Experian Credit Freeze: How It Works, Why to Consider It

You can freeze your credit in minutes to protect your identity and financial information. It's free and you can thaw at any time.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

A credit freeze is a great way to protect your credit reports. It's free and it goes into effect quickly, preventing financial scammers from stealing your information and opening accounts in your name.

Experian is one of the three credit bureaus to offer this option, also known as a security freeze. Freeze your Experian credit report online (the easiest option) by phone or by mail. A PIN is no longer required.

Freeze your Experian credit online

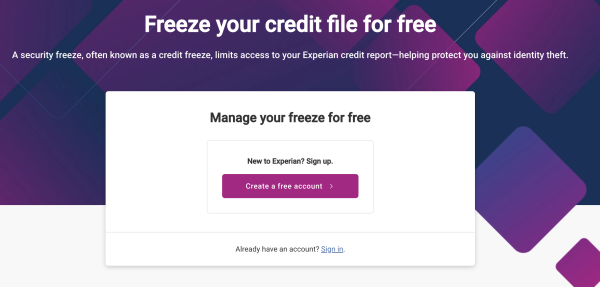

Go to Experian's credit freeze page and either sign up to create an account or log in if you already have one.

The Experian's freeze site looks like this:

If you're signing up for an account, you’ll need to input info such as your name, address, last four digits of your Social Security number and contact info.

You may need to go through a two-factor identification flow, where a code or link is sent to your phone before you can set up an account.

Once you've created an account, you might see other credit content, such as information on getting your credit score. Just scroll down to "security freeze" at the bottom of the page.

If you already have an Experian account, log in, go to "security freeze" and then you can toggle between the "frozen" and "unfrozen" options for your credit report.

An online credit freeze will go into effect immediately.

Freeze your Experian credit by phone

If you prefer to get information about the process by phone, the number is 888-397-3742 (888-EXPERIAN).

You’ll be asked to provide personal data, such as your Social Security number.

Freeze your Experian credit by mail

If you prefer to use the mail, send your request by certified mail to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

Your letter should include your full name, Social Security number, birthdate, two years’ worth of addresses, a government-issued ID card, such as a driver’s license, and a utility bill or other acceptable proof of address. NerdWallet recommends sending all information using certified mail.

You can expect your credit freeze to take effect within three days of Experian receiving your request by mail.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Why should I freeze my credit?

If you freeze your credit with Experian, you’ll still be able to use it as you do now, but you won’t be able to apply for new credit without first lifting the freeze.

That means if your personal data was compromised during a breach, no one else can use it to create a credit account, protecting your credit and saving you time and aggravation in trying to clear it up.

Freezing and unfreezing your credit reports does not affect your credit score. With the appropriate paperwork, you can also freeze your child’s credit as an extra precaution.

» Learn more: How to protect your child’s credit

If you need to apply for credit in the near future, you can temporarily lift the freeze. You can add it back manually after your application or purchase is complete.

You can also use the option to lift the freeze for a scheduled amount of time. After that time period, the freeze will automatically be reapplied, so it’s one less thing for you to worry about.

To get the strongest protection, you’ll need to freeze your credit with each of the three credit bureaus.

» Learn how to initiate an Equifax credit freeze and a TransUnion credit freeze

Unthaw your Experian credit the same way

It’s just as easy to “thaw” or unfreeze your credit as it is to freeze it, and it’s also free.

You must complete the process at all three bureaus individually with one exception: If you’re making a single credit application — say, getting preapproved for a car loan or an apartment. In this case, you may be able to find out which credit bureau’s data the lender is using and lift the freeze there, saving you some time.

To lift your credit freeze with Experian, follow these steps:

- Online: Log in to your Experian account through the same page where placed the freeze. You’ll have the option to temporarily or permanently unfreeze your credit.

- By phone: Call the automated line at 888-397-3742. You’ll go through steps to verify your identity, similar to what you experience if you place a freeze over the phone.

- By mail: Send a written request that includes your name, address and Social Security number to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

»MORE: Get your free credit report summary from NerdWallet

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles