United MileagePlus Program: The Complete Guide

The U.S.-based airline's MileagePlus loyalty program lets passengers easily earn and redeem miles.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

United MileagePlus is the frequent flyer program for United Airlines, which is among the largest airlines in the U.S. and the world.

The airline operates 4,500 daily flights to more than 300 cities across five continents. In addition, United has partnerships with 16 airlines and is also a member of Star Alliance. These relationships mean you can earn and redeem United miles on more than 40 airlines while traveling to almost anywhere in the world.

And if you’re an infrequent United flyer, relax: Your United miles will not expire, as long as your account remains open.

United Airlines frequent flyer sign-up

To earn miles with United Airlines, you’ll first need to sign up for a MileagePlus frequent flyer account. It’s free to join.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

How much are United miles worth?

Based on our most recent analysis, NerdWallet values United MileagePlus miles at 1.2 cents apiece. To determine the value of reward miles, we compared cash prices and reward redemptions for economy round-trip routes across several destinations and dates.

We divided the cost of the cash ticket by the cost of the reward ticket to determine a “cent per mile” value for each flight, then averaged this value across several flights and dates. Read more about how we arrived at these figures.

NerdWallet’s valuation is a baseline value, based on real-world data collected from hundreds of economy routes, not a maximized value. In other words, aim for award redemptions that offer at least 1.2 cents or more in value from your United miles.

Use our United miles calculator to determine the value of your miles.

United MileagePlus miles value over time

United MileagePlus miles have steadily increased in value over time, meaning you can expect to get more value out of your miles.

United Airlines vs. competitors

United Airlines ranked sixth out of eight airlines in NerdWallet’s 2025 best overall airline analysis.

Its loyalty program, MileagePlus, didn’t fare much better, coming in fifth place in our airline rewards program analysis.

Here's a closer look at how United competed across subcategories:

- Last in rewards rate.

- Fifth in operations.

- Tied for third in elite status benefits.

- Seventh in terms of lowest total fees.

How to earn United miles

You can earn miles when you fly on paid tickets with United or its partner airlines, by using a United Airlines credit card, and by shopping and dining with partners.

MileagePlus miles can be redeemed for award flights and many other uses, though flight redemptions typically offer the most value. United miles do not expire, as long as your account remains open and in good standing.

Earn MileagePlus miles when you fly

The total miles you'll earn for a United flight depends on how much you spent on the ticket and your status level within the MileagePlus program. All statuses above basic membership earn mile bonuses.

For example, the basic member rewards rate is 5 miles per dollar. But at Premier Silver level, you earn a 40% bonus, which turns your rate into 7 miles per dollar. We'll have more on status levels below — or you can jump ahead to that part now .

| Status level | Miles earned | Status bonus |

|---|---|---|

| MileagePlus member (basic) | 5 miles per $1 spent. | None. |

| Premier Silver | 7 miles per $1 spent. | 40% bonus compared with basic. |

| Premier Gold | 8 miles per $1 spent. | 60% bonus compared with basic. |

| Premier Platinum | 9 miles per $1 spent. | 80% bonus compared with basic. |

| Premier 1K | 11 miles per $1 spent. | 120% bonus compared with basic. |

NOTE: You earn miles only on airfare and airline fees. Government-imposed taxes and fees do not earn miles. Generally, the most you can earn on a ticket is 75,000 miles.

Earning on other airlines: When the ticket is issued by United (ticket number starting with 016), you’ll earn miles based on the cost of the fare. But if your ticket is booked through one of United’s partners, miles are awarded based on a calculation involving the fare class of the ticket and the flight distance. One exception is flights operated by JetBlue, which will earn based on your dollar spend and elite status when credited to MileagePlus, thanks to the airlines' Blue Sky partnership.

Earn United MileagePlus miles with a credit card

United Airlines offers co-branded credit cards through Chase. Bonuses between cards vary, so if you’re considering a credit card, take a look at its bonus history to take advantage of a high welcome offer.

» Learn more: The best airline credit cards right now

NerdWallet's favorite United credit card is the United℠ Explorer Card. It gives you 2 miles per dollar spent at restaurants, on hotel stays and on purchases from United, and 1 mile per dollar on all other purchases. You also get a great sign-up bonus to start. There's an annual fee, but the checked bag benefit and the two United Club lounge passes per year on this card can make up for it quickly.

Here's a quick look at United card options:

United credit cards

Annual Fee

$0 intro for the first year, then $150

$350

$695

$0

Earning Rate

• 5 miles per $1 on prepaid hotels booked through United.

• 2 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and hotels (when booked directly with hotel).

• 1 mile per $1 on all other purchases.

• 5 miles per $1 on hotel stays through Renowned Hotels and Resorts.

• 3 miles per $1 on United purchases.

• 2 miles per $1 at restaurants, select streaming services and all other travel.

• 1 mile per $1 on all other purchases.

• 5 miles per $1 on hotel stays through Renowned Hotels and Resorts.

• 4 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and all other travel purchases.

• 1 mile per $1 on all other purchases.

• 2 miles per $1 on United purchases, gas stations and local transit and commuting.

• 1 mile per $1 on all other purchases.

United benefits

• First checked bag free for you and one companion on your reservation.

• 2 United Club one-time passes each year.

• $100 United Travelbank credits after spending $10,000 in a calendar year.

• 10,000-mile discount after spending $20,000 in a calendar year.

• Credit every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• No foreign transaction fees.

• First and second checked bag free for you and one companion on your reservation.

• $200 yearly United TravelBank credit.

• Yearly 10,000-mile discount.

• Another 10,000-mile discount after spending $20,000 in purchases per calendar year.

• 2 global Economy Plus seat upgrades after spending $40,000 in a calendar year.

• Annual 1,000 Card Bonus Premier Qualifying Points deposit.

• Credit every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• No foreign transaction fees.

• First and second checked bag free for you and one companion on your reservation.

• Access to United Club airport lounges.

• A 10,000-mile discount after spending $20,000 in purchases per calendar year (up to two times per year).

• Annual 1,500 Card Bonus Premier Qualifying Points deposit.

• Credit every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• No foreign transaction fees.

• No foreign transaction fees.

• 2 free checked bags after you spend $10,000 in a calendar year.

Bonus offer

Earn 70,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

Earn 80,000 bonus miles and 3,000 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Earn 90,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 30,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open.

Still not sure?

There are also two United business cards:

- Earn 2 miles per dollar spent on restaurants, gas stations, office supplies stores, transit and United purchases.

- Earn 1 mile per dollar spent on all other purchases.

- Annual fee: $150.

- 2 miles per dollar on United ticket purchases.

- 1.5 miles per dollar on every purchase.

- Access to United Club airport lounges.

- Annual fee: $695.

Here are more resources for shopping United credit cards:

If you don't qualify for or want a United credit card, another option to consider is the United MileagePlus Debit Rewards Card. This is a debit card that doesn't require a credit check and allows you to earn miles when you spend with the card and when you maintain certain amounts of money in your account balance.

However, the earning rates are poor (1 mile per $1 spent on United purchases and 1 mile per $2 spent on all other purchases) compared to what you would get with a United credit card, and you need to keep a balance of at least $2,000 to get the $4 monthly fee waived.

Earn United MileagePlus miles through partners

- Hotels and Vrbo. You can earn additional MileagePlus miles at most major hotel chains and Vrbo. In some cases, you earn 1 to 3 miles per dollar spent; in others, you earn a flat number of miles per stay. See partner hotels and the earning rules here.

- Dining. Register a credit card with MileagePlus Dining, and every time you use that card at a participating restaurant, club or bar, you'll earn up to 5 miles per dollar spent. There are more than 11,000 participating locations.

- Auto rentals and other transportation. Avis and Budget offer the option to earn MileagePlus miles on car rentals. See the rules here. Car-sharing service Turo is also a partner, as well as ridesharing platform Lyft.

- Shopping. When you shop online through the MileagePlus Shopping mall, you earn miles for every dollar you spend at more than 1,100 retailers.

- Financial partners. Earn miles when doing business with lending and utilities partners, among others. Details here.

Buy United miles

If you want to buy United miles, you can do so on the MileagePlus website, but this is generally not a good idea. You'll pay far more than the 1.2 cents per mile at which NerdWallet values MileagePlus miles. However, if you need a few thousand miles to top up your account for a valuable award, it could make sense.

United miles pooling

United’s miles pooling feature allows you to combine and share your miles with the miles of up to four other MileagePlus members, including children. These miles can then be redeemed for only United and United Express flights; you won’t be able to redeem them for anything else like upgrades, seat assignments or flights on partner airlines.

Any MileagePlus member can create a pool and be the pool leader as long as they are at least 18 years old. You can only be part of one pool at a time, but if you decide to leave your pool, you forfeit any miles that you contributed to the pool.

United mileage pooling is a much better alternative to transferring your miles to someone else’s account, which incurs hefty fees of $7.50 per 500 miles transferred and a $30 processing fee.

» Learn more: How to earn United MileagePlus miles

How to redeem United miles

MileagePlus miles are redeemable for flights on United Airlines, on Star Alliance airlines and other airline partners. Star Alliance has 25 member airlines and United has partnerships with 16 airlines. All of this means that you can use United miles to fly on 40-plus airlines, creating many opportunities for traveling the world.

🤓 Nerdy Tip

MileagePlus members can pay for United and select partner airline flights using a combination of miles and cash, called Money + Miles. You'll earn miles on the cash portion of the payment, excluding taxes and fees. United award tickets

United offers several levels of award seats, requiring more miles for more desirable seats and cabins. Flights can be booked as one-way tickets or round trips; if you’re seeking maximum flexibility, it can be better to book a one-way ticket vs. round trip.

Generally, there are two kinds of award redemptions:

- Saver awards are cheaper in terms of miles required to book them — often ranging from 5,000 to 12,500 miles for domestic economy, for example. But they are scarcer and might not be available for the flight you want. Select Chase United cardholders and United elites are eligible for discounts on saver awards.

- Everyday awards allow all MileagePlus members to book any open seat on a flight, even if it’s the last one available. However, these cost significantly more than saver awards.

Generally, prices that are cheaper with cash will also be cheaper with miles. It’s best to compare the cost of each before booking.

Note that if you pay for a flight with miles, you won’t earn frequent flyer miles for that flight.

Good redemption options

- Award flights. Aim for redemptions worth at least 1.2 cents per MileagePlus mile, NerdWallet’s baseline value. It's even possible to find redemptions worth much more than that. United has many opportunities for sweet spot redemptions.

- Upgrades. Upgrading to premium economy, business or first class with miles can also return a value greater than 1.2 cents per mile. Some upgrades require a cash co-pay as well as miles. The price of an upgrade depends on the fare class of your current ticket — upgrading from a cheaper fare will generally cost more.

» Learn more: How the United upgrade clearing order works

Bad redemption options

Other redemption options include United Club membership fees, hotel stays, car rentals, cruises and gift cards. These options tend to offer a lower value than 1.2 cents per mile, so we recommend avoiding them.

» Learn more: The complete guide to redeeming United MileagePlus miles

United elite status

There are four levels of United MileagePlus elite status, which are (in order from lowest to highest):

Here’s what each level entails, and what it takes to get there:

MileagePlus elite levels and benefits

On United, elite statuses are called Premier levels.

With Premier status, you’ll qualify for mileage bonuses, seat upgrades, priority check-in, complimentary checked baggage, better award seat availability, discounted and waived fees, and other benefits. And if you get Gold status or higher, you’ll have lounge access when traveling internationally. Premier Platinum and 1K members also get access to PlusPoints, which can be used to request upgrades to United Polaris business class. Here’s a full list of the perks at each level.

If you want elite perks but can’t qualify for Premier status, consider getting one of the airline’s co-branded credit cards. They offer many of the same benefits, including free checked bags, priority boarding, better access to award seats and even United Club airport lounge access.

» Learn more: 7 things to know about United Airlines lounges

How to get elite status on United

To earn MileagePlus Premier elite status, you need to do things the airline cares about as a business: fly often and spend a lot of money. This will earn you a combination of Premier Qualifying Points (PQP) and Premier Qualifying Flights (PQF).

- PQP are earned on the base fare, carrier surcharges, Economy Plus seats or subscriptions, preferred seat purchases, upgrade award co-pays, paid upgrades, and flights ticketed and operated by Star Alliance partners.

- A PQF is one flight. Each segment flown will count as one PQF. Flights taken in basic economy will not earn any PQF.

» Learn more: Guide to United Airlines Premier elite status

PQP and PQF are all credited to the person flying, not the person paying for the tickets. If you fly award flights on United booked with MileagePlus miles, you will earn 1 PQP for every 100 miles redeemed and PQF.

You can also earn PQP through spending on a United credit card. You'll earn either 1 PQP per $15 or $20 spent, depending on which card you hold. Some cards like the United Club℠ Card and the United Quest℠ Card even come with annual PQP deposits just for holding the card.

United elite status requirements

To become an elite member, you need a specific number of either PQF and PQP or PQP only. Here are the requirements to earn status in 2026 (unchanged from 2025):

| MileagePlus Premier level | Status requirements |

|---|---|

| Premier Silver | 15 PQF and 5,000 PQP, or 6,000 PQP. |

| Premier Gold | 30 PQF and 10,000 PQP, or 12,000 PQP. |

| Premier Platinum | 45 PQF and 15,000 PQP, or 18,000 PQP. |

| Premier 1K | 60 PQF and 22,000 PQP, or 28,000 PQP. |

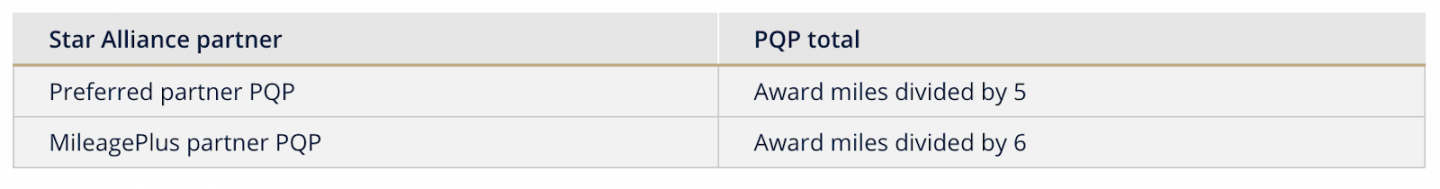

For flights with Star Alliance partners that are not ticketed by United (ticket number does not start with 016), PQP will be earned based on the fare class, the flight distance and an airline’s designation as a “Preferred” or “MileagePlus” partner. There is a cap on the number of PQP you can earn for each segment, depending on the cabin class and the airline’s designation.

Star Alliance partner flights ticketed by United will earn based on the fare paid. This can significantly affect the number of award miles and PQP you earn, so it’s worth calculating whether it makes more sense to book through United or a partner airline if prices are similar.

Earning Premier status is based on flying and spending during the previous calendar year. Once you qualify for a Premier status, it is valid from the date you qualified through the end of the following program year (elite status levels reset at the end of January). For example, if you qualify for Premier Silver status in June 2026, you’ll keep your status through Jan. 31, 2028.

You can also request a United status match challenge. Based on your eligible status with another airline, you'll typically match to one of United's Premier status levels and need to complete a set of requirements within 120 days to retain the status.

United Airlines partners

Star Alliance members

In general, you can earn MileagePlus miles on flights with Star Alliance partners and redeem your miles for flights on Star Alliance airlines.

United Star Alliance airline partners

- Aegean Airlines.

- Air Canada.

- Air China.

- Air India.

- Air New Zealand.

- All Nippon Airways (ANA).

- Asiana Airlines.

- Austrian Airlines.

- Avianca.

- Brussels Airlines.

- Copa Airlines.

- Croatia Airlines.

- EgyptAir.

- Ethiopian Airlines.

- Eva Air.

- Lot Polish Airlines.

- Lufthansa.

- Shenzhen Airlines.

- Singapore Airlines.

- South African Airways.

- Swiss.

- TAP Air Portugal.

- Thai Airways.

- Turkish Airlines.

Other partner airlines

On airlines outside the Star Alliance, your ability to earn and/or redeem miles is more limited. For example, you may be able to earn miles but not redeem them, or you may be able to redeem only for certain flights.

United Airlines non-alliance airline partners

- Aer Lingus.

- Air Dolomiti.

- Airlink.

- Azul.

- Cape Air.

- Discover Airlines.

- Edelweiss.

- Emirates.

- Eurowings.

- Flydubai.

- Hawaiian Airlines.

- ITA Airways.

- JetBlue Airways.

- JSX.

- Olympic Air.

- Virgin Australia.

Frequently Asked Questions

How do I redeem my United miles?

The simplest way to redeem United miles is to use them for award flights on United and its partner airlines. You will need to log in to your United MileagePlus account to search for available flights. Other ways to use United miles include flight upgrades, hotel bookings, shopping and gift cards.

Can United miles be transferred to partner airlines?

No, you cannot transfer your United miles to other airlines. However, you can use your United miles to book flights on partner and Star Alliance airlines.

How many miles does it take for a free flight on United?

United no longer has an award chart and instead uses dynamic pricing, so the price of an award ticket fluctuates based on the date of travel and the airline. To see a list of the lowest award fares, check out United’s flight award deals to various destinations for as low as 5,000 miles.

Can you use United miles to pay for part of a flight?

United has a Money + Miles payment option, giving flyers the ability to pay for United and select partner flights using a combination of miles and cash.

When should you use miles instead of paying?

NerdWallet values United miles at 1.2 cents each, which means that 10,000 United miles are worth $120. Although there is no hard and fast rule that applies in every instance, generally it makes sense to use your miles when you can extract a value greater than 1.2 cents from each mile. So, if a flight costs 10,000 miles or $50, you’d be better off paying cash. However, if that same 10,000-mile flight costs $200, it would be preferable to use your miles.

Is United MileagePlus free?

It's free to join United’s MileagePlus loyalty program. All you need to do is head over to United’s website and sign up for an account.

The information related to the United℠ TravelBank Card and United Club℠ Business Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles