9 Best Nomad Travel Insurance Options

Digital nomads might travel for extended periods of time, so their needs are different than the average traveler.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Travel insurance can safeguard your nonrefundable reservations and reimburse you for any unexpected emergency medical costs that you incur while traveling. However, the travel health insurance needs of those taking several short vacations per year will vary from those of digital nomads, who may spend significant portions of the year living and working from abroad.

Digital nomads may also return home less often, travel with equipment (e.g., laptop, camera, etc.), participate in adventurous activities and want access to health insurance, especially if they don’t have that coverage back home.

Given the prevalence of remote work and increasing options to live and work from abroad, here you'll find some of the most popular nomad travel insurance options.

1. World Nomads

World Nomads is a travel insurance provider that offers coverage for residents of many countries and also allows you to extend your coverage mid-trip. It is underwritten by Nationwide Insurance. Regardless of which plan you choose, the health insurance limits are fairly good.

Importantly, the provider does not have a pandemic exclusion, so COVID-related claims are covered. However, World Nomads specifically states that fear of travel is not a valid reason for trip cancellation. So if you’d like the option to cancel a trip at your discretion, you’ll want to consider plans that offer Cancel For Any Reason coverage.

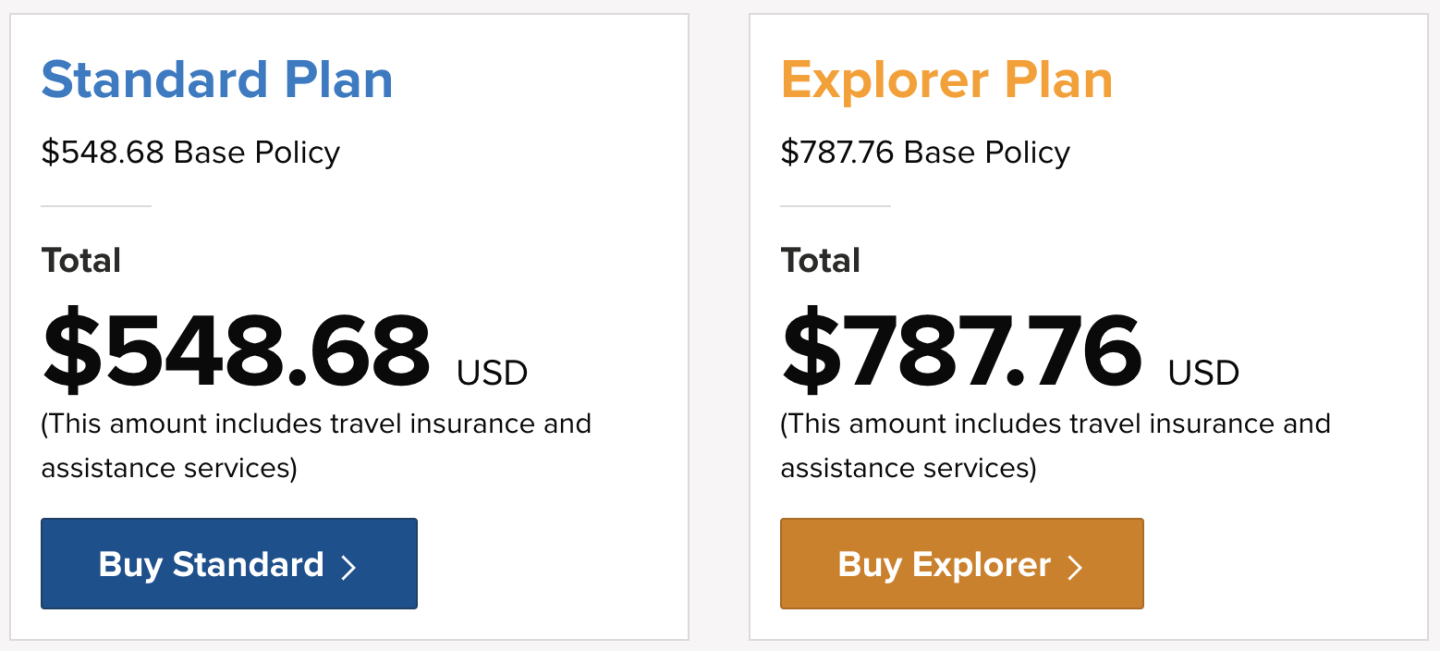

There are two trip insurance policies available from World Nomads: Standard and Explorer. The Standard Plan has lower coverage limits and includes more than 200 sports (including some adventure sports), while the Explorer Plan adds on 60 other activities and sports, including more dangerous ones such as shark cage diving, skydiving and paragliding.

The inclusion of athletic activities in both World Nomads plans is unique, since most traditional travel insurance plans exclude them.

Here's a list of what's included with World of Nomads coverage:

Trip cancellation, interruption and delay.

Emergency healthcare coverage, evacuation, repatriation and 24-hour assistance services.

Accidental death and dismemberment.

Nonmedical emergency transportation.

Baggage delay and loss.

Rental car damage (Explorer Plan only).

Adventure sports and activities.

And here are a few items of note that are excluded (not a comprehensive list):

Pre-existing conditions.

War.

Self-harm or accidents occurring while intoxicated.

Finally, coverage can’t exceed 180 days, so if you’re traveling abroad longer than that, you’d have to renew your plan once the current coverage period ends.

To see how World Nomads compares to other travel health insurance providers, we considered a sample 180-day trip to multiple countries by a 30-year-old resident of Colorado.

Due to the lower limits and less coverage for adventure activities, the World Nomads Standard Plan is priced at $549, which is meaningfully cheaper than the $788 Explorer Plan.

It's important to note that if your nonrefundable prepaid trip costs are more than $2,500, the Standard Plan will cover you only up to $2,500 on trip cancellation. In this case, you’d want to consider the pricier Explorer Plan, which provides coverage up to $10,000 on trip cancellation. Notably, emergency accident & medical coverage is $100,000 on both plans, which offers a lot of assurance, especially if you’re abroad for a long time.

The most significant advantage of World Nomads is coverage for adventure activities. In this case, assessing the suitability of the plan has more to do with the type of coverage you’re looking for than price. Because of the multitude of advantages of World Nomads plans over various providers, we've named World Nomads as one of the best travel insurance companies out there. Check out our full rationale here: Best Travel Insurance Right Now.

2. SafetyWing

SafetyWing is another popular digital nomad travel health insurance option that also offers COVID coverage. You can purchase your policy while you’re abroad, which makes it easy for those who are already traveling and decide to get insurance coverage mid-trip.

Unless you are a resident of North Korea, Cuba or Iran, you can purchase a SafetyWing policy. The default length of coverage is 28 days, and the policy will continue to renew unless canceled (maximum policy length is 364 days).

SafetyWing also provides U.S. citizens with incidental coverage in the U.S. for up to 15 days out of every 90 days. Despite the U.S. coverage, SafetyWing is meant to provide medical and travel insurance coverage while you’re abroad; it does not meet the health insurance requirement under the Affordable Care Act.

Included:

Trip interruption and delay.

Emergency medical and dental expenses.

Emergency medical evacuation, repatriation of remains and accidental death.

Lost checked luggage and lost visa/travel documents.

Return of minor children and pets.

Political evacuation and border entry protection.

Excluded (not a comprehensive list):

Pre-existing conditions.

Mental health disorders.

Intentional acts or damages sustained under the influence of drugs or alcohol.

The cost of a SafetyWing policy is based on your age and whether you’d like health insurance coverage while you’re in the U.S. For example, a four-week policy for someone aged 18 to 39 years old who doesn’t need health insurance coverage in the U.S. will cost $45. If you would like coverage while in the U.S., the policy cost jumps to $83.

A 180-day coverage comes out to $290 for a traveler between ages 10 and 39, but increases to $536 if you want to add on U.S. coverage. A deductible of $250 applies every time you start or renew a policy.

Overall, the options to purchase a plan mid-trip and receive health insurance coverage while in the U.S. are some of the main benefits of a SafetyWing policy.

3. Atlas Travel Insurance

Atlas Travel Insurance offers health insurance plans for digital nomads and long-term travelers looking for medical coverage (including for COVID-19) and some supplemental trip benefits (e.g., trip interruption). When selecting a policy, you’ll need to specify if you’d like to include the U.S. within your coverage area. Coverage limits decrease with age, and the plans offer varying levels of deductibles.

Included:

Medical expenses and emergency dental.

Emergency medical and political evacuation.

Trip interruption; travel delay.

Lost checked luggage and stolen visa/passport.

Natural disaster and border entry protections.

Return of minor children and pets.

Repatriation of remains; accidental death and dismemberment.

Excluded (not a comprehensive list):

Many adventure sports.

Pre-existing conditions.

Mental health disorders.

Various diseases including cancer.

Self-inflicted injuries and those arising when under the influence of drugs or alcohol.

