A Beginner’s Guide to Hilton Credit Cards: Pros, Cons and Which Are Worth It

Hilton offers credit cards that include a no-annual-fee version to a premium one. Are they worth it?

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Hilton’s credit cards, issued by American Express, cater to a range of travel priorities, offering perks that vary widely depending on the card.

From the no-annual-fee entry-level card to premium options that pack in luxury benefits, there’s a Hilton card for a variety of travelers. But which one of them (if any) is right for you?

There are four Hilton credit cards, including one small-business option. They are:

- Hilton Honors American Express Card, which has an annual fee of $0 (see rates and fees).

- Hilton Honors American Express Surpass® Card, which has an annual fee of $150 (see rates and fees).

- Hilton Honors American Express Aspire Card, which has an annual fee of $550 (see rates and fees).

- The Hilton Honors American Express Business Card, which has an annual fee of $195 (see rates and fees).

Here’s a breakdown of each Hilton card, with a look at the benefits and drawbacks.

On this page

What each Hilton credit card offers

Higher annual fees correlate with better benefits, but those might not be worth it to all travelers, especially those who either don't regularly stay with Hilton or who just prefer budget Hilton brands over the luxury names.

Here's what each card offers:

Annual fee: $0 annual fee (see rates and fees).

Ongoing rewards:

- 7 points per $1 spent at Hilton.

- 5 points per $1 spent at U.S. restaurants, U.S. supermarkets and U.S. gas stations.

- All other eligible purchases earn 3 points per $1 spent. Terms apply.

The Hilton Honors American Express Card has few ongoing benefits. The welcome offer is fairly good, as you'll earn enough points to cover at least a night or two (and maybe even three) depending on the property. That offer: Earn 70,000 Bonus Points plus a Free Night Reward after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026. Terms Apply.

Besides that, you get complimentary Hilton Honors™ Silver Status, which doesn't offer much in the way of perks, unless you get excited by a free bottled water. But you do get your fifth night free on award redemptions. Terms apply.

Who is the Hilton Honors American Express Card best for? If you stay at Hilton occasionally and want a card with an annual fee of $0 to boost your points balance, this is a solid pick. But don’t expect major perks beyond points accumulation.

Annual fee: $150 annual fee (see rates and fees).

Ongoing rewards:

- 12 points per $1 spent at Hilton.

- 6 points per $1 spent at U.S. restaurants, U.S. supermarkets and U.S. gas stations.

- 4 points per $1 spent on U.S. online retail.

- All other eligible purchases earn 3 points per $1 spent. Terms apply.

The Hilton Honors American Express Surpass® Card has the following introductory offer: Earn 130,000 Bonus Points plus a Free Night Reward after you spend $3,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026. Terms Apply.

You’ll also be granted Hilton Honors™ Gold Status as long as you hold the card. Terms apply.

Hilton’s Gold status is substantially more rewarding than Silver, entitling you to room upgrades and daily food and beverage credits for you and a guest. Terms apply.

If you’re a heavy spender, you also have the ability to earn a free night certificate when you use the card for $15,000 in spending in a calendar year.

Annual fee: $550 annual fee (see rates and fees).

Ongoing rewards:

- 14 points per $1 spent at Hilton.

- 7 points per $1 spent on flights booked directly with airlines or amextravel.com; on car rentals booked directly from select car rental companies; and at U.S. restaurants.

- All other eligible purchases earn 3 points per $1 spent. Terms apply.

For frequent Hilton guests or travelers seeking luxury benefits, the Aspire card’s perks can easily outweigh the fee. However, casual travelers may find it difficult to maximize the high-cost benefits.

First off, there's the welcome bonus: Earn 150,000 Hilton Honors Bonus Points after you spend $6,000 on eligible purchases on the Hilton Honors American Express Aspire Card within your first 6 months of Card Membership. Terms Apply.

But that’s not all. Cardholders also enjoy:

- Complimentary Hilton Honors™ Diamond Status.

- An annual free night award.

- Up to $400 of resort credit annually (up to $200 semiannually).

- Up to $200 of airfare credit annually (up to $50 per quarter).

- $209 CLEAR+ membership credit.

Terms apply.

Annual fee: $195 annual fee (see rates and fees).

The only small-business card that Hilton offers, The Hilton Honors American Express Business Card charges a $195 annual fee.

The benefits that come with this $195 annual fee mimic many of those from the Hilton Honors American Express Surpass® Card. Those benefits include:

- Hilton Honors™ Gold Status with the ability to spend your way to higher Diamond status.

- Up to $60 per quarter good on eligible purchases made with your card at Hilton properties, such as in-hotel dining or spa services.

