Generali Global Assistance Travel Insurance Review: Is it Worth The Cost?

One of Generali's distinguishing features is the COVID-19 coverage that comes with every plan.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

at SquareMouth

Generali

Generali isn't specifically a travel insurance provider, but instead, a large insurance company offering various products.

at SquareMouth

Pros

- Three plan options.

- Includes wide ranging COVID coverage.

- The premium plan includes pre-exisiting medical condition coverage.

Cons

- Rental car coverage only on highest cost plan.

- Baggage delay benefits don't kick in until 24 hours on the Standard plan.

More travelers than ever are considering travel insurance, but navigating the vast seas of insurance companies and coverage options can leave you feeling less than enthused about your next trip. But if you want to protect your investment, Generali Global Assistance is a notable provider. Here’s what to expect and the plans the company offers.

Generali Global Assistance plans and costs

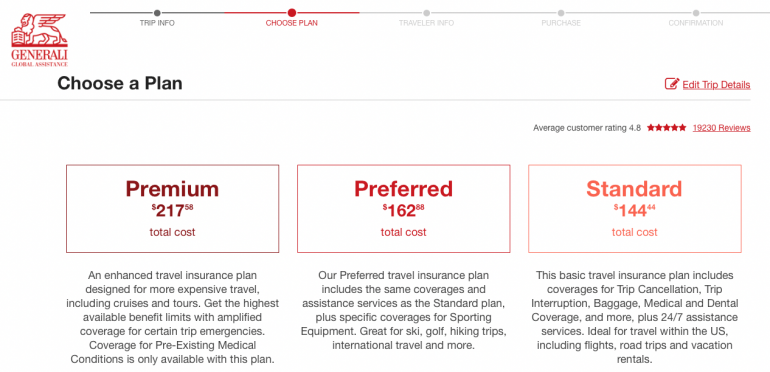

Generali offers three different plans (Standard, Preferred or Premium), depending on what type of trip you’re planning. Each offers a different level of coverage and benefits.

| Coverage | Standard plan | Preferred plan | Premium plan |

|---|---|---|---|

| Trip cancellation | 100% of trip cost insured. | 100% of trip cost insured. | 100% of trip cost insured. |

| Trip interruption | 125% of trip cost insured. | 150% of trip cost insured. | 175% of trip cost insured. |

| Travel delay | $1,000 per person, $150 per person daily limit. | $1,000 per person, $200 per person per day. | $1,000 per person, $300 per person daily limit. |

| Baggage | $1,000 per person. | $1,500 per person. | $2,000 per person. |

| Sporting equipment | N/A. | $1,500 per person. | $2,000 per person. |

| Baggage delay | $200 per person. | $300 per person. | $500 per person. |

| Sporting equipment delay | N/A. | $300 per person. | $500 per person. |

| Missed connection | $500 per person. | $750 per person. | $1,000 per person. |

| Medical and dental, including telemedicine | $50,000 per person. | $150,000 per person ($500 emergency dental expense limit). | $250,000 per person. |

| Emergency assistance and transportation | Up to $250,000 per person. | Up to $500,000 per person. | $1,000,000 per person. |

| Accidental death and dismemberment | Air flight accident: $50,000 per person/$100,000 per plan. |

|

|

| Rental car damage | N/A. | N/A. | $25,000 per person/per plan. |

Generali plan cost

Here’s a closer look at what a standard coverage plan with Generali might cost. Let’s say you and your partner — two travelers in their thirties — are planning to take a roughly $4,000 trip from New York to Germany for one week.

For this itinerary, a Generali Standard plan would cost $144. Rental car coverage isn’t included, but you can add it to your plan for $63 for the week.

The Preferred level of coverage can be a good option for those traveling with expensive gear like golf clubs or skis. For the same sample itinerary, a Generali Preferred plan would cost $162, an $18 upgrade from Standard. Rental car coverage is also extra.

The Premium plan is designed for luxury travel or vacations with a high price tag. Notably, this plan includes rental car insurance for no extra fee. Also important to note that only the Premium plan offers coverage for pre-existing medical conditions. A Generali Premium plan for our sample itinerary would cost $217, a $55 upgrade from Standard.

» Learn more: How to cancel a flight with travel insurance

Which Generali travel insurance plan is best for me?

It’s important to choose the right coverage for you and your trip based on your needs and what each plan covers. So make sure to look at each carefully.

- If you have pre-existing medical conditions, your best bet will be to stick with the Premium plan. It’s more expensive, but you’ll be covered no matter what medical issues arise on your trip.

- The Standard plan is the only one with no coverage for accidental death and dismemberment during on-the-ground travel (air travel is covered, though).

- If you’re traveling with sports equipment, you may want to opt for one of the top two tiers of coverage. Just make sure to accurately estimate how much your gear is worth to ensure you’re getting the coverage you need.

- If your trip is worth more, you’re bringing more luggage, etc., consider more expensive coverage. That way, if something goes wrong, you, your possessions and plans are more fully protected.

How to choose a Generali plan online

When it comes time to get a quote and choose your travel insurance plan, you can do so on the Generali website. Type in trip details like destination, where you’re from, your age, the total cost of the trip and your travel dates. Quotes for all three tiers of plans will be presented.

Then, select add-ons like rental car insurance if you’re not opting for the Premium plan and start the checkout process.

What isn’t covered with Generali

Like many travel insurance policies, there are several incidents that aren’t covered by Generali travel insurance. Examples include injuries that result from mental disorders, pregnancy, injuries as a result of being under the influence of drugs or alcohol, or if you are flying an aircraft yourself.

Destination matters, too. As of publication, you can’t get coverage for travel to Belarus, the Crimea Peninsula, Cuba, Iran, North Korea, Russia, Syria or Ukraine. Also, you won’t be covered for anything that results from acts of war or civil disorder.

If you’re participating in extreme sports or activities like skydiving, mountain climbing or backcountry skiing, many benefits won’t be covered.

No matter what policy you choose, read the fine print before your buy, including everything that’s excluded from coverage. That will help ensure there are no surprises if your trip goes awry.

Generali insurance, recapped

Generali provides three tiers of travel insurance for those who want to protect their nonrefundable trip expenses and/or who want to have a safety net in case their travels are disrupted or canceled.

Just like with any travel insurance policy, check to see if you’re already covered before you buy (many travel credit cards offer travel insurance), determine what kind of coverage you need and how much, and always read the details of what is and isn't included in coverage. That goes for policies available from Generali Travel Insurance as well as other providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Cards for Travel Insurance from our Partners

Chase Sapphire Reserve®

Rewards rate 1x-8x Points

Intro offer 125,000 Points

Chase Sapphire Preferred® Card

Rewards rate 1x-5x Points

Intro offer 75,000 Points

Southwest Rapid Rewards® Plus Credit Card

Rewards rate 1x-2x Points

Intro offer Companion Pass + 20,000 Points

More like this

Related articles