How to Earn United Miles: 32 Easy Ways

You don't need to fly a lot on United just to earn United miles. Travel partners like Avis and Vrbo can also help.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

United Airlines is one of the largest U.S.-based carriers and a founding member of Star Alliance. Due its vast network and membership in Star Alliance, passengers can earn United miles with over 40 partner airlines. The airline’s extensive network offers incredible opportunities to not only fly all over the world, but to redeem miles.

But in order to redeem United miles, you'll have to earn them first. Here are the best ways to earn United miles, including ways to earn miles without flying and some lesser-known options so you can maximize your earnings.

On this page

- 1. Sign up for United Airlines credit cards

- 2. Sign up for credit cards that earn Chase Ultimate Rewards® and transfer to United

- 3. Sign up for Marriott credit cards and transfer Marriott Bonvoy® points to United

- 4. Earn United miles on credit card bonus categories

- 5. Spend and save using a United MileagePlus debit card

- 6. Earn United miles on flights

- 7. Shop on the United MileagePlus shopping portal

- 8. Visit restaurants through MileagePlus dining

- 9. Use the United MileagePlus X app

- 10. Transfer points from hotels to United

- 11. Earn United miles for staying at hotels

- 12. Reserve vacation homes through Vrbo

- 13. Book car rentals

- 14. Go on a cruise

- 15. Book a vacation through United Packages

- 16. Get identity protection from LifeLock with Norton

- 17. Take online surveys with e-Rewards and Opinion Miles Club

- 18. Enroll in Emergency Assistance Plus (EA+)

- 19. Shop on MyPoints

- 20. Order travel documents from VisaCentral

- 21. Donate to charity

- 22. Get the Timeshifter app to help with jet lag

- 23. Sign up for a Spotify Premium subscription

- 24. Take out a home loan through Rocket Mortgage

- 25. Take out a business loan from MerchantRefi

- 26. Purchase flying wellness products from Therabody

- 27. Purchase flowers

- 28. Shop on Gopuff

- 29. Use energy providers NRG or Reliant

- 30. Book cars through Turo

- 31. Take rides with Lyft

- 32. Purchase United MileagePlus miles

- Final thoughts on earning United miles

» Learn more: Travel loyalty program reviews

1. Sign up for United Airlines credit cards

The best way to quickly earn a lot of United miles is through credit cards. United currently offers four personal cards and two business cards. All United cards are issued by Chase, making them subject to Chase’s 5/24 rule.

Personal cards

United credit cards

Annual Fee

$0 intro for the first year, then $150

$350

$695

$0

Earning Rate

• 5 miles per $1 on prepaid hotels booked through United.

• 2 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and hotels (when booked directly with hotel).

• 1 mile per $1 on all other purchases.

• 5 miles per $1 on hotel stays through Renowned Hotels and Resorts.

• 3 miles per $1 on United purchases.

• 2 miles per $1 at restaurants, select streaming services and all other travel.

• 1 mile per $1 on all other purchases.

• 5 miles per $1 on hotel stays through Renowned Hotels and Resorts.

• 4 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and all other travel purchases.

• 1 mile per $1 on all other purchases.

• 2 miles per $1 on United purchases, gas stations and local transit and commuting.

• 1 mile per $1 on all other purchases.

United benefits

• First checked bag free for you and one companion on your reservation.

• 2 United Club one-time passes each year.

• $100 United Travelbank credits after spending $10,000 in a calendar year.

• 10,000-mile discount after spending $20,000 in a calendar year.

• Credit every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• No foreign transaction fees.

• First and second checked bag free for you and one companion on your reservation.

• $200 yearly United TravelBank credit.

• Yearly 10,000-mile discount.

• Another 10,000-mile discount after spending $20,000 in purchases per calendar year.

• 2 global Economy Plus seat upgrades after spending $40,000 in a calendar year.

• Annual 1,000 Card Bonus Premier Qualifying Points deposit.

• Credit every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• No foreign transaction fees.

• First and second checked bag free for you and one companion on your reservation.

• Access to United Club airport lounges.

• A 10,000-mile discount after spending $20,000 in purchases per calendar year (up to two times per year).

• Annual 1,500 Card Bonus Premier Qualifying Points deposit.

• Credit every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• No foreign transaction fees.

• No foreign transaction fees.

• 2 free checked bags after you spend $10,000 in a calendar year.

Bonus offer

Earn 70,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

Earn 80,000 bonus miles and 3,000 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Earn 90,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 30,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open.

Still not sure?

Best personal card offer: The United Club℠ Card has the highest welcome offer but also has a high annual fee. If you don't care about United Lounge club access, the United Quest℠ Card is solid.

Business cards

United has two business cards, one of which is geared towards those seeking United Club access.

Annual fee

United℠ Business Card

$150.

United Club℠ Business Card

$695.

Earn rate

United℠ Business Card

• 5 miles per $1 on hotel stays booked through United.

• 2 miles per $1 on United purchases, on dining (including delivery services), at gas stations, office supply stores and on local transit and commuting.

• 1 mile per $1 on all other purchases.

United Club℠ Business Card

• 5 miles per $1 on hotel stays at Renowned Hotels and Resorts when you prepay and book through Chase.

• 2 miles per $1 on United purchases, at gas stations and on local transit and commuting.

• 1.5 miles per $1 on all other purchases.

Benefits

United℠ Business Card

• First checked bag free for you and one companion on your reservation.

• 2 United Club one-time passes each year.

• $125 United travelBank credit after you make five United flight purchases per year.

• Up to $50 in TravelBank each anniversary year when you book an Avis or budget car rental through United ($25 per reservation).

• Priority boarding.

• No foreign transaction fees.

United Club℠ Business Card

• First and second checked bag free for you and one companion on your reservation.

• Access to United Club airport lounges.

• Up to $25 statement credit on United FareLock.

• Priority boarding.

• No foreign transaction fees.

Welcome offer

United℠ Business Card

Earn 100,000 bonus miles and 2,000 PQP after you spend $5,000 on purchases in the first 3 months your account is open.

United Club℠ Business Card

Earn 100,000 bonus miles + 2,000 Premier qualifying points after you spend $5,000 on purchases in the first 3 months your account is open.

Best business card offer: The United℠ Business Card is generally better suited for someone who isn't seeking lounge access.

» Learn more: What to know about United lounges

The ideal choice

Signing up for the United℠ Business Card provides a tidy welcome offer. And while it is a business card, you don’t have to own a corporation to apply. Do you sell anything on Amazon or eBay? If so, you may be approved. Input your Social Security number in the field that asks for a business tax ID and type in your home address as your business address.

Don’t be discouraged from applying if the income earned from your hobby business is low. On your application, you’ll list all income earned, which includes your salary from a full-time job. The lender evaluates your entire profile, not just the amount included as your business income.

» Learn more: Which United credit card should you get?

2. Sign up for credit cards that earn Chase Ultimate Rewards® and transfer to United

Another great way to earn United points is by transferring them from Chase Ultimate Rewards®. Chase is the only transferable points program that allows transfers to United, and points transfer at a 1:1 ratio.

NerdWallet recommends these Chase cards:

Popular Chase credit cards

Annual fee

$95.

$795.

$95.

Welcome offer

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

Rewards

• 5x points on all Chase Travel℠ purchases (exclusions apply).

• 5x on Lyft rides and Peloton equipment (for a limited time; terms apply).

• 2x points on all other travel.

• 3x points on dining, takeout and eligible delivery worldwide.

• 3x points for online grocery purchases (exclusions apply).

• 3x points on some streaming services.

