What Is a Routing Number? Definition and Where to Find Yours

This nine-digit number identifies your bank or credit union in a financial transaction.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Your routing number is one of the long strings of numbers at the bottom of your check. You need it to get direct deposits, pay bills and move money between banks. But what exactly is a routing number, where else can you find it (other than the bottom of a check) and how else might you need it? Read on to find out.

What is a routing number?

Routing numbers are nine-digit codes that identify banks or credit unions in financial transactions. The codes were adopted by the American Bankers Association in 1910 to make transactions quicker and more efficient. (They’re also called ABA routing numbers.)

Some banks have one specific routing number for their business, while others — especially bigger banks — have several assigned to them. They reduce the chance of miscommunication in money transfer requests. So even if two banks have similar names, they’re distinct from one another because of their different routing numbers.

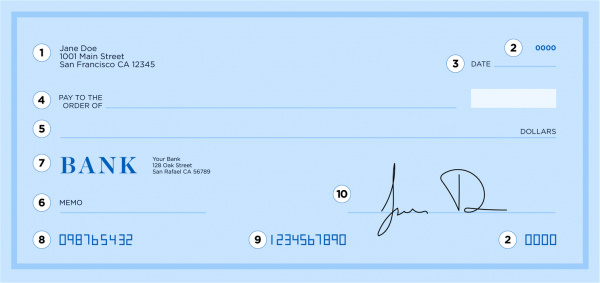

Read ahead to see lists of routing numbers at a few of the largest banks in the country as well as some online banks and credit unions. See the image below for an example of where to find the routing number on a check.

Understanding the parts of a check | |

|---|---|

| |

1. Your personal information 2. Check number 3. Date the check was written 4. Recipient's name 5. Payment amount | 6. Memo line 7. Name of the bank 8. Routing number 9. Account number 10. Your signature |

Each bank has at least one routing number, although larger banks can have more. At a bank with multiple routing numbers, they can be different depending on the location where you opened your account and the type of transaction you’re making. If you opened an account in Texas, for example, your routing number to set up direct deposit can be different from your friend’s in California, and different from your mom’s when she’s accepting an incoming wire transfer — even if the three of you use the same bank.

When you’ll need your routing number

You’ll need your routing number in a variety of situations, including setting up direct deposit, automatic loan payments or recurring transfers like bill payments.

You’ll also need it when you file taxes if you want to receive your tax refund as a direct deposit, or to make a tax payment from your account using electronic withdrawal. If you plan on transferring money between banks via online transfer, you likely need it then, too.

You generally only need your routing number when funds are being directly transferred to or from your bank account — not for debit card or credit card purchases.

How to find your routing number

How to find your routing number on a check: You can find your routing number at the bottom left corner of your personal checks. It’s the first nine digits of the long line of numbers. That long string of numbers is called the magnetic ink character recognition line. It contains your routing number, account number and the check number, in that order. (See the check image above for an example.)

Other ways to find your routing number: If you don’t have a check handy, you can also find the routing number in a few other places:

Your bank statement.

Your bank’s website or mobile app (you may need to log in to your account first).

The American Bankers Association’s routing number lookup.

If you have any issues finding the number, you can always contact your bank’s customer service line.

» Paying by check for the first time? Learn how to write a check correctly

Bank of America routing numbers

Confirm that your state's routing number below is the same on your checks or in your logged-in online account.

Disclaimer: These are Bank of America routing numbers for checking accounts for electronic payments only. Some states or regions may have different routing numbers for checks and electronic payments. There are separate routing numbers for wire transfers as well.

State | Routing number |

|---|---|

Alabama | 051000017 |

Alaska | 051000017 |

Arizona | 122101706 |

Arkansas | 082000073 |

California | 121000358 |

Colorado | 123103716 |

Connecticut | 011900254 |

Delaware | 031202084 |

Washington, D.C. | 054001204 |

Florida | 063100277 |

Georgia | 061000052 |

Hawaii | 051000017 |

Idaho | 123103716 |

Illinois (South and Chicago Metro) | 081904808 |

Illinois (North) | 071000505 |

Indiana | 071214579 |

Iowa | 073000176 |

Kansas | 101100045 |

Kentucky | 064000020 |

Louisiana | 051000017 |

Maine | 011200365 |

Maryland | 052001633 |

Massachusetts | 011000138 |

Michigan | 072000805 |

Minnesota | 071214579 |

Mississippi | 051000017 |

Missouri | 081000032 |

Montana | 051000017 |

Nebraska | 123103716 |

Nevada | 122400724 |

New Hampshire | 011400495 |

New Jersey | 021200339 |

New Mexico | 107000327 |

New York | 021000322 |

North Carolina | 053000196 |

North Dakota | 051000017 |

Ohio | 071214579 |

Oklahoma | 103000017 |

Oregon | 323070380 |

Pennsylvania | 031202084 |

Rhode Island | 011500010 |

South Carolina | 053904483 |

South Dakota | 051000017 |

Tennessee | 064000020 |

Texas | 111000025 |

Utah | 123103716 |

Vermont | 051000017 |

Virginia | 051000017 |

Washington | 125000024 |

West Virginia | 051000017 |

Wisconsin | 051000017 |

Wyoming | 051000017 |

Chase routing numbers

Chase routing numbers for personal accounts could not be obtained from Chase’s public-facing website. You can find your routing number by referencing your Chase bank account checks or by logging in to your account online.

Wells Fargo routing numbers

Confirm that your state's routing number below is the same on your checks or in your logged-in online account.

Disclaimer: The Wells Fargo routing numbers below are for checking accounts that aren't used for wire transfers. There are two for California, but the one listed below works across the state.

State | Routing number |

|---|---|

Alabama | 062000080 |

Alaska | 125200057 |

Arizona | 122105278 |

Arkansas | 111900659 |

California | 121042882 |

Colorado | 102000076 |

Connecticut | 021101108 |

Delaware | 031100869 |

Washington, D.C. | 054001220 |

Florida | 063107513 |

Georgia | 061000227 |

Hawaii | 121042882 |

Idaho | 124103799 |

Illinois | 071101307 |

Indiana | 074900275 |

Iowa | 073000228 |

Kansas | 101089292 |

Kentucky | 121042882 |

Louisiana | 121042882 |

Maine | 121042882 |

Maryland | 055003201 |

Massachusetts | 121042882 |

Michigan | 091101455 |

Minnesota | 091000019 |

Mississippi | 062203751 |

Missouri | 113105449 |

Montana | 092905278 |

Nebraska | 104000058 |

Nevada | 321270742 |

New Hampshire | 121042882 |

New Jersey | 021200025 |

New Mexico | 107002192 |

New York | 026012881 |

North Carolina | 053000219 |

North Dakota | 091300010 |

Ohio | 041215537 |

Oklahoma | 121042882 |

Oregon | 123006800 |

Pennsylvania | 031000503 |

Rhode Island | 121042882 |

South Carolina | 053207766 |

South Dakota | 091400046 |

Tennessee | 064003768 |

Texas | 111900659 |

Texas (El Paso) | 112000066 |

Utah | 124002971 |

Vermont | 121042882 |

Virginia | 051400549 |

Washington | 125008547 |

West Virginia | 121042882 |

Wisconsin | 075911988 |

Wyoming | 102301092 |

Online bank and credit union routing numbers

Confirm that your routing number below is the same in your logged-in online account. Unless otherwise noted, these are the routing numbers for electronic payments and checks.

Financial institution | Routing number |

|---|---|

Ally Bank | 124003116 |

Alliant Credit Union | 271081528 |

Charles Schwab Bank | 121202211 |

Discover Bank | 031100649 |

SoFi Bank | 031101334 |

Synchrony Bank | 021213591 |