Arch RoamRight Review: Is It Worth the Cost?

With affordable rates and glowing reviews, Arch RoamRight is as good a choice as any for travel insurance.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

at Squaremouth

Arch RoamRight

Its annual multi-trip plan is a good value for those who travel often.

at Squaremouth

Pros

- Highly recommended on Squaremouth and TrustPilot.

- Pre-existing conditions exclusion waiver available on both plans.

- Offers an emergency medical coverage plan for last-minute travelers.

Cons

- Only two main policy options.

- No Cancel For Any Reason option.

Although many credit cards offer travel insurance as part of their benefits, coverage limits vary, so you may want to look at standalone travel insurance plans too.

There are a lot of options to choose from, in terms of both insurance providers and cost. If you’re considering Arch RoamRight travel insurance to insure your next trip, let’s take a look at the coverage it provides and how much its plans cost.

What is Arch RoamRight?

Arch Insurance Group has provided underwriting services for many travel insurance companies since 2002.

In 2012, Arch Insurance launched its own Maryland-based travel insurance company called Arch RoamRight and started providing coverage for U.S. citizens and permanent residents.

» Learn more: What to know before buying travel insurance

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Arch RoamRight plans

Arch RoamRight travel insurance offers two types of comprehensive plans: Pro and Pro Plus. Here’s what you can expect to be covered by each plan.

Pro Plan

This more affordable policy covers:

- 100% trip cancellation (with a limit of $15,000).

- 100% trip interruption or delayed arrival.

- Itinerary change or return flight costs.

- Trip delay or missed connection costs.

- Emergency accident and sickness medical expenses.

- Emergency evacuation and repatriation of remains.

- Political and security evacuation.

- Baggage loss or delay expenses.

- Complimentary coverage for one child 17 or younger, with a covered adult.

- Pre-existing medical conditions (if certain conditions are met).

- Worldwide travel assistance.

Pro Plus Plan

The premium policy includes everything you’ll find on a Pro plan plus:

- 150% trip interruption coverage.

- Cancel for work reason coverage.

- Accidental death and dismemberment coverage.

- Optional Platinum upgrade, which will increase some coverage limits, including medical, medevac and trip delay.

» Learn more: The best travel insurance companies

What does Arch RoamRight cover?

Let’s compare the Arch RoamRight travel protection plans, costs and coverage inclusions for a 10-day trip to Spain that costs $2,000 for a 36-year-old resident of Utah.

Pro plan coverage

Coverage and limits for the Pro plan from Arch RoamRight include:

- Trip delay: $150 per day, with a $600 maximum.

- Trip cancellation: 100% of the trip cost, with a $15,000 limit.

- Trip interruption: 100% of the trip cost.

- Baggage delay: $300.

- Lost baggage: $250 per article, combined limit of $500 for valuables, $750 total limit.

- Missed connection: $250.

- Emergency evacuation: $250,000.

- Political and security evacuation: $50,000.

- Emergency accident and sickness medical expense: $25,000, with a $750 maximum for dental.

- Pre-existing medical conditions waiver: Plan must be purchased within 14 days of your initial trip payment.

- Return flight cost: $500 (in case of a Level 4 travel advisory).

The plan cost for our sample trip is $107.

Pro Plus coverage

Coverage and limits for the Pro Plus plan from Arch RoamRight include:

- Trip delay: $200 per day, with a $1,000 maximum.

- Trip cancellation: 100% of the trip cost, with no limits.

- Trip interruption: 150% of the trip cost.

- Baggage delay: $400.

- Lost baggage: $250 per article, combined limit of $600 for valuables, $1,500 total limit.

- Missed connection: $750.

- Emergency evacuation: $500,000.

- Political and security evacuation: $100,000.

- Emergency accident and sickness medical expense: $50,000, with a $750 maximum for dental.

- Accidental death and dismemberment: $10,000 or $25,000 on an aircraft.

- Pre-existing medical conditions waiver: Plan must be purchased within 21 days of your initial trip payment.

- Cancel for work reason: 100% of the trip cost, plan must be purchased within 21 days of your initial trip payment.

- Return flight cost: $750 (in case of a Level 4 travel advisory).

This level of coverage will set you back $121.

Both plans offer the option to add on the following types of coverage:

- Sports and hazardous sports.

- Baggage, sports and business equipment.

🤓 Nerdy Tip

Arch RoamRight also offers medical-only coverage and multi-trip coverage for longer-term trips up to 365 days. Family travel considerations

Arch RoamRight travel insurance can be particularly helpful for families traveling together. This is because one child (17 years old or younger) can receive the same coverage as a covered adult — at no extra charge — on either plan.

So, a family of two adults and two kids could pay for a plan covering two adult travelers, and both kids’ coverage will also be included for free.

» Learn more: When to buy annual or multi-trip travel insurance

How to get a quote from Arch RoamRight

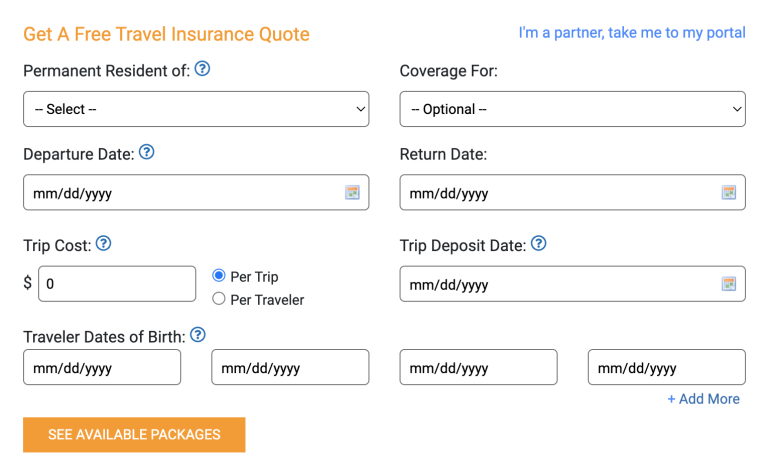

Getting a quote from Arch RoamRight for your next trip is no different than getting one from any other company.

Simply go to RoamRight and fill out the form, which includes information regarding your state of residency, the type of coverage you want (general travel, annual or medical), travel dates, trip cost, trip deposit date and travelers’ dates of birth.

Once the form is complete, click on “See available packages” and take a look at the quotes. Keep in mind that you must purchase a plan at least one day before departure — you can’t purchase a plan after you’ve started your trip.

» Learn more: Common travel insurance myths

Is Arch RoamRight legit?

Yes, Arch RoamRight is a legitimate travel insurance company that maintains an A+ Better Business Bureau rating.

Of those who reviewed Arch RoamRight on InsureMyTrip, a marketplace that helps travelers find the right coverage for their trips, 96% recommend Arch insurance travel protection to other travelers.

Is Arch RoamRight travel insurance worth it?

Purchasing travel insurance is a smart way to protect the investment you’ve made in your travel plans, especially if you’re taking a once-in-a-lifetime vacation or if many expenses associated with the trip are nonrefundable.

Arch RoamRight offers travelers two plans to choose from with the option to add on a few extras.

The company’s stellar BBB rating makes it an attractive option among travel insurance providers. It’s also a great choice for families looking to save a few bucks and still be protected in case of the unexpected.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles