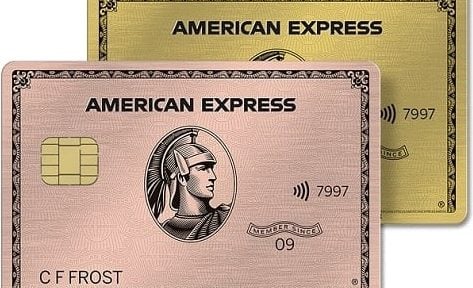

Why the AmEx Gold Card is the Dark-Horse Travel Card You Need in 2026

The grocery and dining bonuses make this card great for people to earn travel rewards at home or on the go.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

With big-time bonus points at U.S. supermarkets and restaurants, the American Express® Gold Card is seemingly a card for everyone. But with a hefty $325 annual fee yet few-to-no bougie benefits like Centurion Lounge access to show for it, it sometimes feels like a card for no one.

The American Express® Gold Card has always been a bit of a conundrum when it comes to travel cards. Among its most touted perks:

- 4x Membership Rewards points at U.S. supermarkets (on up to $25,000 per calendar year).

- 4x Membership Rewards points at restaurants (on up to $50,000 per calendar year).

- 3x points on flights booked directly with airlines or on AmEx Travel.

- 2x points on prepaid hotels and other eligible bookings via AmEx Travel.

- A $10 monthly dining credit to select restaurants and delivery services like Grubhub and Goldbelly. Enrollment required.

- A $7 monthly statement credit for U.S. Dunkin' locations. Enrollment required.

Terms apply.

Compare that to some of the other premium travel cards out there like the American Express Platinum Card®, which offers more rewards on travel, automatic hotel elite status, plus statement credits that in years past were worth more than the card’s annual fee. Enrollment required. Terms apply.

Because while the annual fee on that card has gone up (it's currently $895), some of its travel benefits have gone away. For example, guest access to the swanky Centurion Lounges has gone up to $50 per adult. Meanwhile, the American Express Platinum Card® continuously adds new benefits that can be hard to use and have little to do with travel at all.

A lot of card experts, us Nerds included, consider the American Express® Gold Card a travel card. And sure, it lacks many of the top travel benefits people want (or at least think they want). But instead, this dark-horse card has the kind of travel benefits that you might not realize are absolutely perfect for people whose goal is to earn rewards for their spending — and to put those rewards towards a trip.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

6 reasons the American Express® Gold Card is a top travel card in 2026

1. Big earnings rates on food spending

With the American Express® Gold Card, you’ll earn 4x Membership Rewards points at U.S. supermarkets, plus up to 4x Membership Rewards points at restaurants. Both spend categories have annual limits. Terms apply.

If food is a big part of your budget — no matter whether you cook or dine out — this card is an excellent way to earn rewards on that spending.

2. Monthly restaurant statement credits

Big on takeout? You could get $10 toward your meal every month. Pay with your American Express® Gold Card, and you’re entitled to up to a total of $10 in statement credits on takeout or delivery through Grubhub or Goldbelly, as well as on orders made with The Cheesecake Factory, Wine.com and participating Five Guys locations. Terms apply.

Even if you're dreaming of — rather than planning — a vacation, but you can always get your dim sum delivered, bringing a little taste of your next adventure to your dining room. Plus, you’ll get back $120 of value on the $325 annual fee. Terms apply.

3. Other statement credits, like with Uber and at U.S. Dunkin' locations

And the takeout deals still don’t stop. Cardholders can get up to $120 per year in Uber Cash doled out in $10 monthly increments, which can be used toward Uber Eats or for traditional Uber rides in the U.S. This accounts for up to $120 of value.

Note that you have to add your American Express® Gold Card to your Uber account and use an AmEx card to pay. Enrollment required. Terms apply.

With the card's $84 U.S. Dunkin' credit, you can earn up to $7 in monthly statement credits after you enroll and pay for your treats with your card at U.S. Dunkin' locations. Enrollment required.

And for cardholders who love snagging reservations at top eateries, the card's $100 Resy credit — doled out semi-annually as a statement credit in $50 increments — can be a hit. Purchases made at U.S. Resy restaurants or other eligible Resy purchases are included. Enrollment required.

$100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

4. Car rental loss and damage insurance

If you’ve traded plane travel for road trips (and you’re not driving your own car), charging the rental car to your American Express® Gold Card can help pay for costs if you get into an accident.

While not quite as good as the primary insurance coverage you’ll find on some other travel cards like the Chase Sapphire Reserve®, it still offers secondary rental car coverage, meaning it’ll pick up the cost not covered by your other insurance agreements, such as applicable deductibles. Terms apply.

5. The ability to transfer points

While you can exchange your AmEx Membership Rewards points for cash, they’re typically most valuable when exchanged for travel. What’s more, the AmEx Membership Rewards program has more than 20 travel partners to transfer points to.

Full list of AmEx transfer partners

Airlines

- Aer Lingus AerClub (1:1 ratio).

- AeroMexico Club Premier (1:1.6 ratio).

- Air Canada Aeroplan (1:1 ratio).

- Air France/KLM Flying Blue (1:1 ratio).

- ANA Mileage Club (1:1 ratio).

- Avianca LifeMiles (1:1 ratio).

- British Airways Club (1:1 ratio).

- Cathay Pacific Asia Miles (5:4 ratio)

- Delta SkyMiles (1:1 ratio).

- Emirates Skywards (1:1 ratio).

- Etihad Guest (1:1 ratio).

- Iberia Plus (1:1 ratio).

- JetBlue TrueBlue (2.5:2 ratio).

- Qantas Airways Frequent Flyer(1:1 ratio).

- Singapore Airlines KrisFlyer (1:1 ratio).

- Virgin Atlantic Flying Club (1:1 ratio).

Hotels

- Choice Hotels (1:1 ratio).

- Hilton Hotels & Resorts (1:2 ratio).

- Marriott Hotels & Resorts (1:1 ratio).

For details on transfer ratios, see AmEx's website.

» Learn more: AmEx vs. Chase transfer partners

What’s great about the cheaper American Express® Gold Card is that transfer partner rates are the same as the American Express Platinum Card®. The ability to transfer AmEx Membership Rewards is one of the best benefits out there, so it’s delightful that you can get the same perk on this card, with a lower annual fee.

6. You’re not paying for superfluous benefits

Increasingly, the American Express Platinum Card® has turned into a somewhat glorified coupon book.

Some of the perks are aimed at luxury travelers, like an up to $600 hotel credit per year on prepaid Fine Hotels + Resorts or The Hotel Collection or up to $100 Saks Fifth Avenue credit per year. Both of those credit are doled out as half the amount in the first six months of the calendar year and the last six months of the year. Enrollment required. Terms apply.

Those perks can be delightful, but is that money you would have otherwise spent? If not, then it might not be fair to factor those into justifying the card’s annual fee.

Other perks like the Walmart+ credit, $25 monthly digital entertainment credit and cell phone protection might be more accessible, but still only provide value if you actually use them. The $25 monthly digital entertainment credit only covers certain services like Disney+, Paramount+, YouTube TV, the New York Times, the Wall Street Journal and others. Hopefully you like Baby Yoda. Terms apply. Enrollment required. Terms apply.

In past years, you might have been envious of your friends toting the American Express Platinum Card®, but increasingly, the card has become stressful to use — and ensure it delivers its full value.

Compare it with the small handful of perks on this card, which are far easier to use anyway.

The bottom line

If you’ve got big spending planned for this year — particularly when it comes to spending on dining and groceries, the American Express® Gold Card is one of the most efficient vehicles for earning rewards points. Its earnings rate is astonishingly high, and its rewards can be transferred to other airline and hotel partners, which can make them even more valuable. That’ll put you on your way to a free trip (or at least, help you pay for a big chunk of it). Terms apply.

Throw in the other benefits like Uber or U.S. Dunkin' statement credits — which many people will find easy to use with little or no effort — and it’s easy to see how everyday spending can pay off by holding this card in 2026.

To view rates and fees of the American Express Platinum Card®, see this page.

To view rates and fees of the American Express® Gold Card, see this page.

Insurance Benefit: Car Rental Loss & Damage Insurance

- Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles