How the AmEx ‘Once Per Lifetime’ Rule Works

Does AmEx have a 5/24 rule? No; in fact, the AmEx welcome bonus rules work differently than Chase.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

American Express has an impressive lineup of rewards credit cards with hefty welcome offers and useful perks. While American Express doesn’t have a "5/24" rule like Chase does, the issuer does limit welcome offer eligibility based on your card history — nominally, you’re eligible for one welcome offer per credit card “per lifetime,” but it’s not necessarily as simple as that. Here’s what you need to know about the “once per lifetime” rule.

» Learn more: AmEx Membership Rewards: How to earn and use them

What is AmEx’s once-per-lifetime rule?

American Express restricts each card's welcome bonus so that it can only be earned by one per person, per lifetime. If you earn a bonus on a card once, you can't cancel it, re-apply and then earn that bonus again. You can still apply for the card again at some point down the line, but you won’t be eligible for earning another welcome bonus.

Which cards are affected?

An easy way to tell which cards are affected by the once-per-lifetime rule is to check the terms and conditions for the following language: “Welcome offer not available to applicants who have or have had this Card or previous versions.” Sometimes there are variations of this language and additional restrictions, depending on the number of American Express cards you’ve opened and closed.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

How can I find out if I’m eligible for an AmEx bonus?

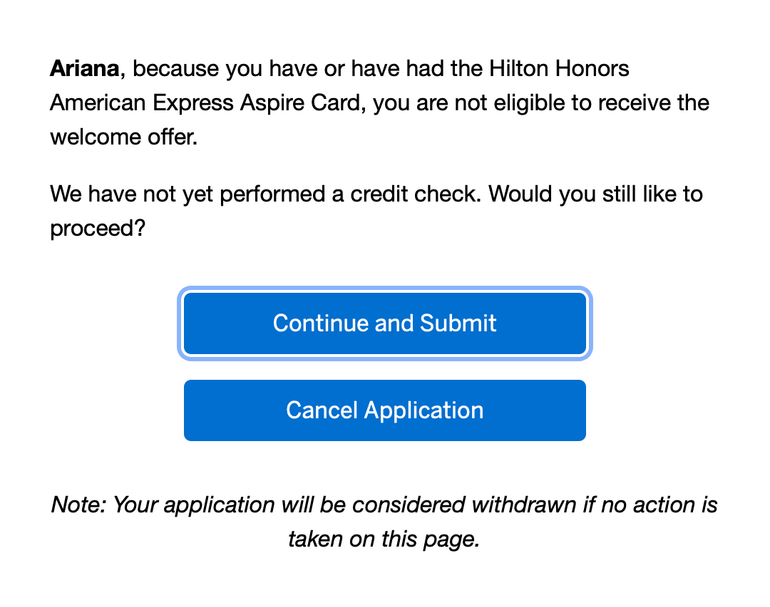

You probably have an idea of which American Express cards you’ve applied to over the past few years, for which you’d therefore be ineligible to earn the welcome bonus again. But if you’ve forgotten, American Express seems to have a safeguard in place. When you apply for a card you’re ineligible for, you’ll receive the following message after filling out your application and hitting “submit:”

What are the workarounds?

Occasionally, you’ll find that the terms on certain offers do not contain once-per-lifetime language. I recently received an offer to upgrade and — when I accessed the card terms — there is no language restricting my ability to earn the welcome bonus. That’s likely because AmEx wants to upsell me to this card, and removing the welcome bonus restriction is an incentive for me to apply for it.

Aside from this, the most foolproof workaround to the AmEx once-per-lifetime rule is to make sure you’re applying for an AmEx card with the highest welcome bonus possible to earn. Do a quick Google search for the card name and “highest offer.” You may come across articles that are a few years old, but they’ll give you an idea of how high a welcome bonus offer has historically been, which can help you decide how good the current offer is.

If you’re not in a rush to bank a new AmEx card welcome bonus offer, it might be worth it to hold off until a higher bonus comes around. After all, you’ll likely only qualify for it once, so waiting could be worthwhile.

AmEx welcome bonus rules, recapped

AmEx’s once-per-lifetime rule on welcome bonus offers is restrictive, but still workable. The fact that American Express keeps track and seems to notify applicants when they’re ineligible before an application is submitted is certainly helpful. That helps minimize the number of credit pulls, which could otherwise push cardholders closer to ineligibility for a Chase card under that issuer’s 5/24 rule.

If you’re interested in a certain AmEx card, it’s worth it to check the terms and conditions to see if you’ve been targeted for an offer that excludes the once-per-lifetime restriction for earning a specific card's welcome bonus. The best way to ensure that you’re being “tracked” properly is to look at these credit card offers while logged into your American Express account. That way, American Express won’t get you mixed up with another cardmember who may use the same computer.

This will ensure that the terms and conditions you pull up for a specific offer accurately reflect your eligibility. If there’s a mix-up, at least AmEx seems to catch it before your application is submitted.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles