3 Easy Ways to Increase Your Annual Vacation Budget

Save and make a little cash here and there so you can set more aside for yearly travel.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Having an annual vacation budget is a helpful way to know how much you can spend on trips and travel every year.

If you would like to increase the amount of money you have available for vacations, this guide offers tips on creating a budget and three steps you can take to boost your vacation kitty.

Pre-work: Create a budget

Before you can begin to think about ways to increase your annual vacation budget, you first need to know your current budget. To do this, you'll need to make a list of your annual income and expenses.

If you don't regularly keep track of your spending, you can estimate how much you'd spend in a year by tracking your expenses for a month and then multiplying that result by 12.

Below is an example of what your budget could look like:

After-tax income: $4,500/month or $54,000/year.

Expenses:

Item | Budget amount |

Rent | $1,400/month. |

Food | $600/month. |

Retirement | $500/month. |

Savings | $450/month. |

Cell phone | $50/month. |

Gym | $45/month. |

Entertainment | $400/month. |

Transportation | $450/month. |

Clothes | $120/month. |

Miscellaneous | $250/month. |

Total | $4,265/month or $51,180/year. |

Two important notes on the above budget: First, we'd recommend using after-tax income when creating your budget, as this is the money you'll have available to spend. Second, you should ensure you have emergency savings, covering at least three to six months of expenses, before increasing your annual vacation budget.

Based on the above example, with an after-tax income of $54,000/year and expenses of $51,180/year, you'd have a total of $2,820 that you could potentially use as your vacation budget. Now that you know your vacation budget, you can take steps to increase it.

» Learn more: How to save for a vacation

How to increase your annual vacation budget

1. Cut back on some discretionary expenses

No, we're not going to tell you to cut back on avocado toast to increase your vacation budget — but we are going to suggest cutting back on avocado toast (or another expense) if it's not something that you genuinely love.

Think about what brings you the most joy in your current budget and what brings you the least, then try to cut back on the latter.

For instance, if you're a fashionista who treasures an after-work gym session, you likely will not want to touch your $120/month clothing expense or $45/month gym membership. But if you're just as happy eating in as going out to restaurants, you could easily scale back your monthly food budget and use the additional cash you'll save for travel.

2. Increase your income with outside work

A surefire way to increase your vacation budget is increasing your income with outside work. While we recognize this option isn't feasible for everyone, outside work can help you earn extra cash for vacations.

Although the side job you take on will depend on your skills and interests, below are some examples that could help increase your vacation budget:

Freelance editing and copywriting.

Neighborhood dog walking.

Photography for local events.

Website design.

To find this kind of work, you can use freelance search sites like Fiverr or Upwork to find clients or let friends and your professional network know that you're available to take on side projects.

» Learn more: There's just one trick to traveling cheaply: flexibility

3. Use websites to get money back on everyday purchases

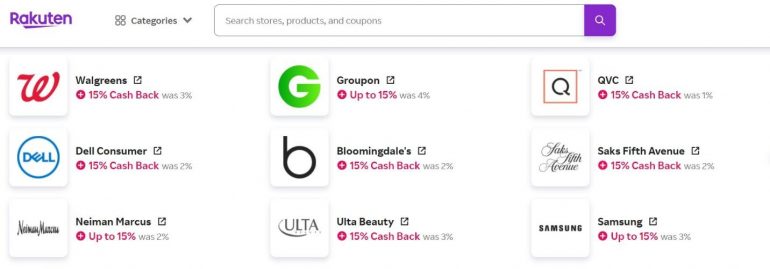

Before you make a purchase online, be sure to check out cash-back sites like TopCashback or Rakuten to see if you can receive money back on your purchases.

How do these websites work? First, you create an account, search for a store you'd like to shop from online and then click a link that connects you to that site. You'll get a set percentage of cash back for the purchases you make.

For instance, you can earn 15% cash back at Walgreens or up to 15% at Samsung. The cash back you can receive and the eligible stores change frequently.

You can increase your vacation budget by using cash-back sites whenever possible for online purchases.

» Learn more: Best cash-back credit cards

The bottom line

To increase your annual vacation budget, you have to figure out how much money you currently have available for travel. After that, you can take steps to increase your available funds for vacations.

This includes reducing discretionary expenses, taking on a reasonable amount of outside work and using websites that give you cash back for everyday purchases. While these steps require some effort on your end, they will pay off when you use your extra funds to take the vacation of your dreams.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2025:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph® Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

Capital One Venture X Rewards Credit Card

Travel

Hotel

With a big sign-up bonus, travel credits, high rewards and airport lounge access, this card could be well worth its annual fee — which is lower than many competitors.