Self-Checkout: Pros, Cons and How Businesses Can Use Them

Self-service checkout systems can be essential for some businesses but inconvenient for others.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Self-checkouts can take many forms, from grocery store kiosks to QR codes at restaurants. Including self-checkout hardware or software as part of your business operations gives customers the option to order and pay for their items without having to interact with an employee.

Self-service point-of-sale systems can be essential for some businesses but inconvenient for others, depending on the type of product offered, staffing needs, theft risk and several other factors. Here’s what to know.

| Pros | Cons |

|---|---|

|

|

advertisement

Which businesses use self-checkouts?

Self-checkouts are most often found in big-box grocery stores and have been met with mixed reviews. But self-service options are available for small businesses, too, and can make a difference in cost and convenience.

Restaurants

Many restaurants have adapted to a more health-conscious world with contactless ordering and payments. At quick-service restaurants, where customers order and pay in a single interaction, face-to-face transactions can be replaced with kiosks.

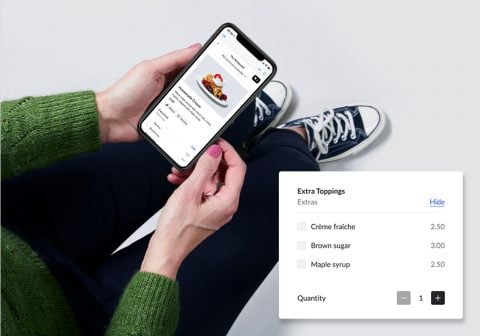

Self-checkout software can also support a sit-down dining experience with tablets or QR codes at tables that let customers place orders at their convenience. POS systems offer features like order customization and bill-splitting to make this process easier.

These checkouts can also be good for business; POS providers Lightspeed and Toast say that customers order more when placing the order themselves.

Retail stores

Self-checkouts are less of a benefit for small retail businesses. Retail transactions can require employee services like ID verification and packing and tag removal. There’s also a higher risk of theft.

Self-checkouts can make operations easier for businesses with high traffic and multiple locations, especially with current labor shortages — but the costs and security risks may be too much for mom-and-pop shops.

Services

On the front end of the transaction, self-check-in has become popular in airports, hotels, medical offices, salons and more. Service employees often have back-to-back appointments, so a self-service check-in can alert a new customer’s arrival without interrupting.

Self-check-in software also helps maintain sanitation and social distancing. Customers can check in on a kiosk or their own devices and wait for their appointment in a waiting room, their car or outside. NCR offers a hotel check-in system that dispenses room keys, for example.

» MORE: Best small-business apps

Subscribe for grant opportunities, product recommendations and no-nonsense advice from the Nerds.

SUBSCRIBE FOR FREE

Pros

Reduced labor costs

Self-service systems can reduce the burden on employees, even eliminating the need for some duties. For example, at a hair salon, self-check-in can replace a front desk associate; stylists can process their own customer’s payment at the end of an appointment.

At a large retail store, a single employee can monitor a block of self-checkout kiosks, freeing up other employees for different tasks. Quick-service restaurants with several tablets can handle a meal rush with only one or two cashiers at the register.

Smoother checkout

Self-checkout stations allow more customers to order and pay at once without additional staffing, speeding up the rate to process orders. Checkout can feel faster to customers when they’re doing it themselves instead of waiting in line or for a cashier to scan their items.

Self-service food orders are also more likely to be accurate. Customers can select their customizations and add notes about dietary restrictions without the risk of miscommunication.

Minimal contact

The COVID-19 pandemic has made it more important than ever to have sanitary and safe business operations, and self-checkouts can help protect both customers and employees.

Instead of face-to-face ordering and payment, entire transactions — including sit-down meals — can be safely completed on tablets, smartphones or kiosks. (Keep in mind, though, that self-checkout stations should be cleaned regularly.)

Cons

Customer difficulties

Self-checkouts can cause frustration and confusion if they’re not user-friendly or if customers aren’t used to the technology. There can be a learning curve with mobile ordering, tablets and kiosks, and some customers may always prefer face-to-face service.

Impersonal experience

Many small businesses benefit from the relationships that good customer service can build with patrons. Adding a self-checkout option or switching altogether can take away the opportunity for employees to sign customers up for rewards accounts, answer questions or upsell a product or service.

Theft risk

The most notorious issue with self-checkouts is an increased risk of theft. This is specific to retail stores and has become a problem in large grocery stores and general merchandise retailers like Target and Walmart. Self-checkout kiosks can be easily “tricked” by switching barcodes, weighing expensive items as cheaper ones or simply placing an item into the bag without scanning it, even accidentally.

But for small restaurants and services that use kiosks for paying for orders upfront or checking in for an appointment, theft risk isn’t an issue. The rare retail store that operates via self-checkout can compensate with solid security measures.

What providers offer self-checkout POS options?

Toast

Monthly fees:

- $0 for Starter Kit plan.

- $69 Point of Sale plan.

- Custom plans available.

Hardware cost:

- $449.10 for Handheld Starter Kit (but $0 if you agree to a higher processing fee).

- $1,024.10 for Countertop Starter Kit (but $0 if you agree to a higher processing fee).

- $1,339.10 for Guest Self-Service Starter Kit (but $0 if you agree to a higher processing fee).

Toast offers self-checkout kiosks that can process orders and payments and update guests on their order status with SMS notifications. The company also provides a QR-code and digital-menu ordering system for table service. As NerdWallet’s current pick for best restaurant POS system, it’s a great choice for adding self-checkout options.

Toast POSon Toast's website |

Lightspeed

Monthly fees for retailers:

Lightspeed offers three different plans for retail stores:

- $109 for Basic plan ($89 if billed annually).

- $179 for Core plan ($149 if billed annually).

- $339 for Plus plan ($289 if billed annually).

Hardware cost:

Pricing for Lightspeed's iPad and desktop hardware kits is quote-based. Individual hardware products are listed in Lightspeed's online store:

- $79 for Mobile Tap V2 card reader.

- $169 for iPad stand.

- $329 for WisePOS E countertop reader.

- $429 for Lightspeed Lite Server for data backup and offline mode functionality.

Lightspeed offers “Self-Order Menu” software that can be used in kiosks and tablets, either at the counter for quick-service or at the table for sit-down dining.

LightSpeed POS |

Square

Monthly fees:

- $0 for Square Free plan.

- $49 for Square Plus plan.

- $149 for Square Premium plans.

Hardware cost:

- $0 for Square magstripe-only card reader ($10 for each additional reader) or if using Tap to Pay for iPhone (iPhone not included).

- $59 for Square Reader contactless and chip card reader.

- $149 for Square Stand iPad POS or Square Stand Mount (iPad not included; monthly financing available).

- $149 for Square Kiosk for self-serve ordering.

- $299 for Square Terminal mobile card reader with built-in printer (monthly financing available).

- $399 for Square Handheld portable POS system with built-in barcode scanner (monthly financing available).

- $799-$899 for Square Register two-screen system (monthly financing available).

- $1,189 and up for Square Register hardware kit with cash drawer and printer.

Square also has QR-code and mobile ordering functionality. The company doesn’t offer its own self-service kiosks, but it partners with Flash Order and KioskBuddy to integrate Square software with a customer-facing tablet.

| |

NCR

Software cost: NCR Silver Starter plan from $0 per month, Premium plan from $165 per month.

Hardware cost: Quote-based.

NCR doesn’t advertise self-service options for restaurants, but the company does offer self-service kiosks for retail checkout. The NCR FastLane SelfServ includes an integrated scanner, scale, touchscreen and card reader and has built-in security measures to help prevent theft and fraud.

Make payments make sense

Find the right payment provider to meet your unique business needs.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

FEATURED

Best Payment Processing Companies

Related articles