How Do Airline Miles Work?

Airline miles, frequent flyer miles and travel points are the rewards currency of some airlines and credit cards.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

If you enjoy flying around the country (or around the world) to visit loved ones, see new places or any other reason, knowing how airline miles work could possibly help you cut costs. In this case, "airline miles" generally refer not to distances flown, but to a kind of currency, created by airline loyalty programs, that you can use for free or discounted flights and other rewards in the future.

Follow this beginner’s guide to airline miles to learn the best ways to earn miles, how to use them for flights and other rewards, and how to maximize your value per point.

What are airline miles?

Airline miles, also called frequent flyer miles, are the airline’s currency that you can use by redeeming them for flights, hotel stays and other rewards. Some airlines call their currency "points" rather than miles, but the concept is the same.

Depending on the airline, your miles can be used to book flights — both on that specific airline and potentially on partner airlines.

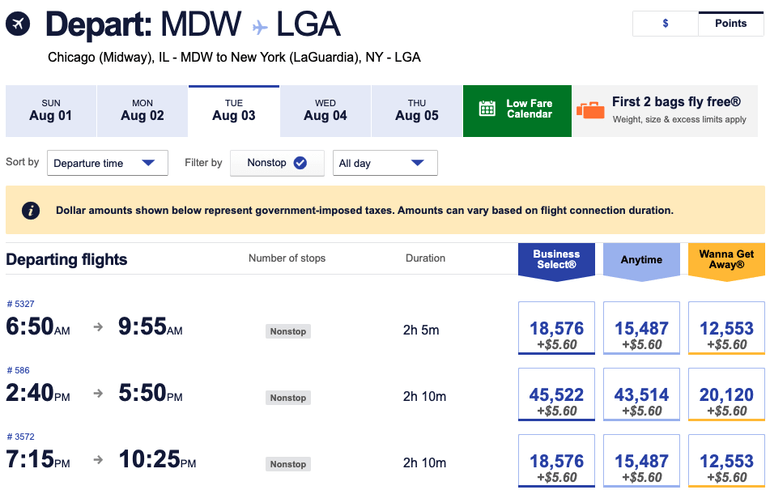

Airlines typically allow you to search for cash flights or award flights separately. Here's flight availability with Rapid Rewards, Southwest Airlines's frequent flyer program, for a flight from Chicago to New York City.

If you wanted to view the cash price for flights instead of the airline miles price, you would toggle to the "$" button in the top right.

How much are airline miles worth?

According to NerdWallet's analysis, miles from major airlines are worth about 1 to 1.6 cents each. But the flights you choose may influence your valuation.

For example, JetBlue TrueBlue uses a system where your points have a mostly fixed value: The number of points you'll need to book a flight directly mirrors the price of the cash fare.

Other airlines, like American for partner awards, use an award chart to determine how many miles you’ll need for a flight. These costs are typically based on the regions you’re flying from and to.

🤓 Nerdy Tip

Region-based award charts will sometimes create opportunities to get more value out of a redemption. Many travel points collectors refer to these as "sweet spots." Some airline loyalty programs also let you use miles or points for hotel stays, car rentals, magazine subscriptions, merchandise or flight upgrades. In most cases, these types of redemptions will get you a low value for your miles. To get the best value, you'll want to plan to redeem your airline miles for flights.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

How to earn airline miles

There are a number of ways to build a balance of valuable airline miles.

Earn miles by flying

The default way to earn miles with most airline loyalty programs is flying. When you fly on a paid fare, you are usually eligible to earn frequent flyer miles for the trip.

Depending on the airline’s rules, you may earn miles based on how far you travel or the flight cost. In most cases, you will earn a number of points per dollar spent or per mile flown. Travelers with elite status in the airline’s loyalty program may earn more miles for each trip than other members.

» Learn more: How to know how many miles you’ll earn from a flight

Earn miles by spending on credit cards

How do credit card miles work? Generally, you can earn miles from spending on either a co-branded airline credit card or a general travel rewards credit card.

Airline credit cards

For savvy travelers, credit card rewards make up a large portion of miles earnings. Example airline credit cards include the JetBlue Plus Card and the United Quest℠ Card.

Popular airline cards

Annual fee

$0 intro for the first year, then $150.

$99.

$0 intro for the first year, then $150.

$99.

Earning rates

• 5 miles per $1 on prepaid hotels booked through United.

• 2 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and hotels (when booked directly with hotel).

• 1 mile per $1 on all other purchases.

• 2 points per $1 on Southwest purchases.

• 2 points per $1 at gas stations and grocery stores on the first $5,000 in combined purchases per anniversary year.

• 1 point per $1 on all other purchases.

• 2 miles per $1 on purchases made directly with Delta and at U.S. supermarkets and restaurants worldwide (including takeout and delivery in the U.S.).

• 1 mile per $1 on all other eligible purchases.

Terms apply.

• 6 points per $1 with JetBlue.

• 2 points per $1 at restaurants and grocery stores.

• 1 point per $1 on other purchases.

• 1 Mosaic tile per $1,000 spent.

Still not sure?

Depending on the airline and credit card you choose, you may earn anywhere from 1 to 3 miles per dollar spent on the card. You usually earn more when you use the card to purchase travel directly from the airline. You could also earn more by making purchases in expense categories that pay bonus miles, like restaurants or gas stations (these vary from issuer to issuer).

» Learn more: The beginner's guide to points and miles

When you open a new airline credit card account, you may be eligible for a big welcome bonus after meeting a minimum purchase requirement. After that, you'll continue to earn miles for purchases you would have made anyway.

🤓 Nerdy Tip

Make sure to pay off your credit card balance in full by the due date each month, or you may wind up spending more in interest than the value you earn from airline miles. Airline credit cards are a subset of general travel credit cards, and there are pros and cons for choosing either (though some frequent travelers opt to have both types of cards in their wallets). If you prefer to have more flexibility to book with multiple airline partners instead of one, a general travel credit card will likely fit the bill.

» Learn more: Are airline credit cards worth it?

General travel credit cards

In addition to airline-specific cards, you can apply for a general travel rewards card, like the Chase Sapphire Preferred® Card or American Express® Gold Card, which give you points that can be transferred to airline rewards programs, used to purchase travel directly in the card issuer’s travel booking portal or redeemed for other things, like merchandise.

How the cards compare

Annual fee

$795

$895

Bonus offer

Chase Sapphire Reserve®

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

American Express Platinum Card®

You may be eligible for as high as 175,000 Membership Rewards® Points after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. Terms apply.

Rewards

Chase Sapphire Reserve®

- 8 points per dollar spent on all travel booked through Chase.

- 4 points per dollar spent on flights booked directly with airlines and on hotel stays booked directly.

- 3 points per dollar spent on dining.

- 1 point per dollar spent on all other purchases.

- Note: Travel bonus rewards are after the first $300 is spent on travel purchases annually.

American Express Platinum Card®

- 5 Membership Rewards points per dollar spent on flights booked directly with airlines or with American Express' travel portal, on up to $500,000 spent per year.

- 5 points per dollar on prepaid hotels booked through American Express' travel portal.

- 1 point per dollar on all other purchases.

- Terms apply (see rates and fees).

» Learn more: The best travel rewards cards for beginners

Cardholders are able to redeem their points and miles with various airlines through individual online portals that are managed by the issuer. These relationships, often called transfer partnerships, vary across credit cards.

Here's a closer look at the most popular general travel credit cards, their rewards programs and their transfer partners:

Earn by traveling with partners

Airlines, hotels and rental car companies often collaborate to allow you to earn awards with one program while spending with another brand.

For example, auto rental company Enterprise gives you opportunities to earn miles at JetBlue, Turkish Airlines, Lufthansa or Virgin Atlantic with every paid rental. If you’re renting a car anyway, consider adding your frequent flyer number to earn more value from the rental.

Earn via dining and shopping programs

Another way to earn miles is through airline dining and shopping programs. With dining programs, you can earn miles when you eat at any participating restaurant and pay with a linked credit or debit card. Many major airlines offer this type of program, so it’s a good idea to link your most-used cards to your favorite airline’s dining program.

If you’re shopping online, consider starting at an airline shopping portal. These virtual malls allow you to earn bonus miles for shopping with partner retailers.

Hundreds of stores participate, so if you’re buying something online, there’s a good chance you could earn extra miles by using the airline’s shopping portal.

» Learn more: How to earn and double-dip with online shopping portals

How to spend your airline miles

Now we’re getting to the good part: putting your miles to use for discounted travel and other rewards. Spending airline miles is often called redeeming, and the easiest method for finding ways to redeem miles with your airline of choice is to log in to your airline account.

Redeem your miles for flights

Many people primarily opt to redeem airline miles for (nearly) free air travel. Whether you want to hop across the state to visit family or jet across the world on a once-in-a-lifetime vacation, airline miles can help you get there.

Each airline has its own award chart or rules, so redeeming with one airline isn’t exactly like redeeming with another. You'll want to get in the habit of doing the math:

- Divide the cash price by the number of points needed for an award flight.

- Multiply that value by 100. Then, you'll know the value per point in cents.

Double-check that value against our valuations before you book to make sure you’re getting a good or on-par deal.

🤓 Nerdy Tip

If you do the math and find that you're not getting a good deal with an award ticket, consider saving your points for a better redemption in the future and paying instead with a travel credit card now. Advanced airline miles tip: Book flights in the airline alliance

In addition to booking flights on the airline where you have your mileage account, you might consider redeeming miles for flights with partner airlines. These relationships are sometimes known as airline alliances.

» Learn more: The basics of airline alliances and partnerships

There are three major alliances: Star Alliance, SkyTeam and Oneworld. These far-reaching airline partnerships open up virtually the entire world to U.S.-based flyers.

Through these arrangements, you can redeem airline miles as "partner awards," and the process is usually just as easy as redeeming a flight on your own airline.

For example, if you’re a member of United Airlines’ MileagePlus program and you log in to your account to search for award flights to Berlin, you’re likely to see flights on Lufthansa and Swiss Air Lines that you can book easily with United miles.

Redeem miles for hotel stays, rental cars and cruises

Some airline miles programs will let you cash in miles with hotel partners. American Airlines, for example, lets you use AAdvantage miles to pay for stays at more than 150,000 properties worldwide.

🤓 Nerdy Tip

As mentioned before, it's worth highlighting that it's harder to get a good value per mile when redeeming airline miles for other travel rewards. This shouldn’t be your first redemption choice. Some airlines let rewards members redeem miles for rental cars and cruises, too. Others let you cash in miles for whole vacation packages, airline lounge memberships, live events or charitable donations.

» Learn more: Plan your next redemption with our airline points tool

Shop with miles

It's possible to redeem your airline miles for merchandise, gift cards or magazine subscriptions with some programs. These options usually give you the worst value per point, so they should be your absolute last choice for redeeming airline miles.

Which airline miles are the most valuable?

Based on NerdWallet’s analysis, this is the value of an airline mile at major U.S. airlines:

Remember that these are averages, not fixed amounts. The cent-per-mile value you get will depend on the flight and cabin you book. For example, you may be able to get much more value when booking international flights in business or first class.

The best airline credit cards

If you're ready to start earning airline miles for every purchase, consider adding one of these cards to your wallet. Even bad credit doesn't have to keep you from earning travel rewards.

Top choices for credit cards for airline rewards include:

To choose an airline credit card, consider your travel circumstances and preferences. For instance, if your home airport is Chicago-Midway, it might make more sense to have a Rapid Rewards-branded credit card due to Southwest Airlines’ presence at the airport. A Delta-branded credit card might not do you much good.

» Learn more: The best airline credit cards on the market today

How do reward miles work?

Airline miles or points — the currency that you can redeem for flights, hotel stays and other rewards — work a little differently at every airline. Typically, they're worth 1 to 1.6 cents each. You can earn them by flying, spending on co-branded airline credit cards and shopping with specific partners.

JetBlue’s TrueBlue program offers the most valuable miles, but ultimately, the right airline credit card (and loyalty program) for you will depend on where you are and how you like to travel.

To view rates and fees of the Delta SkyMiles® Gold American Express Card, see this page.

To view rates and fees of the American Express Platinum Card®, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles