How to Earn and Redeem Points on Cruises

Using points and miles to book a cruise can be worth it depending on what you want to get out of them otherwise.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

When it comes to sailing the high seas, there are plenty of options for relaxation, adventure and fun in the sun. Whether you're looking for a party boat or a refined, small-ship experience, the cruise industry has something for you.

But these vacations can come with a hefty price tag, so it's no wonder that financially savvy travelers ask: Can miles or points be used for cruises?

What many may not realize is that it's possible to both earn and redeem points and miles on cruises. Here’s a quick look at the best ways to do just that.

Ways to earn or redeem points and miles on cruises

Research which of your existing loyalty rewards programs offer partnerships with cruise lines. If you're starting fresh (with no loyalties), you might consider strategically selecting a program — and applying for its co-branded credit card — to jumpstart your points and miles collection.

Airline cruise booking portals

Many major airlines have cruise booking platforms, which are online travel agencies that book cruises and award frequent flyer miles in the process. These include American Airlines Cruises, Delta SkyMiles Cruises, Spirit Cruises and United Cruises, among others.

Depending on the price of the cruise, you can earn miles for every dollar spent. For example, AAdvantage members earn 1 mile for every dollar they spend, up to 10,000 miles, with American Airlines Cruises.

With United Cruises, you can earn as many as 25,000 miles per cruise with a normal booking or up to 45,000 miles if you book with one of United’s co-branded credit cards, like the The New United℠ Explorer Card.

In addition, United Premier elite members are further incentivized to book cruises with the airline to get access to additional perks like complimentary drinks, spa credits and more.

Knowing how many air miles for a cruise will largely depend on the season, ship and length of the cruise; however, you can score a cruise vacation for as little as 22,000 miles. If you don’t have enough miles, you can sometimes use a mix of miles and cash to pay for a cruise.

Marriott Bonvoy's Cruise with Points

Hotel loyalty program Marriott Bonvoy has a cruise portal that also allows members to earn and redeem hotel points on cruises. In addition to the standard 3 points earned per dollar spent, Marriott Bonvoy credit card holders can earn an additional 2 points per dollar spent on cruises.

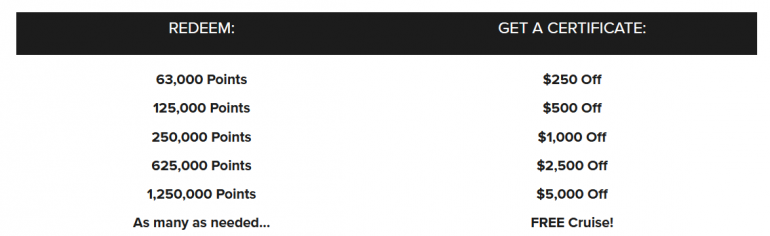

Members can redeem hotel points in increments to reduce the cost of a cruise. For example, you can take $500 off the total price by redeeming 125,000 points, allowing you to pay in part or in full for the cost of a cruise with points.

If you have more Marriott Bonvoy points than you know what to do with, this can be a solid option for an upcoming cruise.

» Learn more: The best ways to rack up Marriott Bonvoy points

Club Wyndham and Norwegian Cruise Line

A partnership between Club Wyndham, Wyndham's timeshare ownership program, and Norwegian Cruise Line means you can redeem Club Wyndham points for Norwegian cruise sailings.

A three-night Bahamas cruise can start as low as 248,000 points. Other options include Hawaii, the Mediterranean, Alaska and more sailings.

Credit card points

Credit card programs like Chase Ultimate Rewards®, American Express Membership Rewards and Capital One Miles reward member spending with points for every dollar. These points can then be spent like cash to offset the cost of a trip, helping members purchase airfare, hotels, rental cars and cruises at a discount.

Redeeming Chase Ultimate Rewards® points for cruises

In April 2025, Chase made it far easier to redeem points for cruises in its travel portal under "Voyages by Chase Travel."

While you still need to call 855-234-2542 to book, you can now compare itineraries, prices and cruise lines like Royal Caribbean, MSC Cruises, and Silversea Cruises online first.

Redeeming AmEx offers for cruises

There are often additional special offers that can add to the experience. For example, The Platinum Card® from American Express and The Business Platinum Card® from American Express have occasional discounts through the AmEx Offers program, often offering a statement credit after spending a certain amount. Enrollment required.

The Cruise Privileges program provides additional discounts for American Express cardholders, such as earning double points on bookings made directly in the AmEx travel portal.

» Learn more: The beginner's guide to points and miles

Cruise credit cards

Co-branded cruise credit cards, like the Carnival World Mastercard, offer points for everyday spending. While these offer exciting benefits for frequent cruisers, they may not be the most rewarding of credit cards for other travelers.

» Learn more: Which cruise credit card should you get?

Unless you have specific cruise plans in mind or like to cruise frequently, these are not credit card loyalty programs from a purely strategic perspective. These cards reward points in a single cruise program, making them less useful than cards with flexible points programs.

More flexible travel credit cards that earn points that can be redeemed for cruises and other travel (like airfare or hotel stays) include the Capital One Venture X Rewards Credit Card, the Chase Sapphire Preferred® Card, the Chase Sapphire Reserve® or The Platinum Card® from American Express.

If you want to use points and miles on cruises

Can frequent flyer miles be used for cruises? Yes. Is it the best value? It depends on what you have planned for your miles.

If you’re saving your points for a long business or first class flight, you will probably squeeze more value from them with that kind of redemption. If you typically use them for cheaper domestic flights, redeeming for a cruise can make more sense.

With a little advance planning, you can put your points and miles to work to enjoy a free or discounted cruise.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2025:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph® Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

Capital One Venture X Rewards Credit Card

Travel

Hotel

With a big sign-up bonus, travel credits, high rewards and airport lounge access, this card could be well worth its annual fee — which is lower than many competitors.