How Does Flight Insurance Work, and Is It Worth It?

Knowing your options can help you pick the best insurance for your nonrefundable flight.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeaways

- Flight insurance covers flight expenses only — lodging, rental cars, etc. are not covered.

- You can purchase standalone flight insurance from a third party or from the airline itself.

- Your qualifying expenses are only reimbursed if a covered reason affects your flight.

- You might already have sufficient flight insurance through your credit card.

Whether you’re booking a flight with cash or miles, flight insurance can help you get your money or miles back if your trip is unexpectedly canceled or delayed. Here’s what you need to know to decide if flight insurance is worth it for your trip.

What is flight insurance?

Travel insurance terminology can get confusing. To keep things simple, when we refer to flight insurance, we mean insurance that will protect your nonrefundable flight that was paid for in cash or with miles.

Generally, flight insurance is offered when you:

- Purchase a comprehensive travel insurance policy through a travel insurance provider (i.e. TravelSafe, Berkshire Hathaway, etc.)

- When you use a premium travel card (that offers complimentary travel insurance) to book your flight.

- Are buying a flight and get an option to purchase the airline’s trip insurance during the checkout process.

Since flight insurance specifically covers your flight, it can be a good option if you need to insure only a flight but no other aspects of your trip. For example, you buy a nonrefundable flight to visit family — you'll be staying with them, and you don’t need to book a hotel, car rental or excursions. Flight insurance might be sufficient for this type of trip, and buying a comprehensive travel insurance plan might be overkill.

» Learn more: Is travel insurance worth it in 2024?

What does flight insurance cover?

Whether you’re getting flight insurance through a comprehensive travel insurance plan, your premium credit card or as an add-on from the airline, there are a few common types of coverage that may be included. Naturally, coverage amounts and limits will vary by policy and/or credit card.

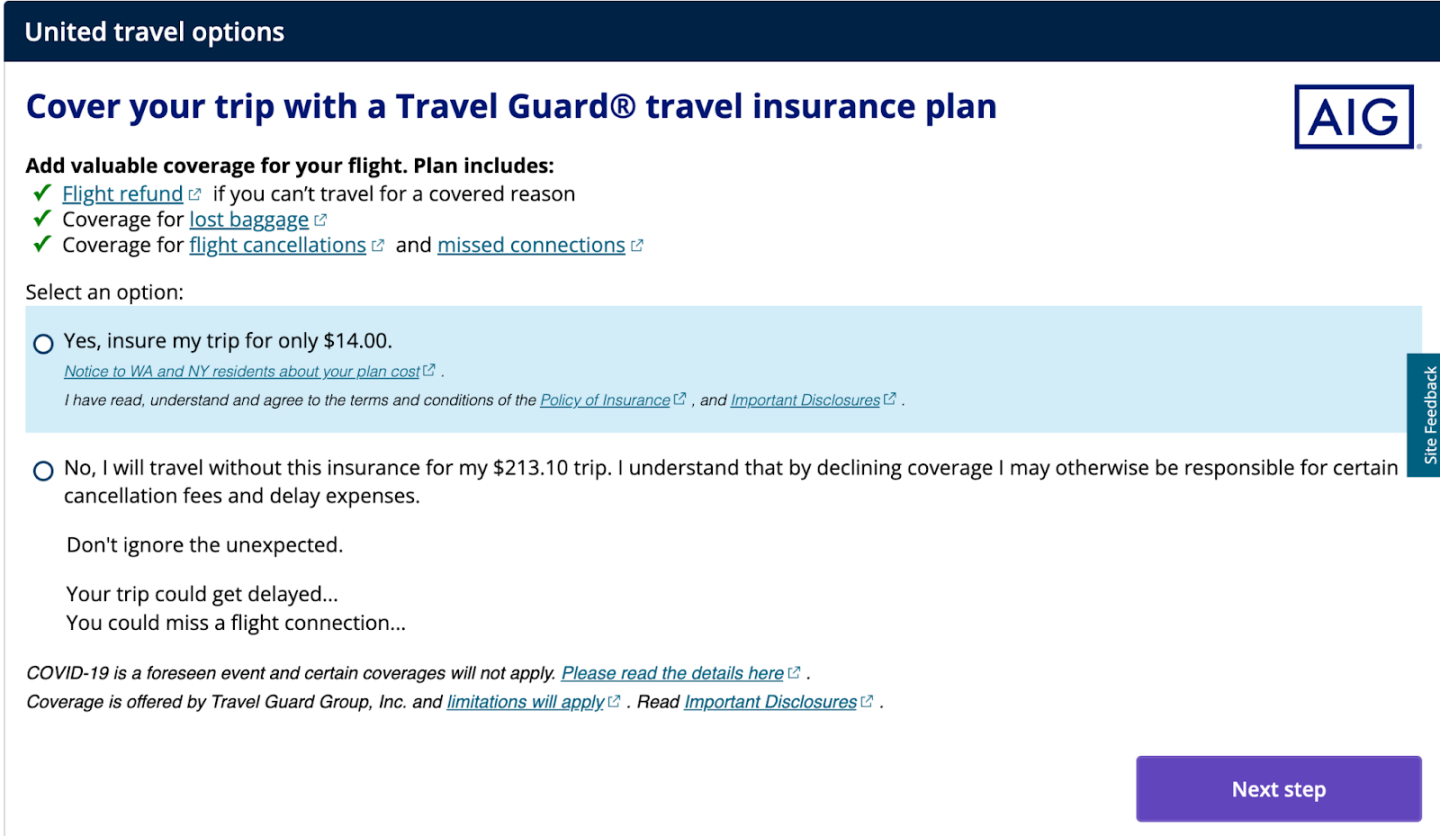

Here’s an example of what coverage is included on a flight insurance plan offered by United Airlines when purchasing a flight.

The flight insurance add-on is provided by Travel Guard and costs $14 to insure a $213 flight. The plan includes: a flight refund (i.e., trip cancellation insurance) if you cannot travel for a covered reason, lost baggage coverage, as well as coverage for flight cancellations and missed connections.

There's a notice posted for residents of Washington and New York, so if you live in one of those states, the coverage may differ.

» Learn more: What to know before buying travel insurance

Trip cancellation insurance

Trip cancellation insurance will reimburse you for prepaid, nonrefundable expenses if your flight is canceled for a covered reason. In the event you use your premium travel card from American Express or Chase to book your trip with points or miles, the trip cancellation insurance that comes with these cards will reimburse you in cash for the value of the points you used.

Notably, trips booked with an American Express card are only covered when booked as roundtrips. If you have a travel card with American Express, you’ll want to check the benefits guide for your card because that's where this caveat is located, and it's easy to overlook.

If you purchase a comprehensive travel insurance policy or an airline add-on policy, you typically will be reimbursed for the full cost of your flight, up to the policy maximums.

» Learn more: The best travel insurance companies

Trip delay insurance

This coverage kicks in if you’re delayed during a trip and you incur expenses as a result. Each policy details the reimbursement amount that is allowed, along with how long the delay must be in order for the trip to qualify.

For example, say you’re going on vacation and you have a connecting flight with a layover. An approaching snowstorm in the connecting city delays your flight, and after hours of waiting in the airport, you find out your upcoming flight is delayed until the next morning. Now you need a hotel room, toiletries, dinner and breakfast the next morning.

If you have trip delay coverage, you will be reimbursed for all of these expenses, as long as the delay exceeds a certain number of hours and you remain within the allowed daily monetary limit. For the United policy shown above, you will be covered up to $500 if you miss your connecting flight due to inclement weather or a delay of your original flight.

According to Squaremouth, a travel insurance comparison site, not all travel insurance policies offer coverage for missed connections, so if you’re booking a flight that has connections, you’ll want to pay attention to this benefit.

» Learn more: Chase trip delay insurance: What to know

Lost-luggage insurance

If you have lost-luggage insurance, you'll be eligible for reimbursement for your luggage contents if your luggage is lost, damaged or stolen during a trip. In the event of damage, the reimbursement would be for the cost to repair or replace, whichever is lower.

Lost-luggage coverage will likely include an overall limit as well as a per-item limit, and a separate limit for expensive items. We examined a flight insurance add-on offered by American Airlines and found that the baggage loss coverage had a limit of $300. If your luggage or its contents cost more than $300, that limit may not be sufficient for you.

» Learn more: Baggage insurance: How it works, what to know

What does flight insurance NOT cover?

Although flight insurance offers many protections, it's important to be aware of what may not be covered. Some examples of things that aren’t covered include:

- Change of mind: If you cancel a flight because you change your mind about going, that won't be covered. The cancellation must be for a covered reason (i.e., too sick to travel and you have a doctor's note, job loss, inclement weather, etc.).

- Expensive luggage: As detailed above with the American Airlines policy, the lost-luggage coverage is capped at $300. If you’re traveling with high-end luggage or your the contents of your luggage exceed that amount, anything above $300 won't be insured if the luggage is lost or damaged.

- Medical evacuation: This type of coverage generally kicks in when you have a medical emergency during your trip and you need to be transported to the nearest medical facility. This type of coverage goes beyond a flight and is a benefit more likely to be included in a comprehensive insurance policy.

A comprehensive travel insurance policy will typically include medical evacuation and higher limits for luggage coverage.

If you’re looking for coverage that goes beyond your flight, you’ll want to look into a standalone travel insurance policy, a credit card that offers travel insurance or the Cancel For Any Reason (CFAR) travel insurance add-on to a comprehensive policy. This optional additional coverage will allow you to cancel your trip for any reason and get the majority (up to 75%) of your nonrefundable trip costs reimbursed.

How do I get flight insurance?

If you’re planning a trip and decide to insure your flight, you’ll first need to determine what type of policy will provide the coverage you need. There are a few ways to protect your flight:

Purchase a standalone travel insurance policy

A comprehensive travel insurance policy will include the most benefits, including trip cancellation, trip delay, baggage loss, emergency medical, repatriation and more. Providers that offer comprehensive travel insurance plans include Seven Corners, World Nomads and Allianz.

Use the complimentary travel insurance provided by your credit card

Many travel cards offer complimentary travel insurance protections that are similar to those offered on standalone travel insurance policies.

However, the limits are usually lower, medical costs may not be included, and the entire trip must be charged on the same card to receive coverage.

Here are a few examples of cards with travel insurance benefits:

Top cards with travel insurance

Annual fee

- $95

- $795

- $895

- $0 intro for the first year, then $150

Travel protections (not a comprehensive list)

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Lost luggage: Up to $3,000 per passenger.

Terms apply.

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $1,500 per person and $6,000 per trip.

• Trip interruption: Up to $1,500 per person and $6,000 per trip.

• Baggage delay: Up to $100 per day for three days.

• Lost luggage: Up to $3,000 per passenger.

Learn more

Purchase the airline’s travel insurance add-on when buying a flight

When you buy your flight from an airline (in cash or miles), you may see an option to purchase trip insurance during the checkout process. As examples, United offers a flight insurance option provided by Travel Guard, while American Airlines’ flight insurance provider is Allianz. Trip protections may include trip cancellation, trip interruption and trip delay, as well as coverage for lost bags.

Since coverage will differ between airlines, you’ll want to be aware of any restrictions. One common theme among the policies is that the protections are only valid if your trip is canceled or delayed for a covered reason, such as a natural disaster, illness, death or other extraordinary event.

NerdWallet recently reviewed travel insurance policies to help you choose the plan that provides the best travel insurance for your trip.

Should I get flight insurance?

If you have a credit card that provides some form of travel insurance, the coverage limits may be enough to protect your flight. If you don’t have one of these cards and your trip only includes a nonrefundable flight, purchasing the travel insurance add-on from the airline when booking your flight may provide sufficient coverage.

However, if your trip also includes a hotel and other nonrefundable bookings, you’d be better off with a standalone travel insurance policy or relying on your credit card coverage (if the limits are sufficient and your entire trip was booked with the card).

Flight insurance on award tickets

If you use airline miles to book an award ticket, the flight insurance offered during the checkout process typically covers a redeposit of your miles back to your frequent flyer account if the trip is canceled.

🤓 Nerdy Tip

Comprehensive trip insurance policies and credit card travel insurance will reimburse you for the taxes and fees paid on award tickets but may not cover the miles. Make sure to check your policy if booking with points; some comprehensive and credit card plans will reimburse you for "redeposit fees" that the airline will charge you to get your miles back (if you didn’t purchase their add-on protection). That redeposit fee reimbursement allows you to get your miles back.

» Learn more: Does travel insurance cover award flights?

Is flight insurance worth it?

If you’re interested in insuring only your flight, you have many options to choose from.

For tickets purchased with cash, comprehensive insurance plans, premium travel credit cards and airline trip insurance will cover your nonrefundable flight costs. Award flights that are booked with miles could benefit from any of the three options if redeposit fees are part of the coverage.

If you want to be able to cancel your flight for any reason whatsoever, CFAR will protect most of your nonrefundable trip deposit, but it is also more expensive and only available as an add-on to a comprehensive travel insurance plan.

To view rates and fees of the American Express Platinum Card®, see this page.

Insurance Benefit: Trip Delay Insurance

- Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

- The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Baggage Insurance Plan

- Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Cards for Travel Insurance from our Partners

Chase Sapphire Reserve®

Rewards rate 1x-8x Points

Intro offer 125,000 Points

Chase Sapphire Preferred® Card

Rewards rate 1x-5x Points

Intro offer 75,000 Points

Southwest Rapid Rewards® Plus Credit Card

Rewards rate 1x-2x Points

Intro offer Companion Pass + 20,000 Points

More like this

Related articles