What Is Homeowners Insurance, and What Does It Cover?

Homeowners insurance covers damage to your home and belongings caused by fire, heavy wind and other disasters.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Home insurance coverage pays to repair or replace damaged property, including your house and belongings.

Home insurance generally covers damage due to fire, wind or snow, but not floods or earthquakes.

It also covers your liability if you hurt someone else or damage their property.

Your home is more than just a roof over your head. It may be your most valuable asset — and one you likely can’t afford to replace out of pocket if disaster strikes. That’s why buying the right homeowners insurance coverage is important.

What is homeowners insurance?

Homeowners insurance is coverage you can buy to protect yourself financially against certain types of damage.

To get this coverage, you pay an insurance company a certain amount of money, called a premium. In return, the company will pay you if a covered event, such as a fire, damages your home or belongings. Homeowners insurance may also provide financial support if you hurt someone else or damage their property.

When you’re buying a home, your mortgage lender will likely require you to have coverage take effect the day you close on the house.

What does homeowners insurance cover?

Homeowners insurance covers your house and belongings in case of events such as fires, hail, tornadoes and burst pipes. If one of these scenarios causes damage, your policy can pay for repairs. Homeowners insurance can also reimburse you for theft or vandalism of your belongings.

But a homeowners policy doesn’t just cover your house and your stuff. It can also pay to defend you from lawsuits or cover medical bills for someone who gets hurt on your property. And if you can’t live at home after a covered disaster, your homeowners policy could pick up the tab for a hotel or rental.

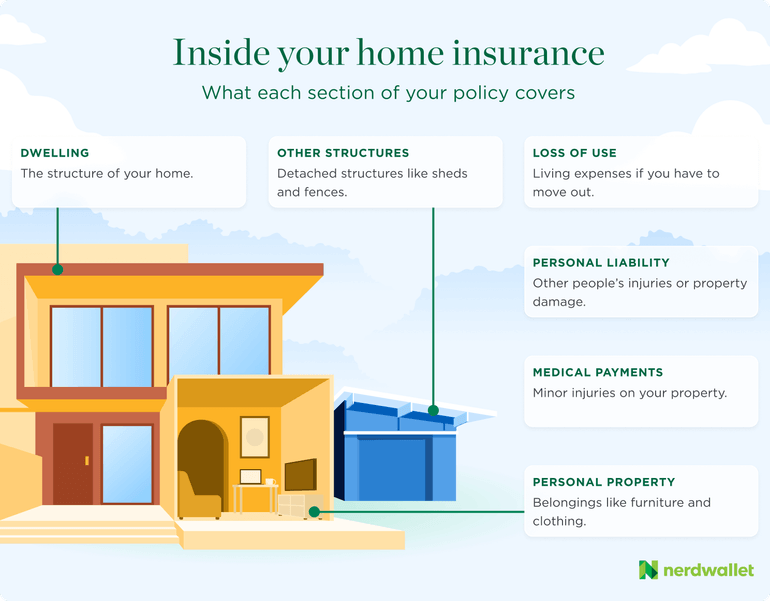

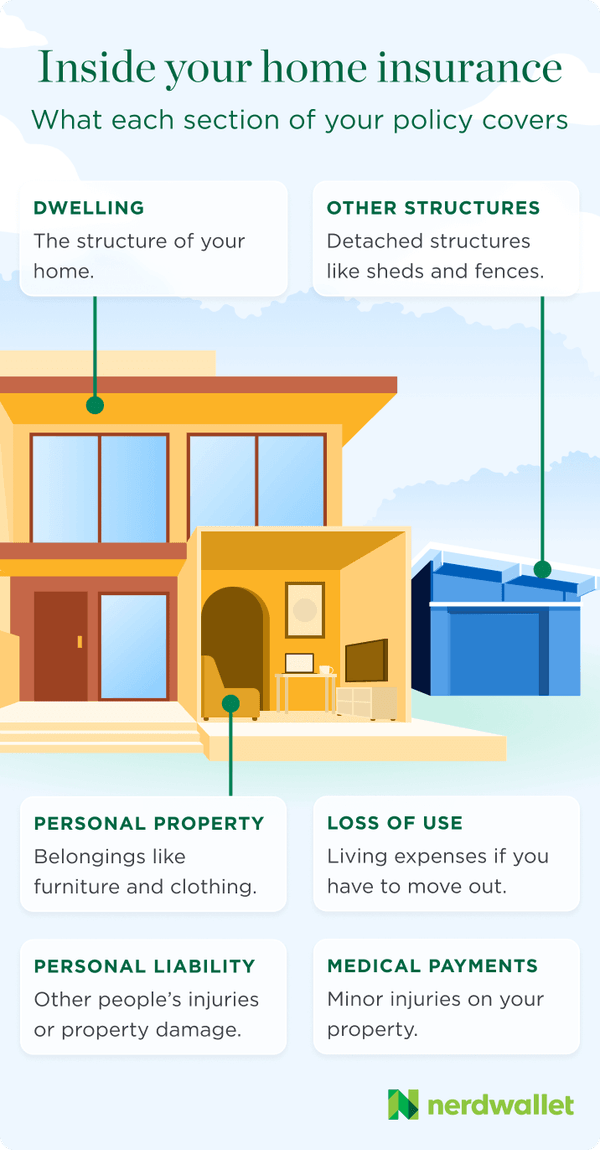

Standard types of home insurance coverage

Standard homeowners insurance policies generally include these six types of coverage:

Dwelling coverage

Dwelling coverage encompasses the structure of your home. That includes the walls, floors, windows, roof and built-in appliances. An attached garage, porch or deck would fall under your dwelling coverage, too.

Which events are covered: Most policies cover your dwelling for any cause of damage that isn’t specifically excluded. The most common causes of home insurance claims include wind, hail, freezing and water damage, according to the Insurance Information Institute.

Typical amount of coverage: Enough to rebuild your home if it’s destroyed.

How it works: A thunderstorm uproots a tree that falls onto your home, crushing part of the roof and attic. You’d pay your share of the repair cost, known as the homeowners insurance deductible. Then your insurer would pay the rest, up to your dwelling coverage limit.

» READ MORE: What is dwelling coverage, and how much do you need?

Other structures coverage

Other structures coverage is just what it sounds like. It insures structures on your property that aren’t attached to your house, such as a shed or fence.

Which events are covered: Most policies cover other structures for any event that isn’t specifically excluded. That means you'd likely have coverage for fire, wind, hail and snow, among other issues.

Typical amount of coverage: 10% of dwelling coverage limit.

How it works: Part of your fence collapses under the weight of heavy snow. The insurance company would pay to repair it, minus your deductible.

» READ MORE: Other structures coverage for homeowners

Personal property coverage

Personal property refers to your personal belongings — like clothes, furniture and electronics. Most homeowners policies cover these items anywhere, not just inside your house. So if someone steals your bike from outside a store, it’ll likely be covered (minus your deductible).

Which events are covered: Personal property coverage often works differently than dwelling and other structures coverage. Instead of covering your belongings for anything that isn’t specifically excluded, homeowners policies often cover only disasters that are listed.

These events, typically called “perils” in your policy, tend to include:

Fire, lightning or smoke.

Windstorm or hail.

Theft or vandalism.

Explosion.

Volcanic eruption.

Falling objects.

Weight of ice, snow or sleet.

Riots.

Accidental discharge of water or steam.

Sudden cracking, burning or bulging.

Freezing.

Sudden damage from short circuiting.

Damage caused by vehicles or aircraft.

Fire, lightning or smoke.

Windstorm or hail.

Theft or vandalism.

Explosion.

Volcanic eruption.

Falling objects.

Weight of ice, snow or sleet.

Riots.

Accidental discharge of water or steam.

Sudden cracking, burning or bulging.

Freezing.

Sudden damage from short circuiting.

Damage caused by vehicles or aircraft.

Typical amount of coverage: 50% to 70% of your dwelling coverage limit. A home inventory can help you estimate a more precise value of your belongings.

How it works: A pipe bursts on a frigid winter night, sending water into your kitchen and dining room. Personal property coverage would pay to replace ruined furniture, minus your deductible.

» READ MORE: What is personal property coverage? A complete guide

Loss of use coverage

The loss of use section of your homeowners policy can come in handy if your home is too damaged to live in. Loss of use coverage may pay for hotel stays, restaurant meals or other expenses associated with living away from home. This part of a homeowners policy is also sometimes called “additional living expenses.”

Which events are covered: As long as your home is being repaired after a covered claim, you’ll likely be eligible for loss of use coverage. But if your home’s damage is from a disaster that isn’t covered — such as a flood — your insurer won’t pay additional living expenses.

Typical amount of coverage: 20% of your dwelling coverage limit.

How it works: After a kitchen fire, your home is out of commission for a few months of repairs. Your insurance company would pay for you and your family to rent a similarly sized house nearby.

» READ MORE: What is loss of use coverage for home insurance?

Liability coverage

Personal liability coverage offers financial help if you accidentally hurt someone or damage their property. Coverage generally extends to anyone in your household, including pets. So if your dog bites someone at the park, you may have coverage. (See Does Homeowners Insurance Cover Dog Bites? for more information.)

Which events are covered: Liability insurance covers bodily injury and property damage to others, with some exceptions. For instance, your policy won't cover criminal acts or harm you cause on purpose. Nor will it pay for injuries or damage from a car accident (your liability car insurance would cover those).

Typical amount of coverage: $100,000 to $500,000.

How it works: A delivery person slips on your icy sidewalk before you can salt it. He breaks his wrist in the fall and sues you for medical bills and lost wages. Your liability coverage could pay your legal fees, plus any damages you’re responsible for in the lawsuit, up to your policy limit.

» READ MORE: Personal liability coverage for homeowners

Medical payments coverage

Like liability coverage, medical payments coverage pays if you hurt someone outside your household by accident. However, you don’t need to be found at fault for medical payments coverage to pay out.

Which events are covered: You could tap your medical payments coverage if someone suffers a minor injury on your property. It could also pay if you harm someone outside your home. But there's no coverage for intentional acts or car accidents, among other exclusions.

Typical amount of coverage: $1,000 to $5,000.

How it works: Your dog bites the hand of a visiting friend. There’s no serious harm, but your medical payments insurance covers the cost of their trip to urgent care for stitches.

» READ MORE: Medical payments coverage for homeowners

What homeowners insurance won't cover

Even the broadest homeowners insurance policy won’t cover everything that could go wrong with your home. For example, you can’t intentionally damage your house and then expect your insurer to pay for it. Policies also typically exclude damage due to:

Flooding from external sources like heavy rainfall or storm surges.

Drain and sewer backups.

Earthquakes, landslides and sinkholes.

Infestations by birds, vermin, fungus or mold.

Wear and tear or neglect.

Nuclear hazard.

Government action, including war.

Power failure.

However, you can buy separate coverage for some of these risks. For example, flood insurance and earthquake insurance are available separately. And many companies offer add-ons to cover drain and sewer backups.

Optional home insurance coverage

Talk to your insurer if you're worried about problems your policy doesn’t cover. In many cases, you can pay for endorsements — or add-ons to your policy — that offer more coverage.

Below are some of the most common home insurance endorsements. Availability may vary by state and company.

Scheduled personal property covers a specific valuable item such as a ring or musical instrument. You may need an appraisal — a document that states the value of the item — to get this coverage.

Ordinance or law coverage pays to bring your home up to current building codes during repairs or rebuilding.

Water backup coverage pays for damage due to backed-up sewer lines, drains or sump pumps.

Equipment breakdown coverage pays to repair or replace major home systems and large appliances if they stop working. (Normal wear and tear generally isn't covered.)

Service line coverage pays for damage to water, electric or other utility lines that you’re responsible for.

Identity theft insurance pays expenses associated with identity theft such as lost wages and legal fees.

Inflation guard automatically raises your coverage limits to keep up with rising costs.

How homeowners insurance works

If your home is destroyed, your insurer won't simply write you a check for the coverage amount listed on your policy. First, you’ll have to file a claim, documenting the damage. And your payout could vary depending on your coverage and deductibles.

Replacement cost vs. actual cash value

One key factor in your payout is whether your coverage will pay whatever it takes to rebuild your home, even if that cost is above your policy limits. This situation may arise, for instance, if construction costs have gone up in your area while your coverage limits haven't changed. Here’s a rundown of several options you may encounter.

Actual cash value coverage pays the cost to repair or replace your damaged property, minus a deduction for depreciation. Most policies don’t use this method for the house, but it’s common for personal belongings. For items that are several years old, this means you’ll probably get only a fraction of what it would cost to buy new ones. Learn more about actual cash value coverage.

Functional replacement cost coverage pays to fix your home with materials that are similar but possibly cheaper. For example, your contractor could replace damaged plaster walls with less expensive drywall.

Replacement cost coverage pays to repair your home with materials of “like kind and quality,” so plaster walls can be replaced with plaster. However, the payout won’t go above your policy’s dwelling coverage limits.

Some policies offer replacement cost coverage for personal items. This means the insurer would pay to replace your old belongings with new ones, with no deduction for depreciation. If this feature is important to you, check the policy details before you buy. It’s a common option, but you typically need to pay more for it. Learn more about replacement cost coverage.

Extended replacement cost coverage will pay more than your dwelling coverage amount, up to a specified limit, if that’s what it takes to fix your home. The limit can be a dollar amount or a percentage, such as 25% above your dwelling coverage amount. This gives you a cushion if rebuilding is more expensive than you expected.

Guaranteed replacement cost coverage pays the full cost to repair or replace your home after a covered loss, even if it goes above your policy limits. Not all insurance companies offer this level of coverage.

Example: Say the structure of your house is insured for $400,000. Here’s how upgrading to other types of coverage could change how much your insurer would pay to rebuild your home. (The table below assumes that extended replacement cost adds an additional 25% of coverage.)

Type of coverage | Amount |

|---|---|

Replacement cost | $400,000 |

Extended replacement cost | $500,000 |

Guaranteed replacement cost | Whatever it takes to restore your home |

Homeowners insurance deductibles

Homeowners policies usually include a deductible — the amount you have to cover before your insurer starts paying. The deductible can be:

A flat dollar amount, such as $500 or $1,000.

A percentage, such as 1% or 2% of the home’s insured value.

When you receive a claim check, your insurer subtracts your deductible amount. Say you have a $1,000 deductible and your insurer approves a claim for $10,000 in repairs. The insurer would pay $9,000, and you would be responsible for $1,000.

Choosing a higher deductible will usually reduce your premium. However, you’ll shoulder more of the financial burden should you need to file a claim. A lower deductible, on the other hand, means you might have a higher premium but your insurer would pick up nearly the whole tab after an incident.

Be aware that some policies include separate — and often higher — deductibles for specific types of claims such as damage from wind or hurricanes. For example, a policy might have a $1,000 deductible for most losses but a 10% deductible for optional earthquake coverage. This means if an earthquake damages a home with $300,000 worth of dwelling coverage, the deductible would be $30,000.

Liability claims generally don’t have a deductible.

Coverage for common scenarios

This table shows common problems and whether your homeowners insurance policy will cover them.

Problem | Covered? |

|---|---|

Fallen tree | Maybe. If a covered event knocks a tree onto your home, your policy will probably pay to remove it. But if the tree simply falls on your lawn, you're on your own. Learn about home insurance and tree removal. |

Fire | Usually. Fire is one of the standard perils most homeowners insurance policies cover. Learn about wildfire insurance. |

HVAC problems | Maybe. If a covered event such as a windstorm damages your heating or cooling system, your homeowners policy would likely pay to repair it. Adding equipment breakdown coverage to your policy means mechanical failures are covered, too. But homeowners insurance won't pay for normal wear and tear. Learn about homeowners insurance and AC units. |

Lost jewelry | Usually not. A standard homeowners insurance policy covers jewelry only for theft, fire or other named events, not for accidental loss. That’s why it’s a good idea to add broader coverage for valuable jewelry. Learn about jewelry insurance. |

Mold | Maybe. It depends on the cause of the mold. Most insurers will cover mold only if it's caused by a covered problem such as a burst pipe. Learn about homeowners insurance and mold. |

Plumbing | Maybe. Damage from sudden, accidental leaks may be covered. Slow leaks that develop over time generally won’t be. (The latter are considered a maintenance issue.) See Does Homeowners Insurance Cover Plumbing Problems? |

Roof leaks | Maybe. It depends on why your roof is leaking. Insurance typically covers damage due to a sudden, accidental event such as hail or wind, but it won't cover simple wear and tear. Learn about homeowners insurance and roof leaks. |

Septic systems | Maybe. It depends on the cause of the damage. If your septic system was damaged by a covered event like fire or lightning, your policy may cover it. However, home insurance won’t pay for damage caused by negligence or wear and tear. For information, read Does Homeowners Insurance Cover Septic Systems? |

Termite damage | Usually not. Insurance companies consider infestations to be a home maintenance issue, which they generally don't cover. Learn about homeowners insurance and termite damage. |

Water damage | Maybe. It depends on the type of water damage. Most home insurance policies won’t cover floods, for example. They won't cover damage from a backed-up drain or sewer unless you've paid for that endorsement. But if a pipe freezes and bursts, your insurer will typically pay for the damage. For more, see Does Homeowners Insurance Cover Water Damage? |

Types of homeowners insurance policies

Homeowners insurance comes in several types, called “policy forms.” Some types have broader coverage than others, so it’s worthwhile to know the difference. Note that different insurance companies may have different names for these policies.

Most popular: HO-3 insurance

HO-3 insurance policies, also called “special form,” are the most common. If you have a mortgage, your lender is likely to require at least this level of coverage.

Most HO-3 insurance policies cover damage to your home from any cause except those the policy specifically excludes. But for your belongings, HO-3 insurance typically covers only damage from the perils listed in your policy.

Broadest coverage: HO-5 insurance

An HO-5 insurance policy offers the most extensive homeowners coverage. It pays for damage to your home and belongings from all causes except those the policy excludes. It’s typically available only for well-maintained homes in low-risk areas, and not all insurers offer it.

HO-5 policies are sometimes called “comprehensive form” or “premier” coverage. However, an HO-3 policy may also be labeled “premier” in some cases, without offering the broader coverage of an HO-5 policy. If you want HO-5 insurance coverage, ask your agent or representative.

» MORE: What is hazard insurance?

Limited coverage: HO-1 and HO-2 insurance

Much less popular are HO-1 and HO-2 homeowners insurance. These policies pay only for damage caused by listed events.

Learn more about types of home insurance policies.

NerdWallet calculated median rates for 40-year-old homeowners from various insurance companies in ZIP codes across all 50 states and Washington, D.C. All rates are rounded to the nearest $5.

Sample homeowners were nonsmokers with good credit living in a single-family, two-story home built in 1984. They had a $1,000 deductible and the following coverage limits:

$400,000 in dwelling coverage.

$40,000 in other structures coverage.

$200,000 in personal property coverage.

$80,000 in loss of use coverage.

$300,000 in liability coverage.

$1,000 in medical payments coverage.

We made minor changes to the sample policy in cases where rates for the above coverage limits or deductibles weren’t available.

These are sample rates generated through Quadrant Information Services. Your own rates will be different.

ON THIS PAGE

ON THIS PAGE