With NYCB Downgraded, Will There Be A Regional Banking Crisis in 2024?

It’s unclear if more regional bank failures are on the way in 2024 in the wake of last year’s bank runs.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Update as of Feb. 8, 2024:

On Feb. 6, Moody’s, one of the top credit rating agencies, downgraded New York Community Bancorp (NYCB) to junk status. Fitch, another credit rating agency, also downgraded the bank’s rating last week. NYCB's shares fell nearly 60% over the past week.

Moody's wrote in its release that the downgrade “reflects multi-faceted financial, risk-management and governance challenges facing NYCB.”

In March 2023, NYCB acquired $38 billion in Signature Bridge Bank’s assets after the latter collapsed suddenly. That acquisition was a major expansion for the regional bank, which then reportedly struggled to meet regulatory requirements. NYCB reported fourth-quarter losses last week.

Moody’s noted in its downgrade that NYCB “took an unanticipated loss on commercial real estate (CRE), which is a significant concentration for the bank.” The credit rating agency further noted that a loss of depositor confidence could put the bank’s funding and liquidity in jeopardy.

In response to the credit downgrade, NYCB issued a press release on Feb. 6 to detail its “deposit stability” (72% of all deposits are insured) and “ample liquidity” (it’s liquidity is$37.3 billion, which the bank says is more than enough to cover uninsured deposits). The bank additionally named a new executive chairman in an effort to “improve all aspects of the Bank’s operations,” according to a statement released by the bank.

The news spurred a broader sell-off of regional bank stocks and stoked fears of further ripple effects in the regional banking industry. The KBW Regional Bank exchange traded fund, an index that tracks regional banks, is down 12% since the start of the year.

Previous updates: • Aug. 22, 2023: This week S&P Global Ratings, one of the top credit rating agencies, cut the ratings of five regional U.S. banks: Associated Banc Corp, Comerica Inc, KeyCorp, UMB Financial Corp. and Valley National Bancorp.

• Aug. 9, 2023: Moody’s cut the ratings of 10 regional banks this week and warned some of the biggest lenders in the U.S. that they could be next.

Multiple lenders are now on notice for a potential downgrade including Bank of New York Mellon; Cullen/Frost Bankers; Northern Trust; State Street; Truist Financial; and U.S. Bancorp. [Editor’s note: Bank of New York Mellon has changed its name to BNY as of June 11, 2024.]

The credit agency also assigned a negative outlook to 11 additional banks including Capital One, Citizens Financial and PNC Financial Services Group.

• July 26, 2023: PacWest Bancorp, a midsize regional lender based in Los Angeles, is set to merge with Banc of California, Inc., the two banks announced on July 25. On May 3, PacWest said in a statement that it was planning to sell its portfolio and was evaluating potential partners and investors. The combined bank will be headquartered in Los Angeles under the Banc of California name and will now have a total of 70 branches. The new company is expected to have $36.1 billion in assets, $25.3 billion in total loans and $30.5 billion in total deposits.

The story below was originally published March 31, 2023 and has since been updated multiple times.

In spring 2023, banking failures in the U.S. and Europe prompted government interventions in an effort to contain the crisis. The collapses brought discussion about regulating the banking sector back into the spotlight in a way we haven’t seen since the Great Recession. The phrase “too big to fail” has made its way into the zeitgeist once again.

On March 21, U.S. Treasury Secretary Janet Yellen said in a statement to the American Bankers Association, “The situation is stabilizing. And the U.S. banking system remains sound.”

Some economic wonks and lawmakers are now arguing for reform including an increase to the $250,000 Federal Deposit Insurance Corp. insurance cap. And midsize banks are asking the FDIC to insure all deposits for at least two years, according to reports. But House Republicans are calling for an end to banking bailouts and said they oppose “any universal guarantee on bank deposits over the current limit.”

However, on March 22, Yellen told senators, “I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits.”

Meanwhile, the Federal Reserve has been on a mission to tame inflation. The Fed raised the federal funds rate 10 times in a row starting in March 2022. After pausing its hikes in June, the Fed raised rates in July to 5.25%-5.5%.

To get you up to speed on the 2023 banking crisis, here are answers to popular questions about last year's events.

How many banks have collapsed?

Three U.S. banks have collapsed so far: Silicon Valley Bank on March 10; Signature Bank on March 12; and First Republic on May 1.

Bank failures are fairly rare. Prior to the collapse of Silicon Valley Bank and Signature Bank, there had not been a bank failure since Kansas-based Almena State Bank on Oct. 23, 2020. Since 2001, there have been 563 bank failures, according to the FDIC.

The failures of SVB and Signature Bank prompted panic among depositors with large accounts since deposits are only FDIC-insured up to $250,000.

Following the failures of Silicon Valley Bank and Signature Bank, the U.S. Treasury Department, the Federal Reserve and the FDIC said on March 12 that depositor’s accounts would be safe. The Deposit Insurance Fund, which is composed of fees assessed on financial institutions as well as interest on government bonds, would foot the bill.

“Let me be clear: The government’s recent actions have demonstrated our resolute commitment to take the necessary steps to ensure that depositors’ savings and the banking system remain safe,” Yellen said in her statement on March 21 to the American Banking Association.

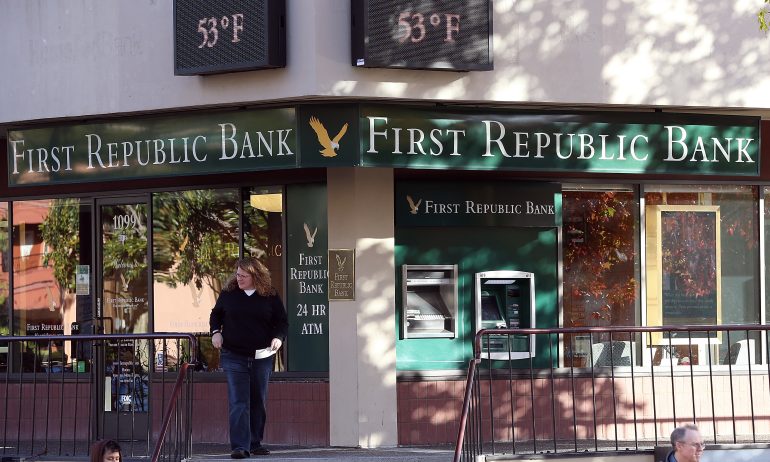

Why did First Republic Bank fail?

First Republic is the latest bank to fail. First Republic was sent to the Federal Deposit Insurance Corporation for receivership on May 1 and was purchased by JP Morgan Chase Bank the same day.

JP Morgan Chase Bank will assume all deposits and assets of First Republic, and its 84 offices in eight states reopened on May 1 as branches of JP Morgan Chase Bank. First Republic customers should continue using their existing branch until JP Morgan Chase notifies them that other Chase branches are available to process their accounts.

As of April 13, First Republic had about $229.1 billion in assets and $103.9 billion in total deposits. The bank had been troubled in the aftermath of two bank failures in March. It received a lifeline of $30 billion from 11 of the nation’s largest banks on March 16, in an effort to suppress the failure of another bank and quell fears of further contagion. On April 24 the troubled bank reported dismal first-quarter results, including a $100 billion decline in deposits. As of end of day on April 28, First Republic's stock price had fallen 95% since the two bank runs rocked the financial system in March.

The cost of resolving First Republic Bank’s failure will cost about $13 billion from the FDIC’s Deposit Insurance Fund. FDIC and JP Morgan Chase entered a loss-share transaction — the FDIC absorbs some of the loss on certain assets sold to a purchaser of a failing bank — on multiple types of loans it purchased from First Republic including family, residential and commercial. The FDIC wrote in a press release that the transaction should minimize disruptions for loan customers.

Why did Silicon Valley Bank fail?

Silicon Valley Bank was the bank of choice for startups, venture capitalists and tech companies. It was the second-largest bank failure in U.S. history.

SVB’s failure was due to a bank run. On March 8, SVB’s CEO Greg Becker sent shareholders a message indicating that it had lost $1.8 billion on the sale of U.S. treasuries and mortgage-backed securities. In response, depositors withdrew $42 billion of their money quickly and by March 10, the bank failed. The FDIC announced the same day that it had taken over and established the new Deposit Insurance National Bank of Santa Clara, which later became Silicon Valley Bridge Bank N.A.

On March 26, the FDIC announced First Citizens would purchase the loans and deposits of Silicon Valley Bridge Bank.

On April 28, the Federal Reserve released a self-condemning assessment of Silicon Valley Bank’s collapse. The report, which Fed Vice Chair for Supervision Michael S. Barr called “unflinching,” highlighted its own shortcomings and neglect in identifying problems with SVB. The review blamed the bank’s failure on a mixture of SVB management, the rollback of banking regulations under the Trump administration and blunders in the Fed’s supervision of the bank.

In particular, the report found supervisors were operating too slowly to remediate the bank’s problems once they were identified. The assessment revealed that at the time of SVB’s collapse it had 31 unaddressed supervisory warnings — three times the number of red flags raised to other banks of its size. It also provided suggestions for fixing weaknesses in order to prevent failures in the financial system.

Why did Signature Bank fail?

On March 12, New York state regulators closed Signature Bank, a lender serving real estate firms, law firms and the cryptocurrency industry. Like SVB, it also collapsed due to a bank run. The FDIC took over the same day and established a new Signature Bridge Bank N.A.

On March 20, a subsidiary of New York Community Bancorp known as Flagstar Bank agreed to buy the loans and deposits of Signature Bank.

On April 28, the FDIC released its own assessment of Signature Bank’s failure and found poor management was primarily to blame for its collapse. It specifically called out management’s pursuit of rapid growth while neglecting to practice appropriate risk management. The report further found shortcomings in the FDIC’s own oversight of Signature Bank saying it could have moved faster in supervisory actions, but blamed “resource challenges with examination staff” that affected delivery of actions.

What’s happening with Silvergate Capital Corp.?

Another failure is on the way, though its closure is less dramatic. Silvergate Capital Corp., which like Signature Bank served the crypto market, announced plans on March 8 to wind down its operations and liquidate its assets. On March 20, the bank said in an SEC filing that its president had been laid off and that it needed more time to complete a 10-K form, which the New York Stock Exchange required for its listing standards.

What happened to Credit Suisse?

At the time of Silicon Valley Bank’s failure, Credit Suisse was on the fast track to collapse following years of missteps and shake-ups. Its turmoil accelerated on March 15 when Saudi National Bank's then-Chairman Ammar Al Khudairy told news outlets that it would not provide additional financial assistance to the bank. Saudi National Bank was one of Credit Suisse’s primary investors. Soon Credit Suisse’s stock price tanked and clients began to pull out their money. On March 16, Credit Suisse said it would borrow 50 billion Swiss francs (about $54 billion) from the Swiss National Bank in an effort to strengthen its liquidity.

The 167-year old Swiss bank is classified as one of 33 “globally systemic banks," according to the Financial Stability Board, an international body that monitors the global financial system. In colloquial terms, it’s one of the banks deemed “too big to fail.” The collapse of any of these globally systemic banks could have, as the name suggests, perilous domino-effect-like implications for the global financial system.

By March 19, Swiss president Alain Berset announced that Credit Suisse’s rival UBS would purchase the troubled bank. Berset called the deal the “best solution to restore confidence that has been lacking in financial markets recently.” However, bondholders will still lose all of their investments — totaling 16 billion Swiss francs or approximately $17 billion — according to the Swiss Financial Market Supervisory Authority, or FINMA.

Swiftly following the announcement that UBS would be buying Credit Suisse, the U.S. Treasury, U.S. Federal Reserve and the European Central Bank issued statements to reassure both the public and the markets that banking systems are strong and stable.

Are other banks are in trouble?

A March 2023 working paper by the National Bureau of Economic Research, or NBER, finds that recent bank asset value declines have made the U.S. banking system vulnerable. NBER finds 10% of banks with larger unrecognized losses than those at SVB and 10% also have lower capitalization than SVB.

The biggest difference between SVB and other banks was its disproportionate share of uninsured funding. But there is still fragility. The paper says, “if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors.”

Should I take my money out of the bank?

No. Your money is safe so long as your bank or credit union is federally insured. All deposit amounts for former account holders with Silicon Valley Bank and Signature Bank are also protected even if you had more than the federally insured $250,000.

In addition, the Federal Reserve Board announced it will safeguard deposits at all banks through the new Bank Term Funding Program. The fund is intended to provide additional sources of liquidity to banks in the form of up to one-year loans. It will have an initial $25 billion available to banks, savings, associations, credit unions and other eligible depository institutions that pledge U.S. Treasuries, agency debt and mortgage-backed securities as collateral.

Are we in a recession?

No. A recession is often the shorthand for “things seem bad in the economy,” but the actual definition is “a significant decline in economic activity that is spread across the economy and that lasts for more than few months,” according to NBER, which tracks business cycles and is the official scorekeeper of recessions.

Its data goes back as far as the mid-19th century. The most recent recession was technically February 2020 through April 2020 at the start of the COVID-19 pandemic.

NBER uses a set of economic indicators to determine business cycles and recessions in the U.S. These indicators include the number of employees; employment; industrial production; manufacturing and trade industries sales; real personal income; real personal consumption expenditures, or PCE; real gross domestic product, or GDP; real gross domestic income, or GDI; and the real average of GDP and GDI. They’re all available on a dashboard compiled by the Federal Reserve Economic Data, or FRED, the research arm of the Federal Reserve Bank of St. Louis.

Are we headed for a depression?

Highly unlikely. A depression is a severe recession marked by decreased demand, a significant fall in economic growth and production, high unemployment and stock market crashes.

The U.S. has only ever experienced one economic depression since the start of the modern industrial period: The Great Depression lasted from 1929 until 1941 during World War II, according to the Federal Reserve.

(Disclosure: NerdWallet also banked with SVB before its closure.)

Photo credit: Justin Sullivan/Getty Images News via Getty Images