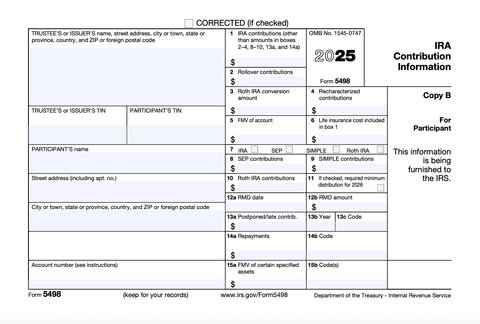

What Is Form 5498: IRA Contribution Information?

Form 5498 documents individual retirement account (IRA) contributions, rollovers and distributions. You don’t need to fill it out or send it to the IRS — just keep it for your records.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Form 5498 is an annual report of your IRA activities (e.g. contributions, RMDs, etc.).

Anyone who contributed to an IRA will get one in the mail, generally between January and mid-June.

You should keep the form in case of an audit or to report your contributions, but there’s no action required on your part.

If you contribute to an individual retirement account (IRA), there’s a tax form you should get familiar with — Form 5498. In simple terms, it’s a record of your IRA activities over the last year.

Form 5498 is typically issued to anyone who has contributed to an IRA, but you generally won’t have to do anything with it once you receive it.

What is Form 5498?

Form 5498 (formally called "Form 5498: IRA Contribution Information") is a document that reports the fair market value of an IRA, along with any changes to that IRA, including contributions, required minimum distributions (RMDs), Roth IRA conversions and rollovers.

As an IRA holder, you are not required to file a Form 5498 with the IRS — your IRA custodian (e.g., Vanguard or Fidelity) does. You simply receive a copy for your own records.

» Learn more: See the rules on required minimum distributions (RMDs)

on Priority Tax Relief's website

on Alleviate Tax's website

Who gets one?

Anyone who owns an IRA should get a Form 5498 each year for each IRA they own. Form 5498 covers information related to traditional and Roth IRAs, SEP IRAs and SIMPLE IRAs.

When is Form 5498 issued?

Because it's possible to contribute to an IRA for the previous tax year until the mid-April tax filing deadline, IRA custodians typically have until the end of May to file Forms 5498.

What do you do with a 5498 tax form?

You don’t need to fill anything out on Form 5498, nor do you need to send it to the IRS — your IRA custodian has already done that for you. Form 5498 is provided to you purely on a “for your information” basis.

That said, like any tax form, it’s worth keeping any Form 5498s you receive in a safe place for several reasons:

It’s good to keep tax forms in case of an audit. In particular, maintain a paper trail for big deductions such as traditional IRA contributions. If, for whatever reason, the IRS questions traditional IRA contributions you deducted in years past, Form 5498 can serve as third-party documentation of those contributions.

Form 5498 may be helpful for properly reporting your IRA contributions on your Form 1040 (individual income tax return). Traditional IRA contributions are an important deduction for many taxpayers, and Form 5498 shows you the amount of traditional contributions that the IRS is expecting you to report for a specific account and tax year. Using it can help you avoid mistakes when adding up the total amount of IRA contributions you can deduct. (Overcontributed? How to fix excess IRA contributions.)

Form 5498 may be useful for putting together a financial plan. Good financial planning means staying within your budget while also preparing for your retirement goals. If you're meeting with a financial planner and making or updating your plan, Form 5498 may provide useful documentation on how much and how frequently you're contributing to your IRA.

Box 3 of Form 5498 can help you stay on top of tax liability from a Roth IRA conversion. If you previously contributed money to a traditional IRA, deducted those contributions, and then converted that traditional IRA to a Roth IRA, you now owe taxes on that money. The “Roth IRA Conversion Amount” box of Form 5498 can help you fill out Form 8606 (Nondeductible IRAs), which tells you how much taxable income your Roth IRA conversion generated.

» Curious about Roth accounts? Shop for some of the best Roth IRA accounts

on Priority Tax Relief's website

on Alleviate Tax's website