5 Best Cash Management Accounts of 2025

+ 1 more

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

The best cash management accounts pay interest and typically come with low or no fees. They're offered by brokerage firms, and they combine services and features similar to those of checking and/or savings, all in one product.

Why trust NerdWallet: Our writers and editors follow strict editorial guidelines to ensure fairness and accuracy in our coverage to help you choose the financial accounts that work best for you. See our criteria for evaluating banks and credit unions.

» Learn more about cash management accounts: Check out NerdWallet’s guide to CMAs

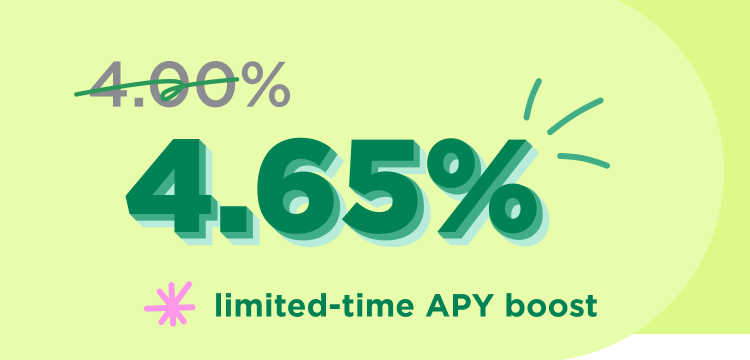

Grow your cash faster with a 4.65% APY for the next six months — that's 12X the national average interest rate*. FDIC insured at program banks.

*The national average annual percentage yield ("APY") is listed as 0.38% as reported by the Federal Deposit Insurance Corporation as of 7/21/2025. Rates may vary based on financial institution. Cash Account offered by Atomic Brokerage, member FINRA/SIPC.

Best Cash Management Accounts

| Bank/institution | NerdWallet rating | Monthly fee | APY | Bonus | Learn more |

|---|---|---|---|---|---|

4.3/5 | $0 | Up to 4.50% With $1 min. balance for APY | 0.50% APY Boost 4.00% base variable APY + 3 months of 0.50% boost. Terms apply. | Learn moreon partner's site at Wealthfront | |

Vanguard Cash Plus Account - Paid non-client promotion Learn moreon partner's site at Vanguard, Deposits are FDIC Insured | 3.6/5 | $0 | 3.65% With $0 min. balance for APY | N/A | Learn moreon partner's site at Vanguard, Deposits are FDIC Insured |

4.2/5 | $0 | 4.65% With $0 min. balance for APY | N/A | Learn moreon partner's site at Betterment | |

3.4/5 | $0 | 3.75% With $0 min. balance for APY | N/A | Learn moreon partner's site at Empower, Deposits are FDIC Insured | |

4.7/5 | $0 | 2.21% With $0 min. balance for APY | N/A |

Our pick for

Cash Management Account

Monthly fee

$0

APY

Up to 4.50%

With $1 min. balance for APY

Bonus

0.50% APY Boost

4.00% base variable APY + 3 months of 0.50% boost. Terms apply.

Our Take

Wealthfront Cash Account offers a 4.00% APY, with no fees, and customers receive a debit card which allows them to withdraw cash from more than 19,000 fee-free ATMs as well as make purchases. Customers also receive two ATM fee reimbursements a month, for up to $7.50 each. The account allows customers to pay bills and link to apps such as Venmo and Cash App to send money to friends and family. Direct deposit with payments up to two days early is also available, and Wealthfront Cash customers can get up to $8 million in FDIC insurance coverage through partner banks.

To learn more, read NerdWallet’s full review of the Wealthfront Cash Account.

Monthly fee

$0

APY

3.65%

With $0 min. balance for APY

Bonus

N/A

Our Take

The Vanguard Cash Plus account offers a high-yield interest rate with no minimum balance requirements. The account has no fees as long as you sign up for e-statements; otherwise, the account has an annual fee of $25. Customers can get up to $1.25 million in FDIC insurance on individual accounts through partner banks.

Read NerdWallet’s full review of the Vanguard Cash Plus Account.

Reviewed in: April 2025. Period considered: April 2025.

Monthly fee

$0

APY

4.65%

With $0 min. balance for APY

Bonus

N/A

Our Take

The Betterment Cash Reserve cash management account has a promotional rate of 4.65% annual percentage yield once new account holders fund their accounts. To earn that rate, you have to make a deposit within 14 days of opening the account. If you don't, or after the promotion ends, your rate will be a still-competitive 4.00%.

The Cash Reserve account and the companion Betterment Checking account have no fees and no minimum balance requirement beyond the $10 it takes to open the account, and individual accounts receive up to $2 million in FDIC insurance coverage through partner banks. Betterment Checking offers a debit card, mobile check deposit and reimbursement of ATM fees worldwide.

To learn more, read NerdWallet’s full review of Betterment Checking and Betterment Cash Reserve.

Betterment says: "Cash Reserve offered by Betterment LLC and requires a Betterment Securities brokerage account. Betterment is not a bank. Learn More (https://www.betterment.com/cash-portfolio). Annual percentage yield (variable) is 4.00% as of 12/27/24, plus a 0.65% boost (“APY Boost”) for new clients with a qualifying deposit. $10 min deposit for base APY. Terms apply (betterment.com/boost); if the base APY changes, the Boosted APY will change. FDIC insurance provided by Program Banks (https://www.betterment.com/cash-portfolio), subject to certain conditions."

Betterment says: "Checking account is FDIC insured up to $250K through nbkc bank, Member FDIC. FDIC insurance only covers the failure of an insured bank. Betterment is not a bank. All ATM fees and the Visa 1% foreign transaction fee are reimbursed. The Betterment Visa Debit Card is issued by nbkc bank, Member FDIC."

Paid non-client promotion: NerdWallet doesn’t invest its money with this provider, but they are our referral partner – so we get paid only if you click through and take a qualifying action (such as open an account with or provide your contact information to the provider). Most importantly, our reviews and ratings are objective and are never impacted by our partnerships. Our opinions are our own. Here is a list of our partners and here’s how we make money.

Monthly fee

$0

APY

3.75%

With $0 min. balance for APY

Bonus

N/A

Our Take

Empower Personal Cash (formerly Personal Capital Cash) offers a 3.75% APY as well as robust budgeting features through its solid mobile apps. It also has no fees or minimum balance, which means it’s a pretty low-cost way to earn a high interest rate. Keep in mind, however, that Empower Personal Cash currently doesn’t support cash deposits, cash withdrawals or check writing. Electronic transfers, wire transfers and direct deposits, however, are supported.

Read NerdWallet’s full review of Empower Personal Cash to learn more.

Monthly fee

$0

APY

2.21%

With $0 min. balance for APY

Bonus

N/A

Our Take

Fidelity Cash Management Account has no monthly fees or minimum balance requirements, and it offers unlimited ATM fee reimbursement and free check writing. The account carries FDIC insurance of up to $5 million through Fidelity’s partner banks.

For more information, read our full review of Fidelity Cash Management.

ON THIS PAGE

Our Nerds say:

"Cash management accounts can be a useful place to park your short-term savings while it earns interest. If you think you might want to use one for regular spending, however, then make sure the account you pick comes with a debit card and free ATM access."

— Chanelle Bessette, NerdWallet banking writer

Frequently asked questions

What is a cash management account?

A cash management account is a hybrid account that offers similar services and features as checking and savings accounts. They aren’t provided by banks; instead, they’re provided by nonbank financial service providers like brokerage and investment firms.

How do cash management accounts work?

Cash management accounts — offered by nonbank financial service providers like brokerage and investment firms — bring checking and savings features under one roof. They typically pay interest and offer tech-savvy features.

Are cash management accounts FDIC insured?

Since CMA providers aren’t banks, they can’t directly offer FDIC insurance to customers’ funds. Instead, providers partner with banks behind the scenes and sweep customers’ cash into bank accounts, thereby allowing banks to extend FDIC coverage to that money.

Since they usually work with multiple partner banks, CMAs tend to offer much higher FDIC insurance limits, even as high as $8 million for individual accounts.

What is the difference between a brokerage account and cash management account?

A brokerage account is an investment account where customers buy, sell and hold types of investments such as stocks and bonds. A cash management account is for short- to medium-term savings and regular spending.

» Want to compare? Check out CMAs versus brokerage accounts

Since most CMAs are offered by brokerage and investment firms, customers can often connect their brokerage account to a CMA and transfer money back and forth under the umbrella of the same provider.

What are some alternatives to cash management accounts?

Some of the best alternatives to cash management accounts include: certificates of deposit (CDs), peer-to-peer lending, high-yield money market accounts (MMAs) and high-yield online savings accounts.

How is cash management defined in consumer finance?

Cash management refers to the way consumers process and determine the usage of their money.

When it comes to cash management accounts, customers can manage the flow of their cash through spending, saving and — usually — investing it all under the same roof.

Last updated on April 21, 2025

NerdWallet's Best Cash Management Accounts of 2025

- Vanguard Cash Plus Account - Paid non-client promotion: Best for Cash Management Account

- Betterment Cash Reserve – Paid non-client promotion: Best for Cash Management Account

- Wealthfront Cash Account - Paid non-client promotion: Best for Cash Management Account

- Empower Personal Cash: Best for Cash Management Account

- Fidelity Cash Management Account: Best for Cash Management Account

Frequently asked questions

What is a cash management account?

A cash management account is a hybrid account that offers similar services and features as checking and savings accounts. They aren’t provided by banks; instead, they’re provided by nonbank financial service providers like brokerage and investment firms.

How do cash management accounts work?

Cash management accounts — offered by nonbank financial service providers like brokerage and investment firms — bring checking, savings and/or investment products all under one roof. They typically pay interest and offer tech-savvy features.

Are cash management accounts FDIC insured?

Since CMA providers aren’t banks, they can’t directly offer FDIC insurance to customers’ funds. Instead, providers partner with banks behind the scenes and sweep customers’ cash into bank accounts, thereby allowing banks to extend FDIC coverage to that money.

Since they usually work with multiple partner banks, CMAs tend to offer much higher FDIC insurance limits, even as high as $8 million for individual accounts.

What is the difference between a brokerage and cash management account?

A brokerage account is an investment account where customers can put their long-term savings to earn interest. A cash management account is for short- to medium-term savings and regular spending and is meant to be used frequently.

Since most CMAs are offered by brokerage and investment firms, customers can often connect their brokerage account to a CMA and transfer money back and forth under the umbrella of the same provider.

What are some alternatives to cash management accounts?

Some of the best alternatives to cash management accounts include: certificates of deposit (CDs), peer-to-peer lending, high-yield money market accounts (MMAs) and high-yield online savings accounts.

To learn more about the similarities and differences of these products, check out this guide from NerdWallet.

How is cash management defined in consumer finance?

Cash management refers to the way consumers process and determine the usage of their money.

When it comes to cash management accounts, customers can manage the flow of their cash through spending, saving and — usually — investing it all under the same roof.