stay within any restrictions (e.g. such as the 100 shareholders limit) to maintain S-corp status and avoid penalties.

Limited ownership: S-corps cap the number of shareholders they can take on—up to 100 shareholders. Plus, shareholders have to be legal residents of the United States. This poses a problem for high-growth businesses or businesses looking to conduct business affairs internationally.

Limited stock flexibility: S-corps prevent issuing preferred stock and different classes of stock, which can make it harder to raise money from investors and incentivize early owners.

Tax qualifications: In general, S-corps tend to get more IRS scrutiny. If you make a mistake (like going over 100 shares or missing a filing deadline), the IRS can terminate your S-corp status—and you’ll be taxed as a C-corp.

Disadvantages of a C-Corp

Double taxation: C-corps might pay more in taxes due to double taxation. The company’s revenue is taxed at the corporate level and then again at the personal level if it’s distributed as dividends.

No personal write-offs: Owners can’t write off business losses on their personal income taxes.

If you're unsure of what's best for your business—and what the further implications of any entity type might entail—it might be useful to consult a business attorney or online legal service to help you make the right decision.

How to set up your business as an S-corp or C-corp

Ultimately, the steps vary a bit depending on what state your business operates in. In most cases, you'll begin by choosing a name for your business and filing articles of incorporation. You'll also have to draft corporate bylaws, hold your first board of directors meeting and issue stock certificates to your shareholders.

Online legal services such as LegalZoom and IncFile make it fast and easy to file incorporation documents if you're doing things yourself. But ideally, you should hire a lawyer to help you set up your corporation.

How to elect S-corporation status

As we've mentioned, becoming an S-corp takes one more step after setting up a C-corp. New businesses should file Form 2553 with the IRS within 75 days of the company's formation date. If you're an existing business that has switched over to S-corp status, then you should file your form no later than March 21.

Some states also require you to file additional paperwork to elect S-corp status.

Once you elect S-corp status, it's certainly possible to go back to a C-corp. However, doing so can have important tax consequences, so make sure to consult your accountant or a tax attorney first.

The bottom line

Now that you know the differences between an S-corp vs. C-corp, plus their advantages and disadvantages, you’re well equipped to make a smart choice for your business. S-corps allow many small businesses to save money on taxes, but C-corps give you more options to expand and raise money.

This being said, before finally settling on a S-corp or C-corp structure, you may also want to consider other types of business entities. In particular, LLCs are a very small business-friendly type of ownership structure. LLCs offer limited liability and less burdensome paperwork and regulatory requirements than corporations.

The way you structure your business is a big decision and has big implications for your business’s future. If you don’t feel sure about choosing your business entity or correctly structuring your company, consider talking to a small business lawyer or accountant.

This article originally appeared on Fundera, a subsidiary of NerdWallet.