The Guide to Virgin Atlantic Flying Club

In addition to award flights, Virgin Atlantic points can be used for some adventurous redemptions.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

In 1984, Sir Richard Branson founded a quirky new airline. Named after his established Virgin Group, he dubbed the airline Virgin Atlantic. His adventurous personality came to personify what the airline was all about, including his famous "screw it, let's do it" philosophy. As it grew, Virgin Atlantic became the airline you flew if you wanted an adventure.

As it wraps up its fourth decade of flying, Virgin Atlantic is setting off on a new adventure. Since 2023, the United Kingdom-based airline has been a part of the SkyTeam alliance — adding over a dozen new airlines to its already-long list of airline and hotel partners.

In this guide, we'll explore how to earn Virgin Atlantic points, the best ways to redeem them, and what it takes to earn elite status with the airline’s loyalty program, the Flying Club.

About Virgin Atlantic

Economy seating on a Virgin Atlantic transatlantic flight. (Photo by Sally French)

Here’s a quick overview of a few key features of Virgin Atlantic and its loyalty program:

Main U.S. routes: Virgin Atlantic operates flights to 12 U.S. cities, with most of its flights routing through London-Heathrow airport. Flights to New York City, Los Angeles, Orlando, Fla., and San Francisco are among the most popular. Virgin Atlantic also operates flights to the U.S. from Manchester, England and Edinburgh, Scotland.

Classes of service: Virgin Atlantic offers three classes of seats — economy, premium economy and "Upper Class" business class. Economy fares are further broken down into three categories: Delight, Classic and Light. Upper Class passengers receive complimentary access to Virgin Atlantic Clubhouse lounges.

Points currency and loyalty program: Virgin Atlantic travelers earn and redeem Virgin points through the Virgin Atlantic Flying Club. Members earn a percent of the actual miles flown multiplied by an earning rate that depends on the fare class and the traveler's level of elite status. Points can be redeemed for flights, upgrades or holiday packages, or they can be transferred to hotel partners or other members.

» Learn more: The guide to Virgin Atlantic premium economy

How to earn Virgin Atlantic Flying Club points

Earn by flying

Flying Club members earn Virgin Atlantic points based on the ticket class and the number of miles flown. Economy flights earn from 25% to 150% of miles flown, while Premium flyers earn 100% to 200% and Upper Class travelers earn 200% to 400%. Here's how those earnings rates shake out:

Economy | Premium | Upper class |

|---|---|---|

Light - 25%. | Class H & K - 100%. | Class I & Z - 200%. |

Classic - 50% to 150%. | Class W & S - 200%. | Class J, C & D - 400%. |

Delight - 150%. | - | - |

Percentages represent points earned per mile flown based on ticket class. | ||

Don't want to do the math? The good news is that Virgin Atlantic offers a handy earning calculator.

Flying Club elite status members earn a bonus on top of the base earnings. Silver members get a 30% points bonus, while Gold elites get a 60% points bonus.

» Learn more: How to know how many miles you’ll earn from a flight

Flying Club members can also earn Virgin points by crediting flights flown on any SkyTeam partner or on any of Virgin Atlantic's nine non-alliance partners. The earnings rate depends on the airline you're flying, the fare class you booked and the distance of the flight.

Earn by spending on credit cards

Another way to earn Flying Club points is by using the Virgin Red Rewards Mastercard. Cardholders earn 3 points per dollar spent on purchases with Virgin companies, including Virgin Atlantic and Virgin Hotels.

Other Virgin Atlantic benefits of holding the card include:

Get 5,000 bonus points each cardholder anniversary year.

Receive 25 tier points (up to 50 per month) for every $2,500 in purchases on the card. That means you can achieve Silver status solely from credit card spending. Plus, you'll have an easier path to Gold by maxing out this opportunity.

After spending $15,000 and $30,000 on the card, you'll earn a choice of rewards, including a reward voucher for a companion fare.

» Learn more: The best airline credit cards right now

Earn Virgin points through transfer partners

Building your Flying Club points balance is easy thanks to Virgin Atlantic's many transfer partners. Virgin Atlantic partners with the following bank and hotel loyalty programs — which travelers can use to convert rewards into Flying Club points.

Brand | Transfer ratio |

|---|---|

American Express Membership Rewards | 1:1. |

Bilt Rewards | 1:1. |

Capital One miles (via Virgin Red) | 1:1. |

Chase Ultimate Rewards® | 1:1. |

Citi ThankYou Points | 1:1. |

Hilton Honors | 10:1.5. |

IHG One Rewards | 5:1. |

Marriott Bonvoy | 3:1. |

Wells Fargo | 1:1. |

World of Hyatt | 5:3. |

If you transfer at least 60,000 Marriott Bonvoy points to Virgin Atlantic, you'll receive an additional bonus of 5,000 Virgin Atlantic points. World of Hyatt has a similar offer: You'll receive 7,500 bonus Virgin points when converting at least 50,000 Hyatt points at one time.

Earn Virgin points on lodging

Virgin Atlantic Flying Club members have a slew of ways to earn Virgin points through hotel stays, such as the following:

Virgin Limited Edition: Earn up to 55,000 Virgin points by booking a stay at one of Richard Branson's retreats.

Virgin Hotels: Earn 2,000 points per stay. Plus, Silver elites will receive complimentary upgrades, and Gold elites will get upgrades and free breakfast.

Rocketmiles: Earn at least 500 points per night — up to 10,000 points per night.

Kaligo.com: Earn up to 10,000 points per night at 550,000 hotels worldwide.

Hyatt: Earn 750 Virgin points per stay at Hyatt hotels and resorts.

IHG: Earn up to 500 Virgin points per stay at select IHG brands.

Marriott: Earn up to 2 points per dollar spent at qualifying Marriott brands.

Best Western: Earn 500 Virgin points per stay at any Best Western property worldwide.

WorldHotels Collection: Earn 500 Virgin points per qualifying stay.

Yotel: Earn 500 Virgin points on stays of three or more nights in New York and 100 points for stays at Yotel airport locations.

Earn Virgin points on car rentals

Another way to earn Flying Club points is through rental car reservations with these five partners:

Avis: Earn from 250 to 1,000 Virgin points, depending on the length of rental and the rate you use.

Alamo: Earn 1,000 Virgin points per rental in the U.S. and Canada.

Hertz: Earn up to 1,100 Virgin points per rental — 1,000 points for leisure rentals plus 100 bonus points for Hertz Gold Plus Reward members.

National: Earn 1,000 Virgin points per rental in the U.S. and Canada and up to 1,200 points in Europe.

Sixt: Earn 500 points per car rental and 3 points for every euro (about $1.09) spent on Sixt premium limousine services.

Other ways to earn Virgin points

Flying Club members can also earn Virgin points through the following methods:

Online shopping: Earn 2 Virgin points for every English pound (about $1.24) spent through the Virgin Atlantic "Retail Therapy" shopping portal.

Virgin Atlantic Holidays: Book a package through Virgin Atlantic Holidays to earn a base of 2 Virgin Points for every English pound (about $1.24) spent. Even better, Silver Flying Club elites earn 3x and Gold Flying Club elites earn 4x points on bookings.

e-Rewards: Convert e-Rewards Currency or Opinion Points to Virgin points. The transfer rate depends on where your account is registered and how many points you convert.

Purple Parking: Earn up to 500 Virgin points for airport parking bookings.

Business Traveller: Earn 400 Virgin points for a one-year subscription, up to 2,300 Virgin points for a three-year subscription.

Purchase points: Buy Virgin points for $25 per 1,000 points, plus a $22 transaction fee.

» Learn more: British Airways vs. Virgin Atlantic: Which is better?

How to redeem Virgin Atlantic Flying Club points for maximum value

Virgin Atlantic award flights

For award flights on Virgin Atlantic, Flying Club uses dynamic award pricing — meaning the number of points required to book a flight will fluctuate depending on demand, availability and travel season.

Customers can use points to book any seat on a Virgin Atlantic-operated flight, meaning there is plenty of award availability. However, if seats are scarce, you'll likely have to shell out more points.

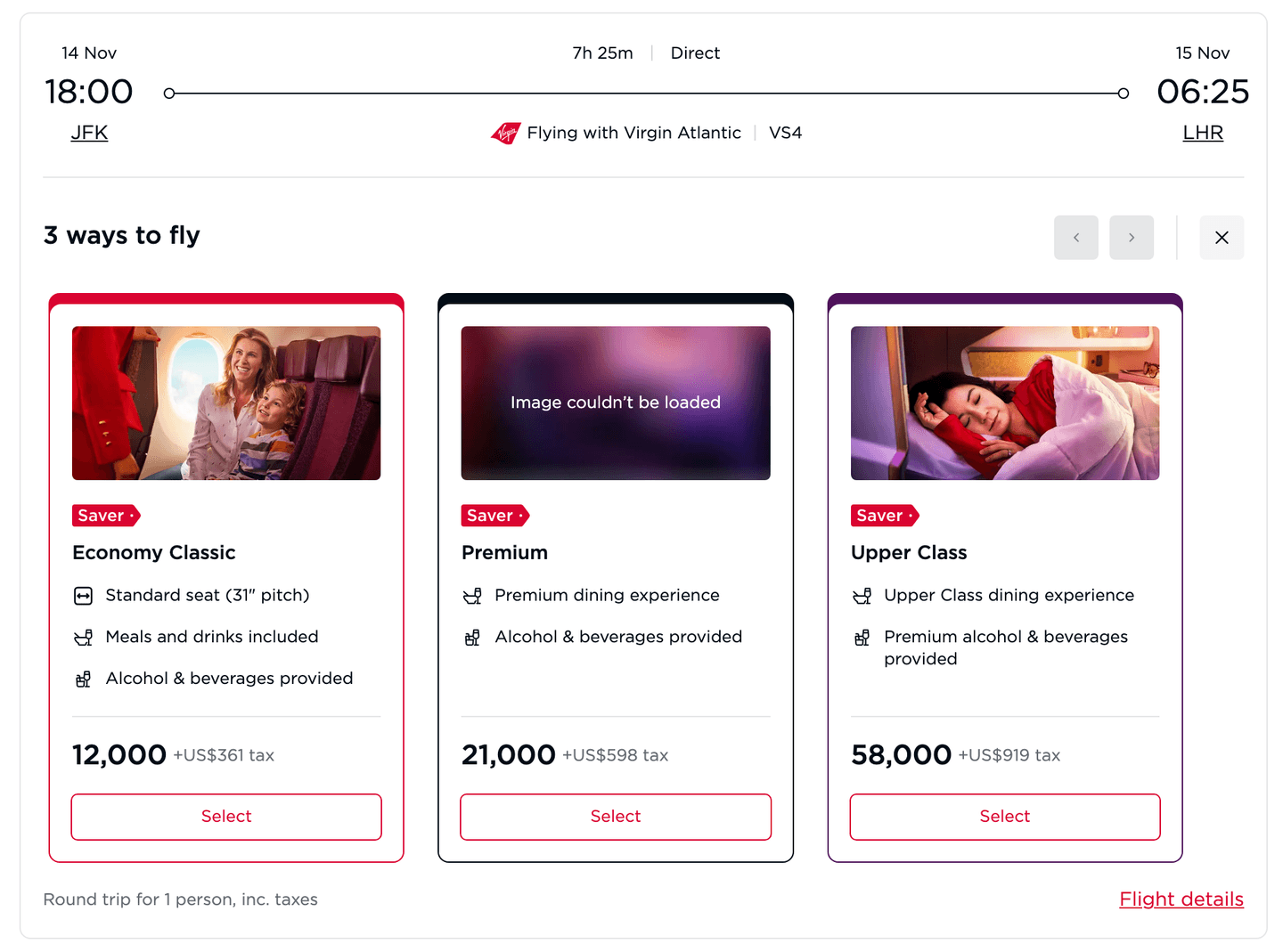

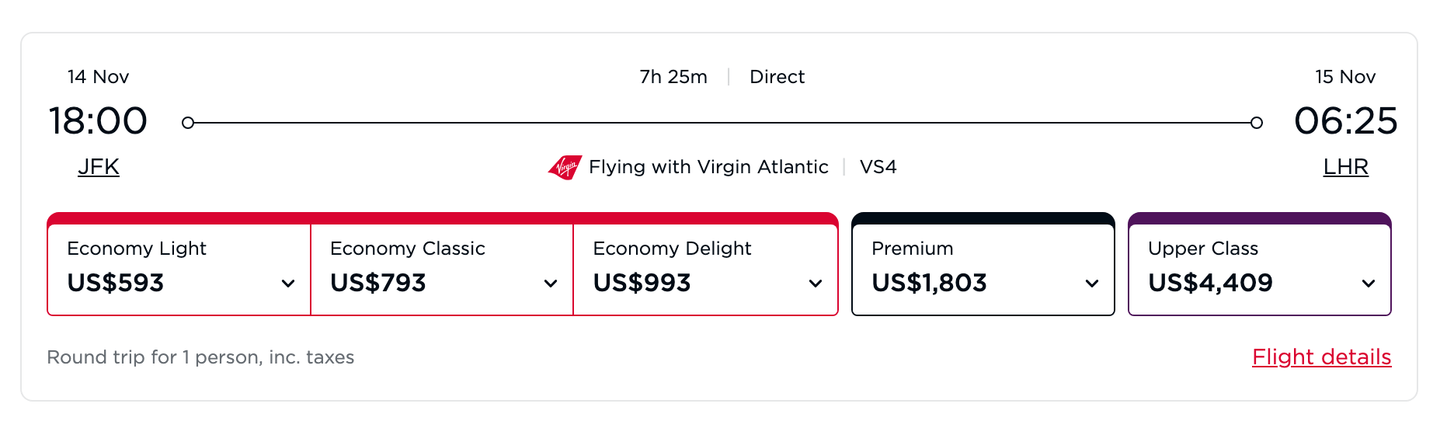

If you can find low-cost Saver reward seats, though, you're in for a treat. You can fly between the U.S. and the U.K. for as few as 12,000 points round-trip in economy and 58,000 points in business class.

However, fuel surcharges can be a major drag on the value of Virgin Atlantic points. Virgin Atlantic is infamous for charging excessively high cash co-pays on award tickets.

For example, you'll need to pay an additional $361 round-trip for that low-mileage economy redemption across the Atlantic. For premium economy, that goes up to $598, and it's $919 for business class.

That may seem extreme when you consider that the cash price without using award tickets would be as little as $593 round-trip for the same flights — or $793 round-trip for Economy Classic fares, which is what Virgin Atlantic economy award tickets are booked in.

However, after subtracting the out-of-pocket cost of the award ($361) from the cash ticket cost ($593), you'd get around 1.9 cents per point in value from this round-trip economy redemption, which is pretty good. Once you start looking at the premium cabins, the value can be even better: 5.7 cents per point for premium economy and 6 cents for business class.

In comparison, NerdWallet values Virgin Atlantic Flying Club points at 1.4 cents each. You should aim to get this value anytime you redeem your Virgin Atlantic Flying Club points for award flights.

Redemptions on All Nippon Airways (ANA)

One of the best sweet spots in the points and miles world is booking ANA business class awards through Virgin Atlantic Flying Club.

Travelers can book ANA business class awards between Hawaii and Tokyo for just 35,000 Virgin points each way. Flights from the U.S. West Coast cost just 45,000 Virgin points each way, and flights to or from the U.S. East Coast cost only 47,500 miles each way.

These are spectacular award redemption rates. For reference, United charges 110,000 MileagePlus miles for the one-way award flights in ANA business class. Air Canada Aeroplan charges between 55,000 and 75,000 points each way, depending on your route.

Even after a recent devaluation, travelers can still book ANA first class awards for as few as 57,500 Virgin points one-way from Hawaii, up to 85,000 points each way from the U.S. East Coast. That's excellent for awards that otherwise cost 110,000 Air Canada Aeroplan points or 121,000 United MileagePlus miles.

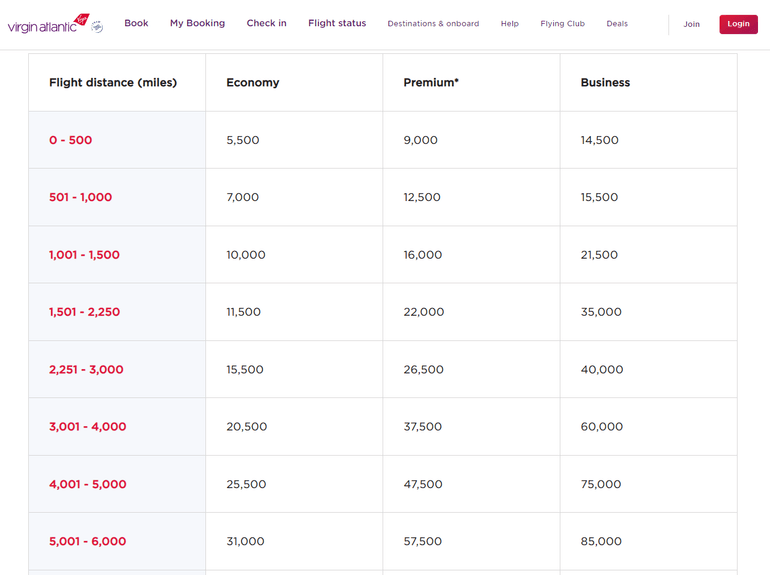

Here's the full breakdown of Virgin Atlantic Flying Club award prices on ANA:

Route | ANA business class | ANA first class |

|---|---|---|

Japan - Hawaii | 35,000 points (one way). | 57,500 points (one way). |

Japan - Western U.S. | 45,000 points (one way). | 72,500 points (one way). |

Japan - Central and Eastern U.S. | 47,500 points (one way). | 85,000 points (one way). |

Booking (certain) awards on Delta Air Lines

Booking an award flight on Delta Air Lines can be an excellent way to redeem Virgin Atlantic points. Flying Club members can book seats in Delta Main Cabin and Delta One business class. Unfortunately, Delta premium economy awards aren't bookable through Virgin Atlantic Flying Club.

Award flights now start at just 7,500 points for short flights under 500 miles, and nonstop flights up to 1,000 miles in distance cost just 8,500 points. That's enough to cover flights like Atlanta to Nassau, Bahamas.

Delta award flights to mainland Europe can also be a Virgin Atlantic Flying Club sweet spot. Nonstop flights cost 30,000 points in economy or just 50,000 points in Delta One business class. And the taxes and fees are minimal on these awards.

However, not all Delta flights are a good deal once you factor in the full cost of the award flight. Make sure to take notice of the taxes and fuel surcharges that apply. Delta Main Cabin awards to the U.K. can cost $556 round-trip out-of-pocket, while taxes and fees on Delta One awards can climb over $2,000 round-trip. With the out-of-pocket cost so high, it may make more sense to pay cash for a flight rather than redeem Virgin points.

Also, after a 2021 devaluation, longer and connecting domestic Delta flights aren't as appealing as before. That's because Virgin Atlantic charges separately for each flight and more for longer flights. For example, an award flight on Delta from Charlotte to Los Angeles costs 21,000 points one-way whether you connect through Minneapolis-St. Paul or Salt Lake City.

Depending on how much Delta is charging for an award, this can still be a good deal. For example, Delta is currently charging 34,500 SkyMiles each way for the same awards — with a 15% discount if you're a Delta cardholder.

Air France and KLM

Like on Delta and Virgin Atlantic, Flying Club redemptions on Air France and KLM range from mediocre to excellent. Fuel surcharges and taxes can eat into the value of what would otherwise be spectacular redemption rates.

For example, a one-way award flight from Atlanta to Paris-Charles de Gaulle in Air France economy class costs just 12,000 points. But you'll have to pay a not-so-nice $146 in taxes and fees.

Virgin Atlantic is also useful for hopping through Europe on KLM and Air France. Awards cost as little as 4,000 Virgin points each way on off-peak dates for under 600 miles in distance from the origin to the destination. That's true even if a connection makes the routing more than 600 miles.

» Learn more: 6 cheap flights within Europe to book with points

Redemptions on Air New Zealand

Virgin Atlantic also offers excellent award rates on Air New Zealand. For instance, you can book round-trip awards between Hawaii and New Zealand for 60,000 Virgin points in economy or just 90,000 Virgin points in business class. Similarly, flights between Los Angeles and the South Pacific cost 60,000 points round-trip in economy or 90,000 points round-trip in business class.

Unfortunately, this is mostly a theoretical sweet spot considering just how difficult Air New Zealand award availability can be to find. If you do find availability, you'll need to call Virgin Atlantic to book awards.

Lap infant award prices

Virgin Atlantic remains one of the best ways to book an award flight with a lap infant. Parents need to pay as few as 1,000 Virgin points each way for a child under the age of two, with the price depending on the class of the ticket:

1,000 points in economy.

2,000 points in Premium.

5,000 points in Upper Class.

And these rates also apply to partner awards. You only have to pay 1,000 points each way to add an infant to an economy award or 5,000 one-way in business class.

Unique ways to redeem Virgin points

All airline loyalty programs let members redeem miles for free flights, and most programs offer ways to redeem miles for hotels or other travel redemptions. But only Virgin Atlantic lets you use points for some truly unique redemptions, including a one-week stay at Necker Island, Sir Richard Brandon's private Caribbean island. However, that redemption will cost you a minimum of two million points — making it out of reach for almost everyone.

Virgin Atlantic Flying Club redemptions to avoid

According to NerdWallet's analysis, Virgin points have a value of 1.4 cents per point. Here are some redemptions that fall short of this threshold.

Points Plus Money Reservations

Virgin Atlantic likes to promote the ability to use Points Plus Money to book Virgin Atlantic flights. When booking eligible flights on Virgin Atlantic, you'll get the choice during checkout to apply as few as 3,000 points to reduce your out-of-pocket cost. However, this option doesn’t provide great value, as it has a rather poor redemption rate of less than one cent per point.

For example, on our booking from New York to London, Virgin Atlantic provides the following Points Plus Money redemption options:

$20.46 off for 3,000 points.

$40.92 off for 6,000 points.

$61.39 off for 9,000 points.

$81.85 off for 12,000 points.

$102.32 off for 15,000 points.

Each of these redemption options provides around 0.68 cents per point in value — which is well below our average value for Virgin points. The only time this redemption makes sense is if you have a small Virgin points balance and no way of topping it off for higher-value redemptions.

Most SkyTeam airline redemptions

When Virgin Atlantic joined SkyTeam in March 2023, it added redemptions through over a dozen of its new partners. Flying Club uses an identical distance-based award chart for these new SkyTeam partners — from Aerolinas Argentinas to Xiamen Air, with redemptions starting at just 5,500 points each way for flights under 500 miles.

Travelers may be able to find some niche value using this award chart — such as on short yet expensive international flights. However, distance-based award charts like these are generally constructed to keep travelers from getting outsized value.

Other non-alliance partner airlines

In addition to its SkyTeam alliance partners, Flying Club has nine additional partners. Two of these were covered above: ANA and Air New Zealand. However, not all non-alliance partner awards offer above-average value. Here are the four non-alliance partners with disappointing awards charts:

Hawaiian Airlines: Has a modest awards chart offering 7,500-mile intra-island flights and flights to the mainland starting at 20,000 miles each way.

Singapore Airlines: There are no business or first class awards offered to/from the U.S., and economy rates aren't compelling.

South African Airways: Offers 20,000-point round-trips within South Africa. However, South African Airways' limited route network makes it much less relevant to U.S. travelers.

Virgin Australia: Offers economy redemptions only. Rates are as low as 16,000 points round-trip within Australia. However, Virgin Australia's only long-haul flight is currently to Tokyo.

Three additional Virgin Atlantic Flying Club partners are earn-only partners: IndiGo, LATAM Airlines and SAS.

Convert Virgin points to hotel points

Virgin Atlantic members may convert Flying Club points to several hotel programs. The conversion rate isn't terrible if you need miles in a pinch. But travelers should be able to find better redemptions than these:

Hilton Honors: 2 Virgin points = 3 Hilton Honors points. Minimum transfer of 10,000 Virgin points, and transfers must be made in increments of 10,000 Virgin points.

IHG One Rewards: 1 Virgin point = 1 IHG One Rewards point. A minimum transfer of 10,000 Virgin points, then transfers can be made in increments of 5,000 Virgin points.

If you're considering transferring Virgin points to hotel points, consider booking a night through Kaligo instead. You can redeem from 20,000 to 40,000 Virgin points per night at over 465,000 hotels through Kaligo. That's still a lot of Virgin points to pay, but it might be cheaper than transferring points to Hilton or IHG.

Virgin Atlantic Flying Club’s elite status program

Flying Club has three member levels within its loyalty program, and members start in the Red tier just for joining Virgin Atlantic Flying Club. After earning 400 tier points, you're upgraded to Silver tier and after 1,000 tier points, you'll reach the Gold tier.

Virgin Atlantic Flying Club tier | Tier points required |

|---|---|

Red | None — basic level. |

Silver | 400. |

Gold | 1,000. |

Tier points are earned based on the ticket class purchased, ranging from 25 to 200 tier points for each one-way flight. As of Sept. 1, 2020, award tickets also receive tier points toward elite status.

Class of service | Tier points earned |

|---|---|

Economy | 25 to 50. |

Premium | 50 to 100. |

Upper class | 100 to 200. |

As you achieve higher status, you'll receive more valuable perks, as is the case with most airline loyalty programs. Higher elite status levels receive a bonus of 30% to 60% tier points on every flight.

Silver status receives a 30% points bonus, extra checked baggage, premium check-in, and the ability to select a seat ahead of time when flying on a Light economy ticket. Flying Club Silver members get SkyTeam Elite status perks when flying on other SkyTeam partners.

Gold elites receive top-tier benefits — including 60% bonus points, extra checked bags, Upper Class check-in, expanded award availability, and Clubhouse passes for you and a guest. Plus, Flying Club Gold elites get SkyTeam Elite Plus perks when flying on other SkyTeam airlines.

» Learn more: Which airline elite status should you go for this year?

Virgin Atlantic Clubhouses

Virgin Atlantic operates a network of Clubhouses located in six airports. In addition to its flagship location in London-Heathrow, you'll find Virgin Atlantic Clubhouses in the following airports:

Boston.

Johannesburg.

New York-John F. Kennedy.

San Francisco.

Washington-Dulles.

Virgin Atlantic Clubhouse lounges are considered some of the best airport lounges in the world. Travelers can enjoy complimentary bartender-prepared beverages, freshly cooked food, workout rooms and even a retreat area to relax in.

As part of Virgin Atlantic joining SkyTeam, the airline opened its flagship London Heathrow Clubhouse location to SkyTeam Elite Plus members traveling on Virgin Atlantic, Delta or Aeromexico.

All other SkyTeam Elite Plus members will have to use a partner lounge. Likewise, you'll have access to a partner lounge when flying Virgin Atlantic out of an airport that doesn't have a Clubhouse.

Virgin Atlantic Flying Club, recapped

Economy seating on a Virgin Atlantic transatlantic flight. (Photo by Sally French)

Virgin Atlantic — and its partner Virgin Red program — offer a slew of partnerships that make it easy for travelers to earn and redeem Virgin points. You can earn Virgin points through flights, card spending, hotel stays, car rentals and transferring points from many bank point programs.

Not all Virgin point redemptions are created equally. Redemption options range from spectacular (e.g. ANA business class awards) to mediocre (e.g. most SkyTeam partner redemptions) to downright bad (e.g. Points Plus Money).

Hopefully this guide helped you find new ways to earn Flying Club points, better ways to redeem Virgin Atlantic points, shortcuts to earning elite status, and why it's worth chasing that status.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2025:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph® Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card