Competitive yield

No state or local taxes on earned interest

Backed by the U.S. government

Withdraw at any time

No minimums

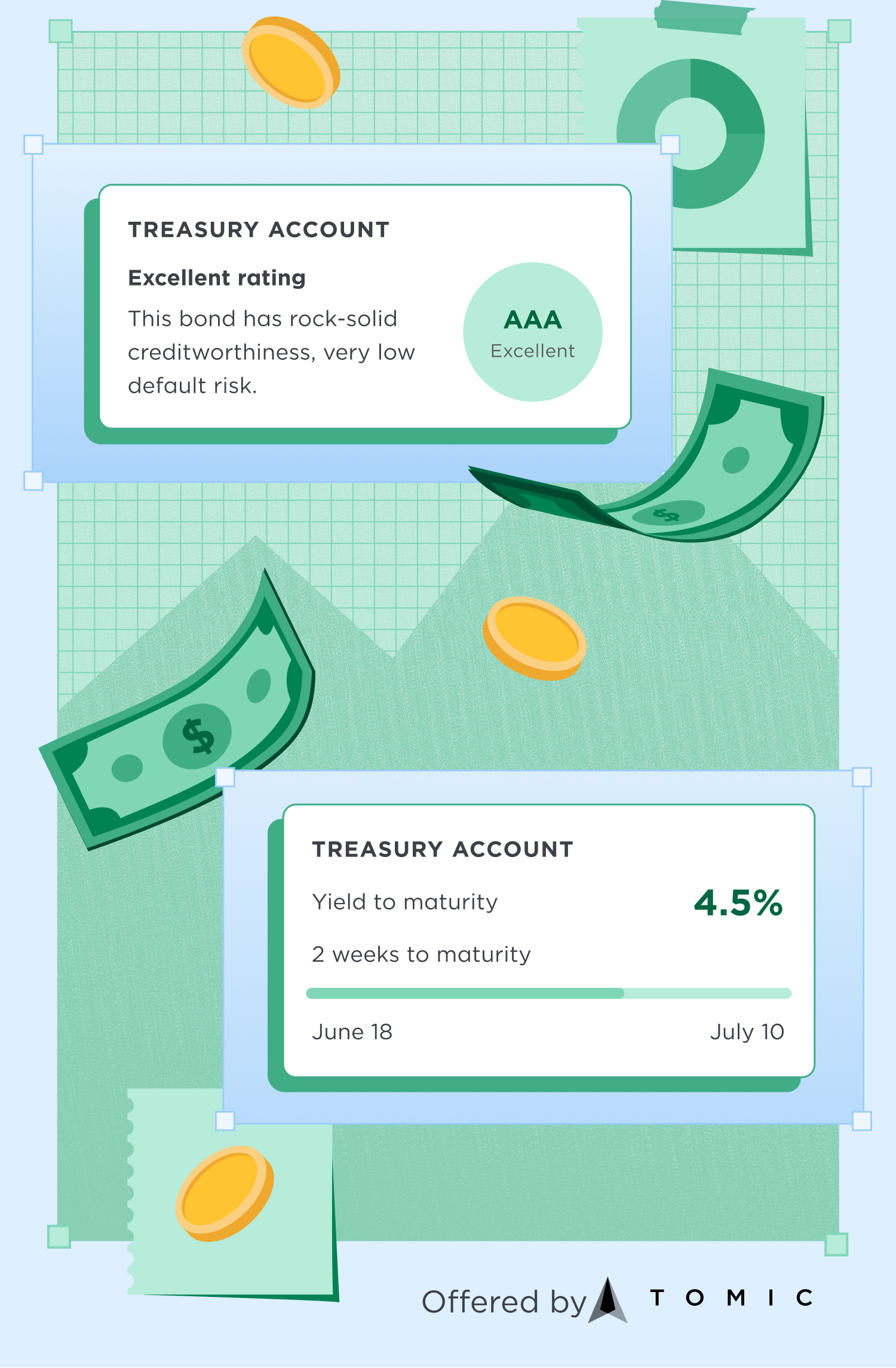

*The annualized yield for a Treasury Bill (“T-Bill”) maturing in one month as of xx/xx/xxxx when held to maturity is -.--%. Rate shown is gross of fees. Annual percentage yield (APY) is the nominal interest rate of the T-Bill maturing in one month with 12 compounding periods per year. Annualized yield and APY are investment characteristics of the T-bill and should not be regarded as performance or a projection of performance of any Treasury account. The effective return on T-Bills will be reduced by fees which has a compounding impact on returns over time.

See how much you could earn

Want to know what investing in T-Bills could mean for your money? Let's run the numbers.

NERDY TIP 🤓

You can take money out of your Treasury Account (offered by Atomic) at any time, but to capture the full yield, you’ll need to allow your T-Bills to mature — this generally takes 4 weeks from the date of investment.

What sets the Atomic Treasury Account apart

TREASURY ACCOUNT1 Offered by | HIGH-YIELD SAVINGS ACCOUNT | REGULAR SAVINGS ACCOUNT | |

|---|---|---|---|

| YIELD* | T-Bills tend to offer higher yields than high-yield savings accounts. Yields are fixed for each T-Bill held in your account. | Yields are typically lower than a Treasury investment account and can fluctuate at any time, and payment of interest is not guaranteed. | Yields are a fraction of what a high-yield account or Treasury investment account may offer, and payment of interest is not guaranteed. |

| TAXES** | Earned interest is exempt from state and local taxes, so you can keep more of your money. | Earned interest is subject to state and local taxes, which can be hefty in areas with high tax burdens. | Earned interest is subject to state and local taxes, which can be hefty in areas with high tax burdens. |

| SECURITY | Protected by SIPC but not insured by the Federal Deposit Insurance Corporation². | Insured by the Federal Deposit Insurance Corporation up to maximum limits allowed by law. | Insured by the Federal Deposit Insurance Corporation up to maximum limits allowed by law. |

T-Bills tend to offer higher yields than high-yield savings accounts. Yields are fixed for each T-Bill held in your account.

Earned interest is exempt from state and local taxes, so you can keep more of your money.

Protected by SIPC but not insured by the Federal Deposit Insurance Corporation².

Yields are typically lower than a Treasury investment account and can fluctuate at any time, and payment of interest is not guaranteed.

Earned interest is subject to state and local taxes, which can be hefty in areas with high tax burdens.

Insured by the Federal Deposit Insurance Corporation up to maximum limits allowed by law.

Yields are a fraction of what a high-yield account or Treasury investment account may offer, and payment of interest is not guaranteed.

Earned interest is subject to state and local taxes, which can be hefty in areas with high tax burdens.

Insured by the Federal Deposit Insurance Corporation up to maximum limits allowed by law.

**Earned interest generated from these accounts is typically taxed — just like your paycheck. Federal tax is due each year on earned interest.

NERDY TIP 🤓

Consider using a Treasury Account (offered by Atomic) for money that you might need soon — like a down payment on a house. A high-yield savings account may also be a smart place to store money that you might need now, like an emergency fund.

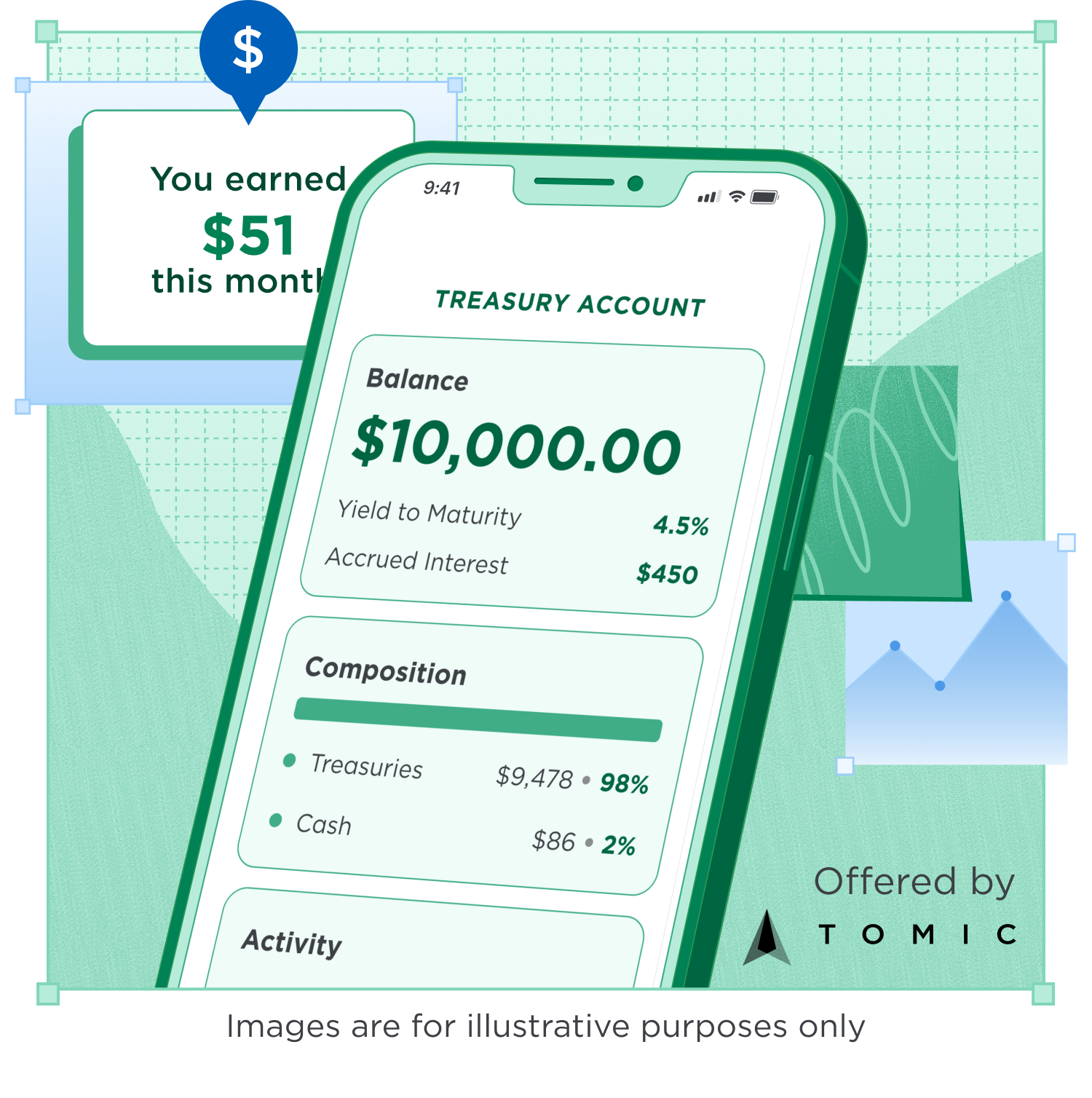

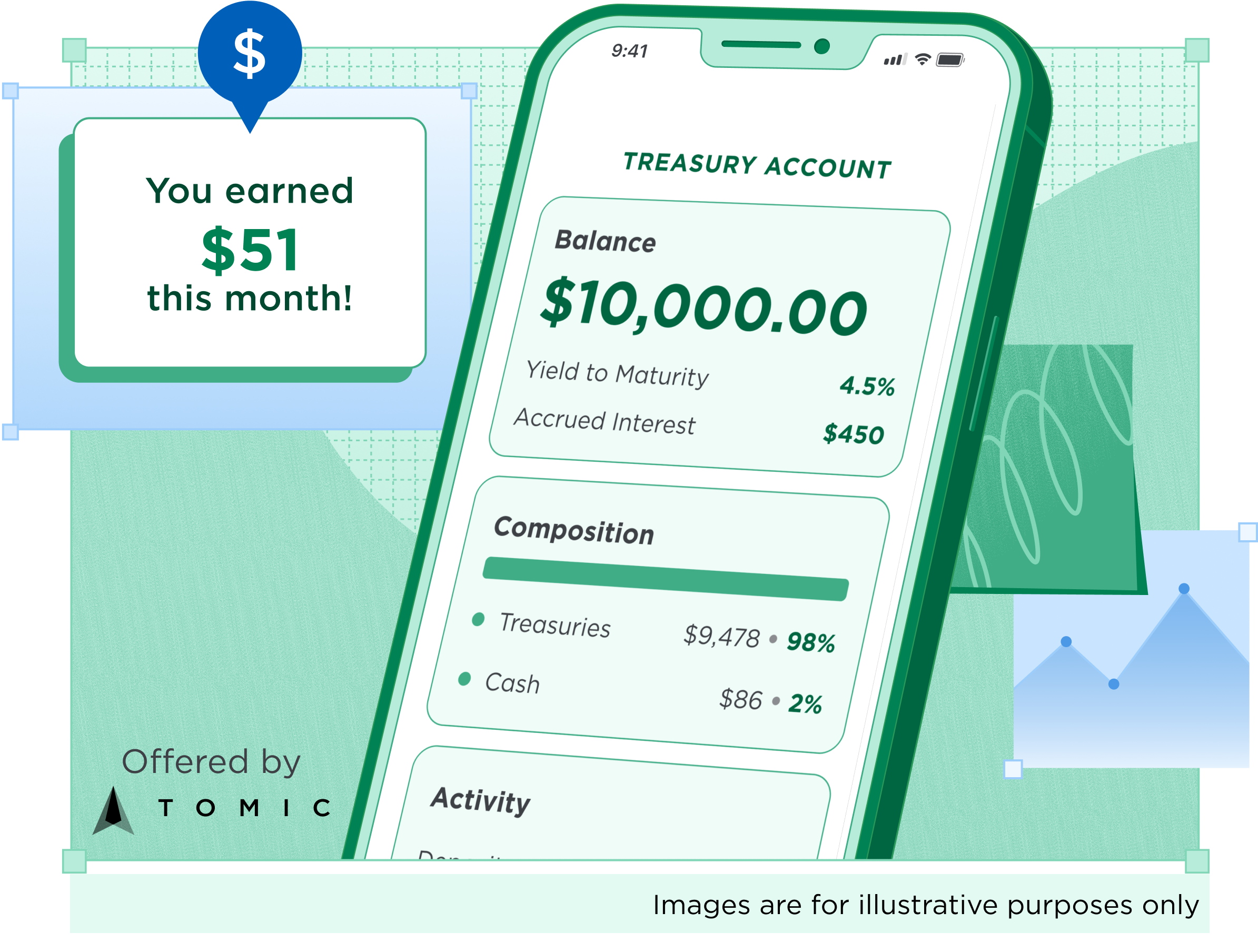

Start earning up to --.--% APY* on T-Bills with a Treasury Account

- High yield: Earn up to --.--% APY* on T-Bills through a Treasury Account, which can be more attractive than high-yield and regular savings accounts.

- Tax advantages: Earned interest is exempt from state and local income taxes — which can make the Atomic Treasury Account more attractive for customers in states with high tax burdens, like New York and California. Federal taxes still apply.

- Daily liquidity Access your funds any time with no restrictions on withdrawals.3 However, to capture the full yield, you’ll need to allow your T-Bills to mature — this generally takes up to 4 weeks.

- Security: T-Bills are a low-risk investment backed by the full faith and credit of the U.S. Government.

- No minimums The Atomic Treasury Account has no minimum deposit or balance requirements.

- Automatic management Once funds are deposited into the Atomic Treasury Account, they are automatically used to purchase your Treasury Bills. As your Treasury Bills mature, their interest and your principal are re-invested in new T-Bills of the same term — so your money is working hard for you with minimal effort.