• 1x point on all other purchases.

• 8 points per $1 spent on all travel booked through Chase.

• 4 points per $1 spent on bookings directly through an airline or hotel.

• 3 points per $1 spent on dining, takeout and eligible delivery worldwide.

• 1 point per $1 spent on all other purchases.

• 3 points per $1 on the first $150,000 spent on travel, shipping, select advertising, internet, cable and phone services business categories each account anniversary year.

• 5 points per $1 spent on Lyft rides through Sept. 30, 2027.

• 1 point per $1 spent on all other purchases.

Learn more

If you already have any of the cards mentioned above, you can apply for one of the following no-fee cards with Chase. The cash-back you earn can be combined with earnings from other cards as Ultimate Rewards® points. Having these cards in addition to the premium travel cards is a great way to increase your Chase Ultimate Rewards® point balance.

No-fee personal and business credit cards

Annual fee

$0.

$0.

$0.

$0.

Welcome offer

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Earn $750 when you spend $6,000 on purchases in the first three months after account opening.

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

Rewards

• 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

• 5% cash back on up to $1,500 in combined purchases in quarterly categories. Activation required.

• 5% cash back on up to $25,000 in purchases each anniversary year at office supply stores and internet, cable and phone services.

• 1.5% cash back on all spending.

Learn more

» Learn more: Chase 5/24 rule explained

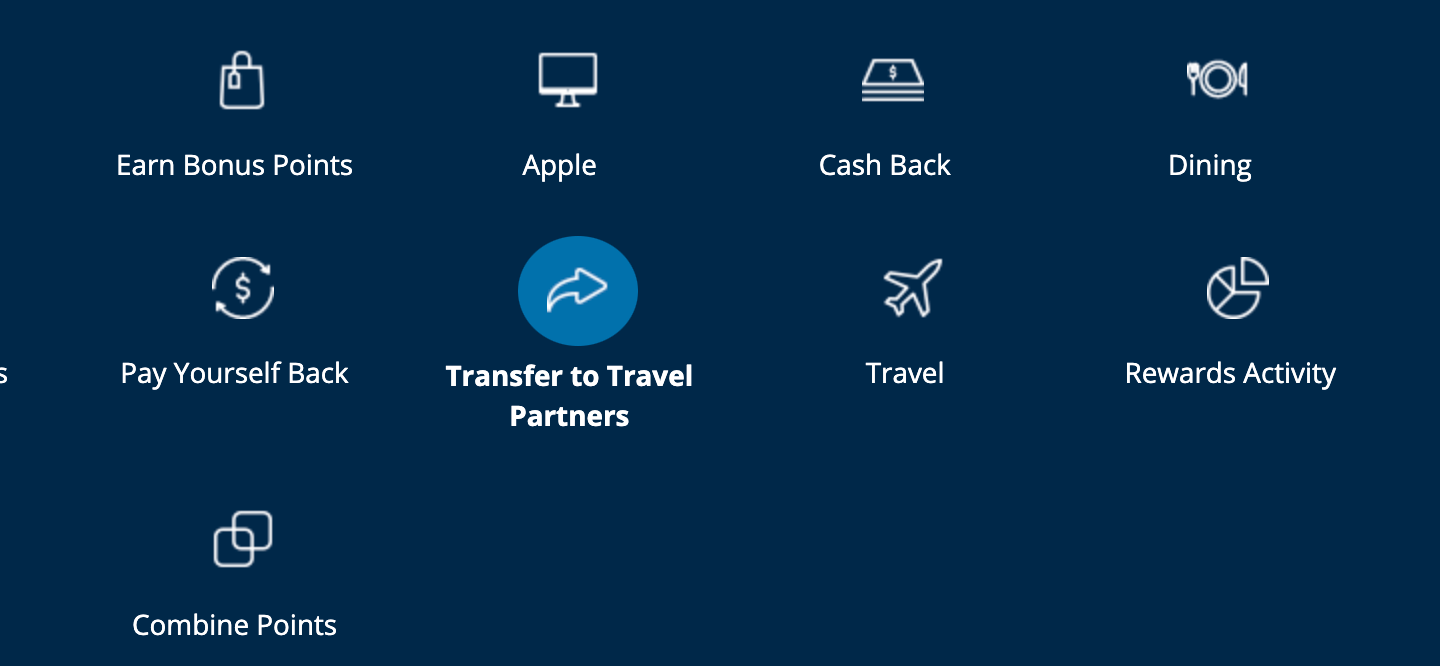

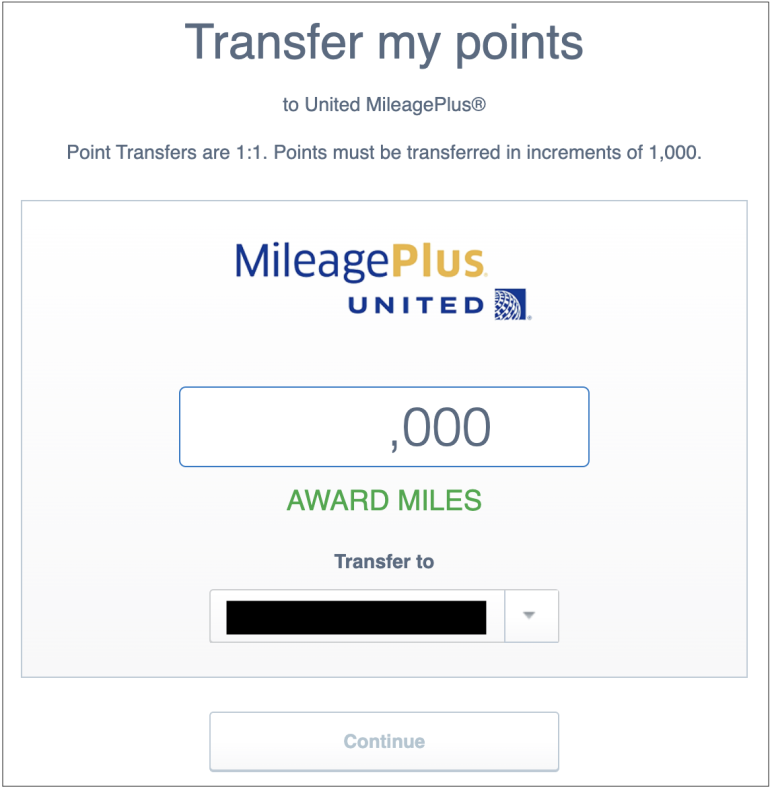

How to transfer from Chase Ultimate Rewards® to United

When you’re ready to transfer points from Chase to United, log into your Chase account and head over to the Chase Ultimate Rewards® page. From the menu at the top, select Transfer to Travel Partners.

Then, choose United from the choices provided and input your United MileagePlus details. This step will link your United and Chase accounts to allow for future transfers. Once your accounts are linked, you are ready to complete the points transfer.

Points transfer at a 1:1 ratio and must be transferred in increments of 1,000. Most transfers are instantaneous, which is great because you won't have to worry about an award disappearing while waiting for points to arrive.

3. Sign up for Marriott credit cards and transfer Marriott Bonvoy® points to United

Although many hotel programs allow you to convert hotel points to airline miles, the conversion ratios are usually weak and not really worth it. In most situations, you’d be better off keeping hotel points in your account and using them for a future stay.

However, Marriott offers a unique transfer bonus to United Airlines as part of a partnership between United and Marriott called RewardsPlus. When you convert Marriott points to United miles, you receive a 10,000-mile bonus for every 60,000 Bonvoy points transferred.

Thus, converting 60,000 Marriott points to United gets a base transfer ratio of 3:1, plus 10,000 bonus MileagePlus miles. The calculation is as follows:

- 60,000 / 3 = 20,000.

- 20,000 + 10,000 = 30,000.

NerdWallet recommends the following Marriott Bonvoy credit cards:

Annual fee

$0.

$250.

$650.

$125.

Rewards

• 3 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 2 points per $1 on grocery stores, rideshare, select food delivery, select streaming and internet, cable and phone services.

• 1 point per $1 on all other eligible purchases.

• 6 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 4 points per $1 on up to $15,000 a year in combined purchases at U.S. supermarkets and at restaurants worldwide (including takeout and delivery in the U.S).

• 2 points per $1 on all other eligible purchases.

Terms apply.

• 6 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 3 points per $1 at restaurants worldwide and on flights booked directly with airlines.

• 2 points per $1 on all other eligible purchases.

Terms apply.

• 6 points per $1 at participating Marriott Bonvoy hotels.

• 4 points per $1 on restaurants worldwide, U.S. gas stations, on wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping.

• 2 points per $1 on all other eligible purchases.

Terms apply.

Welcome offer

Earn 2 Free Night Awards (each night valued up to 50,000 points) after spending $1,000 on eligible purchases within 3 months of account opening with the Marriott Bonvoy Bold® Credit Card. Certain hotels have resort fees.

Earn 85,000 Marriott Bonvoy® bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership. Terms Apply.

Earn 100,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership. Terms Apply.

Earn 3 Free Night Awards after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership. Each Free Night Award has a redemption level up to 50,000 Marriott Bonvoy® points, for a total potential value of up to 150,000 points, at hotels participating in Marriott Bonvoy®. Terms apply.

Learn more

» Learn more: Which Marriott Bonvoy credit card should I choose?

Try to transfer Bonvoy points in increments of 60,000 to take advantage of the 10,000-mile bonus.

When a Marriott transfer to United makes sense

NerdWallet values Marriott points at 0.8 cent each, so 60,000 Marriott points equates to $480. Based on our 1.2 cents valuation of United miles, 30,000 miles are worth $360. Considering this math, converting Marriott points to United miles does not make a ton of sense.

However, consider this hotel point transfer in the context of your travel goals. Prospectively transferring Marriott points to United is probably not a good bet. However, if you need to top up your United balance so you can book an award — specifically one in a premium cabin, which often yields a higher redemption value — the transfer may make sense.

If you're a Marriott Vacation Club owner

Marriott Vacation Club owners can exchange their points for miles, starting at 500 Vacation Club Points for 8,000 United miles — capped at 40,000 miles per member, per year.

Use American Express to maximize the conversion rate

Marriott is a transfer partner of American Express Membership Rewards, which often runs transfer bonuses.

If you have a United redemption in mind and the timing aligns with a transfer bonus from AmEx to Marriott, you could walk away with significantly more United miles after completing a three-way transfer, AmEx → Marriott → United.

4. Earn United miles on credit card bonus categories

In addition to earning United miles each time you swipe your United credit card, you can also earn bonus miles on purchases in specified categories.

| Card name | United purchases earn rate | Other purchases earn rate |

|---|---|---|

| United Quest℠ Card | 3x. | 2x on dining, all other travel and select streaming services. |

| United Gateway℠ Card | 2x. | 2x on gas stations and local transit and commuting — including train tickets, taxi cabs, mass transit, tolls and rideshare services. |

| United℠ Explorer Card | 2x. | 2x on restaurants and on hotel stays. |

| United Club℠ Card | 4x. | 2x on dining and all other travel. |

| United℠ Business Card | 2x. | 2x on local transit and commuting — including train tickets, taxi cabs, mass transit, tolls, rideshare services, gas stations, restaurants and office supply stores. |

| United Club℠ Business Card | 2x. | 1.5x on all purchases. |

Note that the United℠ TravelBank Card earns 2% in TravelBank cash per $1 spent on tickets purchased from United and 1.5% on all other purchases. This card is different from the other cards because it does not earn United miles but instead earns cash back that can be redeemed on United flights only.

» Learn more: United TravelBank Card offers simplified rewards

The clear winner in terms of most bonus categories at 2x is the United Quest℠ Card.

However, if you’re a very frequent United flyer, you might benefit more from the United Club℠ Card. The card gets 4x on United purchases, 2x on other travel and lounge access.

As always, when deciding which card to sign up for, evaluate your spending habits. To maximize your earnings, consider using your credit card for most if not all of your purchases, keeping in mind that you shouldn't charge more than you can repay each month. Carrying balances incurs interest that wipes out the value of any rewards.

Many people like to pay in cash when they go out to eat. However, if you’re trying to maximize your miles earned, start using a credit card for all restaurant charges. A small adjustment like this will allow you to earn points where a cash payment would not.

Consider a $100 dinner. If you charge that on the United℠ Explorer Card, you will end up with 200 United miles versus zero if you had paid in cash.

Though this can seem like an inconsequential number of miles (only worth about $2 in United value), you’d be surprised how quickly they add up. An extra few hundred miles can be the difference between having enough miles for a dream award seat or being slightly short and having to pay cash.

To maximize bonus categories, we recommend you get into the habit of strategically thinking about which credit cards you use for which purchases.

5. Spend and save using a United MileagePlus debit card

In addition to its credit card offerings, United also offers the United MileagePlus Debit Rewards Card. That can be an option to consider if you wouldn't otherwise qualify for a United credit card, since this debit card doesn't require a credit check.

With this card, you can earn United miles when you spend on eligible purchases and when you hold an average daily balance of $2,500 or more. However, these earning opportunities are not as lucrative as those on a United credit card.

For example, cardholders earn 1 mile per $1 spent on United purchases (compared to 2 to 4 miles with a United credit card), and 1 mile per $2 spent on other purchases (compared to at least 1 mile per $1 when using a United credit card).

Cardholders can also earn bonus miles each month when they save. Here's how much you could earn in one year:

| Average daily balance | Annual bonus miles |

|---|---|

| $2,500 to $4,999.99 | 2,500. |

| $5,000 to $9,999.99 | 5,000. |

| $10,000 to $24,999.99 | 15,000. |

| $25,000 to $49,999.99 | 30,000. |

| $50,000 or more | 70,000. |

You'll also need to pay a $4 monthly fee unless you have an average daily balance of $2,000 or more.

