When to Use Credit Card Points and When to Transfer Them to Airlines

You should transfer if it'll cost fewer points to book with an airline's miles.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

This page is out of date

In June 2025, Chase announced changes to redemption rates on travel booked through the issuer's travel portal for the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card. Instead of being able to automatically redeem points at a higher rate (1.5 cents per point for the Chase Sapphire Reserve® and 1.25 cents per point for the Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card), cardholders can only redeem points for a higher rate on select airline and hotel bookings.

For more information, see NerdWallet's coverage of the changes.

You’ve earned the credit card welcome bonus, racked up enough points for an award ticket and are ready to cash in. But what’s the best way to book your award flight? Should you use your credit card’s booking platform or transfer those points to an airline frequent flyer program? Which way will make those hard-earned points go the furthest? And how do you know which option offers the best deal?

We’ll help you figure out the ins and outs of when to use credit card points and when to transfer to an airline frequent flyer program so you can get the most out of all those points and miles.

To transfer or not to transfer

Many travel rewards credit cards that aren’t affiliated with an airline offer a few ways to book award travel: by using points to essentially erase travel-related purchases, by using a dedicated booking platform or by transferring your points to airline frequent flyer programs.

The Chase Sapphire Preferred® Card and Chase Sapphire Reserve® credit card let customers book travel through Chase's travel portal.

American Express cardholders can use Membership Rewards to pay with points on American Express Travel. And the Capital One Venture Rewards Credit Card, Capital One VentureOne Rewards Credit Card - Miles Boost and Capital One Venture X Rewards Credit Card offer the option of redeeming points as a statement credit after booking on any travel platform and paying with your card or by booking directly through the bank’s portal.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

The benefits of not transferring points

Sometimes these dedicated redemption options even come with extra incentives. For example, your points can be worth more than the standard 1 cent per point when redeeming Chase Ultimate Rewards® through Chase's travel portal if you have the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

There are several other benefits to booking award travel through these travel portals versus redeeming points to erase purchases later:

- You don’t have to deal with airline award blackout dates or seat restrictions, since you’re not using the airline’s miles.

- You’ll often still earn miles for travel.

- You can pay the taxes and fees with points.

The benefits of transferring points

So why would you want to transfer credit card points to a frequent flyer program instead of booking with your credit card’s platform? Here are several good reasons to consider:

- To keep miles from expiring with account activity.

- To transfer enough miles for a reward flight if you’re just shy of enough miles in your frequent traveler account.

- To get outsize value for your points on some award travel (as detailed below).

The value of point and miles will depend largely on airline award charts. Let’s take a look at a few examples:

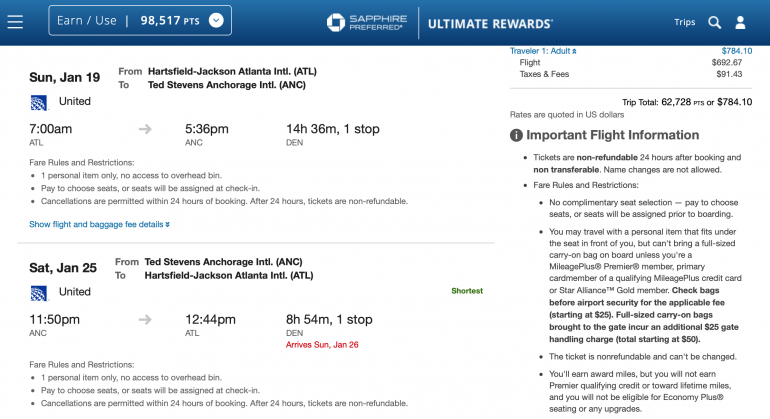

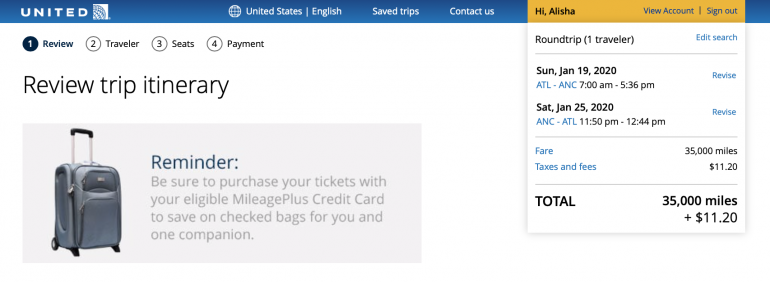

We found this fare for a United award flight from Atlanta to Anchorage at 62,728 Ultimate Rewards® points ($783.10 in cash including taxes and fees). Using United miles, the total required is just 35,000 miles. In this case, it makes more sense to transfer Chase Ultimate Rewards® to United than to redeem points through Chase's travel portal.

With Capital One, a $784.10 flight would cost even more miles: 78,410, which you can get by multiplying the cash price by 100.

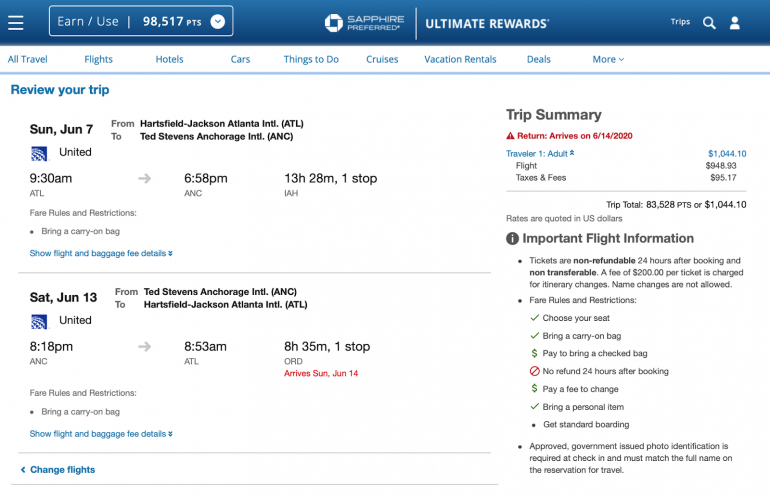

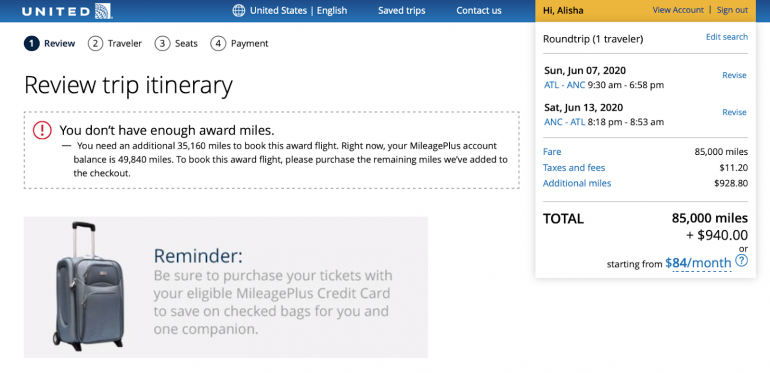

With United’s dynamic award pricing, redemption rates can fluctuate. During peak travel times, miles required for an award flight may go up. In one search, the same route as above taken in June instead of January resulted in much different pricing: 83,528 points when booked through Chase Ultimate Rewards® and 85,000 miles through United.

This suggests that when booking award travel on airlines that use an award pricing structure based largely on peak travel times, it could be more advantageous to transfer points to a frequent flyer program instead of booking with credit card points, if you’re flying in an off-peak season.

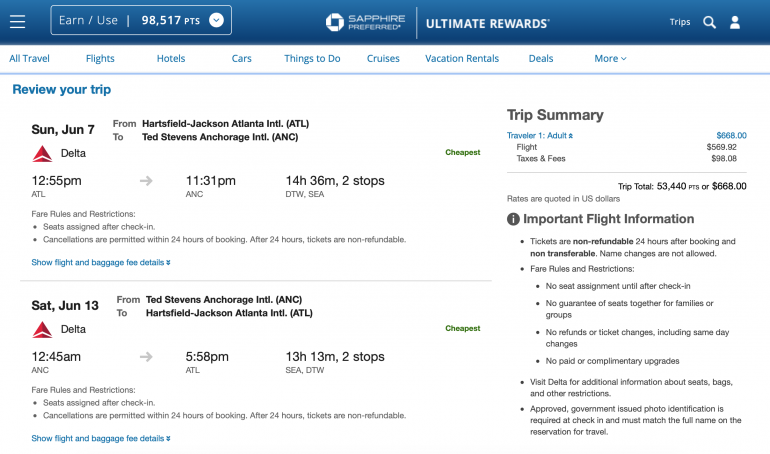

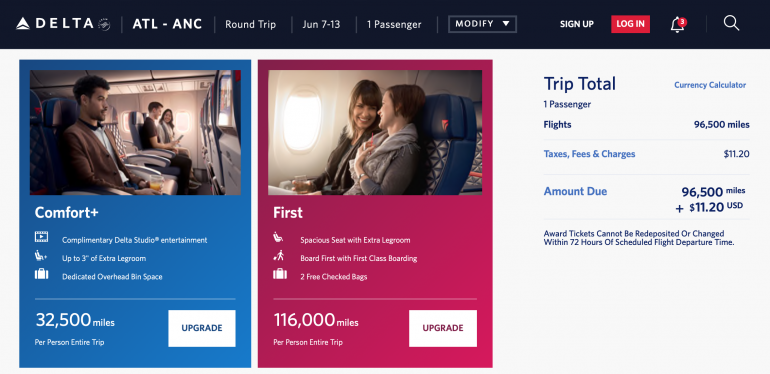

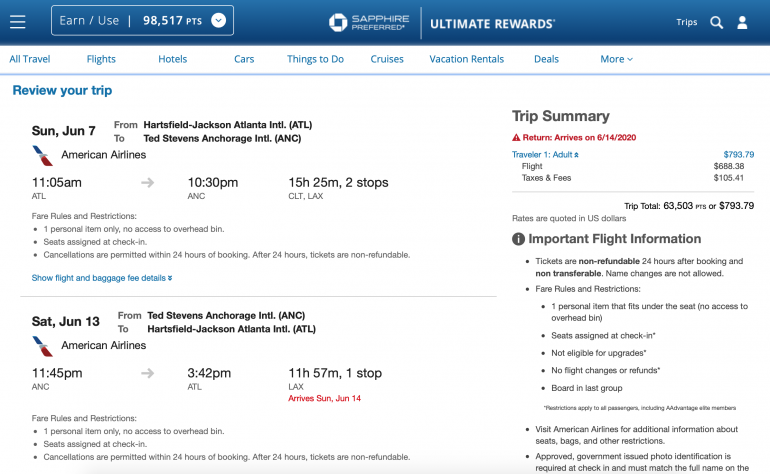

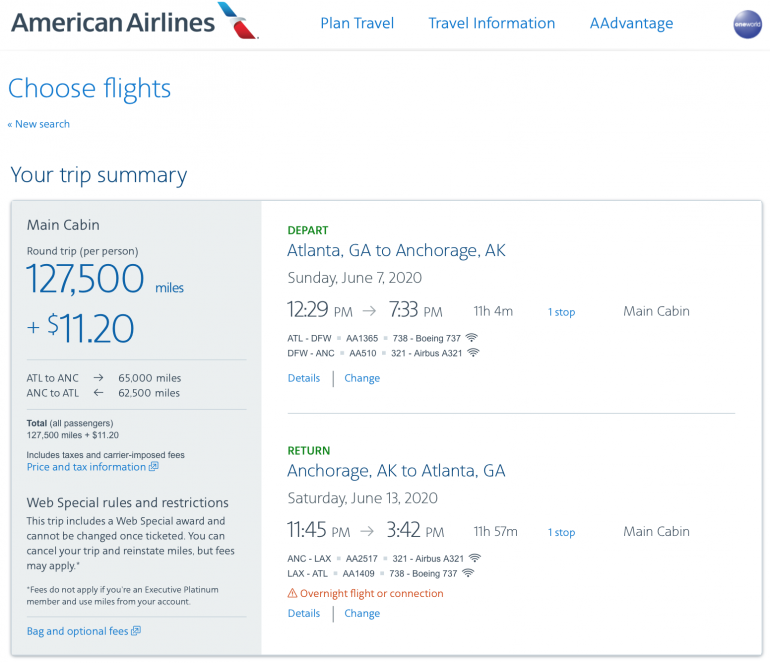

Airlines that still publish an award chart can be easier to predict but don’t always offer the best deals on award flights. Take a look at this flight from Atlanta to Anchorage on Delta (which utilizes a dynamic award system) and American Airlines.

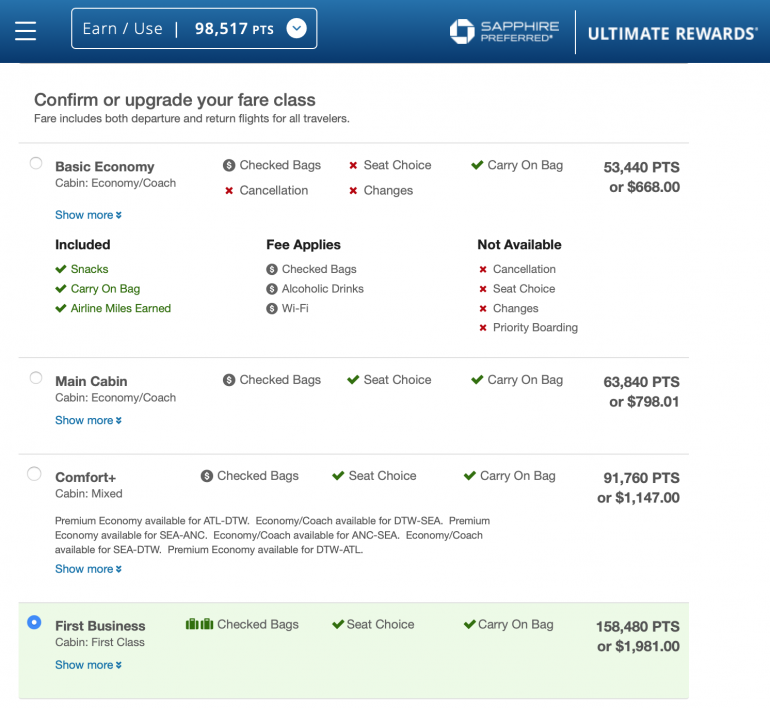

Through the Chase Ultimate Rewards® travel site, a $668 Delta flight would cost 53,440 points. Booked through Delta.com using SkyMiles, the cost would be a whopping 96,500 miles.

A $793.70 flight on American Airlines would cost 63,503 points through Chase Ultimate Rewards®. The same flight would require 127,500 AAdvantage miles.

When airlines that use dynamic award pricing are concerned, it’s always worth it to compare.

» Learn more: How to redeem Chase Ultimate Rewards

Class matters

When selecting first class options for the same flights as above, a different result surfaced. Whereas with Chase Ultimate Rewards® a Delta first class flight required 158,480 points (or 198,100 Capital One miles), Delta.com only charged 116,000 miles.

When transferring points isn’t a good deal

With some airlines and credit cards, transferring points from your credit card to a frequent flyer program may not always be a good deal. If your airline of choice uses dynamic award chart, you’ll likely only save points by transferring them if the cash price of the ticket is high but the award price is low. Likewise, on airlines with distance-based charts, short but expensive flights may be the only time a switch is worth it.

Some credit cards that offer the option to transfer points to a frequent flyer program do so on a 1:1 ratio, meaning 500 credit card points could be transferred for 500 airline miles. But occasionally, that’s not the case.

For example, American Express normally only offers 200 JetBlue points per 250 Membership Rewards points. Similarly, Capital One offers 500 TrueBlue points per 1,000 Capital One miles. If transfer rates aren’t at least 1:1, it’s much less likely to be worth the trade, unless you’ve found an exceptional airline award flight deal.

You should always check the transfer ratio before committing, because once you transfer points to an airline, you can’t get them back.

How to tell if transferring points is a good deal

Start by checking out both your credit card’s booking platform (if they offer one) and the airline website. Search for the flight you want on both, and price it in credit card points and frequent flyer miles. Then compare the total cost of each. As long as you can transfer points to miles on at least a 1:1 ratio, it’s as simple as seeing which costs less.

The bottom line

There are no hard and fast rules for when to use credit card points and when to transfer to an airline frequent flyer program to book award travel. Your best bet will always be to check your redemption options with your credit card and airline of choice. Then, if you can save valuable points and miles by transferring, don’t hesitate to do so.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles