Cost to Install or Replace Gutters in 2026: Is It Worth It?

Your cost of gutter replacement or installation could range from a few hundred dollars to several thousand, depending on factors like your home’s size and gutter materials you choose.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

The cost of replacement gutters for an average-size home, including materials and installation, is around $2,000 to $6,000. However, your costs will depend on the size of your home and the type of gutters you choose.

Gutter installation could cost as little as $150 for a small roof with minimal debris removal, or as much as $10,000 for custom-built gutters on a large home with multiple levels.

Not all homes need gutters, but they can help prevent costly water damage in wetter climates and for houses with architecture that doesn’t drain easily.

Are gutters worth the money?

In general, gutters are recommended for most homes. Gutters help protect your home and surrounding property from water damage.

Gutters are especially important if:

- Your home sits at the bottom of a hill or slope.

- Your home is built on clay-rich soil, which drains water more slowly than other soil types.

- Your house has a basement.

- Your house has no roof overhang or a very small overhang.

There are a few situations, however, where gutters may not be necessary:

- Your home is completely surrounded by concrete, which could be in the form of patios, streets, sidewalks, driveways or other concrete structures.

- Your home is at the top of a hill, and the land slopes downward, away from your house.

- Your roof has a large overhang.

- You live in a dry climate that receives very little rain or snow.

Is it worth it to replace my gutters?

Depending on the material you select, your gutters might last anywhere from 10 to 100+ years. Many gutter issues can be fixed by cleaning or repairing specific sections.

However, if you’re experiencing significant leaks or water damage in your home, it’s likely worth it to replace your gutters rather than pay for costly repairs to your home’s foundation.

Here are some warning signs that it’s time to clean, repair or replace your gutters:

- Cracks.

- Fallen fasteners and/or nails.

- Holes.

- Mildew around your foundation.

- Rust.

- Orange flecks on and around your gutters (signs of new rust forming).

- Peeling paint.

- Sagging gutters.

- Water leaking into your basement or foundation.

- Water pooling around gutter downspouts.

Is it worth hiring a professional to install gutters?

Installing gutters yourself isn’t generally recommended unless you’re highly experienced. Here’s why:

- You may get injured from working on the roof and ladders.

- You may have to rent special equipment.

- The work usually requires more than one person.

- The job can be more complex than anticipated, and you have to be very careful with the measurements, pitch, installation and inspection.

- Improper installation can damage your home.

Even if DIY gutter installation isn’t a reasonable option, you may be able to do some of the necessary gutter cleaning and maintenance yourself. If you’re comfortable on a ladder and use proper safety equipment, you can extend the life of your gutters with regular maintenance.

How much do gutters cost?

The average price for gutter installation is $4 to $40 per linear foot. The size of your home significantly influences your specific price range. Gutter replacement cost will fall on the higher end of the range, because your installer will have to remove and dispose of the existing gutter system.

Several factors can impact your final cost:

- Style. Gutters are available in different styles, such as half-round, K-style and custom-built fascia style. Half-round and K-style gutters start at around $3 per linear foot, while custom-built fascia style starts at $6 per linear foot and can cost up to $40 per linear foot.

- Home height. The height of your home affects gutter installation prices because of the danger involved in working on upper floors. More stories require extra tools and safety equipment.

- Gutter removal. Gutter replacement costs are typically higher than new installation, because your installer has to remove and dispose of the existing gutter system. Plan to spend $1 to $2 per square foot to remove existing gutters, plus an additional $150 to $350 for debris removal.

