What Factors Affect Your Credit Scores?

Your payment history and how much of your credit limits you use are the two biggest credit scoring factors.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Your credit scores are determined by several factors, such as paying your bills on time, how much of your available credit you're using and the length of time you've used credit. Understanding what factors affect credit scores helps you plan the most effective way to build your credit and protect it.

» Get your free credit score from NerdWallet

Credit scoring companies calculate your scores from data in your credit reports. While they won’t reveal their exact formulas, they share the basic ingredients they use to calculate scores.

Why do you care? Because your credit often holds the key to other parts of your life: whether you can get a credit card or car loan, and at what interest rate; whether you can buy a house or rent the apartment you want; even how much you pay on car insurance and utility deposits.

» Learn more: What is credit and why is it important?

What affects your credit scores the most?

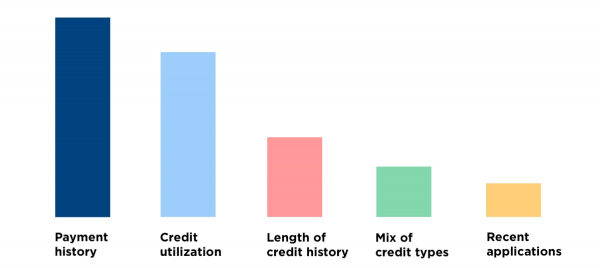

The two major scoring companies in the U.S., FICO and VantageScore, differ in how they weight the factors in the calculations, but they agree on the two factors that are most important: Payment history, or your record of paying your bills on time, and credit utilization, which is the portion of your credit limits that you actually use. Together, these two factors make up more than half of your credit scores.

Here's a breakdown of all the factors that affect your scores:

Payment history

Your credit reports reveal your payment history, or whether you've consistently paid bills and other obligations on time. FICO says payment history accounts for 35% of your score. VantageScore says payment history counts for 40% of its 3.0 scoring model.

What to do: Pay all bills on time. Late payments by 30 days or more can dent your scores — and the later you pay, the greater the damage. Set up autopay or calendar reminders so you don't miss due dates. You might also want to ask creditors to move your due dates so they better align with when you get paid.

Credit utilization

The amount of your credit limit you use, expressed as a percentage, is called credit utilization. FICO says the amount of available credit you use counts for 30% of your score, while VantageScore 3.0 puts credit utilization at 20%.

What to do: Experts generally recommend the 30% utilization rule, meaning you use no more than 30% of your available credit. People with the highest scores tend to use much less than that. To lower your credit utilization, you can try things like setting balance alerts or making extra payments during the month.

The good news is that score damage from having high credit utilization can be reversed. Once you pay a high balance down and the creditor reports it to the credit bureaus, the damage disappears.

Once you’ve mastered paying on time and keeping credit utilization low, turn your attention to other credit factors. These also affect your scores, though not nearly as much:

The length of time you’ve had credit

Credit scoring companies look at your credit age (sometimes called "depth of credit"), or how long you've been managing credit, to determine your score. The "older" your credit history, the better because they're relying on this long view to assess your ability to manage credit and debt. Their assessment informs decisions about whether to lend you money in the future.

What to do: Keep old accounts open unless there is a compelling reason to close them, such as an annual fee on a card you no longer use. You might be able to help yourself a little in this category by becoming an authorized user on a trusted person's credit card. Look for someone with a long credit history and an excellent payment record.

The kinds of credit you have, or credit mix

It's best to have a mix of installment accounts — those with a set number of equal payments, such as car payments or mortgages — and credit card accounts.

What to do: Having a good mix of at least five accounts is a sweet spot for credit scoring. Anything less can create a thin credit file, which can make generating a score difficult. Having this goal in mind as you’re building credit can strengthen your score.

The length of time since you've applied for new credit

Each application that causes a hard inquiry on your credit may take a few points off your score.

What to do: Space new applications out by at least six months to keep your score healthy and growing.

Factors that don't affect your credit score

Checking your own score: If you get your score through your bank or a free credit score service, it does not affect your score. That's because checking your own score is considered a soft pull on your credit. You can check it as many times as you want with no impact to your score.

Rent and utility payments: In most cases, your rent payments and your utility payments are not reported to the credit bureaus, so they do not count toward your score. The exception is if you use a rent-reporting service or if you are late on utility payments. The utility company may charge it off or sell it to a collector, who can report it to the credit bureaus and hurt your score. Some products, such as Experian Boost, allow you to add utility and eligible rent payment information to your Experian credit report, which can influence your credit.

Income and bank balances: Credit reports list only credit accounts — not savings, checking or investment accounts — so your balances won't help (or hurt) your score.

Your age: Credit scoring companies don't take your age into account, but your age can still unofficially influence your scores. See the average credit score by age to find out where your score falls compared with others your age.

Credit scoring companies review your credit reports to see how you’re doing on all these factors. Then they build your scores from that data. You can see the same things they do by checking your credit reports.

» Next: Get your free credit reports

Focus your credit-building efforts on on-time payments and keeping balances low relative to credit limits, because those factors have the biggest effect on your scores. You can track your score and get personalized tips with NerdWallet’s free credit score dashboard.