6. Earn United miles on flights

Flying with United, Star Alliance airlines or with United’s other airline partners is an easy way to earn MileagePlus miles. First, register for a MileagePlus account. After registration, you will receive your MileagePlus number, which you can add to all future reservations.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

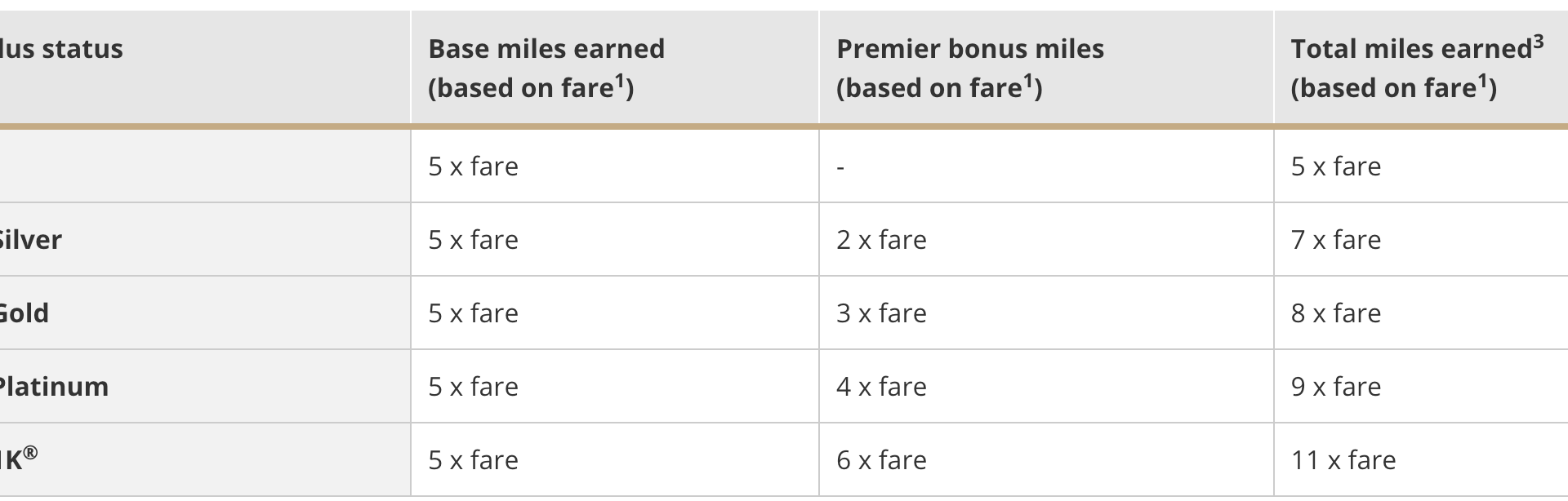

Earn miles on United flights and partner airlines with tickets issued by United

Generally, the number of United miles earned depends on the price of the flight and your elite status level:

Earning miles on Star Alliance and partner airlines

You can also earn United miles when flying on over 40 airline partners, 25 of which are part of Star Alliance. United’s membership in the Star Alliance network offers incredible opportunities for earning miles given the extensive coverage provided by the partner airlines.

Star Alliance member airlines

- Aegean Airlines.

- Air Canada.

- Air China.

- Air India.

- Air New Zealand.

- All Nippon Airways (ANA).

- Asiana Airlines.

- Austrian Airlines.

- Avianca.

- Brussels Airlines.

- Copa Airlines.

- Croatia Airlines.

- EgyptAir.

- Ethiopian Airlines.

- Eva Air.

- Lot Polish Airlines.

- Lufthansa.

- Scandinavian Airlines (leaving alliance Aug. 31, 2024).

- Shenzhen Airlines.

- Singapore Airlines.

- South African Airways.

- Swiss.

- TAP Air Portugal.

- Thai Airways.

- Turkish Airlines.

- United Airlines.

To determine the number of miles earned for each flight, you will need to review each airline’s mileage policy. For example, a flight on Air Canada will earn miles based on the following rates:

» Learn more: Your guide to the United Airlines MileagePlus program

7. Shop on the United MileagePlus shopping portal

Shop online

Earn United miles for shopping online through the airline’s MileagePlus Shopping portal.

To begin, register for an account using your MileagePlus number. Below you can see the earn rate at various featured merchants (note that these earn rates change often, so you may see different offers):

Upon logging in, search for a store and click on its offer. Once you complete your purchase, the transaction will be recorded.

Clicking through the MileagePlus Shopping portal is a simple way to earn miles for something you would buy anyway. For example, if you’re making a $200 purchase at Bloomingdales, by clicking through MileagePlus Shopping, you’ll earn 400 United miles given the 2x earn rate (as shown above). Miles will usually post within three to five days but can take up to 15 days.

Shop in store

The MileagePlus Shopping portal also lets you earn United miles on in-store purchases. From the MileagePlus Shopping homepage, choose “in-store miles” from the top menu, which will take you to a map of the U.S.

Input your ZIP code and click the "search" button to see a list of stores near you that are participating.

A sample search of ZIP code 10022 in New York City revealed many participating stores. Click on a store’s marker on the map to view the earn rate.

Get a United browser button add-on

A new feature of the United MileagePlus Shopping mall is the ability to install a shopping button on your Google Chrome browser.

Once the button is installed, each time you visit an online merchant that participates in the MileagePlus Shopping portal, you will get a notification in the top right of your browser informing you of the earn rate.

Click on the purple “Activate” button to record the transaction. This button eliminates the need to visit the shopping portal each time you want to buy something online. This new feature is great for those who want to earn United miles for online purchases but forget to visit the shopping portal beforehand.

🤓 Nerdy Tip

The MileagePlus shopping mall frequently offers bonuses for spending over a specified amount (usually about $200), so review the site periodically (or install the button) to see if you could earn extra miles. 8. Visit restaurants through MileagePlus dining

United participates in a restaurant dining rewards program that allows you to earn MileagePlus miles for dining at participating bars, restaurants or clubs. To start earning miles, sign up for a MileagePlus Dining account and add a debit or credit card to your profile.

Even if you don’t have a United co-branded credit card, you can use any card you have now. Whenever you visit a participating bar, club or restaurant, use the card in your profile and the miles will post automatically.

If you’ve never participated in the program, you can usually earn a bonus for signing up.

Currently, United is offering up to 500 bonus miles when you spend $25 on a dining or takeout order in the first 30 days of sining up. United Premier frequent flyers can earn 500 bonus miles for a total of 1,000 miles earned.

The number of United miles earned per $1 depends on your member level. Earnings range from 1 mile per $2 spent (basic members) to 5 miles per $1 spent (VIP members), which is a 5% return on your bill.

🤓 Nerdy Tip

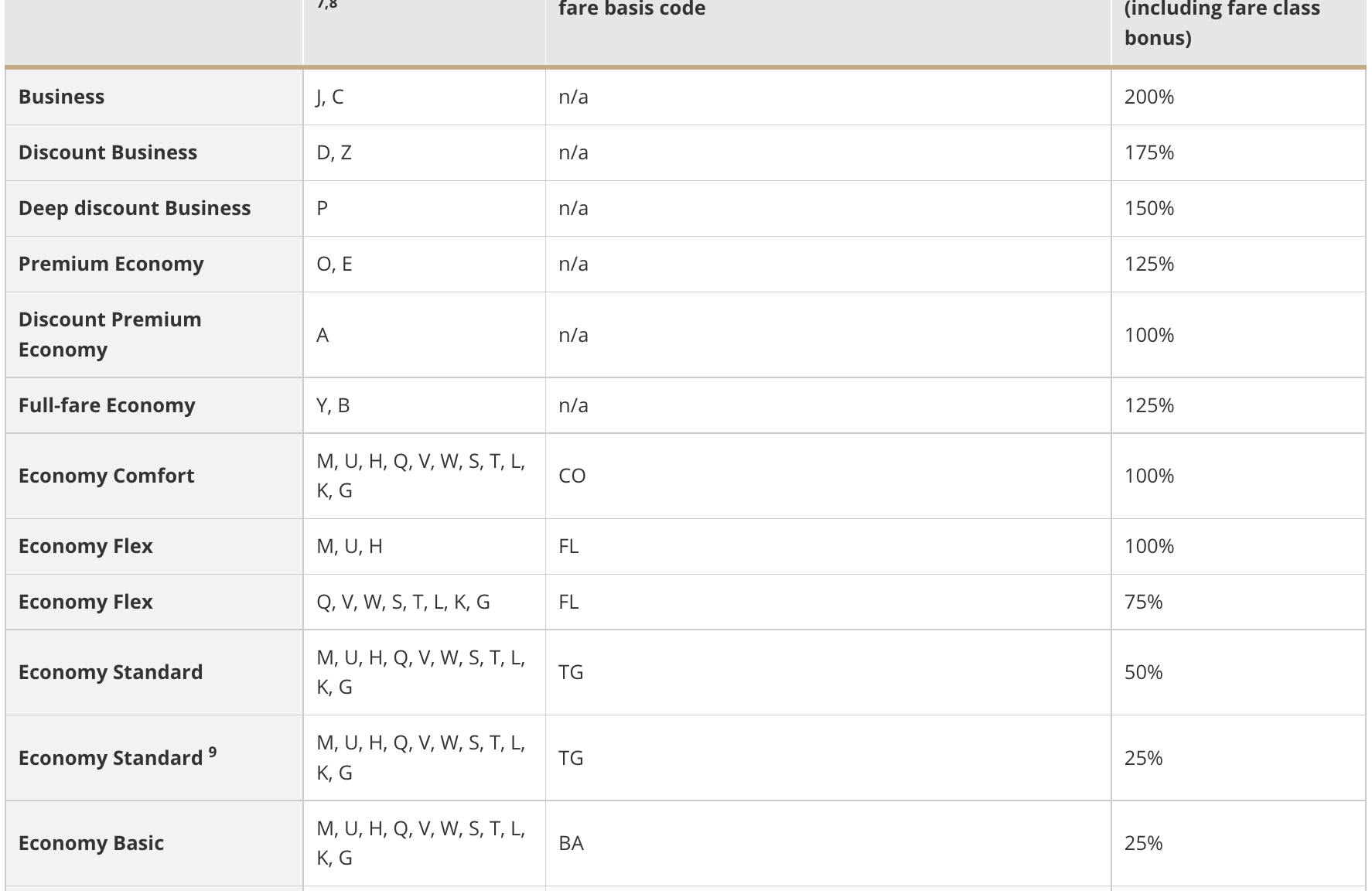

If you’re going out to eat, do a quick search on the MileagePlus Dining website to see if any restaurants near you participate in the program. 9. Use the United MileagePlus X app

Want to earn United miles on the go? The United MileagePlus X app offers an easy way to earn miles from your smartphone.

The app is an easy way to see several ways you can earn extra miles in one location. You’ll be able to earn miles on:

- MileagePlus eGift card purchases.

- MileagePlus Dining.

- MileagePlus Shopping.

- Featured store apps.

If you hold a United credit card, you can also earn a 25% card member bonus plus up to 5 miles per $1 on all purchases with the MileagePlus X app.

10. Transfer points from hotels to United

Marriott isn't the only hotel brand that allows you to convert points to United miles.

We've compiled a list of all other properties that allow point conversions to MileagePlus miles. This is a great option for those who have hotel points that they don’t know what to do with. Or maybe you got a bunch of hotel points through work trips, but you prefer to stay in Airbnbs while traveling for personal vacations.

Here are the transfer ratios from hotel points to United miles:

| Hotel Brand | Transfer Rate |

|---|---|

| Accor | 2,000 points:1,000 miles. |

| Choice | 5,000 points:1,000 miles. |

| Hilton | 10,000 points:1,000 miles. |

| Hyatt | 2.5 points:1 mile. Receive a 5,000-mile bonus when you convert 50,000 points into 20,000 miles. |

| IHG | 5 points:1 mile, (10,000 points:2,000 miles). |

| Shangri-La Circle | 1 point:1 mile. Convert a minimum of 2,500 points. |

| Wyndham | 6,000 points:1,200 miles. 16,000 points:3,200 miles. 30,000 points:6,000 miles. |

To transfer hotel points, head over to the United hotel partner page and select the hotel you’re looking to transfer the points from. Log in to your account on the hotel’s website and look for the option to convert your hotel points to United miles.

11. Earn United miles for staying at hotels

United’s hotel partners

At many hotels, you can earn United miles instead of hotel points when staying. Below is a list of hotels that let you earn United miles instead of hotel points, as well as the earning rate.

Usually, it's not possible to earn both hotel points and airline miles with these partners, so a choice will have to be made. There’s no right or wrong answer; it really depends on your preferences and how relevant hotel points may be to your travels.

| Chain | Hotel Name | Earn Rate |

|---|---|---|

| Best Western | Best Western. | 250 miles per stay. |

| Choice Hotels | Ascend Hotel Collection, Cambria Suites, Clarion, Comfort Inn, Comfort Suites, Country Inn & Suites by Radisson, Econo Lodge, MainStay Suites, Park Plaza, Quality Inn, Radisson, Radisson Blu, Radisson Red, Rodeway Inn, Sleep Inn, Suburban Extended Stay Hotel. | 250 miles per stay. MainStay Suites earn 250 miles per stay in the U.S., Canada, Mexico, the Caribbean and Europe (excluding Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway and Sweden). |

| Hyatt | Andaz, Grand Hyatt, Hyatt Centric, Hyatt Hotels & Resorts, Hyatt House, Hyatt Place, Hyatt Regency, Hyatt Summerfield Suites, Hyatt Zilara, Hyatt Ziva, Park Hyatt Hotels, Unbound Collection. | 500 miles per stay. |

| IHG | Atwell Suites, Avid, Candlewood Suites, Crowne Plaza Hotels & Resorts, Even, Holiday Inn Club Vacations, Holiday Inn Express, Holiday Inn Hotels & Resorts, Hotel Indigo, Hualuxe, IHG, Kimpton Hotels & Restaurants, Regent, Six Senses, Staybridge Suites, Vignette Collection, Voco. | Candlewood Suites and Staybridge Suites earn 1 mile for every $1 spent. All other IHG properties earn 2 miles per $1 spent. |

| Langham | Cordis Hotels and Resorts, The Langham Hotels and Resorts, Eaton HK. | 500 miles per night up to 1,500 per stay. Eaton HK earns 250 miles per night up to 750 miles per stay. |

| Marriott | AC Hotels by Marriott, aloft, Courtyard by Marriott, Element by Westin, Fairfield Inn by Marriott, Four Points by Sheraton, Marriott Executive Apartments, Moxy Hotels, Protea Hotels, SpringHill Suites by Marriott, TownePlace Suites by Marriott. | 1 mile for every $1 spent. |

| Marriott | Autograph Collection Hotels, Delta Hotels, Design Hotels, EDITION, Gaylord Hotels, JW Marriott Hotels & Resorts, Le Meridien, Marriott Hotels & Resorts, Marriott Vacation Club, Renaissance Hotels & Resorts, Residence Inn by Marriott, Sheraton Hotels & Resorts, St. Regis Hotels & Resorts, The Luxury Collection, The Ritz-Carlton, W Hotels, Tribute Portfolio, Westin Hotels & Resorts. | 2 miles for every $1 spent. |

| Millennium | Millennium Hotels and Resorts. | 500 miles at Millennium and 250 miles at Copthorne properties. |

| Shangri-La | Kerry Hotels, JEN, Shangri-La Hotels & Resorts, Traders Hotels. | 500 miles per stay. |

| Wyndham | AmericInn by Wyndham, Baymont by Wyndham, Days Inn by Wyndham, Dazzler by Wyndham, Dolce Hotels and Resorts by Wyndham, Esplendor Boutique Hotels by Wyndham, Hawthorn Suites by Wyndham, Howard Johnson by Wyndham, La Quinta by Wyndham, Microtel by Wyndham, Ramada by Wyndham, Super 8 by Wyndham, Trademark Collection by Wyndham, Travelodge by Wyndham, TRYP by Wyndham, Wingate by Wyndham, Wyndham, Wyndham Garden, Wyndham Grand. | Wyndham Rewards Blue and Gold Members earn 1 mile for every $1 spent per stay. Wyndham Rewards Platinum and Diamond Members earn 2 miles for every $1 spent per stay. |

| Villas of Distinction | Villas of Distinction properties. | Earn 3 miles per $1 when staying at luxury villas in over 50 countries. |

Rocketmiles

You can also earn United miles by booking hotels through Rocketmiles, which is a booking site that allows you to earn from 1,000 to 10,000 points per night depending on the hotel. Generally, the more expensive the hotel, the more points you can earn per night.

