What Is the FAFSA Submission Summary?

The FAFSA Submission Summary is a document that contains your financial aid eligibility and a summary of your FAFSA responses.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The FAFSA Submission Summary is a document containing your estimated financial aid eligibility for the relevant academic year and copies of your responses on the Free Application for Federal Student Aid (FAFSA).

The summary is not an official financial aid offer. Colleges use the information from your summary to create financial aid offers once they’ve admitted you.

Here’s what you need to know about your FAFSA Submission Summary and how it factors into your financial aid package.

» MORE: 2025-26 FAFSA is now open

What information does the FAFSA Submission Summary include?

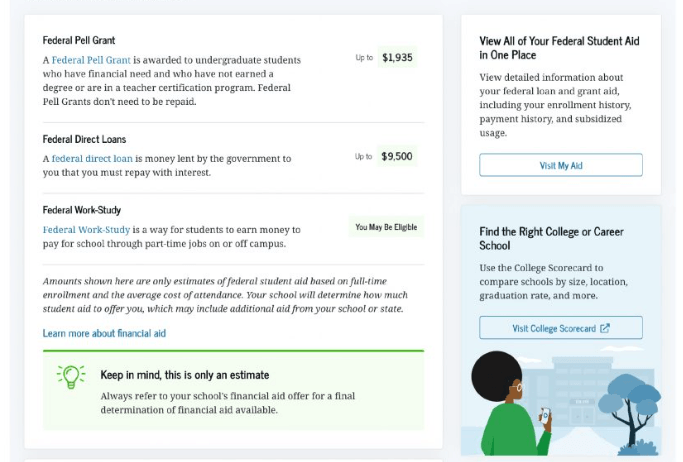

The FAFSA Submission Summary provides basic information about your financial aid eligibility, including:

Estimated eligibility for federal student loans.

Estimated eligibility for the need-based Pell Grant, which provides up to $7,395 per academic year that you don’t repay.

Estimated eligibility for federal work-study.

A copy of the answers you provided for each FAFSA question.

Information about the school(s) you selected to send your FAFSA to, including graduation rates, median student debt upon completion and average annual cost of attendance.

Example FAFSA Submission Summary

The summary also contains your Student Aid Index (SAI), a measure of your financial need that colleges use to determine your financial aid offers. The index ranges from -1,500 to 999,999. A lower SAI indicates higher financial need.

If your FAFSA was incomplete, your Submission Summary will include instructions on how to resolve any issues before you can receive your SAI.

» MORE: When is the FAFSA deadline?

How to access and download your FAFSA Submission Summary

You can access your FAFSA Submission Summary after the Education Department processes your FAFSA, typically one to three business days after you submit the form.

To find your FAFSA Submission Summary, log into your StudentAid.gov account and check your main dashboard. You’ll find the date you submitted your FAFSA, the date it was processed and a link to view your summary.

Only students can access their FAFSA Submission Summary. FAFSA contributors, like parents or spouses, cannot directly access the document.

To download a copy of your summary, select the “Print FAFSA Submission Summary” button in the upper-right corner of your dashboard and save the document as a PDF.

What should you do with your FAFSA Submission Summary?

Review the report carefully to make sure all the information you provided is correct. That information determines your SAI and your eligibility for federal and institutional aid, so it’s crucial that it’s accurate and up to date.

If you find a mistake, like an error in your address, go to your studentaid.gov account to make a FAFSA correction. If the Social Security number or any tax information imported from the IRS on your FAFSA is incorrect, though, you might have to submit a new application on paper. In that case, contact your school’s financial aid office to find out what your next step should be.

If your current financial situation is different than what’s reported in your FAFSA — for example, if your parents’ income this year will be substantially less than the information on the tax returns you provided — talk with the financial aid office at the school you plan to attend.

Only after you have exhausted all federal and free student aid that you can access through the FAFSA — such as grants, scholarships and federal student loans — should you turn to private student loans.