How to Buy Southwest Points

While generally not a great value, buying Rapid Rewards points is easy to do through the Southwest website.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Southwest is one of the most popular airlines in the U.S., offering numerous methods to earn Rapid Rewards points that can be redeemed for flights.

But what happens if you’re looking to redeem your Southwest points for an award ticket but realize you don’t have enough points? If you need the points ASAP, one way to get them quickly is to buy them.

Buying Southwest points generally isn’t recommended because you might end up paying more for the points than you would if you bought the flight, but in certain cases, it can make sense.

Keep reading to learn how to buy Southwest points and when it can be a good idea.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

How to purchase more Southwest points

Southwest Airlines partners with Points.com to sell its Rapid Rewards points. Follow these steps to bolster your points collection immediately.

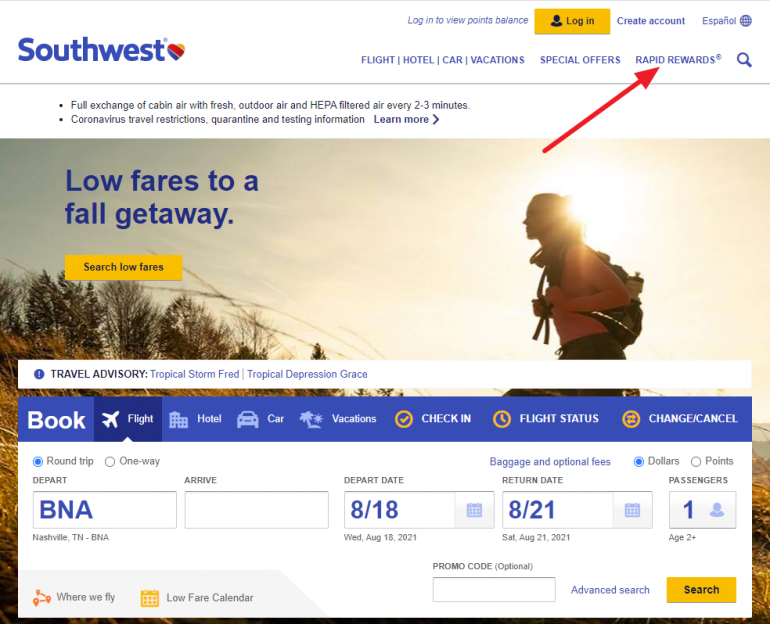

1. Go to southwest.com, log in to your account and click on "Rapid Rewards."

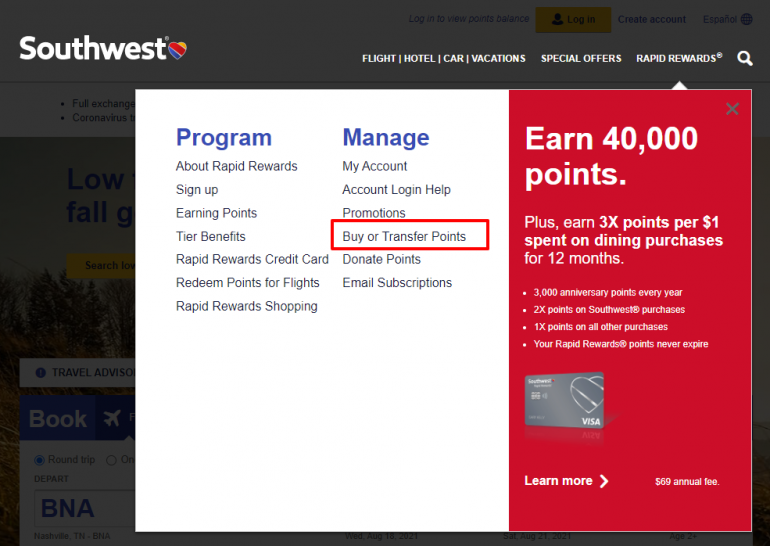

2. From there, click on Buy or Transfer Points.

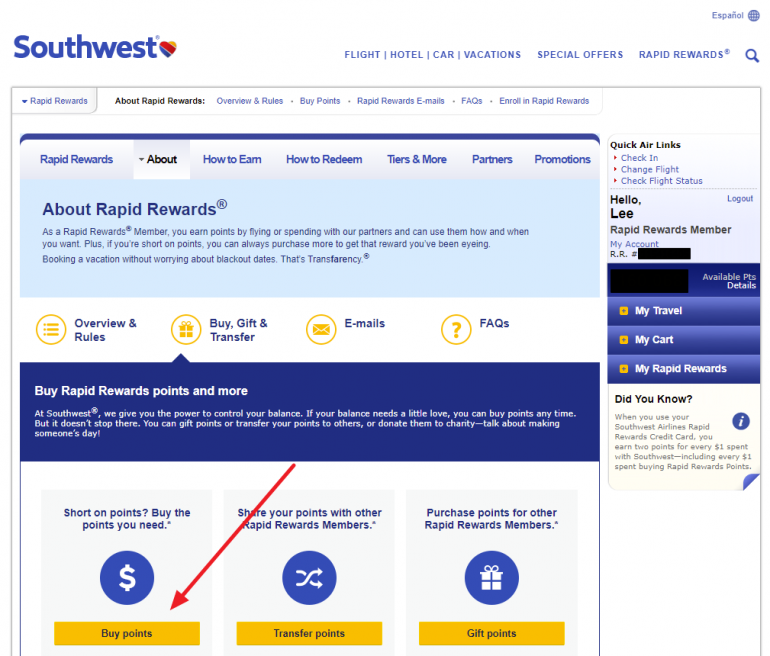

3. Click on "Buy points."

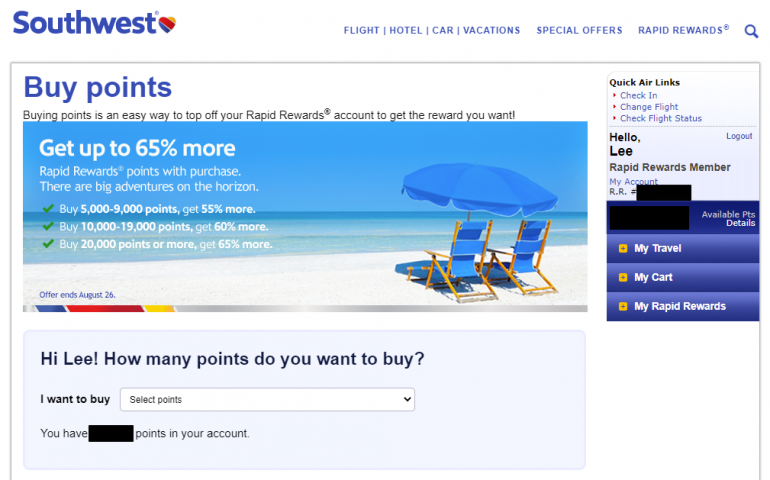

4. Choose how many points you want to buy.

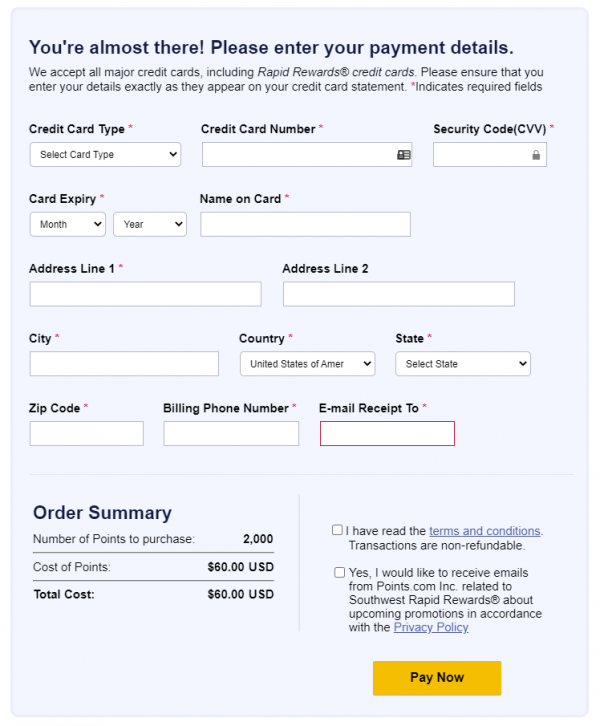

5. Enter your payment details to complete the purchase.

How much do Southwest points cost?

The base cost to buy Southwest points starts at $60 for 2,000 points, which is 3 cents per point. As you buy more points, the price per point decreases.

🤓 Nerdy Tip

Sometimes the airline offers a bonus points promotion, like 40% off when you buy more than 15,000 points, which can make the price per point drop even further. Meanwhile, NerdWallet found the average value of a Rapid Rewards point when redeemed for award flights is 1.3 cents each. If you buy Southwest points at the base rate of 3 cents per point, you’re paying more than double what they’re worth.

That’s why there are only a few instances when it makes sense to buy Southwest points.

When to buy Southwest points

Unlike United Airlines miles or American Airlines miles, Southwest points have a fairly fixed value when redeemed for flights. Because of this, it's hard to find a redemption of outsized value that justifies the cost of buying Rapid Rewards points.

That being said, buying Southwest points can still make sense in a few scenarios, like:

- When you're traveling with the Southwest Companion Pass. When you hold the Companion Pass, your designated companion can travel for free whenever you fly. This effectively doubles the value of your points, which makes it more attractive to buy Southwest points when you can buy them at a good price.

- During a bonus points promotion. Southwest holds regular bonus promotions where you will receive extra points on your purchase. These promotions can substantially increase the number of points you receive, which reduces the overall cost per point.

- When you don’t have Chase Ultimate Rewards® or Marriott points. Southwest is a transfer partner of both of these programs (more on this below).

Alternatives to buying Southwest points

Because it will most likely cost you more than 1.3 cents per point to purchase Southwest points, you may be hesitant to purchase them. Thankfully, there are alternative ways to earn additional Southwest points without flying, but they’re not all instantaneous.

Ways to get Southwest points instantly

A points transfer using both of the following methods happens pretty quickly.

Transfer Chase Ultimate Rewards® points to Southwest

Southwest Airlines is a transfer partner with Chase Ultimate Rewards®. Points are transferred instantly on a 1:1 basis and there are no fees.

Convert Marriott points to Southwest

Marriott Bonvoy points convert to Southwest points at a 3:1 ratio. This means that 30,000 Marriott points yield 10,000 Southwest points. This method might result in lost value because Marriott points are worth about 0.8 cent each while Southwest points are worth about 1.3 cents each.

With a 3:1 transfer ratio, you’d convert about 2.4 cents of Marriott points into 1.3 cents of Southwest points.

Marriott offers a transfer bonus that makes the transfer a bit more even. For every 60,000 Marriott points transferred, you will receive a 5,000-point bonus. So instead of getting 20,000 Southwest points, you’ll end up with 25,000, but you will still lose value.

If you won’t use the Marriott points anyway, the transfer might still be a good choice.

Marriott hasn’t disclosed how long it takes for a points transfer to post but travelers report it can take anywhere from several hours to two days to complete a points transfer from Marriott to Southwest.

5 other ways to get Southwest points

Here are several other ways to earn Southwest points. None of these methods will get you the points you need instantly, but if you’re not in a time crunch, these are the best ways to go.

1. Spending on a Southwest credit card

When you have a Southwest credit card, you can earn points on every purchase. Plus, when you sign up for a new card, you have the potential to earn a welcome bonus.

Welcome offer

Earn Companion Pass through 2/28/27 and 40,000 bonus points after spending $5,000 on purchases in the first 3 months from account opening.

Earn Companion Pass through 2/28/27 and 30,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening.

Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open.

Annual fee

$229.

$149.

$299.

$149.

Earning rates

• 4 points per $1 on Southwest purchases.

• 2 points per $1 at gas stations and restaurants.

• 1 point per $1 on all other purchases.

• 3 points per $1 on Southwest purchases.

• 2 points per $1 at restaurants and grocery stores on the first $8,000 in combined purchases per anniversary year.

• 1 point per $1 on all other purchases.

• 4 points per $1 on Southwest purchases.

• 2 points per $1 on gas stations, restaurants, direct hotel bookings, local transit and commuting (including rideshare).

• 1 point per $1 on all other purchases.

• 3 points per $1 on Southwest purchases.

• 2 points per $1 on gas stations and restaurants on the first $8,000 in combined purchases per anniversary year.

• 1 point per $1 on all other purchases.

Other benefits

• 7,500-point anniversary bonus each year.

• 6,000-point anniversary bonus each year.

• 9,000-point anniversary bonus each year.

• Statement credit of up to $120 every four years toward Global Entry, TSA PreCheck® or NEXUS application fee.

• 6,000-point anniversary bonus each year.

Learn more

2. Partner offers

Southwest partners with a variety of businesses where you can earn additional points by using their services or buying their products. These partners include rental cars, hotels and retailers.

3. Rapid Rewards Dining

Register your debit or credit cards with Rapid Rewards Dining to earn additional points when you dine at participating restaurants.

4. Online shopping

When you start your online shopping at Rapid Rewards Shopping, you can earn extra points on your online purchases. Participating retailers include Kohl's, Office Depot, Walgreens and American Eagle.

5. Cancel another upcoming flight

Canceling a flight booked with points returns the unused points back into your account without any expiration date. This could be useful if you need those points more urgently or if the flight dropped in price. Plus, you can rebook the cheaper flight later.

» Learn more: How to earn Southwest points

Frequently Asked Questions

Does buying points count toward the Southwest Companion Pass?

No. Although purchased points can be used to book travel, they don't count toward earning the Southwest Companion Pass. To earn the Southwest Companion Pass, you must fly 100 one-way qualifying flights or earn 135,000 Companion Pass qualifying points. These points can be earned on revenue flights, partner hotel stays and car rentals, and spending or welcome bonuses from any of the Rapid Rewards credit cards.

Can I get Southwest A-List status by buying points?

No, purchased points don't count toward elite status with Southwest Airlines. A-List and A-List Preferred are the elite status levels for Southwest Airlines, and they're earned based on one-way segments flown and tier qualifying points earned. Additionally, some Southwest credit cards, like the Southwest Rapid Rewards® Priority Credit Card, earn up to 15,000 tier qualifying points per year, based on your spending.

Does buying Southwest points code as a travel purchase?

Points purchases don't count as "airfare" or "travel," so you won't earn bonus points when you use a travel credit card. However, you will earn rewards from your credit card at its non-bonus rate for the purchase. Your best bet is to use the purchase toward earning a welcome bonus, meeting a spending hurdle or using a credit card that earns high rewards on non-bonus purchases.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles