Get your free credit score

NerdWallet uses 128-bit encryption to secure your information.

★ 4.8 APP STORE RATING

100+ EDITORS, WRITERS, AND CONTENT SPECIALISTS

10K+ ARTICLES AND FINANCIAL RESOURCES

★ 4.8 APP STORE RATING

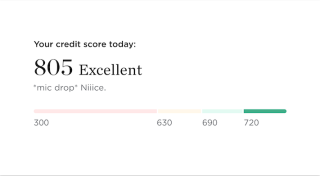

Join NerdWallet and monitor your credit score

HOW IT WORKS

Your free credit score with NerdWallet unlocks

Credit monitoring

Check your free credit score and credit report as often as you want, and get alerts about changes so you can manage your credit effectively.

Credit education

Stay on top of your score with insights and alerts tailored to you. Use our credit simulator to check out how actions might affect your score.

Credit card offers

Understand which credit cards fit your financial needs and check out the credit score guidelines for approval.

TESTIMONIALS

Trusted by 14M+ users like you

Great way to keep track of all your accounts in one place, they notify you of big transactions, credit score changes, and the best cards/banks/loan institutions available suited to you!

Gage DeRosia

It’s great! You continually get credit score updates, advice, and free reads! I linked all of my accounts and have monthly graphs of what’s coming in and going out, and includes net worth.

Chad Dunlap

LET'S COVER THE BASICS

Credit score 101

MORE HELP

FAQs

Download the app to make smart money moves