The 3 Credit Bureaus and Why They Matter to You

Experian, Equifax and TransUnion are the three credit reporting agencies that gather data about your finances and compile them into credit reports, which determine your credit score.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

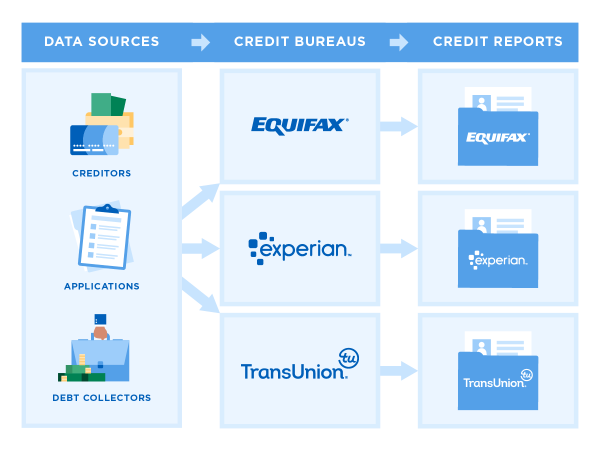

A credit bureau — sometimes called a credit reporting agency — is a business that collects data about how you've used credit from lenders to generate credit reports. The three major credit bureaus are Equifax, Experian and TransUnion.

Your credit scores are calculated using data from the credit reports from the bureaus, and your credit score will vary depending on which bureau provided the data.

Credit bureaus also sell your data to lenders and others who want to check your credit before doing business with you.

You can dispute errors on your credit report and also put a security freeze on your credit. You must complete each action with the individual bureaus.

What are the three credit bureaus?

The three major credit bureaus are Equifax, Experian and TransUnion. Credit bureaus gather and maintain data on consumers' credit use, which means that if you have a credit card or a loan, you probably have a credit file with one, two or all three major credit bureaus.

Sometimes called credit reporting agencies, these credit bureaus can collect and sell information on your consumer credit behavior without your consent. However, businesses that check your credit, such as credit card issuers and lenders, must have a legitimate reason to look at your credit file — for example, a lender might look at your credit because you applied for a loan or a credit card.

In most cases, they must have your permission.

The information credit bureaus collect is typically used:

To calculate credit scores.

To make lending decisions, such as whether to offer a consumer a credit card or loan and at what interest rate.

In some pre-employment background checks.

To evaluate lease applications.

In setting some insurance rates.

To decide whether someone must pay a utility deposit.

You have a right to see your credit reports and to dispute information that is inaccurate or should no longer be reported because of its age.

» Get your free credit report from NerdWallet today

What data do the credit bureaus collect?

Your credit reports include identifying information, such as your name, birthdate, Social Security number and addresses (past and present).

They also can contain:

A list of current and past credit accounts.

Payment history, such as whether you paid on time.

Negative information, such as collections, bankruptcies, repossessions and foreclosures. Each type of negative mark must come off your report after a set time, usually seven years.

A record of who has accessed your credit report, for instance, when you apply for credit or when a marketer wants to preapprove you for an offer.

» Learn more: How long do derogatory marks stay on your credit file?

If data privacy is a concern, you should know that credit bureaus are highly regulated by the Fair Credit Reporting Act, which puts limitations on how they collect and share your personal data.

What information is not in my credit reports?

Your credit reports do not contain your credit score. Credit scoring companies, primarily FICO and VantageScore, use the data from your credit reports to calculate your score.

Some types of accounts don't routinely show up on your report, such as utilities and rent. But those accounts can still end up on your report if there's a payment problem that leads to a debt collection, which is a negative mark that appears on your credit reports.

Other personal information is excluded, such as your race, religion, gender, citizenship or criminal records.

Where do the credit bureaus get their data?

Creditors report how you handle accounts, including payment history, to the credit bureaus. They're not required to report to the credit bureaus, but most do because information on how borrowers have handled credit cards and loans in the past helps them make lending decisions.

Creditors may report to one, two or all three bureaus — so your credit report at each bureau can vary a bit from the others.

Some types of accounts don't routinely show up on your report, such as utilities and rent. But those accounts can still end up on your report if there's a payment problem that leads to a debt collection.

Data also comes from public records, such as:

Repossessions.

Bankruptcy filings.

Foreclosures.

Can other types of data help my credit reports?

If you are new to credit, you might benefit from getting other types of account information added to your reports. Options include:

Rental payments: If you're a renter, you can look into rent reporting.

Phone, streaming services and utility payments: You can use one of the newer products that gather some data from bank accounts you link, such as Experian Boost and UltraFICO.

» Check out our guide to rent reporting services

How can I check my credit reports?

You're entitled to free weekly credit reports from each bureau. Use AnnualCreditReport.com to download your reports. It's important to check all three reports because credit bureaus operate independently, and, as a result, each may receive information from a different set of sources.

Read your reports to make sure your identifying information and account information are correct, because mistakes can lower your credit scores.

You can also check on personal finance websites that offer free credit reports, such as NerdWallet.com. NerdWallet’s credit report uses TransUnion data.

» Learn more about how to read your credit reports

What if I see a mistake on my credit report?

If you see an error, you can dispute it. That means you file a formal complaint online, by phone or by mail, and the bureau must respond. Each credit bureau has a slightly different procedure for disputing.

It’s important to fix a mistake with all three major bureaus, because credit reporting agencies do not share information.

» Need a credit bureau’s phone number? We got you covered.

How do I freeze my credit on all three bureaus?

To protect your credit, NerdWallet recommends you place a credit freeze with each major credit bureau. A credit freeze prevents scammers from opening accounts in your name and damaging your credit. It's free to freeze your credit (and to unfreeze, or thaw, it when you want to apply for something), and it won't hurt your score.

» Find out more about how to freeze your credit