IRS Form 941: How to Fill Out Employer’s Quarterly Federal Tax Return

Stay in the clear and keep your finances in order with everything you need to know about IRS Form 941.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is Form 941?

IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well as calculate and report the employer’s Social Security and Medicare tax burden.

Unlike individual taxpayers who have to file only one tax return per year, many businesses are required to file quarterly tax returns. Failure to file IRS Form 941 on time or underreporting your tax liability can result in penalties from the IRS.

Completing Form 941 includes reporting:

- Wages you paid.

- Tips your employees reported to you.

- Federal income tax you withheld from your employees' paychecks.

- Employer and employee shares of Social Security and Medicare taxes.

- Additional Medicare tax withheld from employee paychecks.

- Current quarter’s adjustments to Social Security and Medicare taxes for fractions of cents, sick pay, tips and group-term life insurance.

- Qualified small-business payroll tax credit for increasing research activities.

After accounting for all of these items, IRS Form 941 will tell you how much money you should have paid or will need to pay to the government to cover your payroll tax responsibilities for the quarter.

Note: The video below relates to the 2019 version of Form 941 but can still help you understand the process.

This guide explains everything you need to know about IRS Form 941, along with step-by-step instructions to help you complete this form.

Who needs to file IRS Form 941?

Most businesses with employees have to file IRS Form 941 each quarter to report and calculate employment taxes. Some states have analogs to Form 941 that you may also have to file to report income withholdings and employer taxes at the state level.

These types of businesses don’t have to file Form 941:

- Seasonal businesses don’t have to file during quarters when they haven’t hired anyone.

- Businesses that hire only farmworkers.

- People who hire household employees, such as maids or nannies.

What is the deadline for filing Form 941?

The deadline for filing Form 941 is one month following the last day of the reporting period. Here are the calendar deadlines for filing Form 941:

- First quarter: April 30, for the period covering Jan. 1 to March 31.

- Second quarter: July 31, for the period covering April 1 to June 30.

- Third quarter: Oct. 31, for the period covering July 1 to Sept. 30.

- Fourth quarter: Jan. 31, for the period covering Oct. 1 to Dec. 31.

If the due date falls on a weekend or holiday, then you have to file by the next business day. If you file by mail, your return will be tracked according to the date of postage. You get an additional 10 business days to file if you’ve paid your employment tax deposits in full and on time for the entire quarter that’s covered by the return.

How to file IRS Form 941

To submit the form

The fastest way to file Form 941 is through the federal e-File system. Business taxpayers can access e-File through most tax preparation software for small businesses. Your accountant or tax professional should also have access to e-File.

You can also mail Form 941. The mailing address depends on the state your business is in, whether you’re submitting payment with your return and what quarter you’re filing for. Be sure to include the payment voucher.

To make a payment

If you need to make a payment, you can do so through the EFTPS — Electronic Federal Tax Payment System. Any tax payments related to Form 941 can be made through EFTPS. You can also mail a check to the IRS.

IRS Form 941 instructions: A step-by-step guide

IRS Form 941 is a three-page form. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment.

Here's a step-by-step guide and instructions for filing IRS Form 941.

1. Gather information needed to complete Form 941

Form 941 asks for the total amount of tax you've remitted on behalf of your employees for the quarter. In order to complete IRS Form 941 effectively and efficiently, gather the information that you’ll need ahead of time. This information includes:

- Basic business information, such as business address and employer identification number, or EIN.

- Number of employees.

- Total wages you paid this quarter.

- Taxable Social Security and Medicare wages for the quarter.

- Total amount of federal income taxes, Social Security tax and Medicare tax withheld from employees’ wages this quarter.

- Employment tax deposits that you’ve already made for the quarter.

If you use payroll software or accounting software, you should be able to retrieve the data you need for IRS Form 941. Additionally, most employers are required to make employment tax deposits on a monthly or semiweekly basis. You should also be able to get information by looking at your payment history in EFTPS or at your business bank account statements.

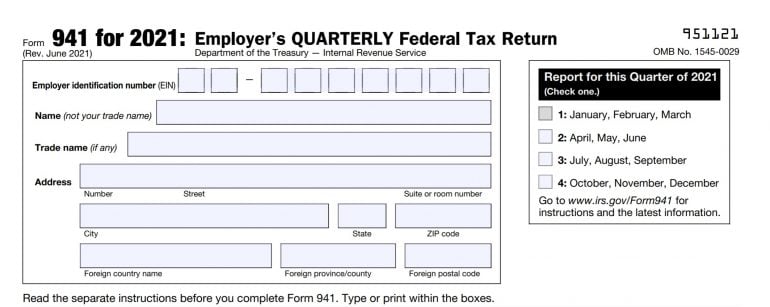

2. Fill in the business information at the top of Form 941

The first section asks for basic information about your business, as well as the quarter you’re filing for. In this section, you’ll provide your business tax ID number, name and trade name (if applicable) and address.

3. Fill in Part 1 of Form 941

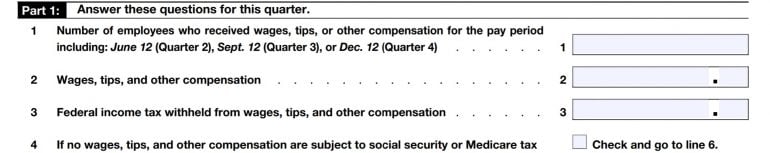

Part 1 is broken down into 15 lines about wages you’ve paid, federal income taxes withheld, etc.

This is the most involved section of Form 941, largely due to the calculations on line 5. However, lines 1-4 are based on the information you can gather from your accounting or payroll software. These lines will ask for:

- Line 1: Number of employees you paid for the quarter.

- Line 2: Total wages, tips and other compensation you paid for the quarter.

- Line 3: Federal income tax withheld from wages, tips and other compensation you paid for the quarter.

- Line 4: Check this box if the wages, tips and other compensation you paid isn't subject to Social Security and Medicare tax.

Line 4 won't apply to most businesses, so you can leave it blank. If you’re unsure if it applies to you, IRS Publication 15 explains the types of businesses that fall into this exemption.

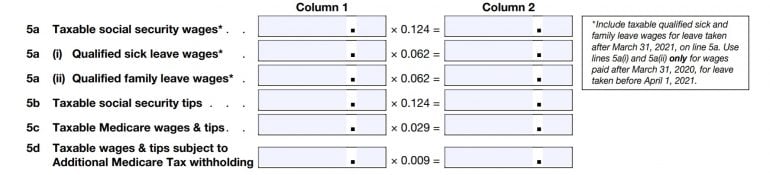

The most complicated section of Form 941 involves lines 5a to 5d, where you calculate your taxable Social Security and Medicare wages. You’ll see a lot of decimals in this section of the form. Those decimals are a stand-in for the percentage of wages and tips deducted for Social Security and Medicare tax.

» MORE: See our payroll tax explainer

To make sure your calculations are correct, you need to break down the wages by type for lines 5a and 5b (i.e., regular wages or tips). Here’s an example of lines 5a to 5d for a business that had one employee. That employee earned $25,000 this quarter in wages and $5,000 this quarter in tips.

- Line 5a: $25,000 x 0.124 = $3,100.

- Line 5b: $5,000 x 0.124 = $620.

- Line 5c: $30,000 x 0.029 = $870.

- Line 5d: Leave blank because the employee doesn’t earn more than $200,000 per year.

Once you complete these calculations in lines 5a through 5d, you’ll add Column 2 from these lines and fill in the total on line 5e. Then, on line 6, you’ll add lines 3, 5e and 5f (if applicable) to calculate your total taxes before adjustments and fill in that total.

After this, you can calculate your total employment tax liability for the quarter. You’ll complete lines 7 through 9 if your business has any adjustments to report for fractions of cents, sick pay, tips and group term life insurance. The adjustments for sick pay and life insurance come into play if, for instance, an insurance company reimbursed a portion of your employee’s wages while they were on short-term disability. On line 10, you’ll fill in your total taxes after adjustments by combining the amounts in lines 6 through 9.

Next, if your business can claim payroll tax credits for increasing research activities, you’ll complete lines 11a through 11g and attach IRS Form 8974. (Payroll tax credits are available to companies that engage in research and development in technology, science, medicine or related fields.) On line 12, you’ll subtract line 11g from line 10 in order to calculate your total taxes after adjustments and credits and fill in this total.

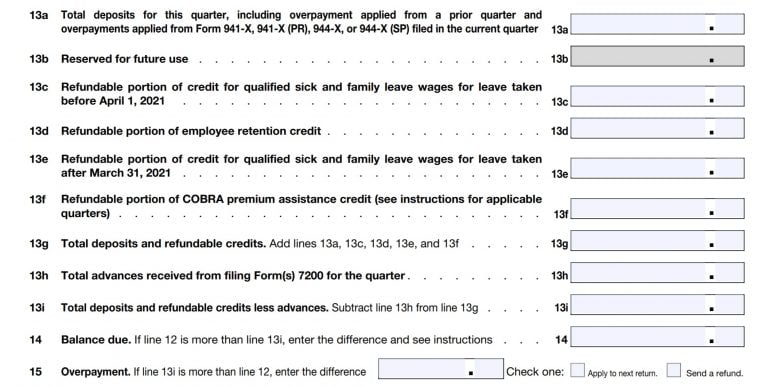

Then, on lines 13a to 13i, you’ll tally your total deposits and refundable advances. If your liability is higher than the deposits you’ve already made, the form will indicate a balance due on line 14.

If your employment tax liability is less than the deposits you’ve made, the overpayment gets noted on line 15. You can choose to receive a refund check or have the overpayment applied as a credit on your next tax return by checking one of the boxes next to line 15.

4. Fill in Part 2 of Form 941

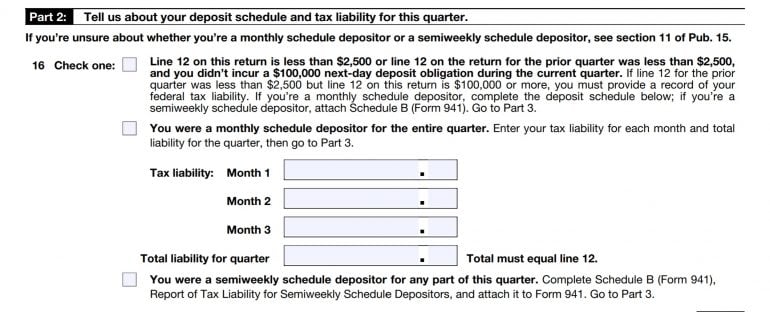

Part 2 asks about your deposit schedule and tax liability for the quarter. In this part, you’ll indicate whether you’re a monthly or semiweekly schedule depositor. If you’re a monthly depositor, fill in the three boxes labeled Month 1, Month 2 and Month 3 — this total must equal the number on line 12 on Part 1.

If you’re a semiweekly depositor — meaning you have more than $50,000 for tax liability for the quarter — you’ll complete Form 941 Schedule B and attach it with this form. Schedule B breaks down your tax liability for each day of the quarter.

5. Fill in Parts 3 and 4 of Form 941

In Part 3, you’ll be asked if your business closed, if you stopped paying wages or if you’re a seasonal employer who doesn’t have to file IRS Form 941 every quarter. You’ll also report your health plan, wages and sick leave associated with COVID-related measures such as the employee retention credit.

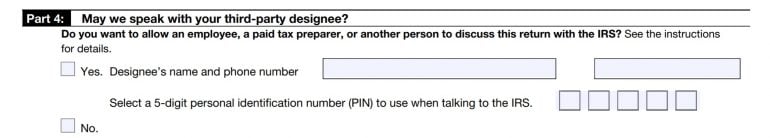

In Part 4, you’ll be asked whether you authorize a third-party designee to speak with the IRS on behalf of your business with regard to this return. A third-party designee might be your CPA, enrolled agent or tax advisor. If you are granting authorization to a third-party designee, check the “Yes” box and fill in the person’s name and phone number. If you’re not, you’ll check the “No” box.

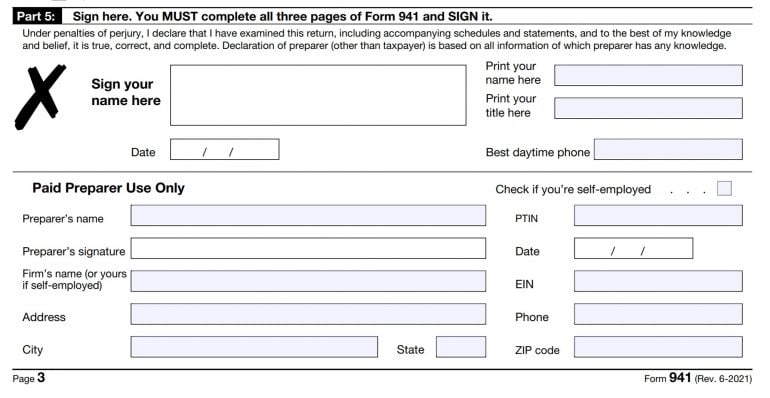

6. Review Form 941 and fill in Part 5

Before you sign and complete Part 5, review everything you’ve filled in to ensure that the information is correct. If you work with a tax advisor or business accountant, you may want them to review the return as well. Once you’ve reviewed your completed IRS Form 941, you’ll be able to sign and date Part 5.

If you’ve used a paid preparer (someone like a CPA or tax professional you’ve paid to complete this form on your behalf), they’ll complete the Paid Preparer Use Only section under your signature.

7. Submit Form 941 to the IRS and pay any remaining balance

If you’re filing online, you can use EFTPS to pay your tax bill. As an alternative, you can mail in the payment along with the payment voucher (Form 941-V) on the third page of Form 941 if your balance for the current quarter is less than $2,500, or if you’re a monthly depositor who owes a small balance (no more than $100 or 2% of the total tax due).

Other small-business tax forms to know

One of the reasons business taxes are so complex is that there’s never just a single return to file, and you may need to complete other related forms. Here a few to keep in mind:

- IRS Form 1065: Known as the U.S. Return of Partnership Income, Form 1065 is an informational tax form used to report the income, gains, losses, deductions, credits and other applicable information for a partnership or LLC. See our guide.

- Schedule C: IRS Schedule C is a tax form for reporting profit or loss from a business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is typically for people who operate sole proprietorships or single-member LLCs. See our guide.

- Schedule SE: You use IRS Schedule SE to calculate how much self-employment tax you owe. See our guide.

- Schedule K-1: Schedule K-1 is the federal tax form that partnerships, S corporations, trusts or estates use to report annual income, losses, credits, deductions and other distributions for each partner, shareholder or beneficiary. See our guide.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles