Medicare Open Enrollment Guide: What You Need to Know

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

When is Medicare open enrollment?

Mark your calendar

What can you do during Medicare open enrollment?

With Medicare Advantage:

- Change from one Medicare Advantage plan to another.

- Change from a Medicare Advantage plan without drug coverage to a plan with drug coverage, or vice versa.

- Switch from Medicare Advantage to Original Medicare.

With Original Medicare:

- Enroll in a Medicare Part D prescription drug plan.

- Switch from one Medicare Part D plan to another.

- Quit your Medicare Part D plan (but watch out for late enrollment penalties if you go back later).

- Switch from Original Medicare to a Medicare Advantage plan.

Compare Medicare Advantage plans

| Insurance company | CMS Star Rating | States available | Members in high-rated plans | Member experience |

|---|---|---|---|---|

| 4.1 /5 | 48 states and Washington, D.C. | Medium (50% to 84%) | 3.76 (Above average) | |

| 3.61 /5 | 46 states and Washington, D.C. | Low (49% or less) | 3.61 (Above average) | |

| 4.19 /5 | 43 states and Washington, D.C. | Medium (50% to 84%) | 3.88 (Above average) | |

| Best for low-cost plan availability (855) 432-0512 / TTY 711 | 3.68 /5 | 29 states and Washington, D.C. | Medium (50% to 84%) | 3.89 (Above average) |

| 4.19 /5 | 29 states | Medium (50% to 84%) | 3.66 (Above average) |

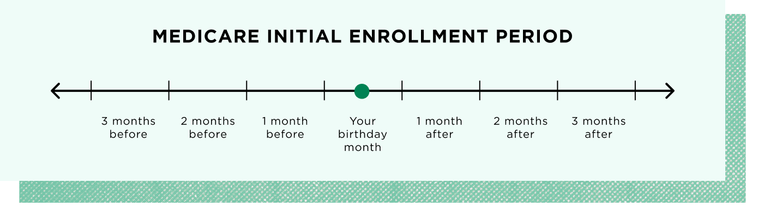

Can I sign up for Medicare during open enrollment?

Your Medicare open enrollment checklist

1. Review your ANOC.

2. Check to see if your drugs are covered.

3. Make sure your providers are in network.

4. Compare your plan options during open enrollment.

What if I just want to keep my current coverage?

Part D plans change from year to year, too. Watch out for changes to covered drugs, premiums and out-of-pocket costs. Plug your drugs into a plan comparison tool to find the best coverage option for you.

lead writer covering Medicare

Can I drop my Medicare Advantage plan and go back to Original Medicare?

- Medicare open enrollment: Oct. 15 to Dec. 7.

- Medicare Advantage open enrollment: Jan. 1 to March 31.

When can I change my Medicare Supplement Insurance plan?

What happens if I do nothing during Medicare open enrollment?

- If your Medicare Advantage plan ends, you’ll be enrolled in Original Medicare unless you pick another Medicare Advantage plan.

- If your Medicare Part D plan ends, you’ll lose prescription drug coverage unless you sign up for another plan. (If you have Extra Help, you’ll be automatically enrolled in a new plan unless you choose one yourself.)

Shopping for Medicare Advantage plans? We have you covered.

| MEDICARE ADVANTAGE is an alternative to traditional Medicare offered by private health insurers. Compare options from our Medicare Advantage roundup. | |

| Best for size of network

| Best for Part B Giveback

|

| Best for ratings

| Best for low-cost plan availability

|

| Star ratings from CMS and on a 5-★ scale. | |

Best Medicare plans in each state

Top Medicare Advantage companies

- Best for size of network: UnitedHealthcare.

- Best for ratings: Aetna.

- Best for low-cost plan availability: HealthSpring (formerly Cigna).

- Best for Part B Giveback: Humana.

- Best startup: Devoted Health.

Article sources

- 1. Centers for Medicare & Medicaid Services. Medicare Open Enrollment. Accessed Nov 5, 2025.

- 2. Centers for Medicare & Medicaid Services. Joining a plan. Accessed Nov 5, 2025.

- 3. Centers for Medicare & Medicaid Services. When does Medicare coverage start?. Accessed Nov 5, 2025.