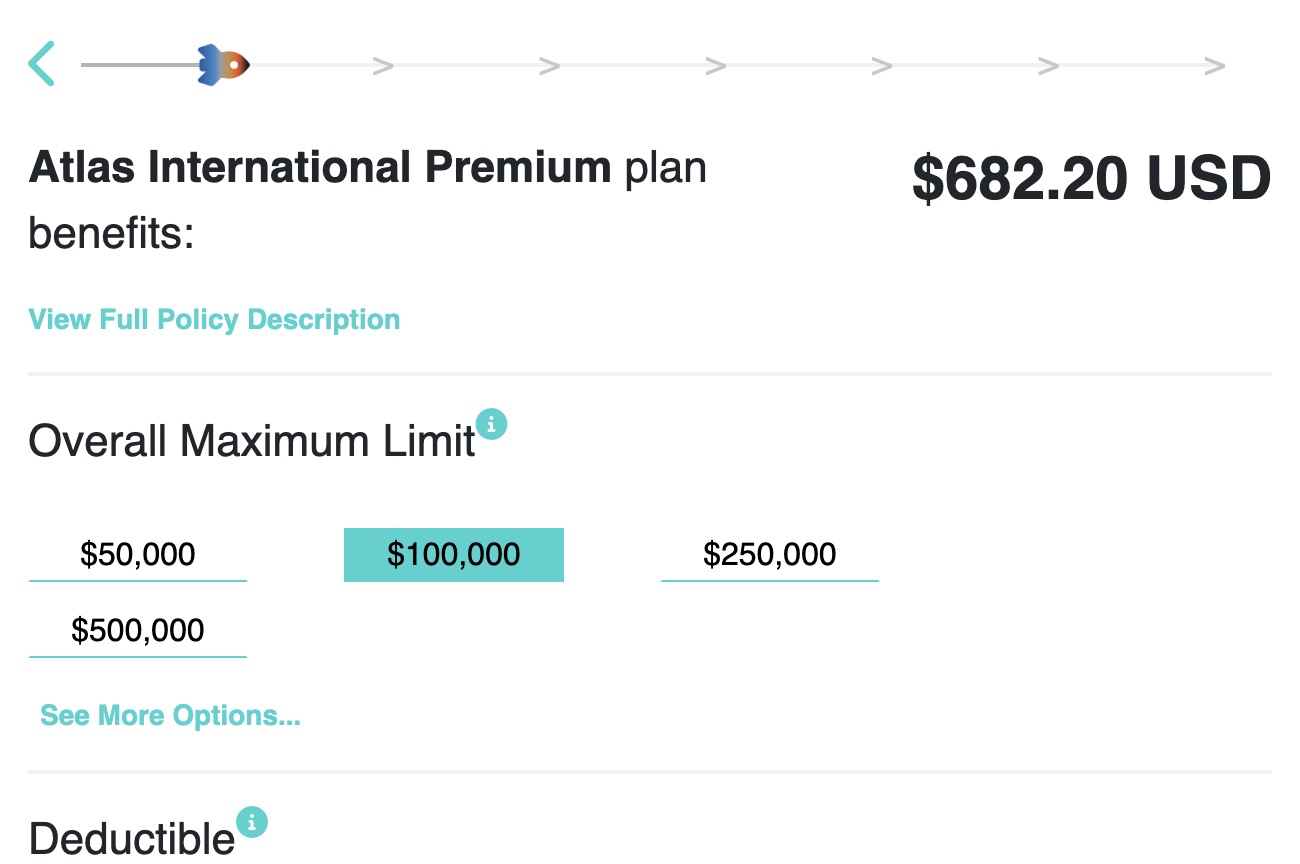

To compare these plans, we used the same parameters as the preceding example: a 180-day trip by a 30-year-old. Atlas offers two options to digital nomads: Atlas International and Atlas International Premium, which cost $274 and $682, respectively.

The main difference between these two Atlas plans is that the Premium option offers higher coverage limits.

It's also possible to customize the overall maximum limit and the deductible on both policies, so if you don’t want to go with the more Atlas International Premium plan, you can up the limits or change the deductible on the Atlas International plan.

4. Allianz Global Assistance

Allianz Global Assistance offers affordable coverage for annual or multi-trip travel. It’s more cost-effective than purchasing coverage for separate trips individually. Allianz’s multi-trip policy covers trips up to 45 days in length.

Allianz is best for travelers who take multiple trips per year from their home base and not those who travel overseas for an extended period of time.

Included:

Covered illness.

Missed or delayed departures.

Baggage loss or delays.

A tropical storm (before it’s named).

Loss of passport.

Unforeseen pregnancy complications.

Excluded (not a comprehensive list):

Losses that arise from foreseeable events.

War or civil unrest.

Participating in extreme or high-risk sports.

Flying an aircraft as pilot or crew.

Terrorist events.

Epidemic.

Allianz plans limit or exclude coverage related to COVID-19 or resulting from Russia’s invasion of Ukraine.

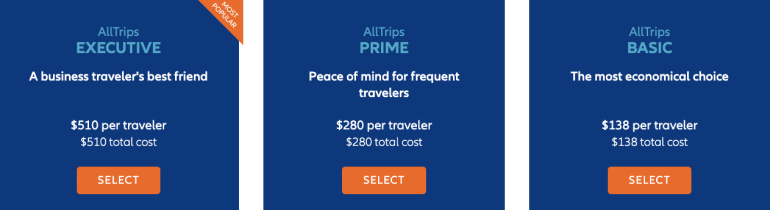

Allianz Global Assistance offers a few annual plan options to digital nomads. The plans last a full year, so keep that in mind when comparing costs with other nomad insurance providers. The plans are Basic, Prime and Executive, quoting $138, $280 and $510 per year, respectively.

The Basic insurance plan from Allianz is designed for medical emergencies and provides some travel coverage, but it doesn’t provide any trip cancellation or trip interruption coverage.

The Prime plan provides affordable trip protection and medical coverage abroad.

The Executive plan is designed for business travelers by providing higher coverage limits and rental car damage and equipment rentals. The Executive plan covers personal vacations in addition to business trips.

It's also possible to sign up for a Premier plan, which lasts up to 365 days but covers up to 90 days of consecutive travel.

5. Insured Nomads

Insured Nomads provides medical coverage, travel insurance and trip cancellation to digital nomads, remote workers and expats.

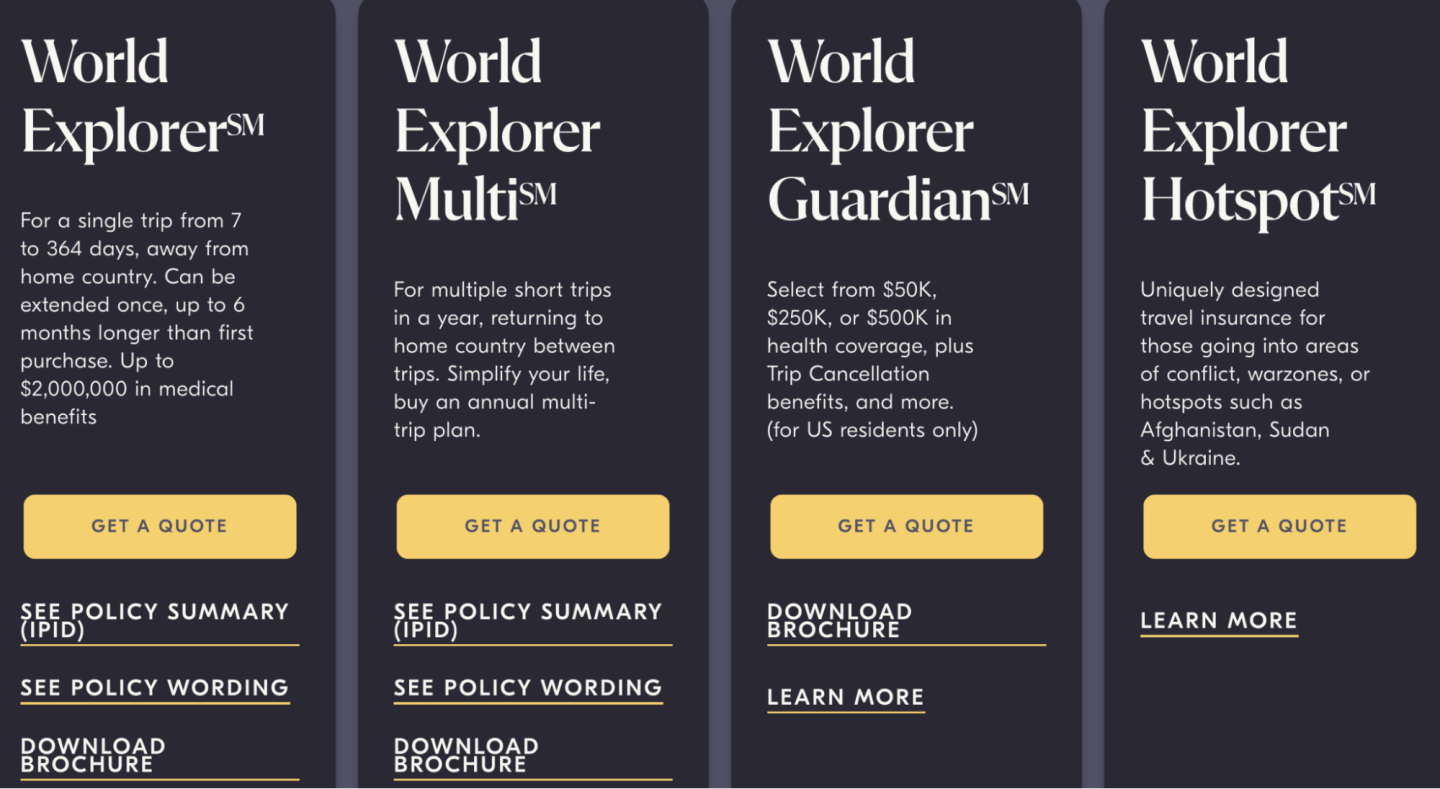

Insured Nomads offers four plans, and they all have their own function. For example, the World Explorer plan provides coverage for a single trip lasting between seven and 364 days away from home, and the World Explorer Multi offers coverage for multiple trips within a single year. Plans are available to citizens of any country, not just the U.S.

Depending on the plan, you’ll have the option to add adventure sports, pet insurance, accidental death and dismemberment and car rental insurance for an extra fee.

Included:

Medical benefits, including 24-hour emergency medical care.

COVID-19 coverage.

Acute onset of pre-existing condition.

Emergency dental treatment.

Local ambulance transport.

Natural disaster accommodations.

Evacuation and repatriation.

Airport lounge access for delayed flights.

Lost luggage.

Excluded (not a comprehensive list):

War and terrorism.

Pre-existing conditions.

Public health emergencies or natural disasters in countries deemed Level 4 by the U.S. Department of State.

Illegal acts.

Self-harm.

Injuries sustained while under the influence of drugs or alcohol.

Extreme sports (unless an add-on was purchased).

The quote for a traveler between the ages of 30 and 39 looking to travel to Mexico for six months with the World Explorer plan costs $679. This plan has a medical benefit limit of $250,000 and a deductible of $100. Increasing the medical benefit maximum to $1,000,000 increases the premium to $830, and that’s without any of the additional benefits, such as adventure sports or marine activities.

» Learn more: How to find the best travel insurance

6. IMG Global

IMG Global offers an insurance plan just for expats and citizens of the world called Global Medical Insurance. It’s a medical-only plan that doesn’t offer trip protection, but offers medical coverage worldwide.

Several tiers of Global medical insurance from IMG Global are available: Bronze, Silver, Gold and Platinum. The more expensive the plan, the lower the deductible and the higher the policy maximum.

The following expat insurance rates are for a 30-year-old traveler whose primary travel destination is Spain.

Plan level | Deductible | Policy maximum | Monthly cost for sample trip |

|---|---|---|---|

Bronze | $250. | $1,000,000. | $201. |

Silver | $250. | $5,000,000. | $278. |

Gold | $250. | $5,000,000. | $474. |

Platinum | $100. | $8,000,000. | $834. |

The deductible amounts can be adjusted in every plan above to reduce the monthly payment. Additionally, the total coverage cost for the year can be reduced with an annual payment. An optional dental and vision rider is available for the policy you pick.

Undoubtedly, the cost is on the high end, but it does come with some noticeable extras, such as COVID-19 coverage, telemedicine and mental health professional counseling, that most travel insurance providers don’t cover.

It’s possible to purchase a World Explorer policy after you’ve left on your trip, and you can extend coverage by up to six months beyond the initial policy purchase.

In addition to the Global Medical Insurance, IMG Global offers the following plans to long-term travelers:

The Global Employer Option: Medical coverage for internationally assigned employees.

International Marine Medical Insurance: Health insurance for long-term (longer than one year) marine crew.

MP+ International: Group travel insurance for mission groups.

7. Heymondo

Heymondo offers comprehensive travel insurance plans to short-term and long-term travelers. Digital nomads and expats can purchase a Long Stay plan for trips longer than 90 days. The initial coverage is capped at 90 days, but you can renew if necessary. You can also add electronics and adventure sports riders to the Long Stay policy at an extra cost.

Coverage is available to travelers between 90 days old and 49 years old.

What’s included:

Emergency medical and dental coverage (with a $250 deductible).

Medical transport and repatriation home.

Baggage delay, theft and loss.

Travel delay or a missed connection.

Natural disaster.

Personal liability.

Accidental death or disability.

What’s not included (not a comprehensive list):

Pre-existing conditions.

General medical check-ups.

Trips aimed at receiving medical treatment.

Burial, ceremony and coffin costs in the repatriation of remains.

Petty theft.

Damage caused by strikes, earthquakes or radioactivity.

Motor vehicles.

A 90-day global coverage that excludes travel to Canada and U.S. costs $257 upfront. You can renew coverage once it expires or prepay for additional coverage at the following prices:

30 days: $76.

120 days: $304.

180 days: $456.

275 days: $731.

Notably, medical coverage includes COVID-19, including medically prescribed PCR tests and extra lodging expenses when you’re prescribed a medical quarantine.

» Learn more: Best long-term travel insurance options

8. Travelex Insurance

Travelex Insurance offers long-term nomad insurance with its Travel Select plan, which is one of the provider’s comprehensive travel insurance plans. This plan covers trips up to 364 days. You must select travel dates and provide the cost of your trip to get a quote.

A 30-year-old Colorado resident traveling to Italy for six months will pay $734 for a Travel Select plan from Travelex Insurance to cover a trip that costs $5,000. It comes with:

100% trip cancellation.

150% trip interruption.

$2,000 trip delay (with a $250 daily limit).

$1,000 baggage loss.

$200 baggage delay.

$50,000 emergency medical expense.

$500,000 emergency medical evacuation and repatriation.

$25,000 accidental death and dismemberment.

Pre-existing conditions waiver: available if purchase conditions are met (more on this below).

Add-ons to the Travel Select plan include double the medical expense, adventure sports rider, car rental collision protection, extra accidental death and dismemberment coverage and even Cancel for Any Reason coverage covering 75% of the insured trip's cost (though the covered trip cost maxes out at $10,000).

The good thing about this plan is it provides coverage for pre-existing conditions as long as you pay for insurance within 15 days of the initial trip deposit. Most annual policies notably exclude a pre-existing conditions waiver.

The bad thing is its high cost because of all the bells and whistles of a comprehensive plan.

9. AIG Travel Guard

AIG Travel Guard offers an annual plan that provides essential coverage to business and leisure travelers who are U.S. residents (not available for Washington state residents).

The Travel Guard Annual Plan is an option for travelers who take multiple trips within a single year (364 days), with a limit of 90 days per trip.

Included:

100% trip interruption.

Trip delay.

Missed connection.

Baggage loss or delay.

Medical expenses, including dental.

Emergency evacuation and repatriation of remains.

Non-flight accidental death or dismemberment.

Security evacuation.

Excluded:

War or acts of war.

Participation in a riot, civil disorder or insurrection.

Commission or an attempt to commit a felony.

Being under the influence of drugs or intoxicated above the legal limit.

Trips taken against a physician’s advice.

Release, escape or dispersal of nuclear or radioactive contamination, and pathogenic or poisonous biological or chemical materials.

A Travel Guard Annual Plan comes out to $242 for a Colorado resident, which is a pretty good deal considering all the inclusions — but remember that your trips cannot exceed 90 days each, so its usage is limited to remote workers taking shorter trips.

» Learn more: How much does travel insurance cost?

Nomad travel insurance recapped

Expats and digital nomads have different travel health insurance needs than the average traveler, so choosing a policy that aligns with your travel style is advisable.

If you’re looking for adventure sports coverage, World Nomads, Insured Nomads, Heymondo and Travelex Insurance all have the option to add a rider to their policies.

However, if those benefits aren’t relevant to you and you’d instead prefer to have the option of medical coverage when you’re abroad (and to a certain degree while you’re in the U.S.), consider SafetyWing or Atlas, which offer this feature. For medical-only coverage, IMG Global provides some options, albeit pretty expensive ones.

Additionally, take into consideration your travel style. Are you taking one long trip or multiple shorter trips within one year? Because Allianz and AIG Travel Guard won’t work well if you plan to be abroad longer than the limit specified in the policy.

1x-8x

Points100,000 Points + $500 Travel Credit

Points1x-5x

Points75,000

Points1x-2x

Points50,000

Points