However, it’s important to note that the cost of a stay booked with Rocketmiles can be more expensive than with other online travel agencies (likely due to a premium charged for earning lots of United miles). So keep this in mind when shopping around for a hotel.

United Hotels

You can also earn United miles when you book a hotel through United’s hotel portal, which lets you earn 2 miles per $1 spent (and sometimes offers special earning opportunities).

This could be a great option in these cases:

- You’d like to earn United miles and hotel points for your stay.

- The hotel you’d like to stay at isn’t listed as an earning partner in the list above.

- The hotel you’d like to stay at is an earning partner, but the miles earned from your stay when booked through United Hotels exceed the miles you would earn based on the hotel partner chart above.

The example below shows you how many miles you might earn at Los Angeles hotels for a three-night stay in December:

Hyatt Regency Los Angeles International Airport

You will earn 1,291 MileagePlus miles for this booking. This option results in a much better rate than if you were to book the hotel through United’s partner link to Hyatt, which would only earn 500 United miles per stay and no Hyatt points.

Hotel Burbank

Staying at this property would earn 1,167 MileagePlus miles if booked through the United hotel portal. Hotel Burbank isn’t one of the partner hotels listed in the chart above, so booking through the United Hotel site is a great way to earn MileagePlus points on your booking. This is another example where the United Hotel site wins.

🤓 Nerdy Tip

Before making your hotel reservation, check the MileagePlus shopping mall to see if there is an opportunity to earn United miles on your booking with the hotel or online travel agency. For example, we found the MileagePlus Shopping mall running a promo that earned 3 miles per $1 spent at Booking.com. If Booking.com has a cheaper price than the United Hotel site, this option might be an even better idea. And of course, this earn rate is in addition to any hotel points you’d earn on the booking. 12. Reserve vacation homes through Vrbo

If you prefer booking vacation rentals rather than hotels, you can now earn 3 miles for every $1 when booking stays through Vrbo. That's effectively a 3% return on how much you spent on your vacation rental in the form of United miles.

Similar to Airbnb, Vrbo allows you to book stays in houses, condos, cabins, yurts and more. You earn the miles after your stay is completed, and miles are awarded based on the cost of the rental only (excluding taxes, cleaning fees and all other fees).

13. Book car rentals

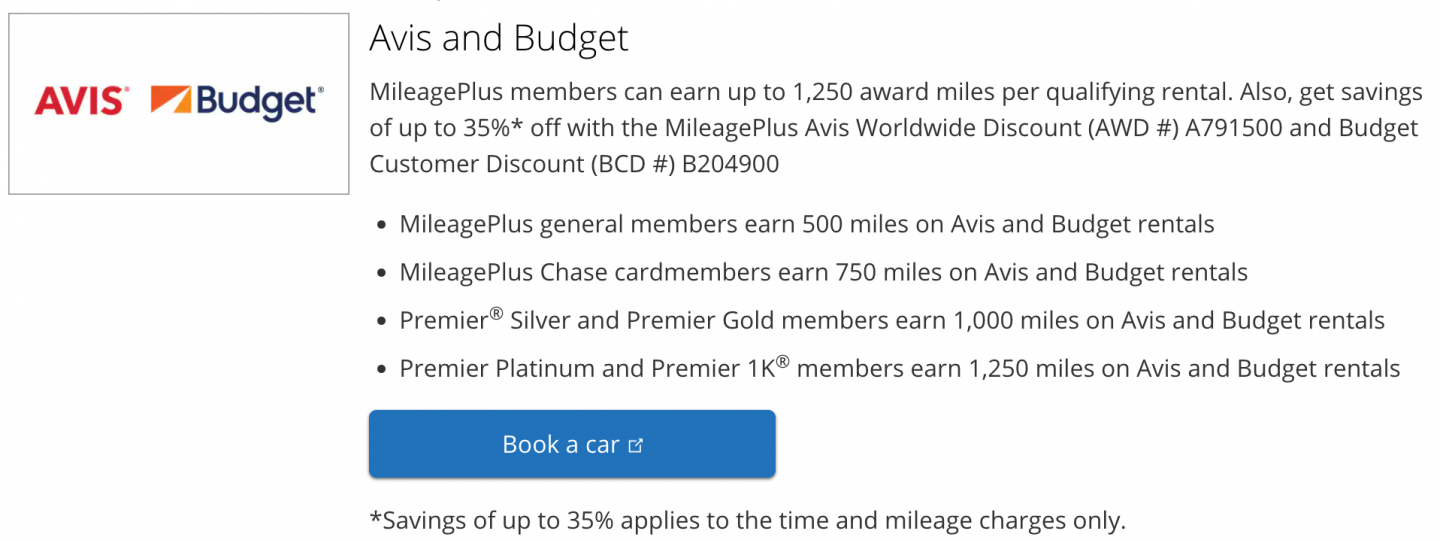

United has partnerships with Avis and Budget, allowing you to earn up to 1,250 United miles for car rentals.

To earn United miles, click “Book a car” and input any relevant discount codes.

🤓 Nerdy Tip

Review your printed rental agreement to ensure your MileagePlus number is included so you can earn these miles. 14. Go on a cruise