- 12 points per $1 spent on Hilton purchases, 5 points per $1 for the first $100,000 of purchases in each calendar year that are not Hilton purchases and 3 points per $1 for other purchases.

Terms apply.

Like the other cards on this list, The Hilton Honors American Express Business Card comes with a welcome bonus. Earn 175,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $8,000 in purchases on the Hilton Honors Business Card in the first six months of Card Membership. Offer ends 4/15/2026. Terms Apply.

» Learn more: The pros and cons of the Hilton loyalty program

Nerdy Perspective

How do you use Hilton Honors points?

Comparing Hilton credit cards, side-by-side

| Annual fee | $0. | $150. | $550. |

| Free night certificate | N/A | Certificate can be earned after spending $15,000 in a calendar year. | Initial certificate distributed when you are approved for the card and every year on your cardmember anniversary. Earn a second night when you spend $30,000 and a third night when you spend $60,000 on the card in a calendar year. |

| Elite status | Hilton Honors™ Silver. | Hilton Honors™ Gold. | Hilton Honors™ Diamond. |

| Welcome offer | Earn 70,000 Bonus Points plus a Free Night Reward after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026. Terms Apply. | Earn 130,000 Bonus Points plus a Free Night Reward after you spend $3,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026. Terms Apply. | Earn 150,000 Hilton Honors Bonus Points after you spend $6,000 on eligible purchases on the Hilton Honors American Express Aspire Card within your first 6 months of Card Membership. Terms Apply. |

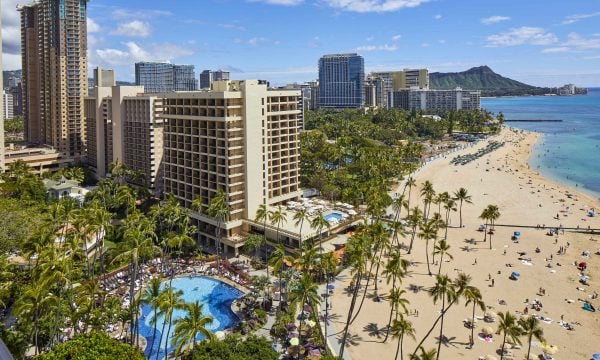

How many Hilton Honors points are needed for a free night?

Hilton ditched its award chart in favor of dynamic pricing. The minimum number of Hilton points needed to book a standard room is 5,000, but rooms at high-end properties can reach upward of 150,000 or more.

Use the Hilton Points Explorer tool to search hotels by redemption rates, and if you have a specific destination in mind, it’s also simple to search by location.

Hilton offers the ability to search using flexible pricing, allowing members to scan award rates a month at a time. To do this, check “My Dates are Flexible” in the date-selection tool.

Read more about redeeming Hilton points: The Guide to Booking Award Nights With Hilton.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Is a Hilton credit card worth it?

If you're a Hilton loyalist, a Hilton credit card can be worth it — especially if you can use free night certificates, resort credits or elite status upgrades.

But if you’re not planning regular Hilton stays, a general travel credit card may offer more flexibility and better rewards for everyday purchases.

How to choose a Hilton credit card

Which Hilton credit card is right for you? Ask yourself these key questions before deciding:

How often do I travel?

If you’re often on the road, it’s much easier to extract value from these credit cards. Then again, the $400 resort credit and $200 flight credit that come with the Hilton Honors American Express Aspire Card are of no use to you if you never leave your city.

Do I value elite status?

If room upgrades and extra perks matter, go for the gold. After all, perks like these start when you have Gold status, which is conferred by the Hilton Honors American Express Surpass® Card.

» Learn more: How to become a Hilton Honors member

What's my budget for credit card annual fees?

The Hilton Honors American Express Aspire Card’s $550 annual fee comes with more than that in credits, but having cash in your bank may be more valuable to you.

If you just want a way to earn a few extra Hilton points, you may want to consider the Hilton Honors American Express Card and its $0 annual fee. Although it offers the fewest perks, it’s also the cheapest to have in your wallet.

If you’re considering a Hilton credit card ...

Hilton credit cards offer a variety of benefits, but they’re not a one-size-fits-all solution. Carefully consider your travel habits, budget and ability to maximize rewards before committing to any of these cards.

To view rates and fees of the Hilton Honors American Express Card, see this page. To view rates and fees of the Hilton Honors American Express Surpass® Card, see this page. To view rates and fees of The Hilton Honors American Express Business Card, see this page. All information about the Hilton Honors American Express Aspire Card has been collected independently by NerdWallet. The Hilton Honors American Express Aspire Card is no longer available through NerdWallet.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles