Best Credit Cards With No Credit Check

Some credit cards, particularly from newer companies, promise no credit check and no fees — an ideal combo for those with bad credit. Here are our top picks.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Credit cards that advertise "no credit check" can be appealing to those with poor credit (FICO scores of 629 or lower), since applying for them won't impact your credit scores. But often, such cards come with high fees and interest rates — hence the name fee-harvester cards.

They may let you dodge that hard pull on your credit report, but you'll pay for it in the long run.

But some credit card companies — especially newer startups in the space — are advertising both no credit check and no fees (or at least low fees). Many of these so-called alternative credit cards have proprietary underwriting technology that can evaluate creditworthiness by looking at other factors, like your bank account, instead of traditional FICO scores and credit histories.

In short, if you have poor credit, fee-harvester cards and traditional secured credit cards are no longer your only options. Here are some low- and no-fee cards that don’t require a credit check.

Best credit cards with no credit check

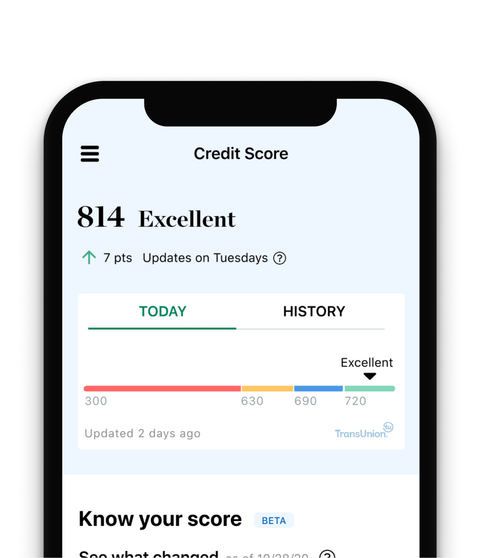

Trying to get approved for a card?

Create a NerdWallet account for insight on your credit score and personalized recommendations for the right card for you.

Chime Card™

Our pick for: Chime users

CARD DETAILS

Credit check: None.

Security deposit: No minimum security deposit is required. You decide your credit limit based on how much you move to your secured account.

Fees: $0 annual fee.

APR: N/A.

WHY WE LIKE IT

For those with poor credit or no credit, the Chime Card™ removes many of the limitations of traditional secured credit cards. A Chime Checking Account — a bank account that allows you to deposit money — is required to get the card.

You also get to decide how much you spend. The money you move from the Chime Checking Account to the Credit Builder secured account determines the amount of your credit limit. So if you move, say, $25 to your secured account, you’ll be able to spend $25 with the card. The money in the secured account can also be used to pay off the balance, and those payments will allow you to build credit. For instance, if you spent $15 on gas with your secured card, you'd be able to use that $25 you moved to your secured account to pay off the $15. Your payments are reported to all three major credit bureaus: TransUnion, Equifax and Experian. These companies collect the information used to calculate your credit scores

DRAWBACKS

The Chime Card™ requires a Chime Checking Account to qualify. It’s free to open one, but it does require some additional effort beyond the card's application. And if you prefer the option to carry a balance from month to month, this card doesn't allow it. There is no upgrade path, either.

See more from Chime®

Chime says the following:

- The Chime Card™ is issued by The Bancorp Bank, N.A. or Stride Bank, N.A., pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see the back of your card for its issuing bank.

- Based on a representative study conducted by Experian® in Sept 2025, the top 10% of members who made their first purchase with Credit Builder, an earlier version of Chime Card™, between April and August 2024, observed a FICO® Score 8 increase of 71 points after approximately 8 months. Average increase of 28 points across all participants in the study. Credit score improvement not guaranteed. Paying on time may increase your score, while late payment may decrease your score. Other credit activity can impact your score. Credit score is one of many factors creditors may consider in evaluating credit applications.

- On-time payment history may have a positive impact on your credit score. Late payment may negatively impact your credit score. Chime will report your activities to Transunion®, Experian®, and Equifax®. Impact on your credit may vary, as Credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

- Money added to the Chime Card™ will be held in a secured deposit account as collateral for your Chime Card™, and you can spend up to this amount. You can use money deposited in your Secured Deposit Account to pay off your charges at the end of every month.

- Out-of-network ATM withdrawal and over the counter advance fees may apply.

- SpotMe® on Credit is an optional, no interest / no fee overdraft line of credit tied to the Secured Deposit Account available to qualifying members with an active Chime Card Account. To qualify for the SpotMe on Chime Card service, you must receive $200 or more in qualifying direct deposits to your Chime® Checking Account each month and have activated your physical secured Chime Visa® Credit Card or Chime Visa® Debit Card. Qualifying members will be allowed to overdraw their Secured Deposit Account up to $20, but may later be eligible for a higher limit of up to $200 or more based on Chime account history, direct deposit frequency and amount, spending activity and other risk-based factors. The SpotMe on Chime Card Limit will be displayed within the Chime mobile app and is subject to change at any time, at Chime’s or its banking partners’ discretion. Although Chime does not charge any overdraft fees for SpotMe on Chime Card, there may be out-of-network or third-party fees associated with ATM transactions and fees associated with OTC cash withdrawals. SpotMe on Chime Card won’t cover non-card transactions. SpotMe on Chime Card Terms and Conditions.

- With a qualifying direct deposit, earn 1.5% cash back on eligible secured Chime Visa® Credit Card purchases.

🤓 Nerdy Tip

While any credit card's rewards, benefits and fee structure can be adjusted at any time, new cards from startup financial technology companies are particularly prone to significant changes as they find their place in the market. Keep that in mind as you research your credit card options. Current Build Card

Our pick for: Current users

CARD DETAILS

Credit check: None.

Security deposit: No upfront security deposit is required. You determine the credit limit based on how much money is in your linked Current account.

Fees: The annual fee is $0 (see terms). Depending on your transactions and payments, other fees may apply.

APR: N/A.

WHY WE LIKE IT

The Current Build Card doesn’t require a credit check or a minimum security deposit. As a result, it’s easier to apply for with less-than-ideal credit. You’re required to open a Current account, which is free, and fund it with an amount you choose. The money you put into the account determines the spending limit on the card. You can’t overspend or fall into a debt cycle with this card because you can't carry a balance from one month to the next. That's why interest charges don't apply. Rarer still for a card in its class, this card earns 1 point for every dollar spent at any grocery store or restaurant, and points can be redeemed for cash back.

DRAWBACKS

Because you don’t have the option to carry a balance on the Current Build Card, you might be unprepared for managing a real credit card, which would require staying on top of costs to prevent debt. Keep in mind, too, that while the Current Build Card doesn't have an annual fee, it has other potential costs. Depending on how you use the card, things like late payment fees, foreign transaction fees, out-of-network ATM fees and card replacement fees may apply. This card also doesn’t offer a path to upgrade to a better credit card with the same issuer.

See more from Current

You may earn Points in connection with your everyday spending and by completing other actions that Current designates as subject to the Current Points Program. The amount of Points granted for different actions as well as the purchase requirements necessary to earn Points will vary, and is subject to Current’s sole discretion. After qualifying, please allow 3-5 business days for points to post to your Current account. Points will expire 365 days after they settle. The Current Points program is not available to Teen Account holders. See Current Points Terms and Conditions.

Varo Believe Secured Credit Card

Our pick for: Varo users

CARD DETAILS

Credit check: None.

Security deposit: You decide your credit limit based on how much you move into a secured account.

Fees: None.

APR: None.

WHY WE LIKE IT

With the Varo Believe Secured Credit Card, you get to choose your own credit limit. The amount of money in your Varo Believe secured account becomes your credit limit (although there is a $2,500-per-day spending cap). The card reports to all three major credit bureaus, and it doesn’t charge interest or fees because it doesn’t allow you to carry a balance. Because you can only spend as much as you deposit in the secured account, incurring debt is impossible.

DRAWBACKS

To qualify, you need a Varo bank account that has received direct deposits of at least $200 in the past 31 days. The card doesn’t offer ongoing rewards in broad spending categories, as a few secured credit cards do, though you can earn cash back when the card is used to shop with select retailers through Varo’s online offers. (There’s a $200 cap on the amount of cash back you can earn per month.) This card also doesn’t offer a path to upgrade to an unsecured credit card once you work your way to better credit.

Find the best card for your credit

Check your score anytime, and NerdWallet will show you which credit cards make the most sense.

Grow Credit Mastercard

Our pick for: Subscriptions

CARD DETAILS

Credit check: The company runs only a soft credit check, which won't impact your credit scores.

Security deposit: None for most membership plans.

Fees: You'll owe a membership fee, ranging from $3.99 to $12.99 a month.

APR: None.

WHY WE LIKE IT

The Grow Credit Mastercard is a virtual card issued by Cross River Bank that is friendly to those with poor credit or no credit. Grow Credit has proprietary technology that looks at income to evaluate creditworthiness. To weigh that information, the company requires you to link a bank account through Plaid.

With the card, you choose a membership plan that helps you build credit as you pay for eligible monthly subscriptions or bills. For example, if you normally pay $7.99 a month for Netflix, you can make that payment with the Grow Credit Mastercard. When you then pay off that charge, on time and in full, it can help your credit. (Qualifying subscriptions and bills vary by membership plan.) The Grow Credit Mastercard reports payments to all three major credit bureaus.

DRAWBACKS

You can't use the card for any transactions other than qualifying bills and subscriptions. You also can't carry a balance from one month to another. Plus, you'll owe a monthly membership fee that varies depending on tier. Two of the membership tiers — the Grow membership tier (annual cost of about $84) and the Accelerate membership tier (nearly $156 annually) — are likely not worth the cost. That's money you won't get back.

You're better off with Grow Credit's Build membership plan, which costs $3.99 a month. Or you could consider a secured credit card that charges no annual or monthly fees and offers a chance to get your deposit back.

opensky® Secured Visa® Credit Card

Our pick for: Those who are unbanked

CARD DETAILS

Credit check: None.

Security deposit: Normally, a $200 minimum deposit is required.

Fees: A $35 annual fee. Depending on your transactions and payments, other fees may apply.

APR: The ongoing APR is 23.89% Variable APR.

WHY WE LIKE IT

The opensky® Secured Visa® Credit Card is a traditional secured credit card ideal for those with poor credit. Among secured credit cards, it’s one of the few that lets you qualify without a credit check or bank account. It reports payments to all three credit bureaus and lets you carry an ongoing balance. With a good payment history, you may also potentially qualify for a credit limit increase in as little as six months.

DRAWBACKS

The card’s minimum deposit requirement may be an obstacle for some. And while the $35 annual fee is on the low end, it's possible to find secured credit cards that don't charge an annual fee at all. For instance, you might instead consider this card's sibling, the opensky® Plus Secured Visa® Credit Card, which charges an annual fee of $0 (though it does require a higher security deposit). Neither of the opensky cards requires a credit check, however.

Cred.ai Credit Card

Our pick for: Spending guardrails

CARD DETAILS

Credit check: None.

Security deposit: None, though a linked Cred.ai deposit account is generally required.

Fees: None when you're covered by the "Cred.ai Guaranty."

APR: A variable rate of 16.76% (as of this writing).

WHY WE LIKE IT

The Cred.ai credit card, also known as the Unicorn Card, assigns a spending limit based on the amount in your linked Cred.ai deposit account. As you make purchases with the card, funds are set aside in the deposit account so they can cover the bill when it comes due. This way, you avoid late fees or interest charges.

The card also offers a variety of features including virtual card numbers for safe purchases, limited authorization windows and credit utilization guardrails to simplify finances. Payment activity is reported to all three major credit bureaus.

DRAWBACKS

The Cred.ai credit card can be difficult to understand since it doesn’t function like a traditional credit card. The marketing copy for its unique features may further add to the confusion. Unpacking how this card works can be especially overwhelming for a credit beginner, but it may still be worth your time if you want an option that reins in spending. Rewards are not available on this card, and there's no option to upgrade to a better product from Cred.ai.

GO2bank Secured Credit Card

Our pick for: A low security deposit

CARD DETAILS

Credit check: None.

Security deposit: A $100 minimum deposit is required.

Fees: A $0 annual fee. Depending on your transactions and payments, other fees may apply.

APR: The ongoing APR is 22.99% (as of this writing).

WHY WE LIKE IT

The GO2bank Secured Credit Card is a solid option for those with poor credit. To apply, you’ll need to have a GO2bank account and eligible deposits. There won't be a credit check to apply. The GO2bank Secured Credit Card has a relatively low minimum security deposit requirement among secured credit cards: $100. The amount deposited determines your credit limit.

As with a regular credit card, the lower the credit limit, the less you’ll want to spend using the card. Using less than 30% of your available credit limit can help your credit score. The GO2bank Secured Credit Card reports your payments to all three credit bureaus, which helps you build credit.

DRAWBACKS

Aside from the required security deposit, the GO2bank Secured Credit Card also requires you to have a GO2bank account to qualify, which adds an extra step in the application process. You’ll need direct deposits in the previous statement period to that account to avoid the $5 monthly fee. It doesn’t offer a path to upgrade to an unsecured credit card once you've established a good payment history, so you’ll have to close your account if you want to get your security deposit back. The card also charges a 3% foreign transaction fee on every purchase, so it’s not ideal for traveling abroad.

The secured Self Visa® Credit Card

Our pick for: A mix of credit-building features

CARD DETAILS

Credit check: No hard credit check, although there may be a soft inquiry, which won't impact your credit scores.

Security deposit: A $100 minimum (though you may be able to pay that over time; see below).

Fees: An annual fee of $0 intro first year, $25 thereafter†. Depending on your transactions and payments, other fees may apply.

APR: The ongoing APR is 27.49% Variable†.

WHY WE LIKE IT

The secured Self Visa® Credit Card has a relatively low barrier to entry: You need an upfront security deposit of $100. But if you can't afford that immediately, you can also sign up for a Credit Builder Account and build up the $100 deposit with monthly contributions.

This can be an ideal option if your budget would benefit from paying a deposit in small installments over time. You’ll eventually get this money back when you close the account in good standing (though you won't get back any fees or interest you pay). Plus, if you get the Credit Builder Account, the mix of credit types can be a win for your credit scores if you can maintain on-time payments. (The secured Self Visa® Credit Card and the Credit Builder Account are both reported to all three major credit bureaus — the former as a revolving line of credit, and the latter as an installment loan.)

DRAWBACKS

While a $100 security deposit is significantly less than is required by some traditional secured credit cards, several credit cards (see above) allow you the flexibility to choose how much you deposit. The secured Self Visa® Credit Card also charges an annual fee, and while it's on the lower end, other credit cards skip it altogether.

More from Self

- Card eligibility: Active Credit Builder Account in good standing, 3 on time payments, $100 or more in savings progress. Requirements subject to change.

- Bank eligibility: The The secured Self Visa® Credit Card is issued by Lead Bank or First Century Bank, N.A., each Member FDIC.

- Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval.

Firstcard® Secured Credit Builder Card

Our pick for: Newcomers to the U.S.

CARD DETAILS

Credit check: None.

Security deposit: No upfront security deposit is required. You determine the credit limit based on how much money is in your Firstcard deposit account.

Fees: $72-$144/year, depending on subscription plan. Depending on your transactions and payments, other fees may apply.

APR: N/A.

WHY WE LIKE IT

The Firstcard® Secured Credit Builder Card is friendly to those with little or no credit history, and it's especially welcoming to U.S. newcomers who may lack a Social Security number. (The Firstcard® Secured Credit Builder Card requires passport and visa information if you can't meet that requirement.) It reports to the major credit bureaus, and it's among the most affordable starter cards; there's no annual fee, late fee or APR.

To get the card, you’ll need a Firstcard deposit account to transfer money into, via a direct deposit or direct transfer from a linked bank account or debit card. The amount deposited determines the card's credit limit. You can start using the card immediately after adding it to your Apple or Google Wallet.

DRAWBACKS

The card isn't free to hold, and the fee you'll pay depends on the subscription plan you have with Firstcard. That means it'll be costly to keep in the long run, so once you've established credit, you'll want to try to move on to a better product.

Arro Card

Our pick for: Useful rewards

CARD DETAILS

Credit check: None.

Security deposit: No minimum security deposit is required. However, applicants must link their bank accounts to apply for the card.

Fees: $60 annual Arro membership fee. Note that the fee can potentially be lower in the first year of having the card, depending on what initial credit line you're approved for.

APR: Starting APR of 16% (as of this writing). Cardholders also have the opportunity to lower their interest rate by completing in-app challenges and tasks.

WHY WE LIKE IT

For those with thin or no credit, the Arro Card can be an accessible option. It doesn’t require a hard inquiry on your credit report when you apply, so your credit scores won’t be affected. It also reports payments to the three major credit bureaus. Cardholders also have the opportunity to earn higher credit limits and lower APRs by completing gamified challenges, personal finance lessons and videos on Arro’s app.

Notably, the card earns rewards for useful spending categories: 1% cash back on gas and groceries, including groceries purchased at Walmart and Target. Despite the low earning rate, groceries and gas are common spending categories that can be valuable — especially when your main priority is building credit and not earning rewards.

DRAWBACKS

To get the Arro Card, you'll have to pay a yearly Arro membership fee of $60. While this fee is on the low end compared with what some similar cards charge, many cards for subprime consumers don't have such fees at all. Note that Arro's membership fee can potentially be discounted for the first year, depending on what credit line you’re approved for. Despite the potential discounts, a yearly cost can be a barrier to entry for some applicants.

Also, the card doesn’t offer a path to upgrade to an unsecured option.

Credit cards that didn't make the list

The following cards also skip the credit check, but they pack fewer valuable features compared with other credit cards.

- Ava Credit Builder Card: You'll avoid a hard pull on your credit report, and there are no interest charges. But you'll also face severe restrictions in terms of where and how much you can spend with the card. In addition, you'll owe a membership fee of as much as $108 a year.

- Kikoff Secured Credit Card: This card doesn't require a credit check, and technically its annual fee is $0. But to get it, you'll need a paid Kikoff subscription, which will cost you — at a minimum — $60 a year. And while there's no official minimum security deposit required, you'll need to put down at least $50 if you want the card to report to the three credit bureaus.

- Possible Card: This card promises no credit check and no interest charges, and it reports to all three major credit bureaus. But you'll owe a monthly fee that can equal up to $192 per year. Plus, as of this writing, the card is available by invitation only to a limited number of users.

- Super.com Card: This card avoids an upfront security deposit; your credit limit is equal to the amount of money in the bank account linked to the card. But to get the card, you'll have to pay a significant $15-a-month membership fee. That equates to $180 per year.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Related articles