What Is Form 1099-NEC for Nonemployee Compensation?

Form 1099-NEC is used for reporting compensation paid to nonemployees. Here's what you need to know.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeaways

- The 1099-NEC replaced the 1099-MISC in 2020 for reporting nonemployee compensation.

- Any nonemployee who made $600 or more will receive a 1099-NEC.

- You'll receive the 1099-NEC by early February, as businesses are required to send them out by Jan. 31.

Form 1099-NEC is a tax document that reports compensation paid by a business to someone who is not an employee.

It's a relatively new tax document, having been reintroduced in 2020. Previously, businesses used Form 1099-MISC to report nonemployee compensation.

Who should get a Form 1099-NEC?

A business must file Form 1099-NEC if it paid someone at least $600 during the year and the person meets these criteria:

- They are not an employee.

- The business made payment for services in the course of your business — in other words, this wasn’t a personal payment.

- The recipient is an individual, partnership or estate. In a few cases, payments made to corporations will also need to be included.

Eligible payments can include commissions, fees, prizes and awards for services.

Who doesn't need a Form 1099-NEC?

There are a handful of exceptions to the requirement for businesses to report nonemployee compensation. These include:

- Payments to most corporations, both S corporations and C corporations. A business would only include payments to corporations if it was for fish purchases for cash, attorney’s fees or payments made by a federal executive agency.

- Payments for merchandise, telegrams, telephone, freight, storage and similar items.

- Rent payments made to real estate agents or property managers.

- Payments to a tax-exempt organization.

What do I do if I get a Form 1099-NEC?

If you receive a Form 1099-NEC, that means a client has calculated that they paid you $600 or more over the prior tax year.

You'll probably get the form by early February, since employers are required to file their Form 1099-NECs by Jan. 31. While you're always supposed to account for any freelance or consulting income on your tax return, a Form 1099-NEC serves a couple of functions:

- The form gives you a handy reference for your clients' calculations of how much they paid you.

- It reminds you that the IRS knows about these payments, which could help tax authorities catch on if you fail to include them in your return.

Form 1099-NECs, like most other 1099s, are considered informational returns. That means all you need to do when you receive one is reference it when you’re filling out your tax return. It’ll help you to complete certain schedules (additional tax forms) that you’ll need to append to your return, such as Schedule C, which concerns business income.

You'll include your payments in your calculations for your personal or business income for the year, and then look at whether you have any deductions or credits that reduce the amount you owe in taxes on the proceeds.

If you get stuck, good tax software can likely guide you through the process.

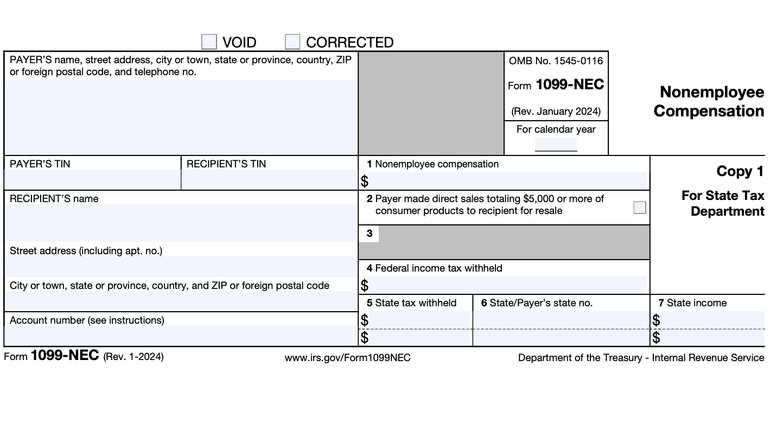

What’s included on Form 1099-NEC?

Form 1099-NEC is a fairly short form with multiple copies. The information on Form 1099-NEC includes:

- Payer’s information, including name, address and taxpayer identification number (TIN).

- Recipient’s information, including name, address and TIN.

- The total amount of nonemployee compensation paid.

- Any federal or state income tax withheld.

How do you file a Form 1099-NEC?

If you're a business, the easiest way to get the personal information that you need from a nonemployee is to have them fill out a W-9. With that and the information from your accounting records, you should have enough information to fill out the 1099-NEC.

It's important to keep in mind that the IRS doesn't release a new 1099-NEC form every year. It's considered a continuous form, which means it's only updated on an as-needed basis. You can find the most recent form on the IRS website.

Just like with the 1099-MISC, there are multiple copies of the form that need to be distributed.

- Copy A goes to the IRS.

- Copy 1 is sent to your state tax department.

- Copy B is sent to the recipient.

- Copy 2 is also sent to the recipient.

When is Form 1099-NEC due?

The due date for Form 1099-NEC is Jan. 31. Businesses need to send a copy of the form to both the recipient and the IRS by this date. If the due date falls on a weekend or holiday, you must file the form on the next business day.

You can either request copies of official 1099 forms from the IRS website and receive them by mail or use the IRS Filing Information Returns Electronically (FIRE) system to file electronically.

Do I still need to file a Form 1099-MISC?

Because Form 1099-NEC is in use again, Form 1099-MISC is no longer used to report nonemployee compensation. Box seven of the 1099-MISC used to include nonemployee compensation, but it's now used for direct sales made of $5,000 or more. Things on the form will look a little different, but it hasn’t changed substantially.

The 1099-MISC still has a role in a business's reporting; it's used to report payments of $600 or more for awards, medical and health care payments, payments to an attorney and more .

Note that Form 1099-MISC has a slightly different due date from Form 1099-NEC. Businesses must provide a 1099-MISC to any recipients by Jan. 31, but they don’t need to file it with the IRS until Feb. 28, or March 31 if filing electronically.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Internal Revenue Service. About Form 1099-MISC, Miscellaneous Information. Accessed Dec 6, 2023.

Related articles