The Best Budget Apps for 2026

NerdWallet’s editorial team evaluated a wide range of budgeting apps based on features, user reviews, and usability to identify top options. Our recommendations include tools tailored for individuals, couples, and wealth tracking

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Choosing a budget app can feel overwhelming. There are many on the market and they all offer different things — and at different price points.

Some apps take a more hands-off approach, letting you do the work of entering transactions and categorizing expenses. Others do the work for you through automation, bank connectivity and AI assistance.

Many people download apps only to quit weeks or months later because it’s not a good fit. This guide helps you find an app that matches how you actually manage money. Because the best budget is the one you’ll stick to.

NerdWallet's editorial team assessed popular budget apps and user reviews to arrive at top choices for you to consider. See our full methodology at the bottom of the page.

On this page

- Monarch Money, for flexible budgeting

- YNAB, for hands-on zero-based budgeting

- Goodbudget, for hands-on envelope budgeting

- Empower Personal Dashboard, for tracking wealth and spending

- PocketGuard, for a budget snapshot

- Honeydue, for budgeting with a partner

- EveryDollar, for simple zero-based budgeting

- Copilot Money, for autocategorization

- WalletHub, for credit monitoring

- Popular budget apps, according to Reddit users

Monarch Money, for flexible budgeting

Monarch Money stands out for its robust lineup of features and customizable budgeting tools. It works well for singles or couples and you can add a household member to the same subscription at no extra cost.

Monarch lets you to sync bank accounts, credit cards, loans and investments. After syncing, you can choose between two budgeting styles:

Flex budgeting is a high-level view that groups spending into three buckets: your fixed expenses, non-monthly recurring expenses (like annual subscriptions and kids' activity fees) and flexible expenses, such as groceries and dining out. This is the default option when you sign up for Monarch.

Category budgeting is a more detailed approach, where you set spending limits for specific categories, from your utilities to clothing.

Beyond budgeting features, Monarch includes a net worth tracker, investment dashboard, personalized reports and bill reminders. Its collaboration tools also stand out: users can tag expenses and set shared savings goals. Recent updates include an AI assistant, weekly spending recaps, improved goal-setting tools and support for equity compensation.

The app is available on desktop and mobile.

Is this app right for you?

Consider downloading this app if you:

- Want lots of customization and don’t mind spending time setting up your budget.

- Want to manage your money with your partner or household member in one place.

- Want to see your bigger financial picture, including investments and net worth.

- Want the option to switch budgeting styles.

You should skip this app if you:

- Are looking for a hands-off approach to budgeting.

- Need a free or low-cost option.

- Are a beginner who might feel overwhelmed by lots of features and options.

Cost

Monarch is $99.99 if paid annually, or $14.99 per month if paid monthly. There's a free seven-day trial and money-back guarantee.

Ratings

App Store rating: 4.9 stars

Google Play rating: 4.7 stars

» We tried this app. See our Monarch Money app review

YNAB, for hands-on zero-based budgeting

This app is designed so that users plan ahead for their financial decisions, rather than track past transactions. YNAB (You Need A Budget) follows the zero-based budgeting system, which means you assign a job to every dollar you earn.

When you get paid, you decide how much of your income goes toward spending, savings and debt. The goal is to become more intentional with your money because actively deciding how it's used.

YNAB lets you to link checking and savings accounts, credit cards and loans, or you can opt out of syncing and manually add or import transactions, if you prefer.

The app also features a loan payoff simulator and “YNAB Together,” which allows up to five users — including partners, parents or caregivers — to share one membership.

The app works on mobile, desktop and Apple Watch.

Is this app right for you?

Consider downloading this app if you:

- Want to be proactive and hands-on with your budgeting.

- Like assigning every dollar a “job.”

- Are focused on paying down a debt.

- Want to budget with other members of your household under one plan.

You should skip this app if you:

- Want to set up your budget once and let automation take over.

- Are looking for a free or low-cost option.

Cost

YNAB costs $14.99 if you pay per month, or $109 if you pay annually, although you can try it out in a free 34-day trial. College students can use YNAB for free for a year.

Ratings

App Store rating: 4.8

Google Play rating: 4.5

» We tried this app. See our YNAB review

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Goodbudget, for hands-on envelope budgeting

Goodbudget is more about planning your finances than tracking previous transactions. This app is based on the envelope budgeting system, in which you portion out your monthly income toward specific spending categories (called envelopes).

The free version doesn’t connect to your bank accounts. You manually add account balances (that you can pull from your bank’s website), as well as cash amounts, debts and income. Then you assign money to envelopes.

The free version allows one account, two devices and limited envelopes. The paid version, Goodbudget Premium, allows unlimited envelopes and accounts, up to five devices and other perks. You can also link checking, savings and credit accounts to allow automatic tracking.

You can access the app from your phone and the web. You’ll also find many helpful articles and videos that help you use the app. Goodbudget provides courses related to budgeting, paying off debt and more.

Is this app right for you?

Consider downloading this app if you:

- Like the idea of envelope budgeting but don’t want to carry cash.

- Enjoy making a plan for every dollar ahead of time.

- Want to share a budget with your partner or household member.

- Are comfortable entering expenses by hand to avoid paying.

You should skip this app if you:

- Prefer automatic bank syncing.

- Want to set your budget and forget about it, thanks to automation.

- Like sleek graphics and modern aesthetics.

Cost

Goodbudget is free. Goodbudget Premium is $10 if you pay per month, or $80 if you pay per year.

Ratings

App Store rating: 4.6

Google Play rating: 3.3

» We tried this app. See our Goodbudget review

Empower Personal Dashboard, for tracking wealth and spending

Empower is primarily an investment tool, but its free app includes features helpful for budgeters looking to track their spending.

You can connect and monitor checking, savings and credit card accounts, as well as IRAs, 401(k)s, mortgages and loans. With that information, Empower offers a net worth and portfolio tracker.

The app provides a spending snapshot by listing recent transactions by category. You can customize those categories and see the total monthly spending each category represents.

Empower can be accessed on mobile and desktop.

Is this app right for you?

Consider downloading this app if you:

- Want to see your full financial picture in one place — not just a monthly budget.

- Want to focus on building your net worth and investments.

- Prioritize a free tool.

You should skip this app if you:

- Are looking for hands-on tools to help you focus on spending and saving.

- Want to actively plan or assign money to spending categories.

Cost

Empower is free.

Ratings

App Store rating: 4.6

Google Play rating: 3.1

» We tried this app. See our Empower Personal Dashboard review

PocketGuard, for a budget snapshot

PocketGuard is another app that follows the zero-based budgeting framework.

After you connect your checking, savings and credit card accounts, you enter your monthly income and recurring expenses, such as housing, utilities, groceries and transportation costs.

The app then shows a detailed view of your incoming and outgoing cash flow and calculates how much money you have left to spend after covering bills, debt payments and savings goals. If there's an imbalance in your budget, the app will let you know.

You can customize how your transactions are categorized in bulk, rather than manually changing categories one by one, but there are limits on how many times free users can do this. PocketGuard also organizes recurring bills so you know what’s ahead, and its subscription manager lets you track and cancel subscriptions.

Other PocketGuard features include a net worth tracker, which allows you to sync investment accounts, track property values and manually track other assets; a savings goals tracker; and a debt payoff plan.

You can access PocketGuard on the web, phone and Apple Watch.

Is this app right for you?

Consider downloading this app if you:

- Want a relatively hands-off budgeting experience.

- Are looking to see how much money is leftover at the end of each month.

- Want to track spending, net worth and subscriptions in a single app.

You should skip this app if you:

- Enjoy digging into details, like assigning a job to every dollar or creating very specific budgeting categories.

- Are looking for advanced customization.

- Want a free app.

Cost

PocketGuard offers a free seven-day trial. After that, it costs $12.99 per month if you pay monthly, or $74.99 per year if you pay annually.

Ratings

App Store rating: 4.6

Google Play rating: 4.2

» We tried this app. See our PocketGuard app review

Honeydue, for budgeting with a partner

Honeydue is designed so you and your partner can view both your financial pictures in one app. Both partners can sync bank accounts, credit cards, loans and investments. (Although you can choose how much you share with your significant other.)

The free budget app automatically categorizes expenses, but you’re also able to create custom categories. Together, you can set up monthly limits on each of these categories, and Honeydue will alert you when you or your partner is nearing them.

Honeydue also sends reminders for upcoming bills and lets you chat and send emojis.

Is this app right for you?

Consider downloading this app if you:

- Are in a relationship and want a shared view of your money, but also want to control what you share with your partner.

- Value in-app communication, whether it’s giving a thumbs up when your partner pays a bill on time or asking them about a purchase.

- Appreciate alerts (i.e., when you’re reaching a spending limit).

- Want a dose of reflection and learning alongside financial planning.

You should skip this app if you:

- Want to search transactions in your app to find specific retailers or items.

- Like to automate regular financial transactions, like a payday every two weeks or monthly rent. These functions aren’t currently possible.

- Prefer to budget on your desktop because it offers a bigger screen or different view (Honeydue currently doesn’t offer a desktop version of its app).

Cost

Honeydue is free.

Ratings

App Store rating: 4.5

Google Play rating: 4.2

» We tried this app. See our Honeydue review

EveryDollar, for simple zero-based budgeting

Everydollar, designed by personal finance expert Dave Ramsey’s company Ramsey Solutions, offers another zero-based budgeting framework. It relaunched in January of 2026 to include features like a “margin finder” to find extra breathing room in your budget, personalized plans, daily lessons and live group coaching.

In the free version of the EveryDollar app, you can't sync accounts with your bank. Instead, you need to manually enter incoming and outgoing money throughout the month. You will also need to categorize line items in your budget as you add them.

The premium version of EveryDollar allows you to connect your bank account, which means your transactions automatically appear in the app. Premium users also get access to custom reports and recommendations based on your habits.

EveryDollar is available on both mobile and the web.

Is this app right for you?

Consider downloading this app if you:

- Like clear rules and guidelines.

- Don’t mind manually entering transactions.

- Are a fan of Dave Ramsey’s approach to money.

You should skip this app if you:

- Want a fully automated app.

- Desire flexibility.

- Want advanced customization features.

Cost

The basic version of EveryDollar is free. You can try the premium version for free for 14 days. After the trial, you pay $79.99 a year if you pay annually, or $17.99 a month if you pay monthly.

Ratings

App Store rating: 4.7

Google Play rating: 4.3

» We tried this app. See our EveryDollar review

Copilot Money, for autocategorization

Copilot uses AI to autocategorize spending and help users understand where their money goes. The app is designed solely for Apple users and learns your spending patterns over time to suggest savings goals and make predictions.

While Copilot includes budgeting tools, it's better suited for getting a big-picture view of your finances. The app tracks spending, cash flow, net worth and investments in one place, making it easy to see how everything fits together.

Copilot offers snapshots of daily spending and upcoming bills, along with a high-level overview of cashflow. It spots subscription services you might have forgotten about, and lets you roll over money you didn’t spend to the next month or save for bigger purchases.

Is this app right for you?

Consider downloading this app if you:

- Are an Apple user who wants automatic categorization with minimal setup logistics.

- Like a high-level view of your finances.

- Want to track spending, cash flow and net worth in one place.

You should skip this app if you:

- Are an Android or PC user. (The app is only available for Apple devices.)

- Are looking for strict category limits or a more hands-on experience.

- Want a free budgeting app.

Cost

Copilot Money costs $13 per month, or $95 if billed annually. A one-month free trial lets you try it out before buying.

Ratings

App Store rating: 4.8

WalletHub, for credit monitoring

WalletHub is a multifaceted financial app that hosts several areas of financial wellness: spending, credit, investments and identity protection.

The free version centers on credit, offering daily credit reports and scores, as well as credit monitoring and tips for improving your score. Advanced features, including budgeting, credit building, identity protection and account sharing require an upgrade to the premium version.

For budgeting, the platform hosts a spending tracker, budgeting tool and subscription manager. It also provides a financial “score” to assess your overall financial health. The new “spending trimmer” helps you spot chances to save and compares you with your peers.

Is this app right for you?

Consider downloading this app if you:

- Want a free way to track credit daily and monitor your score.

- Are focused on rebuilding or protecting your credit.

You should skip this app if you:

- Want a budgeting-first app.

- Have other ways to closely monitor your credit.

- Don’t want to upgrade to access advanced features.

Cost

A free version of WalletHub is available if you are only interested in credit monitoring. WalletHub Premium costs $7.99 per month, billed annually, with a 30-day money-back guarantee. Premium+ costs $10.50 per month, billed annually.

Ratings

App Store rating: 4.8

Google Play rating: 4.7

Popular budget apps, according to Reddit users

We sifted through Reddit forums to get a pulse check on how users feel about budget apps. We used an AI tool to help analyze the feedback. People post anonymously, so we cannot confirm their individual experiences or circumstances.

Users stress that the best budget app is the one you’ll actually use and stick with. Users also say you get what you pay for, noting apps with fees tend to offer more features. These references rose to the top of our analysis.

- YNAB is frequently thought of as a top choice, with its biggest caveat being cost.

- Monarch Money garners positive reviews and is often cited as a good replacement for users of the now defunct Mint app.

- Copilot gets mentioned multiple times as a good option that's only available to Apple users.

- Google Sheets and Excel come up consistently as a free and customizable way to make a budget.

Are budget apps secure?

Aggregators and your data

Budget apps that sync your accounts typically rely on third-party companies called aggregators. These companies (like plain, Yodlee and Finicity by Mastercard) connect connect to your bank, credit card and other financial accounts to pull your data.

It's important to understand how these companies protect your information before deciding whether to connect your accounts. To learn more, search online for the app’s name plus “security” for details.

Choose apps that use bank-grade encryption (AES 128-bit or 256-bit) and that support or require multi-factor authentication. Both add strong layers of protection for your data.

If you'd rather not link your accounts, consider apps that let you enter your information manually, such as YNAB or GoodBudget, or try web-based tools like the ones listed below.

Methodology to identify the best budget apps

How we came up with the list

Our editorial team looked for apps that allowed users to do the following:

- Sync several types of financial accounts (and opt out of syncing).

- Plan ahead for financial decisions versus simply tracking past transactions.

- See their expenses categorized in order to understand spending patterns.

- Track bills and receive alerts for upcoming due dates.

- Share financial information with partners or members of the same household.

Our experts also looked for nice-to-have features, such as showing credit score and net worth, as well as investment trackers and detailed help guides. And we noted apps that were free or relatively inexpensive.

The experiences of real users matter, too. So we read reviews of the apps in the iOS App Store and Google Play, noting complaints and kudos. We only included apps that received at least 4.5 stars out of 5 in the iOS App Store or at least 3 out of 5 on Google Play, as well as at least 1,000 reviews. Those ratings were checked and updated on Jan. 12, 2026.

Budgeting resources from NerdWallet

Explore our free tools

We offer other free budgeting tools you can try:

- Use NerdWallet's budget template to record your expenses.

- Compare other online budget spreadsheets for a quick check of your finances.

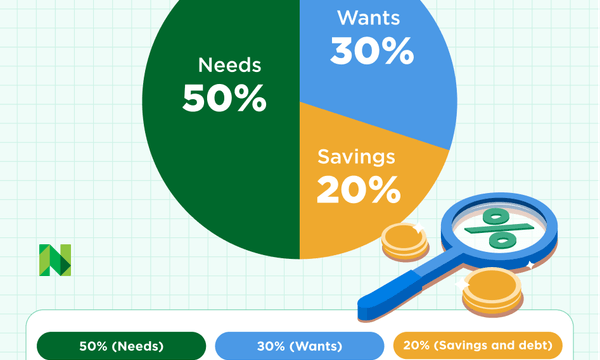

- Estimate how to divide your monthly income with a budget calculator.

- Try the free NerdWallet app, which lets you track your cash flow and net worth. You can also monitor your credit score.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles