Itemized Deductions vs. Standard Deduction: How to Choose

Itemizing allows you to pick and choose your tax deductions. Common deductions include those for medical expenses, mortgage interest and property tax.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

For some taxpayers, itemizing on a tax return can make a huge difference in their tax bill. But itemized deductions aren't necessarily no-brainers.

What are itemized deductions?

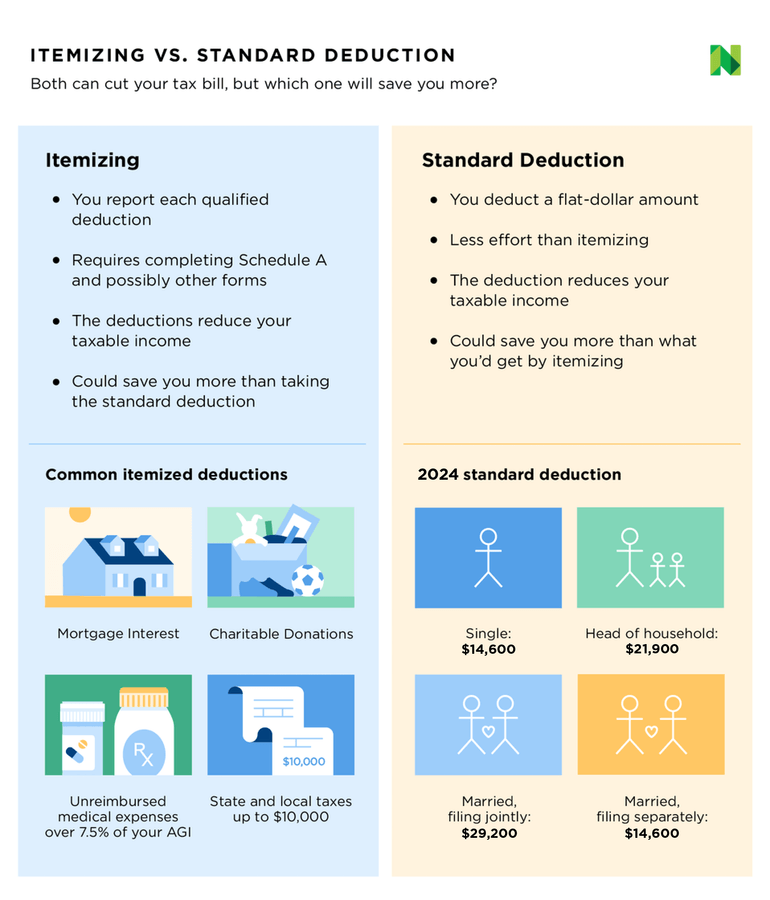

Itemized deductions are certain expenses allowed by the IRS that can decrease your taxable income (the amount of your income that's subject to taxes). When you itemize on your tax return, you opt to pick and choose from the multitude of individual tax deductions out there instead of taking the flat-dollar standard deduction.

» Need to back up? Standard deduction: What it is, when to claim

5.0

NerdWallet rating- Federal: $79 to $139. Free version available for Simple Form 1040 returns only.

- State: $0 to $69 per state.

- Expert help or full service filing is available with an upgrade to Live packages for a fee.

Common itemized deductions

There are many types of itemized deductions, but claiming them can be complicated. Each type of deduction usually has its own set of rules about who and what qualifies, so make sure to learn more about each benefit to understand if it makes sense for your situation.

Here are a few of the most popular itemized deductions:

Medical expense deduction

The IRS lets taxpayers deduct a certain percentage of unreimbursed medical and dental expenses they've amassed throughout the year. The keyword here is unreimbursed: to qualify, expenses must have been paid for out of pocket, meaning your insurance could not have covered them or reimbursed you for them. These types of expenses can include prescription drugs, payments to doctors, hospital care, dentures and more.

» Dive Deeper: How the medical expense deduction works

Property tax deduction

Homeowners who are subject to high property taxes can take advantage of what's known as the SALT deduction, which allows them to write off up to $10,000 in property taxes and either local state and local income taxes or sales taxes.

» Dive Deeper: How the SALT deduction works

Mortgage interest deduction

Taxpayers who have a home mortgage can take advantage of this itemized deduction that allows them to reduce taxable income each year they pay interest toward the loan. The deduction is capped at the first $750,000 of mortgage debt for either your main or second home. For those who are married but file separately, the limit of deductible mortgage interest is capped at the first $375,000. Plus, there are different rules for mortgages before December 2017.

» Dive Deeper: How the mortgage interest deduction works

Charitable contribution deduction

Contributions made to IRS-recognized charities are considered deductible expenses. How much you are able to deduct depends on the type of contribution made, but typically it ranges from 20% to 60% of your adjusted gross income.

Advantages of itemized deductions

Itemized deductions might add up to more than the standard deduction. The more you can deduct, the less you’ll pay in taxes, which is why some people itemize — the total of their itemized deductions is more than the standard deduction.

Some situations make itemizing especially attractive. If you own your home, for example, your itemized deductions for mortgage interest and property taxes may easily exceed the standard deduction, saving you money.

Disadvantages of itemized deductions

You have to understand the rules. As mentioned earlier, some itemized deductions come with a few hurdles. If you have medical expenses, for example, you can only deduct the portion that exceeds 7.5% of your adjusted gross income.

You might have to spend more time on your tax return. If you itemize, you’ll need to set aside extra time when preparing your returns to fill out Form 1040 and Schedule A, as well as the supporting schedules that feed into those forms.

You need proof. You need to be able to substantiate your deductions. That means keeping records and being organized. If you normally take the standard deduction and are thinking of itemizing when preparing your return next year, start saving your receipts and other proof for your deductions now.

5.0

NerdWallet rating- Federal: $79 to $139. Free version available for Simple Form 1040 returns only.

- State: $0 to $69 per state.

- Expert help or full service filing is available with an upgrade to Live packages for a fee.

Advantages of the standard deduction

The standard deduction is basically a flat-dollar, no-questions-asked reduction in your adjusted gross income. When you take the standard deduction, you essentially opt to take a flat-dollar deduction instead of picking and choosing from the multitudes of individual tax deductions out there.

Here are some big reasons people take the standard deduction instead of itemizing on their tax returns.

It's faster. Taking the standard deduction makes the tax-prep process relatively quick and easy, which is probably one reason most taxpayers take the standard deduction instead of itemizing.

It usually gets bigger every year. Congress sets the amount of the standard deduction, and it’s typically adjusted every year for inflation.

Some people get more (or less). The standard deduction is higher for people 65 and older and/or blind, though filing status is still a factor. And if someone can claim you as a dependent, you get a smaller standard deduction.

You can’t take the standard deduction if you’re married but filing separately and your spouse chooses to itemize. You both have to do the same thing — either itemize or take the standard deduction.

» MORE: Try our free tax calculator

Standard deduction vs. itemized deductions

If your itemized deductions add up to more than the standard deduction, you should consider itemizing to save money. On the other hand, if your standard deduction is more than your itemized deductions, it might be worth it to take the standard deduction and save some time.

If you’re using tax software, it’s probably worth the time to answer all the questions about itemized deductions that might apply to you. Why? The software or your tax preparer can run your return both ways to see which method produces a lower tax bill. Even if you end up taking the standard deduction, at least you’ll know you’re coming out ahead.