SBA Form 413: How to Fill out the Personal Financial Statement

SBA Form 413 is typically required as part of an SBA loan application. The SBA uses this form to evaluate your finances.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Concerned about tariffs?

Many small-business owners are under increased economic stress and uncertainty following the latest tariff announcements. NerdWallet is here to help you find answers for whatever you're looking for. Here are some resources to help you get started:

- Need emergency funding? Consider a business line of credit.

- Looking for fast access to working capital? Discover the best working capital loans.

- Want tips on how to mitigate the impact of tariffs? Read our guide.

What is SBA Form 413?

SBA Form 413, formally titled “Personal Financial Statement,” is a document that the U.S. Small Business Administration uses to assess the creditworthiness and repayment ability of its loan applicants. This form collects information about your personal finances, such as assets, liabilities and sources of income.

You’ll be required to complete SBA Form 413, or your lender’s equivalent, as part of the application for most SBA loans.

The SBA also uses this form to determine whether a business meets the qualifying criteria for some of its contracting programs.

How much do you need?

We'll start with a brief questionnaire to better understand the unique

needs of your business.

Once we uncover your personalized matches, our team will consult you

on the process moving forward.

Find the right loan for your business

Tell us how much you need and see your options in minutes.Who needs to fill out SBA Form 413?

If you’re applying for an SBA 7(a) loan, 504 loan or disaster loan, you’ll likely need to complete Form 413. Because SBA microloans are administered by intermediary partners, this specific form is not required for those loans.

SBA Form 413 must be completed by the following business applicants:

- Each proprietor.

- Every general partner.

- Every managing member of an LLC.

- Each owner with 20% or more equity in the business.

- Any person or entity providing a guarantee on the loan.

If you’re a married individual completing this form, the SBA requires you to include the assets and liabilities of your spouse and any minor children . This information is required so that the SBA knows that you have joint assets or liabilities; it does not mean, however, that your spouse is guaranteeing the loan.

Business owners applying for the WOSB Federal Contracting Program or the SBA 8(a) Development Program will also have to fill out Form 413.

How Fundera by NerdWallet Works

Getting a business loan can be challenging. Let our sales experts help you through the process.

Fill out a simple application Our 3-min. questionnaire is free & won't impact credit.

See your loan options Compare rates and repayment terms to choose the best product for your needs.

Get your loan If approved, sign closing documents and receive funds.

How to fill out SBA Form 413

Follow these steps to complete SBA Form 413.

Step 1: Gather financial documents

SBA Form 413 requires a breadth of information and will take time to complete. Getting organized before you start filling out the form will help move the process along.

You may not need to provide these documents to your SBA lender, but they can be useful for completing the form more quickly and accurately:

- Bank statements.

- Retirement account statements (e.g., IRA, 401(k) accounts).

- Life insurance documents.

- Documents concerning any personal investments, such as stocks and bonds.

- Pay stubs showing your annual salary.

- Statements showing any additional forms of income.

- Mortgage statements, auto loan statements, credit card statements and documentation of any other personal debt.

You should ensure that your financial documents are current — within 90 days of your application submission. If you’re filling out an application for the SBA 8(a) program, your information should be up-to-date within 30 days of submission .

Keep in mind that you can reach out to your lender, business accountant or local Small Business Development Center if you need assistance completing Form 413.

Step 2: Select your loan or contracting program

On the first page of Form 413, check the box that corresponds to your application: SBA 7(a) loan; SBA 504 loan or surety bond; disaster loan; Women-Owned Small Business, or WOSB, program or 8(a) program.

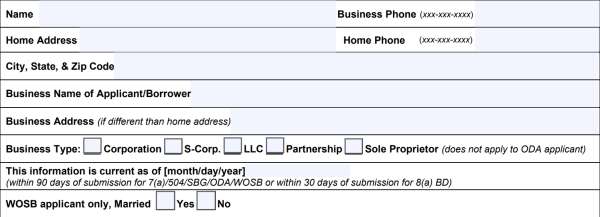

Step 3: Fill in personal and business information

Enter your name, home address and home phone number, as well as your business name, address and phone number.

Select your business entity type and enter the date as of which your information is current. If you’re applying for the WOSB Federal Contracting Program, indicate whether you’re married.

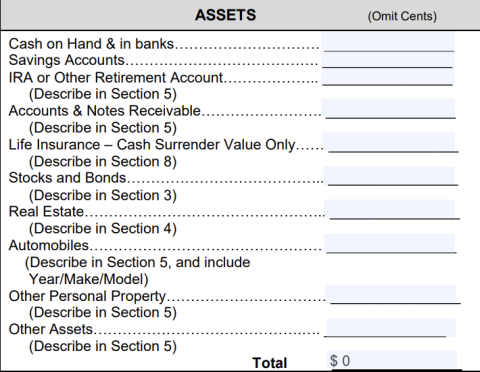

Step 4: Add your assets and calculate their total value

When filling in this section, you’ll want to include accurate information for both your and your spouse’s assets. You can round your valuations to the nearest dollar amount.

Here’s what you’ll need to include:

- Cash on hand and in banks. Along with cash, the amount in your and your spouse’s checking accounts.

- Savings accounts. Include the amount in any money market and CD accounts as well.

- Retirement accounts. The value of your IRA or any other retirement accounts in your name, as well as your spouse’s name (if applicable).

- Accounts and notes receivable. You’ll only need to fill this out if you’ve personally loaned money and that amount is still owed to you.

- Life insurance — cash surrender value only. If your life insurance has a cash payout, list the dollar amount you would receive if you canceled it. This only applies to whole life insurance policies, not term life insurance. You'll describe this in detail in section 8.

- Stocks and bonds. List the current value of all stocks and bonds owned by you and your spouse.

- Real estate. List the current fair market value of all residential real estate you and your spouse own. You’ll describe this in detail in section 4.

- Automobile. The current fair market value of all cars, boats, planes, or other automobiles you and your spouse own (not the automobiles you’re leasing).

- Other personal property. Estimate the combined worth of all the valuable material items you own and could sell for cash but that don’t fall into any of the above categories (e.g., jewelry, electronics and antiques). You'll describe this further in section 5.

- Other assets. Estimate the value of any other assets you own that don’t fall into the above categories. You'll also describe this in detail in section 5.

Once you’ve entered all of your information, you’ll add up the column to calculate the total value of your assets.

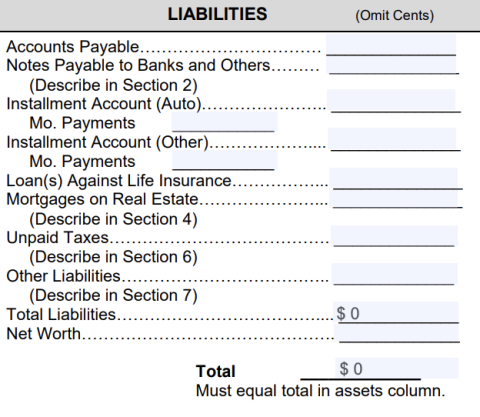

Step 5: Add your liabilities and calculate their total value.

In this section of Form 413, you’ll want to include your liabilities as an individual — and if you’re married, any liabilities you hold jointly with your spouse — just like the assets section.

Here’s what you’ll need to include:

- Accounts payable. This field refers to any debts you owe to a third party (other than banks) usually on a short-term basis (i.e., 30, 60 or 90 days). Most applicants can leave this section blank.

- Notes payable to banks and others. This is where you’ll list all outstanding balances on your personal credit cards or lines of credit. You'll describe this information further in section 2.

- Automobile installment account. Provide the total balance and monthly payment amount for any outstanding automobile loans.

- Other installment accounts. List the total and monthly payment amount of any outstanding personal installment loans on your books, including student and personal loans.

- Loan against life insurance. Provide the balance of any loans you’ve taken out for which you’ve pledged your life insurance policy as collateral (only if it was whole life insurance).

- Mortgages on real estate. The balance of mortgages on your owned real estate. You'll describe this in detail in section 4.

- Unpaid taxes. List any due but unpaid taxes since your most recently filed tax return. You'll describe this further in section 6.

- Other liabilities. Provide the total amount of any other outstanding debt not listed in the previous sections. Most applicants don’t have any additional liabilities; but if you do, you can describe them in detail in section 7.

After completing all these details, you’ll add up the numbers in the column to get your total liabilities. Next, you’ll calculate your net worth by subtracting your total liabilities from your total assets.

If your liabilities are greater than your assets — and you don’t have a high net worth — it doesn’t mean you won’t be able to qualify for an SBA loan. The SBA wants to understand your current debts and will use this information, in addition to the rest of your application, to evaluate your repayment ability.

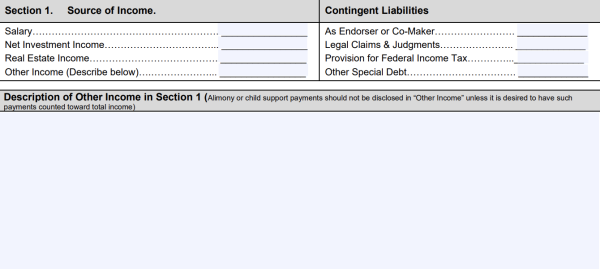

Step 6: Fill in your sources of income and contingent liabilities

Section 1 of SBA Form 413 requires you to fill in your sources of income, including:

- Salary. Provide your and your spouse’s total annual salaries (if applicable), as reported on your tax return.

- Net investment income. List any income you earn as dividends and interest from your investments.

- Real estate income. Provide the net income (i.e., income you earn after expenses) you receive from any of your owned real estate properties — through sale, lease or rental.

- Other income. Provide the total amount of any income received through avenues not listed above.

If you have other income, such as a pension or social security, you’ll elaborate on that income in the “description of other income” box. You should not include alimony or child support payments as other income unless you want them counted toward total income .

In the contingent liabilities box, you’ll add the debts you’re responsible for if certain conditions take place, including:

- As endorser or co-maker. Outstanding debts for which you or your spouse acted as guarantor or co-signer.

- Legal claims and judgments. The total amount you might owe for any pending legal claims or judgments.

- Provision for federal income tax. The amount of money you’re setting aside to pay federal taxes for an expected increase in income due to pending litigation, dispute or asset sale.

- Other special debt. The total amount of any other outstanding contingent debts not listed above.

Depending on your individual financial situation, you may not have anything to complete in this part of the form. If you do, remember that contingent liabilities are not included as part of the liabilities total used to calculate net worth.

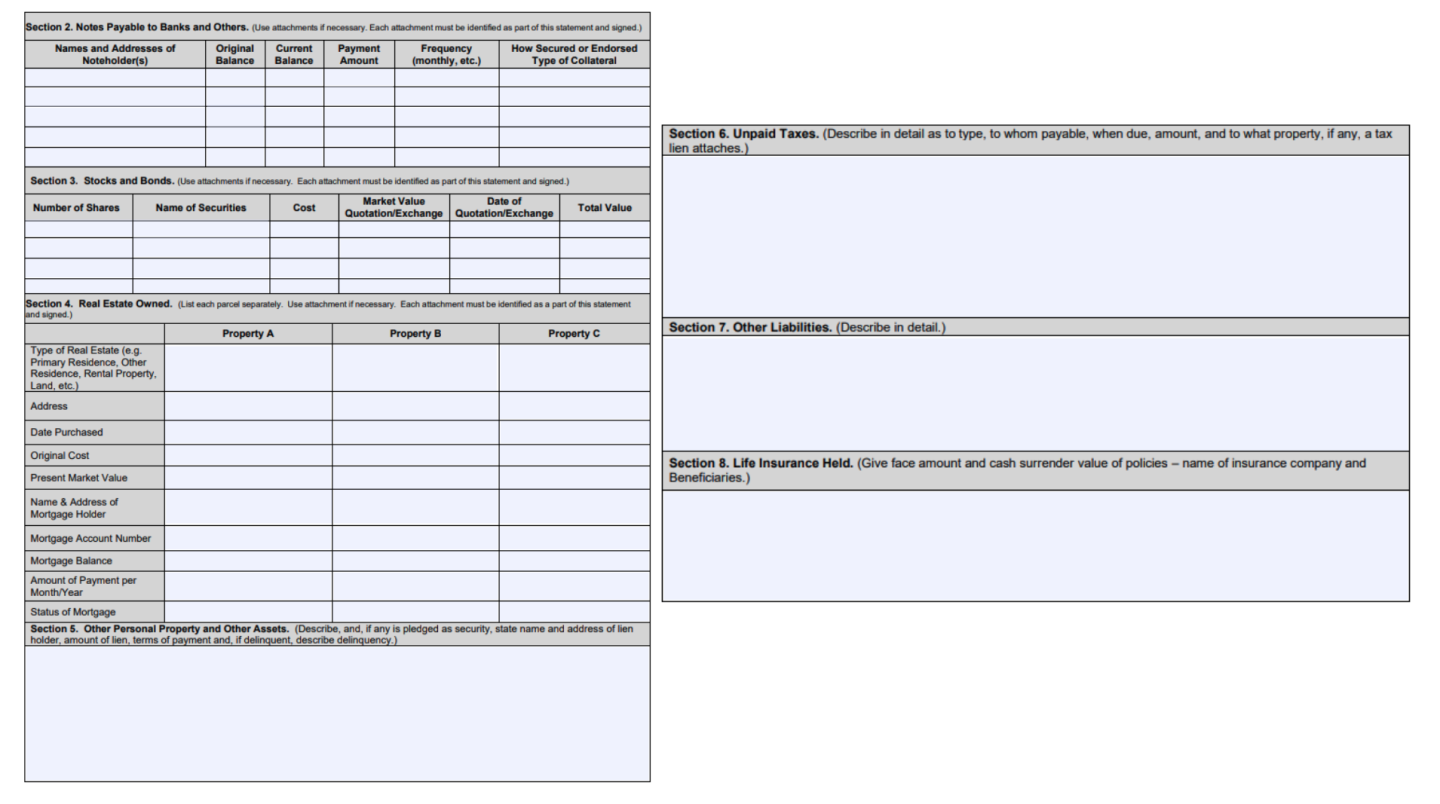

Step 7: Provide additional details regarding assets and liabilities

After completing section 1, you’ll continue the form by filling out sections 2 through 8. Each of these sections will ask you to provide additional information regarding the assets and liabilities you listed earlier.

Depending on your finances, you may not need to complete all of these sections, or provide extensive details.

- Section 2. Fill in details regarding your notes payable to banks and others, such as credit card accounts.

- Section 3. Add information explaining your stocks and bonds.

- Section 4. Provide details regarding any real estate you own.

- Section 5. Describe anything you included as other personal property or other assets.

- Section 6. Detail any information regarding your unpaid taxes.

- Section 7. Describe anything you included as other liabilities.

- Section 8. Add information regarding any life insurance policies you accounted for in the assets box.

If necessary, you can include relevant attachments for these sections — each of which must be identified as part of your SBA personal financial statement and signed .

Step 8: Review the form

SBA Form 413 is nearly finished once you’ve completed sections 1 through 8. Before you sign and date, however, you should thoroughly review the information you’ve provided.

You might ask a business accountant, attorney or loan specialist to review your document as well, so that you can avoid mistakes that might impact your application.

Filling out Form 413 completely and correctly will help expedite the underwriting process for your SBA loan.

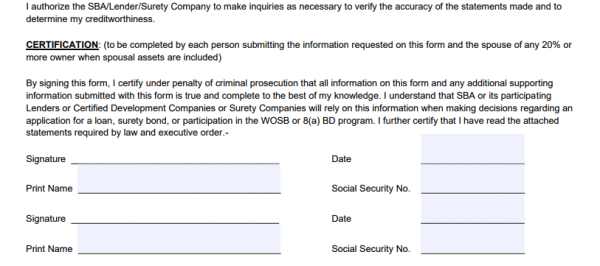

Step 9: Sign and date

Once you’re satisfied that you’ve completed your personal financial statement accurately, you’ll need to sign and date the document. You, the borrower, will sign and date the form, as well as provide your Social Security number.

If you own 20% or more of your business — and you included assets that you share with your spouse — your spouse will also need to sign and date the form.

» MORE: How to apply for an SBA loan

Download SBA Form 413

Download Form 413 via the SBA website. You may also be able to get the form from your individual SBA lender.

Learn more about getting an SBA loan:

- Compare current SBA loan rates.

- What’s the difference between an SBA 7(a) vs. 504 loan?

- Find out how long it takes to get an SBA loan.

A version of this article originally appeared on Fundera, a subsidiary of NerdWallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. U.S. Small Business Administration. Personal Financial Statement. Accessed Oct 1, 2025.

- 1. U.S. Small Business Administration. Personal Financial Statement. Accessed Nov 6, 2023.

Related articles