Chase Pay Yourself Back: What You Need to Know

This redemption option lets certain Chase cardholders redeem points for certain spending categories.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Chase's "Pay Yourself Back" feature lets certain cardholders redeem their points for statement credit to cover recent qualifying purchases, donations to charity or even the card's annual fee.

The eligible purchases change quarterly, for the most part, and vary by card.

Currently, the most notable Chase's Pay Yourself Back offer lets Chase Sapphire Reserve® cardholders redeem points for statement credits on grocery store, pet store, veterinary services and gas purchases through June 30, 2025, plus select charitable donations.

Here’s what you need to know about this limited-time offer.

What is Chase Pay Yourself Back?

Pay Yourself Back is a temporary redemption option for Chase Sapphire, Freedom and Ink cardholders. Typically, these cardholders can redeem Ultimate Rewards® points for a statement credit at a rate of one cent per point.

But through Pay Yourself Back, you can redeem Chase Ultimate Rewards® points to offset eligible purchases — generally at an elevated rate.

Eligible purchase categories vary depending on your Chase credit card. If you have multiple cards that earn Chase Ultimate Rewards®, note that you can transfer points between Chase accounts to take advantage of the different categories offered on different cards.

Only transactions made within the prior 90 days will qualify. You can choose to apply points toward the entire purchase cost or a portion of the transaction.

Which Chase cards are eligible for Chase Pay Yourself Back?

The Pay Yourself Back redemption option is currently available on the following Chase credit cards:

Chase Sapphire Preferred® Card, Chase Ink cards and Chase Freedom cards: Redeem points at a rate of 1.25 cents each for select charities.

Chase's United cards: Redeem miles toward the card's annual fee at a rate of 1.35 - 1.6 cents per mile. Redeem miles for United purchases of $50 or more at a rate of 1 cent per mile. Both offers run through Dec. 31, 2025.

Aeroplan® Credit Card: Redeem Aeroplan points at a rate of 1.25 cents per point for travel purchases made within the last 90 days on up to 200,000 points per year (ongoing, no expiration date). Redeem Aeroplan points for charges at home improvement stores, gas stations and dining at a rate of 0.8 cent per point.

What charities are eligible for Pay Yourself Back?

The current list of charitable organizations eligible for Pay Yourself Back is:

American Red Cross.

Equal Justice Initiative.

Feeding America.

GLSEN.

Habitat for Humanity.

International Medical Corps.

International Rescue Committee.

Leadership Conference Education Fund.

NAACP Legal Defense and Education Fund.

National Urban League.

Out & Equal Workplace Advocates.

SAGE.

Thurgood Marshall College Fund.

United Negro College Fund.

UNICEF USA.

United Way.

World Central Kitchen.

Nerdy Perspective

How do you use Chase Ultimate Rewards® points?

How to request a statement credit

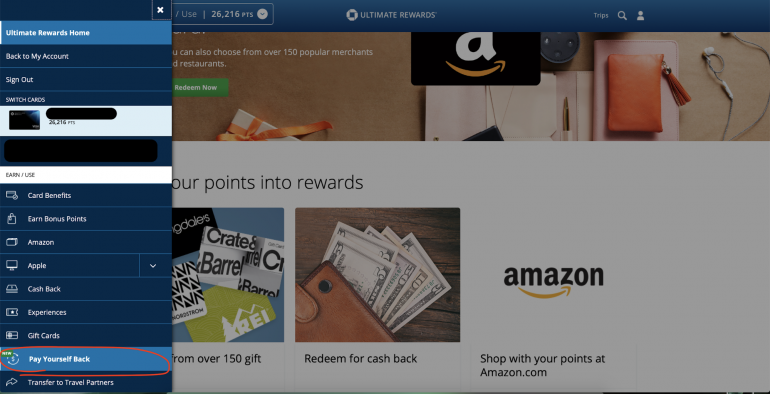

To request a Pay Yourself Back statement credit, log in to your Chase Ultimate Rewards® online account.

Select the left-hand drop-down menu and scroll to “Pay Yourself Back.” If you don’t see the Pay Yourself Back option and have more than one Chase rewards credit card, make sure you’ve selected an eligible card.

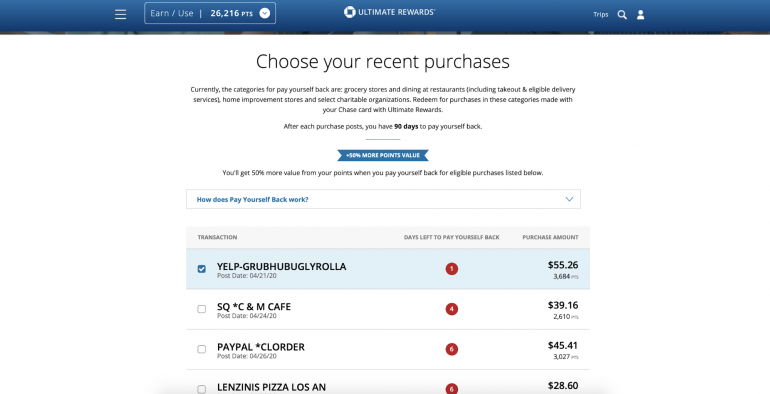

Chase automatically generates a list of eligible purchases that were made within the last 90 days. On this page, you’ll also see how many days are left to use Pay Yourself Back for each purchase. It’s best to select the oldest transactions first so you maximize your opportunities for the statement credit.

Next, check each transaction you’d like to apply your points toward and select “Continue” at the bottom of the page.

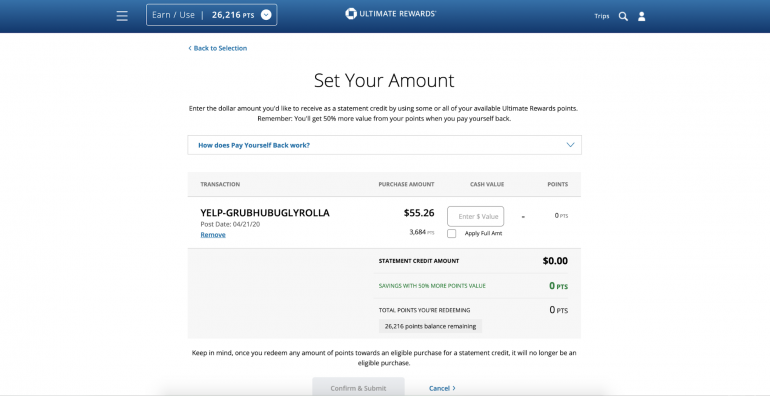

Each purchase you select will be listed on the next page. From here, you can either check “Apply Full Amt” so your points cover the entire transaction, or you can manually enter another dollar value into the blank box.

After entering your selections, the page shows you the total statement credit you’ve requested, the amount of savings you’re receiving through this feature, the total points you’re redeeming and your remaining points balance.

When you’re ready to submit your request, select “Confirm & Submit.” It can take up to three business days to see the statement credit post on the account from the time your request is submitted, and one to two billing cycles to see this credit reflected on your statement.

The information related to the Chase Freedom® has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2025:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph® Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-5%

Cashback$200

1x-5x

Points75,000

Points