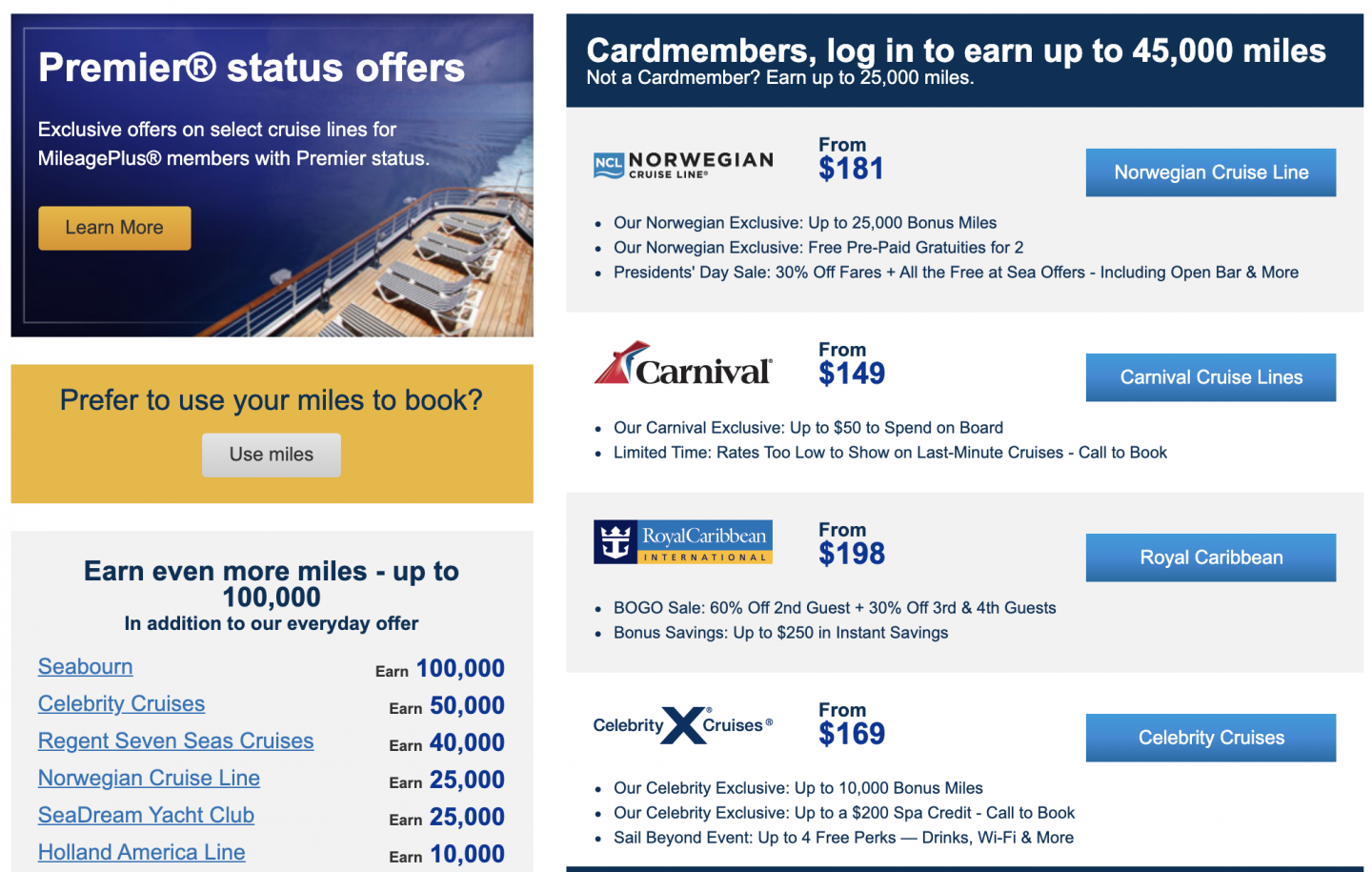

United has a cruise booking platform that lets you earn MileagePlus miles.

At the time of writing, United cardmembers could earn up to 7x miles on their cruise purchase (with a limit of 45,000 miles per booking).

🤓 Nerdy Tip

United Cruises offers a 110% best price guarantee. If you see a lower price on another website within 48 hours of booking, contact United Cruises to get a 110% refund of the price difference. 15. Book a vacation through United Packages

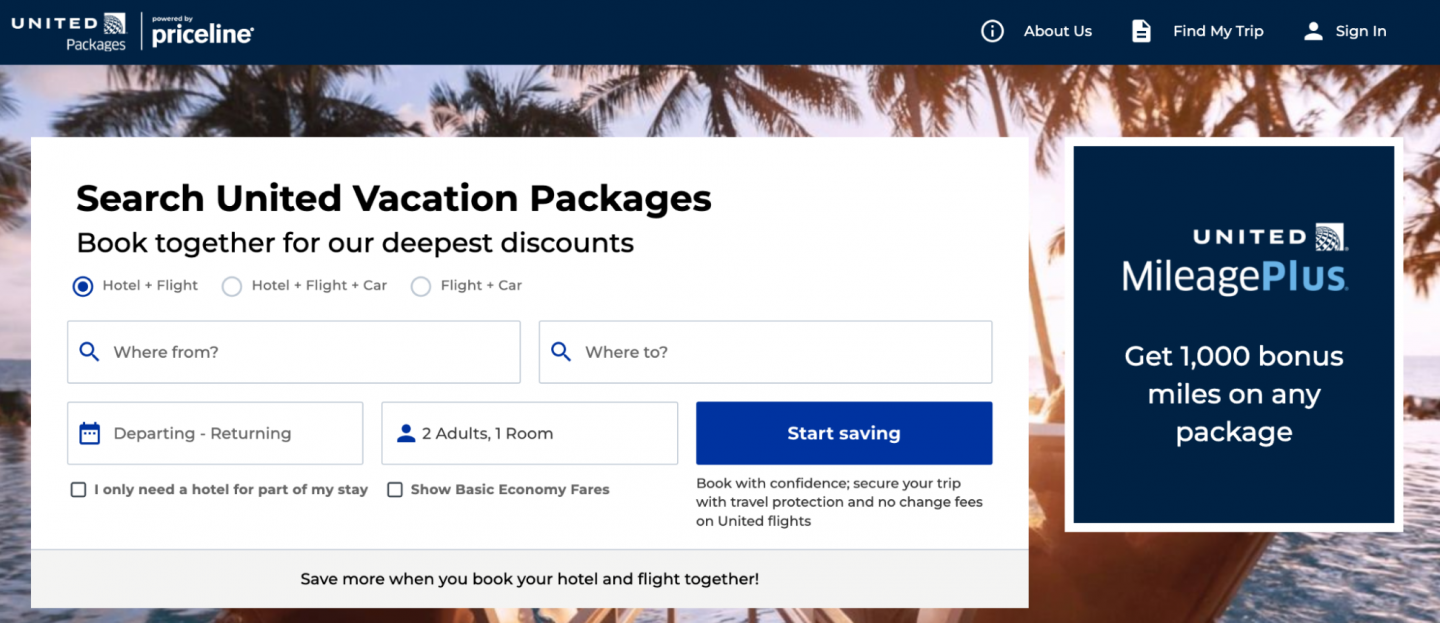

If you like booking your flight, hotel and car rental as a package deal, United offers that through its United Packages platform. Currently, you can earn 1,000 bonus miles on any package you book. If you have a United credit card from Chase, you can earn an additional 2 miles per $1 on bookings.

16. Get identity protection from LifeLock with Norton

LifeLock with Norton offers protection for your identity and electronic devices. You can earn up to 10,000 United miles and get 35% off your first year’s subscription when signing up for identity theft protection.

🤓 Nerdy Tip

When you’re thinking of signing up for any type of service or purchasing anything online (e.g., energy service, cell phone provider, flowers, etc.) do a search to see if your preferred airline is offering miles with the specific vendor. You never know when you can pick up some additional miles. 17. Take online surveys with e-Rewards and Opinion Miles Club

Although this is an uninteresting way to earn United miles, if you have some time to kill, consider taking some surveys.

United partners with e-Rewards and Opinion Miles Club, both of which award United miles for completing surveys. Opinion Miles Club is offering up to 600 MileagePlus miles for signing up and taking your first survey.

To start earning miles, sign up for an account with either or both companies and fill out a questionnaire to find out which surveys you are eligible for.

18. Enroll in Emergency Assistance Plus (EA+)

Emergency Assistance Plus (EA+) provides 24-hour emergency medical and transportation whether you're traveling or at home. Services include emergency medical monitoring, advanced medical payments, medical evacuation and transportation home, medical and travel assistance for you and your companions, and much more. EA+ service starts at $179 per year, and you'll earn 1,400 miles for signing up and renewing each year.

While this sounds like a helpful service, these benefits may already be included if you hold a premium travel card. For instance, the Chase Sapphire Reserve® provides $2,500 of emergency medical coverage when you’re traveling as long as the trip is paid for with the credit card. So, if you have a premium travel rewards card, look through the credit card’s fine print before prior to subscribing for an extra service.

» Learn more: 4 best credit cards for travel insurance benefits

19. Shop on MyPoints

MyPoints is a shopping portal that lets you earn points, which can be redeemed for gift cards or airline miles. If you join through United, you can earn up to 1,500 United miles. You will get 250 MileagePlus miles for signing up and activating your MyPoints account and 1,250 miles after making your first purchase of $50 or more within 30 days.

If you shop online already and MyPoints has the store you’re looking for, taking advantage of this offer is an easy way to pick up 1,500 United miles.

20. Order travel documents from VisaCentral

If you need to order travel documents such as a passport or visa for an international trip, you can do so with VisaCentral and earn United miles while you’re at it.

You can earn 1,000 MileagePlus miles for visa and passport services and 500 miles for Australian Electronic Travel Authority and U.S. Electronic System for Travel Authorization services. VisaCentral’s services are available in Australia, Brazil, Canada, Singapore, the United Kingdom and the U.S.

21. Donate to charity

Through United's Miles on a Mission program, you can donate your miles to one of United's charity partners. You can select a charity or an active campaign to participate in. In addition, United has partnered with the National Foundation for Cancer Research, offering 15 MileagePlus miles for every $1 donated on contributions of $100 or more.

22. Get the Timeshifter app to help with jet lag

Timeshifter is an app that claims to help flyers beat jet lag. Although the app is free for United Premier 1K elites, all other MileagePlus members need to pay for a membership. It costs $24.99 for a one-year subscription and you will get 500 miles for signing up.

If you've never had Spotify Premium — whether paid or through a free trial — you can earn miles with a new subscription. To qualify, you'll need to opt in to the offer and sign up for an individual subscription. You'll receive a one-month free trial, and your bonus miles will be deposited after the third billing cycle.

The amount of miles you will earn depends on your MileagePlus status. General members earn 250 miles, Premier members earn 500 miles, and Premier 1K and Global Services elites earn 1,000 miles.

24. Take out a home loan through Rocket Mortgage

United lets you earn miles when closing a home purchase loan or refinancing an existing loan with Rocket Mortgage (formerly known as Quicken Loans), which allows you to earn 25,000 MileagePlus miles for closing or refinancing a home.

If you’re planning on borrowing for a home purchase or refinancing your mortgage, look around to find the best rate available. Earning miles for such an important financial decision is a cherry on top, not the main factor. However, if you see that your rate available from Rocket Mortgage is the best out there, then taking advantage of this offer is a great way to earn 25,000 United miles.

25. Take out a business loan from MerchantRefi

If you’re looking for a business loan, MerchantRefi is offering MileagePlus members the opportunity to earn 10,000 United miles. To qualify, you must complete a questionnaire and be approved for a qualifying advance.

26. Purchase flying wellness products from Therabody

Therabody is an online shop that sells merchandise to make your flying experience more enjoyable and relaxing. Items include an LED light therapy mask, SmartGoggles to help you sleep mid-flight, a neck massager, and much more. You can earn 6 United miles per $1 when shopping with the retailer.

27. Purchase flowers

Buying flowers is another way to pick up a lot of MileagePlus miles. United partners with these three online flower shops (offers may change):

- FTD: 25 United miles per $1 spent on flowers and gifts.

- Teleflora: 20 United miles per $1 spent on flowers and gifts.

- 1-800-Flowers: 30 United miles per $1 spent on flowers and gifts. Use promo code MP58.

28. Shop on Gopuff

MileagePlus members can earn 2 United miles per dollar spent on qualifying purchases with Gopuff, a delivery service for groceries, snacks, household essentials and other goods. New Gopuff users can earn 500 miles on their first order.

To take advantage of this offer, you must link your MileagePlus and Gopuff accounts.

29. Use energy providers NRG or Reliant

Earn United miles for signing up with energy suppliers NRG or Reliant.

You can earn up to 12,500 United miles, plus 2 miles per $1 spent when you sign up with NRG Home.

If you live in Texas, you have the option of using Reliant. You can earn 15,000 United miles when you switch your utility provider to Reliant plus an extra 500 MileagePlus miles for each month you’re registered (for the next 24 months) for a total of 27,000 miles.

Make sure to read each provider’s terms and conditions. Independent energy providers can offer electricity at variable rates, which can introduce volatility into your monthly bill.

30. Book cars through Turo

Booking through Turo, which is a peer-to-peer car sharing marketplace, will net you 1 United mile per dollar spent on Turo.

And if you’ve never used Turo before, this should sweeten the deal. United customers earn 5 miles on every dollar spent on their first Turo trip.

To get in on the deal, connect your United MileagePlus account to your Turo account.

31. Take rides with Lyft

United's partnership with Lyft lets you earn United miles whenever you take a qualifying ride using the ridesharing platform. To start earning United miles, you'll need to link your United account to your Lyft profile.

You can earn 1 to 4 United miles per $1 spent, depending on what type of ride you book. Here's how it breaks down:

- 4 miles per $1 spent on prescheduled rides to and from an airport.

- 3 miles per $1 spent on Extra Comfort, Lyft Black and Black SUV rides and non-scheduled rides to and from an airport.

- 2 miles per $1 spent on Standard, Priority Pickup and XL rides with a company business profile.

- 1 mile per $1 spent on Standard, Priority Pickup and XL rides.

New Lyft users can also earn 1,000 bonus United miles after signing up for Lyft, linking their MileagePlus account and taking two rides within 30 days.

32. Purchase United MileagePlus miles

Although it's possible to buy United miles, we only recommend purchasing miles in a handful of situations:

- Padding your account to book an award flight.

- Buying miles to book a first- or business-class award that is cheaper to book with miles than buying a cash ticket.

- Buying a small number of miles to keep your miles from expiring.

If you must buy miles, align the timing with an airline promo to get miles for a discount.

NerdWallet values United miles at 1.2 cents each, so keep this in mind when considering a miles purchase. Even in instances where you can purchase United miles for less than 1.2 cents, we’ve provided so many better (and cheaper) ways to earn MileagePlus miles that buying them should only occur when there’s no cheaper option available.

Frequently Asked Questions

How do I earn United miles?

The easiest way to earn United miles is to sign up for a credit card that earns United MileagePlus miles. You can also earn United miles by flying on United, its partner airlines and Star Alliance carriers. If you have points with Chase Ultimate Rewards® or Marriott, you could transfer those points to United.

Do you earn miles on United basic economy?

Yes, passengers earn miles on basic economy tickets in the same way as they would on standard economy tickets. However, basic economy tickets are the most restrictive as they are nonrefundable and unchangeable, so keep that in mind when booking.

Can I earn miles if I buy a United ticket for someone else?

No. The passenger who flies is the one who earns the miles, not the person who purchases the ticket.

How many miles does it take to get a free flight on United?

United uses dynamic pricing, so the cost of a flight in miles can fluctuate based on the travel date and airline partner. However, United publishes flight award deals, allowing you to purchase an award ticket for as few as 5,500 United miles.

Do United miles expire?

No, United miles do not expire.

Final thoughts on earning United miles

United makes it easy to earn MileagePlus miles in so many different ways. The quickest way to get a head start is by earning credit card welcome offers and using credit cards for everyday spending.

Beyond that, consider which of these mileage earning opportunities apply to you and try to incorporate them into your daily routine. Earning miles in some of these random ways can be great for padding your United account and bringing you one step closer to your dream trip.

Information related to the United Club℠ Business Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

To view rates and fees of the Marriott Bonvoy Bevy® American Express® Card, please visit this page.

To view rates and fees of the Marriott Bonvoy Business® American Express® Card, see this page.

To view rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles