How to Combine Chase Points in Your Household

Moving points between your cards or to other members of your household can help you get better redemptions.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

On this page

Chase Ultimate Rewards® is one of the most popular rewards programs out there. Chase offers multiple credit cards that earn points and many ways to redeem them.

If you have more than one Chase credit card or if there is more than one Chase cardmember in your household, you may be able to transfer points between cards. This makes it possible to use your combined pool of points to book the trip you actually want to take — and one that might not have otherwise been possible if you both had points to your name but none sufficient to book what you need.

By combining points strategically in your household, you may get more rewards or unlock more ways to redeem them. Here’s how:

Why combine Chase points in your household?

Just because your card pays you in Chase Ultimate Rewards® points doesn't mean those points will end up offering the same value as another card. A huge reason behind this is the power of transfer partners, which are accessible to holders of the Sapphire cards.

🤓 Nerdy Tip

Pairing some cash-back earning cards, such as the Chase Freedom Flex®, with a card that earns Ultimate Rewards®, like the Chase Sapphire Preferred® Card, allows all the rewards you earn to become transferable. The Chase Sapphire Reserve®, Sapphire Reserve for Business℠, Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card all earn rewards that can be transferred to hotel and airline partners. These include options such as United Airlines, World of Hyatt and Southwest Airlines.

Not only does this give you more flexibility when it comes to redemption options, it can also allow you to redeem your points for more value than you’d get elsewhere.

Transfer points before closing a credit card

When you close a credit card account, you risk losing the points it has earned. But if you have another Chase card, you can preserve those points by transferring them.

» Learn more: The best travel credit cards right now

How to transfer Chase Ultimate Rewards® between cards

Transferring your Chase points from one card to another is simple. You’ll first want to log in to your account, then head to the Ultimate Rewards® redemption page.

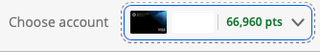

In the top right corner you’ll find a drop-down that lets you select from which card you’d like to redeem points.

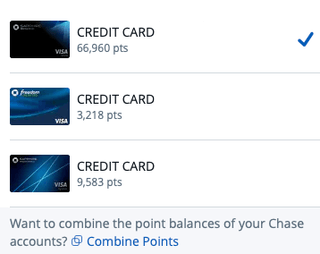

Clicking this will bring up all available cards, as well as the option to combine points between accounts.

Once on the Combine Points page, you’ll be able to select how you’d like your points to be transferred between accounts.

» Learn more: The best Chase transfer partners

How to merge Chase points in a household

You’re allowed to combine Chase points within a household, but the process is less convenient than transferring between personal cards. To add a household member to your own account, you must call the customer service number on the back of your Chase credit card.

From there, a Chase representative can help you add your household member’s Chase-branded card to your own account (so you'll need their account information, including name and credit card number, handy).

This small roadblock is just a one-time thing. Once your household member's account is linked via phone, it remains linked for future digital self-serve combine points redemptions. For families playing in what some might call two-player mode, merging points with a family member is a brilliant move.

Want to receive points from your household member instead of sending them? Have the other cardmember log in to their account and follow the steps above to add you as their transfer partner.

Note, however, that you can link only one person from your household for transfers and they must share your address.

» Learn more: How to redeem Chase Ultimate Rewards® points

What happens if you’d like to share your Chase points but don’t share an address with someone? Although you won’t be able to directly combine your Chase points with another user, you can still transfer them directly to their loyalty accounts.

To do so, you’ll want to make them an authorized user on your account. Once done, you can then transfer your rewards straight to whichever hotel or airline account you’d like.

Be aware that even if you have more than one authorized user on your account, you’re still limited to transferring your points to a single designated user.

» Learn more: Credit card authorized users: What you need to know

If you want to combine Chase points with a household member

The ability to transfer Chase Ultimate Rewards® makes this currency especially valuable. Because points tied to different Chase credit cards are worth different amounts, it’s usually a good idea to combine your points into the account with the highest value. After all, two wallets are better than one, and earning with your family members can really boost your points game.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles