Payment Links: How They Work, Who Offers Them

Payment links allow you to accept payments quickly and don't require you to have a website.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

A payment link is essentially a URL or QR code that takes customers to a stand-alone web page that can be created in a few minutes. A customer who clicks on a link is sent to a simple checkout page where they can complete the transaction. You can set up a unique link for each good or service you’re selling. One payment link can facilitate a transaction for a single intended recipient, like an invoice would, up to an unlimited number of customers.

Payment links are provided by payment service providers and payment processors, typically at no additional cost.

Benefits to using payment links

- A payment link lets you easily accept online payments without the need to build out any other digital infrastructure.

- Payment links are typically customizable, and you can set one up in minutes, making them a good option when speed or flexibility is important.

Drawback to using payment links

- While using a payment link as a de facto invoice can work on occasion, it won't allow you to track multiple invoices at once or automate reminders.

When using a payment link makes sense

If the concept seems simple, that’s because it’s meant to be; it’s an online transaction stripped to its essentials. Here's why you might want to create a link that sends customers to a single-use webpage:

- You don’t have your own website. Maybe you have a new business or handle most of your transactions in person.

- You have a website, but it doesn’t support e-commerce. Or, maybe you don’t want to operate an e-commerce site on an ongoing basis.

- You sell through many digital channels. Perhaps you do a lot of business directly on your social media pages, through text messages or with a newsletter, and you want to tailor the experience for each.

- You need a tool that supports sporadic sales. Maybe you release special editions a few times a year, but you don’t want to go through the process of building it into your permanent website.

- You have distinct audiences. If you plan fundraisers, for example, you probably want to maintain distinct donation pages for each event.

- You want to sell in person without hardware. Add a QR code that goes to your payment page on a poster.

- You mostly sell in person, and maybe even have a website. But occasionally, you’d like to use payment links in specific situations. Even if your current payment processor doesn’t offer payment links, you can use payment links through another payment processor alongside your existing payment setup.

- There is an element of unpredictability to your business, and you want to be able to move quickly. For example, if you grow and sell fresh produce or baked goods.

Choosing a payment links provider

Links are a relatively new addition to the payments scene. A handful of mainstream payments companies have added them to their product lineups in the past 18 months. Adyen and Square each launched a version of payment links in mid-2020, while Stripe started offering them in May 2021. With merchants increasingly looking to do business across multiple channels, more payment processors may offer payment links in the future.

The payment link services offered by the companies listed below provide similar user experiences. But some platforms stand out in other areas. For example, Square has a strong lineup of point-of-sale hardware, making it a good option for those who also accept in-person payments, while PayPal and Stripe can accept payments in several countries and currencies. If you currently don’t have a payment processor or are thinking about switching, consider the full range of features each product offers beyond payment links.

How it works

- You’ll need to create a business account with the payment processing company before using their payment links service. The companies listed below don’t require a long-term contract or monthly fee.

- Just like any other card transaction, you’ll pay a processing fee whenever a customer buys something using a payment link.

- All options below include the ability to customize the payment link, including adding an image.

Popular payment link providers

Stripe

Stripe is a payment processor known for being highly customizable.

How to get payment links: Navigate to your Stripe dashboard, open the “Payment links” page and select “+ New.”

Payment processing fee:

- 2.7% plus 5 cents for in-person transactions.

- 2.9% plus 30 cents for online transactions.

- 3.4% plus 30 cents for manually keyed transactions.

- 4.4% plus 30 cents for international card transactions.

Alternative payment modes accepted: Apple Pay and Google Pay.

Stripe |

Square

Square is a payment processor with tools for in-person and online shopping.

How to get payment links: Log on to your Square dashboard, go to “Online Checkout” and select create a link.

Payment processing fee:

- 2.6% plus 15 cents for in-person transactions with Free plan.

- 3.3% plus 30 cents for online transactions with Free plan.

- 2.5% plus 15 cents for in-person transactions with Plus plan.

- 2.4% plus 15 cents for in-person transaction with Premium plan.

- 2.9% plus 30 cents for online transactions with Plus and Premium plans.

- 3.5% plus 15 cents for manually keyed transactions.

Alternative payment modes accepted: Apple Pay, Google Pay and PayPal.

Square Payment Processing |

Adyen

Adyen is a payment platform specializing in e-commerce businesses that sell through multiple channels.

How to get payment links: Go to your merchant account, navigate to the “Pay by Link” page and click “Create payment link.”

Payment processing fee: Interchange plus a markup that varies depending on the card used.

Alternative payment modes accepted: Apple Pay, Google Pay and Paypal.

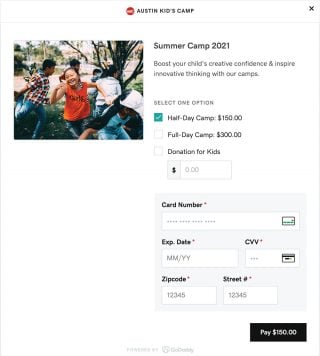

GoDaddy

GoDaddy is a payment processor that specializes in online services, like website builders and marketing tools.

How to get payment links: Log on to your Payments Hub, select “Online Payment Links” and choose “Create Link.”

Payment processing fee: 2.3% plus 30 cents.

Alternative payment modes accepted: PayPal.

PayPal

PayPal is an online payment platform that has a wide global presence.

How to get payment links: Sign in to your PayPal Business account, go to the page titled “Sell on Social Dashboard” and select “Add product.”

Payment processing fee:

- 2.29% plus 9 cents for in-person and QR code transactions.

- 3.49% plus 9 cents for manual-entry card transactions.

- 2.99% plus 49 cents for invoicing (payment made with card) and PayPal Checkout online payments.

- 3.49% plus 49 cents for invoicing (payment made with PayPal).

Alternative payment modes accepted: PayPal, Venmo and some cryptocurrencies.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

FEATURED

Related articles