How Much Is a Secured Credit Card Deposit?

Most secured credit cards require a deposit of $200 to $300. The more you deposit, the higher your credit limit will be and the more flexibility you'll have in using your card.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

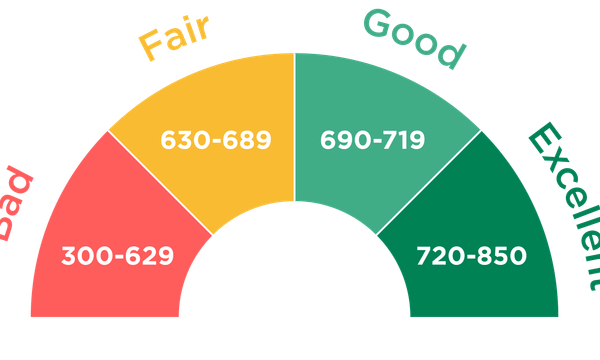

Secured credit cards are an option for many people with bad credit or no credit history who struggle to get approved for a regular credit card. That's because these cards require a cash deposit, which protects the card issuer in case the cardholder doesn't pay the bill.

Most secured cards require a deposit of at least $200 or $300, although at least one card has an option for a lower deposit. Every secured card allows you to deposit more than the minimum, but most set a maximum deposit amount. Your deposit is usually equal to your credit limit. Once you've improved your credit enough to qualify for a regular "unsecured" card, you can upgrade or close your secured account and get your deposit back.

Below are the deposit requirements for some of the most popular secured credit cards. Your local bank or credit union may have additional options.

Major secured credit card deposit requirements

| Card name | Minimum | Maximum |

|---|---|---|

| $49, $99 or $200* | $1,000 | |

| $200 | $2,500 | |

| $200 | $2,500 | |

| $200 | $3,000 | |

| $200 | $5,000 | |

| $200 | None specified** | |

| $300 | $3,000 | |

| $300 | $5,000 | |

| $500 | None specified** | |

| First Progress secured credit cards (all) | $200 | $2,000 |

| Unity Visa Secured Credit Card | $250 | $10,000 |

| Wells Fargo Secured Credit Card | $300 | $10,000 |

| * Some applicants may be able to qualify for a $200 credit line with a deposit of only $49 or $99. Also, when you make your first 5 payments on time, you could get access to a higher credit line with no additional deposit. ** This card is secured by your savings account at the issuing institution. | ||

How much should you deposit?

If the minimum is all you can afford, it's perfectly fine to only deposit that amount. You'll just have to be extra careful in how you use your card. The point of a secured card is to build your credit, and a key element of your credit scores is credit utilization, the percentage of your available credit that you're using. Credit scoring models tend to penalize utilization over 30%, so if your credit limit is $200, you won't want your balance to exceed $60.

If you can afford a higher deposit, consider giving yourself the extra flexibility and breathing room. A deposit of $500 or $1,000 bumps up that 30% threshold to $150 or $300. As you can see in the chart above, some cards let you go much higher. The tool below calculates 30% and 10% amounts for deposit amounts up to $5,000:

Need help saving up for a deposit?

Some people have bad credit but plenty of cash; for them, getting together a few hundred or even a couple of thousand dollars for a secured card deposit is not a big problem. When you're living paycheck to paycheck, however, coming up with an extra $200 can be a significant obstacle. NerdWallet has a guide to saving up for a secured card deposit that's full of actionable tips and ideas.

An important thing to know is that once you get approved for a secured card, you don't have an indefinite amount of time to come up with the deposit.

Trying to get approved for a card?

Create a NerdWallet account for insight on your credit score and personalized recommendations for the right card for you.

When do you pay a secured card deposit?

Each secured credit card issuer has its own rules for paying or "funding" the deposit:

- Some require you to pay the deposit immediately upon approval. They may ask for bank account information on the application itself and immediately withdraw the money.

- Some require you to open a linked savings account. This is common at credit unions, and some banks do it as well. You open an account with the issuer, and the balance of your account then becomes your deposit and determines your credit limit.

- Some give you a set period of time to pay the deposit. If you don't have the deposit funded by the time that period expires, your application status changes from "approved" to "rejected."

Learn more, and find cards that give you a little extra time, in our guide to funding your secured card deposit.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.