How to Use Credit Cards to Manage Your Budget

Use your credit card's built-in tracking features to monitor how much you spend. You can even set limits for yourself.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

With responsible use, credit cards can be great tools for building credit. But they can also be useful for budgeting and controlling your spending. Most major credit card issuers classify purchases by category, allow users to search transactions and get detailed spending reports — all of which can make it easier for cardholders to track and monitor their expenses.

Track your spending

Before you can create a realistic budget, you need to know how much you’re spending. This is easy to track with a credit card because issuers tend to classify your purchases by category. Cardholders are typically able to get a snapshot of their spending, by category, right when they log into their account online. For example:

Purchases on a Chase credit card identified by categories.

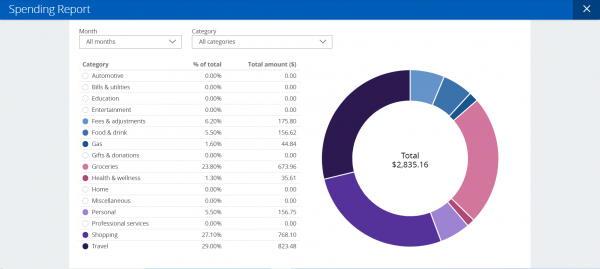

For a larger, more holistic snapshot of spending, most issuers provide annual spending reports. You can also create custom reports for any time period within your online account. For instance, Chase credit card users can access a detailed breakdown of their spending through the “spending report” tab on a web browser and through the “spending summary” tab on Chase’s mobile app.

Spending report on a Chase credit card.

Using these tools to review your transactions on a weekly or monthly basis can help you see how much you’re spending and where you might need to be stricter with your budget.

Tracking your spending this way can also save you time come tax season. Through your credit card’s expenses breakdown tool, you can easily generate a yearly spending report without having to manually input each of your transactions.

This can be particularly helpful if you’re a business owner who uses a small-business credit card. Once spring rolls around, you can easily access your businesses spending data through your card’s yearly spending report.

Review transactions

If you operate on a weekly or monthly budget, check your purchase activity and card statements at least that often to stay on track. Each week or month, have a specific day when you total up your purchases in each category to ensure you’re staying within your self-imposed budget.

The more frequently you go through your transactions, the easier it will be to make sure you don’t go over what you can afford to pay off each month.

It can also help you quickly identify any unauthorized or fraudulent purchases.

Establish spending limits

For a simpler way to stay on budget, set a monthly spending limit. For instance, if you've budgeted your weekly expenses — like groceries, gas, clothing and more — at $1,000 total, you can put everything on your card and keep your balance below the necessary amount. You can, of course, adjust your monthly spending limit as necessary when you have irregular expenditures, like your six-month car insurance premium or a vacation, for example. Setting limits this way can be useful for flexible budgeters who may be more concerned with the bottom line than with specifics.

You can also set spending limits for authorized users of your credit card.

Set up account alerts

Once you have a better overview of your financial health and have set spending limits, you can use your credit card to set up account alerts and notifications to keep you on track. Many card platforms and apps let you set up alerts that will notify you when you’ve gone over your set spending amount, are approaching your credit limit, or when your payments are due.

You can also set up mobile alerts or push notifications through your credit card’s app to be notified when a new account is opened on your credit report or when there's a pull on your credit.

Use your credit card’s other unique features

If you’re struggling to stay within a budget or are finding it difficult to pay your bill on time, consider using the following tools to maximize what your credit card can do for you:

Use "card lock" to control impulse spending. Most credit card platforms and apps allow cardholders to temporarily freeze or lock their cards, which will usually stop purchases, bill payments, balance transfers, and cash advances. While this feature is more commonly used in cases where a card is lost or stolen, you can optimize it as a tool to curb your spending.

Use your card to autopay recurring monthly bills. With your credit card, you can set up and keep track of automatic payments for recurring charges like utility bills, cell phone bills, or Netflix membership fees, for example, so that you don't miss them. However, once you set it, don't forget it — aim to pay off your card bill on time if you can. Consider setting up an alert to help you remember when the card bill is due.

Take advantage of your ability to move your card's due date. Although they're not required to do so, many issuers are willing to move your billing due date if you ask. Moving your billing date to better align with your monthly cash flow can potentially reduce your financial stress. You can request a date change online or by calling the customer service number on the back of your card.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.