IRS Data: Refunds Lag as Agency, Tax Filers Slow Down

Prepare your taxes now. If you owe, you can put off filing, but if you have a refund, it's wise to get in line now.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

April 15 has come and gone, and without any last-minute scrambling to file federal tax returns. On March 21, in an unprecedented move, the IRS extended the income tax filing deadline to July 15, in light of the coronavirus pandemic and the resulting national emergency.

In the first two months of filing season, Americans were filing their federal tax returns at much the same rate as they had in 2019. And the IRS was processing those returns at about the same rate, too. That changed, and dramatically, the week the extension was announced amid a wave of changes that radically altered life nationwide.

During the week ending March 27, the IRS received 27% fewer returns, processed 33% fewer, and issued 18% fewer refunds than in the corresponding week of the 2019 filing season.

5.0

NerdWallet rating- Federal: $79 to $139. Free version available for Simple Form 1040 returns only.

- State: $0 to $69 per state.

- Expert help or full service filing is available with an upgrade to Live packages for a fee.

The IRS publishes cumulative filing statistics each week of filing season, comparing current year statistics with the comparable week in the previous year. Using these cumulative numbers, we determined weekly filing, processing and refund numbers for the 2020 filing season as they compare with corresponding weeks during the 2019 season.

Unfiled returns could include refunds

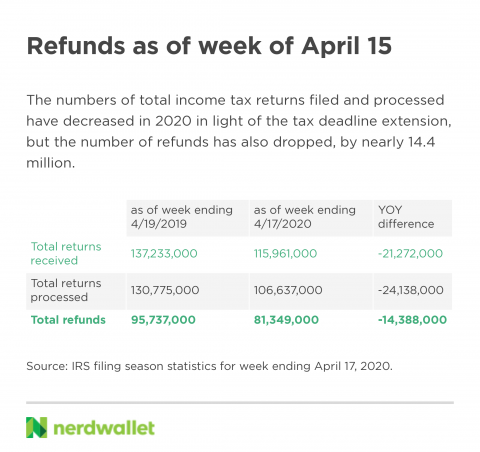

It’s fairly safe to say that people expecting income tax refunds are more eager to file than those anticipating a tax bill. But by the end of the week including the regular tax deadline, the IRS had processed roughly 14 million fewer refunds in 2020 than in 2019.

A portion of these missing refunds could be languishing at the IRS — on April 10 the agency announced it would be “unable to process” paper returns. Mailed-in paper returns accounted for 9% of 2018 returns filed as of November 2019. And some variance in tax refund volume is expected from year to year. But some taxpayers may be taking advantage of the postponed deadline without realizing they’re due a refund.

What it means for consumers: Whether you expect a refund, a tax bill, or aren’t sure at all what to expect, preparing your return now can help you plan for the coming months. If you find you owe, you have until July 15 to file; that gives you time to make a plan for how to pay. If you overpaid and are due a refund, e-file your return as soon as possible — waiting to file will only delay your refund further. You can check your refund’s status online once the IRS has received your return, but the agency’s customer service phone lines are not currently staffed.

IRS lagging compared to 2019

Despite far fewer returns total being filed by the week ending April 17, the IRS isn’t able to keep pace. The agency had processed 92% of the returns received by that week, compared with 95% of those received by April 19, 2019. Three percentage points may seem like a small spread, but that’s about 106.6 million returns processed by April 17, 2020, compared to 130.8 million by April 19, 2019.

IRS.gov traffic exploded with 'Get My Payment' tool

On March 27, 2020, the CARES Act was signed into law. It provided, among other things, that coronavirus relief called economic impact payments would be direct-deposited for taxpayers who already had shared bank account information with the IRS. For the millions of Americans who don’t typically file a tax return or for those who hadn’t received a refund in 2018 or 2019, IRS.gov became a destination for information.

On April 10, the IRS launched a tool to allow nonfilers to input their payment information. Data from these IRS.gov transactions is tracked as “returns” in week 12 filing data in the charts above. Then, on April 15, the agency launched its “Get My Payment” tool, allowing Americans to track their coronavirus relief payments. That week, ending April 17, weekly traffic to the IRS.gov site grew nearly five times, from 54.5 million to 257.8 million.

Finding financial help beyond the IRS

For many Americans, an economic impact payment or tax refund could be a lifeline, helping to cover household expenses or giving them an emergency cushion.

Consumers can find help dealing with these turbulent economic times from other sources, as well. Many mortgage lenders, credit card issuers and other financial institutions are offering relief options.

Tapping your emergency fund can help you manage finances in a crisis, but many Americans don’t have one or have drawn it down. If your budget won’t stretch to cover everything, be strategic about which bills you pay.