How to Find the Right Low-Interest Credit Card

Low- or no-interest cards can make it less costly to carry monthly credit card debt. Here’s how to choose the right offer for you.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

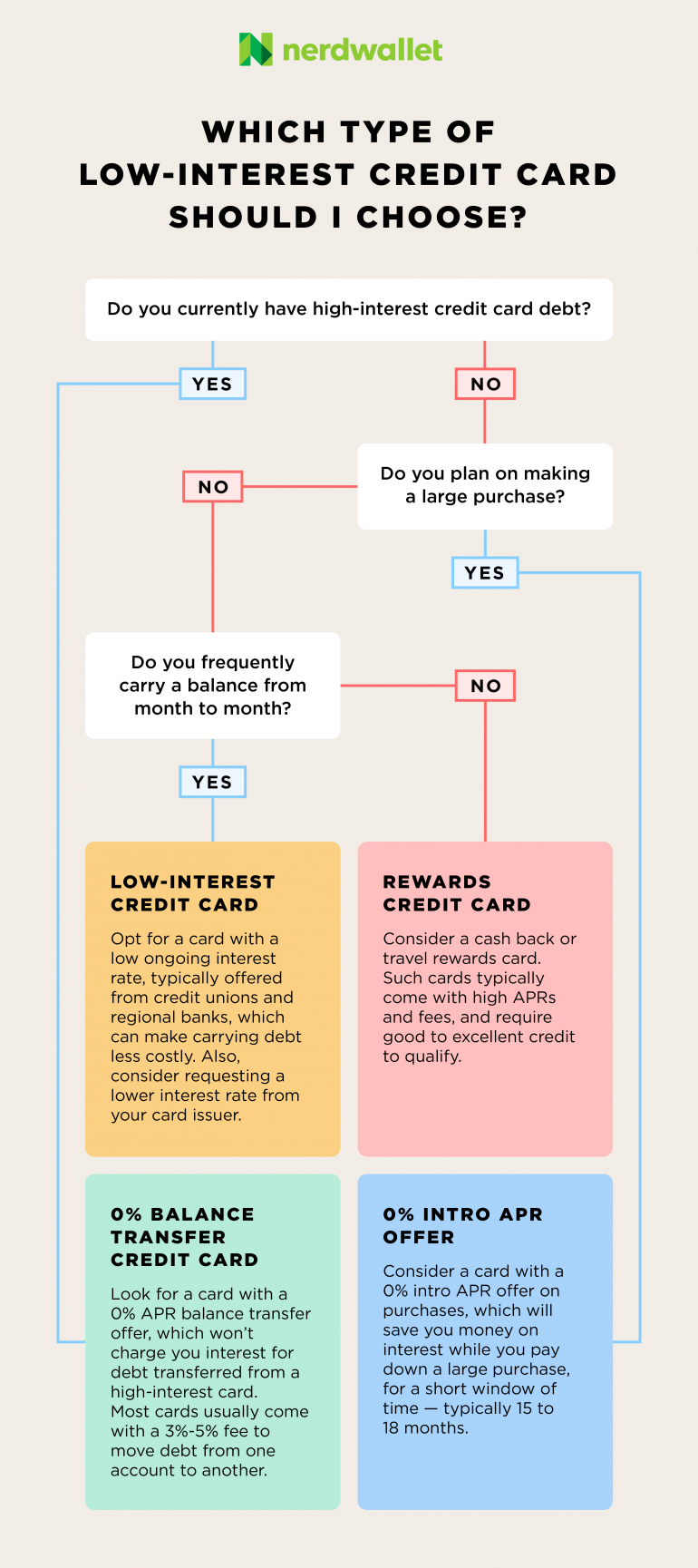

Credit cards with 0% intro APR offers and cards with low ongoing interest rates are useful for paying down debt or financing large purchases. The right type of low-interest card will depend on your needs and specific situation, though.

If you’re carrying debt on a high-interest card, for example, it might make sense to transfer that balance to a card that can save you money while you pay down that debt. And if you tend to carry a balance, a card with a low ongoing interest rate would make it less costly to carry a balance from month to month. On another hand, if you’re looking to make a large purchase, a 0% intro APR offer on purchases will be your best bet.

Here’s how to decide when to opt for a low or no-interest credit card and which one might make the most sense for your needs.

0% balance transfer credit cards

If you have high-interest credit card debt, it might make sense to do a balance transfer by moving that debt to a new card with a low-interest rate.

What to consider before getting a balance transfer credit card

APR: When comparing balance transfer offers, you’ll ideally want to look for a card that comes with a 0% introductory APR offer on balance transfers. For example, the Citi Double Cash® Card comes with a 0% intro APR on balance transfers for 18 months, and then the ongoing APR of 17.49%-27.49% Variable APR. This means that after opening the account, cardholders will have 18 months in which their transfers won’t incur any interest. Note also that while there are cards that offer interest-free periods on both purchases and balance transfers, the two interest rates aren't always the same on all cards. For example, the Discover it® Chrome offers a 0% intro APR on Purchases for 6 months and 0% intro APR on Balance Transfers for 18 months, and then the ongoing APR of 17.49%-26.49% Variable APR. Additionally, there are cards that offer 0% intro APR just for purchases, not balance transfers.

Fees: Most cards, even those with 0% intro APR periods, charge balance transfer fees — typically 3% to 5% of the total amount transferred. Opt for a card with a balance transfer fee on the lower end of that range to ensure that the amount you’ll save on interest will be enough to cover the fee. If you can find a card that doesn't charge this fee and offers 0% intro APR on balance transfers, you’ll save a lot more. But cards that don’t charge balance transfer fees are few and far between these days.

Terms and conditions apply. Credit products subject to lender approval.

0% intro APR cards

Cards with promotional 0% intro APR periods on purchases can help you save money on interest while you pay down a large purchase. The best 0% intro APR cards come with interest-free periods of 15 to 18 months.

What to consider before getting a 0% intro APR credit card

Ongoing interest: Getting a credit card with a 0% introductory APR can save you money in the short run. But when the interest-free period is over, you'll be left with an ongoing APR, which can often be high. This regular interest rate will not only apply to new purchases made, but also to any unpaid balance from the introductory period. If the ongoing interest rate on a 0% intro APR card is high and you're planning on carrying a balance long term, you might be better off with a card that features a lower ongoing APR. (More on this below).

Long-term value: If your main goal is to pay down a large purchase, earning rewards likely isn't your first concern. But once you’ve paid off your balance, you might want a card that proves valuable after the 0% promotional period ends. The $0-annual-fee Wells Fargo Active Cash® Card, for instance, features a 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers, and then the ongoing APR of 18.49%, 24.49%, or 28.49% Variable APR. But it also comes with rich rewards that make the card worth holding on to: Cardholders earn an unlimited 2% cash rewards on purchases.

Low-interest credit cards

Cards that feature low ongoing interest rates make the most sense if you frequently carry a balance. This could be the case if you:

Have an irregular income.

Are paying off several big purchases.

Don't always have enough savings to cover unpredictable expenses.

What to consider before getting a low-interest credit card

Eligibility requirements: As of May 2021, the average APR for cards that accrued interest was 16.30%, according to the Federal Reserve. But there are cards that feature lower APRs and that can save you money on interest. These cards are typically offered by credit unions and regional banks. Not everyone will be eligible for such cards, however, because you'll have to meet certain membership and location requirements to apply. The Lake Michigan Credit Union Prime Platinum Card, for example, features the following interest rate: The ongoing APR is 10.50%-18.00%, Variable APR. You must join Lake Michigan Credit Union to be eligible for the card.

Credit score: The interest rate you’re charged on a credit card typically depends on your credit score. So without good or excellent credit (a score of at least 690 on the FICO scale), you generally won't be able to qualify for a card’s lowest interest rate. If you have less than average credit, consider opting for credit-building options like a secured card or an alternative credit card that use nontraditional underwriting measures to assess credit.

Fees: After you've missed multiple payments, some cards charge penalty APRs, which is a high-interest rate, sometimes as much as double your regular rate. A penalty APR will apply to both previous balances and new charges and may remain on your card for up to six months. Before picking a card, make sure you’re aware of the terms and conditions surrounding its penalty APR. And if you’ve incurred one, try to pay the minimum amount due, as soon as you are able.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.