Equifax Credit Freeze: Your Step-by-Step Guide

A freeze protects your credit, and it’s free and easy to do. You can manage your Equifax credit file online, by phone or by mail.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you’re looking to keep your credit data from being accessed, the best way to protect it is a credit freeze, also known as a security freeze. Credit freezes are free and don’t negatively impact your credit score.

Here’s what to know about freezes and how to place a credit freeze at Equifax.

How to place an Equifax credit freeze

There are three ways to freeze your credit with Equifax: online, by phone and by mail.

How to freeze your Equifax credit online

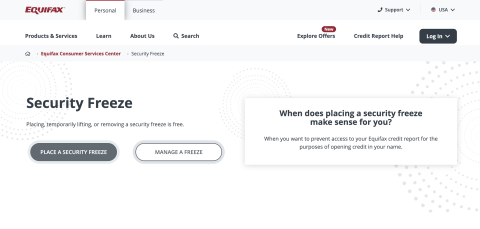

The fastest and easiest way to freeze your credit is via Equifax’s website. You'll be asked for your name, address, Social Security number and other information to verify your identity in order to set up a password-protected "myEquifax" account. When freezing and unfreezing online, you don't need to set a PIN.

The page where you begin looks like this:

How to freeze your Equifax credit by phone

You can request an Equifax security freeze by calling customer care at 888-298-0045.

You’ll need to give your Social Security number, street address and state of residence. You’ll have to answer some security questions to verify your identity.

How to freeze your Equifax credit by mail

If you’d rather set up a security freeze via postal mail, you’ll need to send Equifax a completed security freeze request form. The address is: Equifax Information Services LLC, P.O. Box 105788, Atlanta, GA 30348-5788. NerdWallet recommends sending all items using certified mail so that you can guarantee someone at the credit bureau received and signed for your documents.

You’ll need to include your full name, including any suffixes, your address, Social Security number and date of birth. Equifax also asks that you include copies of documents that verify your identity and address. Acceptable documents include a valid driver’s license or state ID, tax documents, a pay stub and utility bills.

If you are requesting a freeze on behalf of a minor or other protected consumer, you’ll need to submit a minor freeze request form or incapacitated adult freeze request form. You must provide information for the person whose credit you want to freeze along with a copy of their Social Security card and birth certificate, as well as documentation that shows you have the authority to make the request.

» Learn more: How to protect your child’s identity

What does an Equifax credit freeze do?

A credit freeze makes your credit report off-limits to anyone who does not already have access to it. No one else will be able to check your credit until you lift the freeze and scammers won't be approved if they try to misuse your personal data to open a fraudulent credit account.

A freeze does not affect your ability to use the credit accounts you already have. You can still monitor your own credit while it’s frozen by periodically reviewing your credit reports.

» Next steps: Get free weekly credit reports

How to manage your Equifax credit freeze

Because credit reporting agencies don’t share data for freezes, you’ll need to request a freeze at the two other major credit bureaus. NerdWallet has guides for freezing your Experian and TransUnion credit reports as well.

Keep track of your password. Although it’s possible to retrieve lost account-access information, it’s less hassle and faster if you can access it when you want to.

When you want to use your credit, follow our guide on how to unfreeze your credit with each bureau. You can temporarily lift the credit freeze if you need to apply for a new account.

How to unfreeze your Equifax credit file

To lift your credit freeze with Equifax, follow these steps:

Online: Log in to your myEquifax account through the Equifax website to manage your freeze. You’ll have the option to temporarily or permanently unfreeze your credit.

By phone: Call the automated line at 800-349-9960 or customer care at 888-298-0045. You’ll go through the same steps to verify your identity as required to place a freeze over the phone.

By mail: Fill out Equifax’s security freeze request form, checking the appropriate box to either temporarily lift the freeze or remove it altogether. Send the form and your verification documents to Equifax Information Services LLC, P.O. Box 105788, Atlanta, GA 30348-5788.

» What's next? Get your free credit score