Your Guide to the Hawaiian Airlines Award Chart

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Hawaiian Airlines isn't part of one of the “big three” airline alliances, and their route network is small compared to other U.S. airlines. However, considering that Hawaii is a dream destination for many and maintains some valuable partnerships, it’s still worth it to know a little about Hawaiian Airlines’ award chart.

Award types

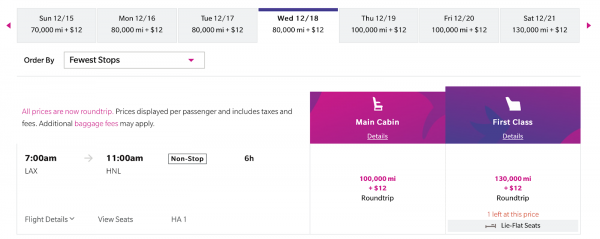

Unlike some larger airlines, Hawaiian still publishes an award chart, but there’s no telling what sort of redemption rates you’re going to find when you actually search for flights. The chart groups award flights into multiple categories of “main cabin” flights. The number of miles for an award flight depends on where you’re flying, but it also appears to depend on when you’re flying; peak times tend to require more miles.

» Learn more: Here's how much your points and miles are worth

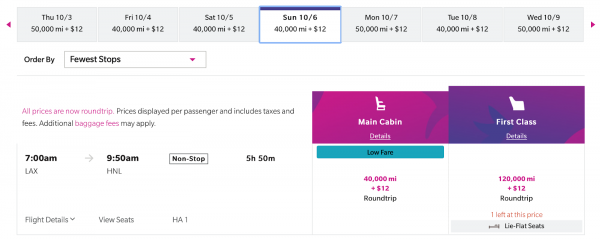

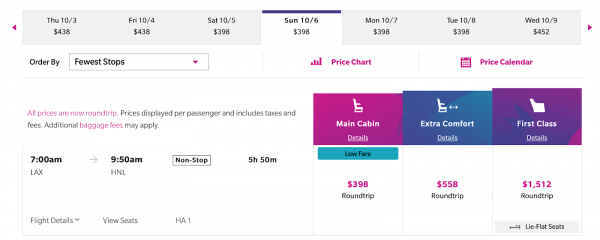

Take one search, for example: An economy flight from Los Angeles to Honolulu in October required 40,000 miles when we checked, while the same seat on a flight closer to Christmas cost 100,000 miles.

Things to know about the Hawaiian Airlines award chart

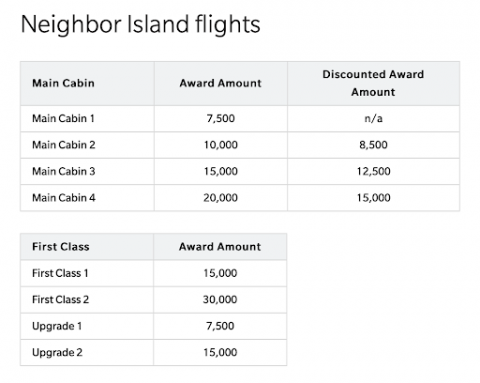

Award redemptions for intra-Hawaii flights range from 7,500 to 15,000 miles each way.

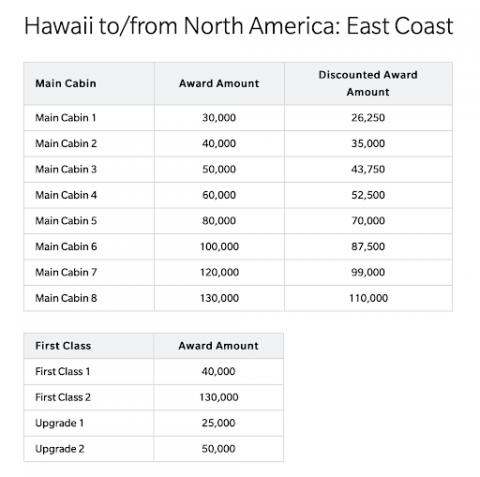

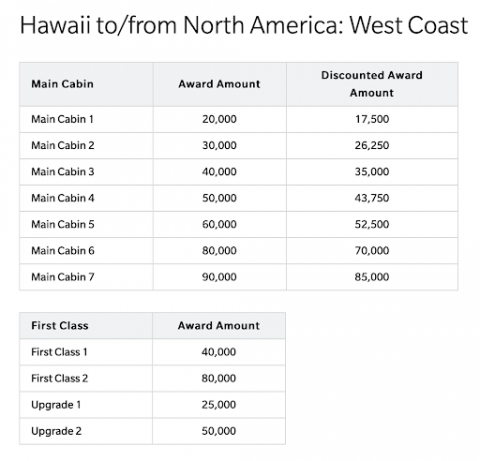

Miles required for flights to and from the continental U.S. vary depending on whether you’re flying to the East Coast or West Coast. As you might expect, flying to the East Coast will require more miles (starting at 30,000 each way) than the West Coast (which starts at 20,000 each way).

If you’re a Pualani Elite, Premier Club member or you have the Hawaiian Airlines® World Elite Mastercard®, you’re eligible for special award flight discounts, as noted in the chart.

» Learn More: Find the best airline credit card for you

You can book any seat in the main cabin or first class or use your points to upgrade. There are no blackout dates, which is a plus. You also have the option to book award flights with a combination of miles and cash, which is helpful if you’re only a few miles short of an award.

Partner awards

You can use Hawaiian miles to book award travel on one of their partner airlines, though each has its own individual award chart:

Japan Airlines.

JetBlue.

Korean Air.

Virgin Atlantic.

Virgin Australia.

Partner redemption rates aren’t competitive when compared to other award charts. For example, Hawaiian requires 80,000 miles for a round-trip economy class award between the West Coast and the United Kingdom. The same award costs just 30,000 miles when booked through Virgin Atlantic Flying Club.

The same goes for Korean Air, which charges 125,000 to 185,000 miles round-trip for a Prestige (i.e. business) class award between the U.S. and Korea. Meanwhile, Hawaiian charges 200,000 miles for the same award. It’s definitely worth comparing redemption rates before booking a Hawaiian partner award.

» Learn more: Hawaiian Airlines HawaiianMiles: The complete guide

Elite status

Hawaiian Airlines has two elite status levels: Pualani Gold and Platinum.

Pualani Gold status requires you to fly 30 segments or 20,000 miles in a calendar year. Once you do, you’ll get the following benefits:

More available seats at the time of booking.

Discounted awards when you book online.

Priority routing and handling.

Access to an exclusive reservations line when booking over the phone.

Complimentary fare-hold reservations.

Member and two guests get access to Premier Club/first class check-in line.

Club access at select lounges.

Zone 2 priority boarding.

Priority security lines in some airports.

Priority baggage handling.

Two free checked bags.

50% bonus miles on cash tickets.

Complimentary upgrades.

Same-day standby for an earlier flight to a neighbor island with no fee.

Pualani Platinum is the top level you can achieve, by flying 60 segments or 40,000 miles. Pualani Platinum includes all of the above benefits, plus:

100% bonus miles on cash tickets.

Neighbor island economy seats that are guaranteed up to 72 hours prior to departure when booking a cash fare.

Three free checked bags.

Those who don’t fly enough to earn elite status but still want the benefits can purchase a Premier Club membership for a $299 annual fee or 40,000 miles. Premier Club members receive some of the same benefits as Pualani Gold members, including:

More available seats at the time of booking.

Discounted awards when booking online.

Priority routing and handling.

Members and two guests get access to Premier Club/first class check-in line.

Enjoy club access at select lounges.

Priority security lines in some airports.

Priority baggage handling.

Zone 2 priority boarding.

Two free checked bags.

Earn rewards with Hawaiian Airlines

HawaiianMiles members earn miles depending on destination and fare class. On intra-Hawaii flights, Pualani Gold, Platinum and Premier Club members earn a flat 500 miles each way.

But flying is hardly the fastest way to earn miles. That designation goes to the Hawaiian Airlines® World Elite Mastercard®.

With this card, you'll earn the following:

3x miles on Hawaiian Airlines purchases.

2x miles on gas, dining and groceries.

1x miles on everything else.

As for benefits, you’ll get two free checked bags when you direct book a Hawaiian flight with your Hawaiian Airlines® World Elite Mastercard®. Cardholders also get a one-time 50% off companion discount on a flight between the mainland U.S. and Hawaii.

You’ll then receive an annual $100 companion discount for round-trip coach travel between Hawaii and the continental U.S. after each account anniversary, which is enough to make up for the annual fee.

Additionally, cardmembers can transfer miles to and from friends and family for no cost. You can also transfer miles at a 1:1 ratio from the American Express Membership Rewards program.

Miles expiration policy

Your miles will expire if there is no activity on your account for 18 months. To keep your account active, you must either earn or redeem miles. Here are a few examples:

Book a flight with miles.

Use your Hawaiian Airlines® World Elite Mastercard®.

Shop with HawaiianMiles partners.

Shop online using the Hawaiian Airlines MileFinder.

The bottom line

Although Hawaiian Airlines publishes an award chart, it contains multiple tiers for economy and first class awards, making it less straightforward than some other airlines' charts. Award redemption rates aren't particularly competitive, in general. But if you frequently fly to Hawaii or between the islands, their rewards program could be worth a look.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2025:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph® Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

Planning a trip? Check out these articles for more inspiration and advice: Find the best travel credit card for you 10 ways to save on an Oahu vacation 6 reasons you should get the Hawaiian Airlines MasterCard, especially now

Capital One Venture X Rewards Credit Card

Travel

Hotel

With a big sign-up bonus, travel credits, high rewards and airport lounge access, this card could be well worth its annual fee — which is lower than many competitors.