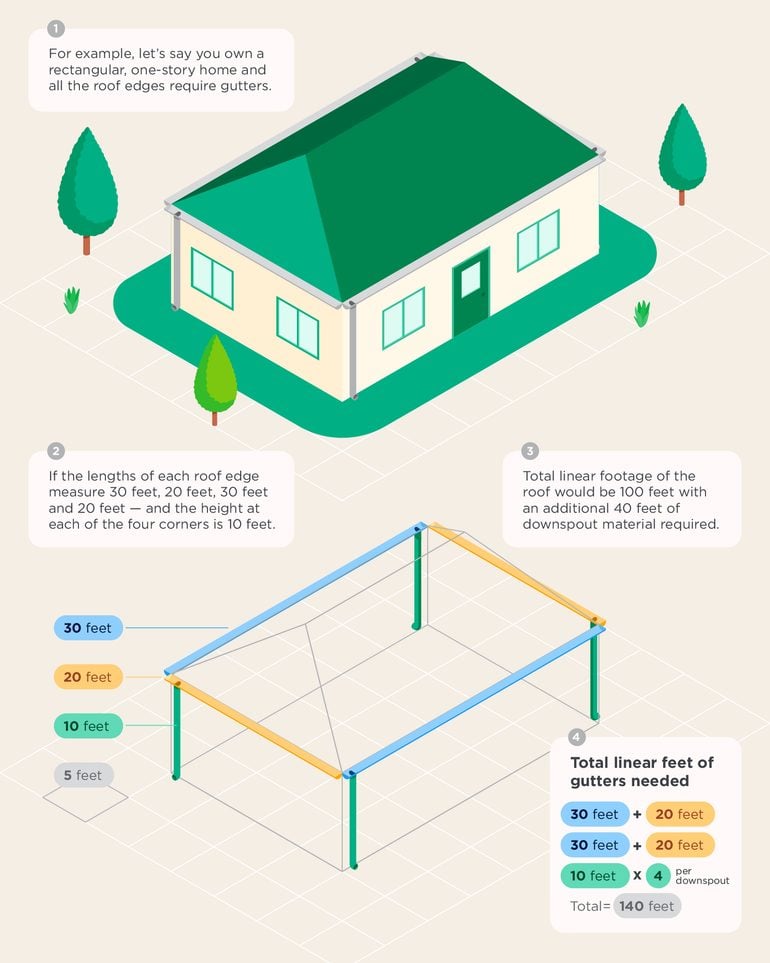

How many feet of gutters and downspouts will I need?

To get a rough idea of how many feet of gutters your home might require (if all roof edges truly need gutters), calculate the linear footage of your roof. If your home isn’t a strict rectangle or square, you may have to do this in sections and add them up. Make sure to add the distance from each roof corner to the ground for downspouts.

Nerdy Perspective

Not every home needs gutters around the entire roof. You may need substantially fewer feet of gutters than your initial rough estimate. Roofs with only one or two slopes may only require gutters on the sides of the home corresponding to those slopes. Having a pro evaluate your roof can help you determine which roof edges need gutters.

Gutter costs by material

Each gutter material comes with unique advantages and drawbacks. Here are the most common gutter materials and their price, lifespan and features:

Aluminum

Price: $3 to $15 per linear foot.

Life: About 20 years.

Pros and cons: Lightweight, rust-resistant and easily replaceable. The downside is that aluminum gutters are vulnerable to cracking, dents and damage from falling debris.

Copper

Price: $15 to $40 per linear foot.

Life: About 50 years on average (sometimes up to 100 years).

Pros and cons: Weather-resistant and won’t warp or rust, but copper gutters may require regular maintenance and are vulnerable to dents.

Galvanized steel

Price: $5 to $20 per linear foot.

Life: 20 to 30 years.

Pros and cons: Highly resistant to damage from impact and winds, and handles heavy rainfall well. Galvanized steel gutters are vulnerable to rust if not properly maintained. They are heavy, difficult to install and aren’t suitable for climates with high salinity in the air.

Vinyl

Price: $3 to $7 per linear foot.

Life: 10 to 20 years.

Pros and cons: Lightweight, easy to install and very resistant to corrosion. Vinyl gutters don’t last as long as many other options, and wetter climates shorten their lifespan. They are also vulnerable to cracking and leaks.

Wood

Price: $20 to $32 per linear foot.

Life: Up to 100 years if maintained properly.

Pros and cons: Wood gutters will rot without annual treatment to protect their interior and exterior.

Zinc

Price: $15 to $40 per linear foot.

Life: 50 to 80 years.

Pros and cons: Low-maintenance, rust-resistant and forms a self-sealing patina that helps prevent cracks and scratches. However, zinc gutters are very heavy.

» MORE: Is a metal roof worth it?

What Reddit users say about replacing and installing gutters

Reddit is an online forum where users share their thoughts in “threads” on various topics. The popular site includes plenty of discussion on financial subjects like home improvement, so we sifted through Reddit forums to get a pulse check on how users feel about gutter costs. People post anonymously, so we cannot confirm their individual experiences or circumstances.

Reddit users suggest getting multiple professional estimates for gutter replacement before making a purchase – typically three quotes from different companies. Most posts we read agreed that any home improvement project involving a ladder is dangerous and not worth attempting to do yourself. Many users also say that regular gutter cleaning can help prevent costly repairs and ensure that your gutters have the longest lifespan possible.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles