4 Times It Makes Sense to Buy Airline Miles

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Generally speaking, buying airline miles isn’t a good idea, because the price at which they’re sold usually exceeds the value of what they can be redeemed for. There are lots of other ways to earn miles, including through flying, credit card spend or promotional bonuses.

But in certain cases, it can make sense to buy miles. Here’s when to consider doing so — and why it’s usually smarter not to.

Why buying miles is generally a bad idea

Consider the following example of a miles purchase option from American Airlines:

When we last checked, a purchase of 100,000 AAdvantage miles would yield you 60,000 bonus miles, which is a very good 60% bonus. Nonetheless, this purchase of 160,000 miles would set you back $3,209, meaning you’re purchasing those miles for 2 cents each.

NerdWallet values American Airlines miles at 1.3 cents each, so by purchasing miles, you’re paying more than what the miles are worth, on average. This is generally true even when there's a generous bonus involved.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

When it could make sense to buy them

It can still make sense to buy miles for the right circumstances, like...

1. If you need to top up an award

Let’s say you want to fly from New York to London in business class on American Airlines. This type of award at the level costs 57,500 miles + $5.60 in taxes, as long as you fly on American. What if you only have 55,000 AAdvantage miles in your account?

When we last checked, you could purchase 3,000 extra miles (available in increments of 1,000) for only $90 to get you that business class seat. Buying miles is a great idea in this case.

2. If the price of a ticket is more expensive than buying miles

If you want to fly in business or first class, tickets are usually very expensive. If you don’t have the miles, you’d have to be comfortable parting with a lot of cash for a business class flight. For example, a nonstop round-trip flight in American Airlines first class from Los Angeles to Tokyo priced at a whopping $20,057 when we checked.

That same flight in miles would cost you 160,000 AAdvantage miles + $56.

If you have no miles but really want to fly in first class, you could buy the miles needed to pay for the award. Although buying those miles would set you back $3,208 when we last checked, that’s a lot cheaper than buying the first class ticket outright.

Although buying miles this way isn’t for everyone, it illustrates how expensive miles purchases can make sense for booking premium cabins at hefty discounts.

3. To keep miles from expiring

If you have airline miles that are about to expire, one way to keep those miles active is to buy more miles.

Let’s say you have miles with American that are about to expire. A cheap way to keep those miles active would be to shop through the American Airlines eShopping portal, earning more miles for your purchase. However, if you need the miles to get into your account very quickly, you might not have enough time for the shopping portal miles to post to your account. In that instance, buying miles is an option.

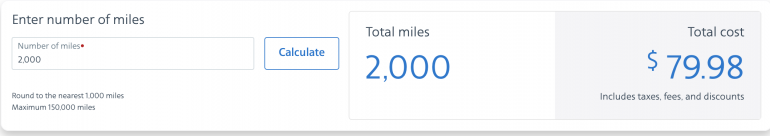

However, even in this scenario, you’d be buying 2,000 American Airlines AAdvantage miles for $80, which means you’re paying a very high 4 cents per mile just to keep your old miles active. Given how expensive it is to buy airline miles in such small increments, use this option only as a last resort.

4. If there’s a great bonus on purchased miles

Although purchasing miles is usually a suboptimal way to top up your account, if the airline or hotel is running a significant bonus or discount, a miles purchase can be the right move. It all depends on what you plan to do with your miles.

» Learn more: Plan your next redemption with our airline points tool

What credit card should you use?

The following airline frequent flyer programs let you buy miles directly from the airline website:

- American AAdvantage.

- Avianca LifeMiles.

- British Airways Club.

- Delta SkyMiles.

As such, purchases made from these airlines will be treated as travel spend. So in this case, using the respective co-branded airline credit card would be a good idea since you would earn the bonus category spend.

For example, the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® earns 2 miles per $1 spent on American Airline purchases.

Or you could use a travel rewards credit card, such as the Wells Fargo Autograph Journey℠ Card, which earns 4 points per $1 on travel purchases from airlines.

Certain other programs process their miles and points purchases through Points.com, in which case you wouldn’t earn any bonus category spend. The miles purchase can still be a good way to meet the minimum spend requirement on a new credit card.

The bottom line

Buying miles is expensive and seldom makes sense. However, if you have a compelling reason for making the purchase (e.g., for an award top-up or for an expensive premium cabin ticket), then it’s good to know the option is there.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles