27 Ways to Earn American Airlines AAdvantage Miles

Here are some ways to earn more American Airlines AAdvantage miles — and many of them don't require flying.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

Looking to fly for free with American Airlines? If you have a stash of American Airlines AAdvantage miles, you can turn around and redeem them for free American Airlines flights.

American Airlines is one of the largest global airlines and a founding member of the Oneworld alliance, which makes it easy to use American miles to book through partner airlines, including Alaska Airlines, British Airways and Japan Airlines.

On its own, American flies to 350 destinations in more than 50 countries — and through Oneworld, passengers can fly to over 1,000 destinations worldwide. One of the best things about the airline is how easy it is to earn AAdvantage frequent flyer miles. If you're not a member, you can sign up for American's frequent flyer program, called AAdvantage.

Here are 27 ways to earn AAdvantage miles with the airline (even some pretty obscure ones) so you can maximize mileage-earning opportunities. (Psst: You can figure out how many American miles you need to earn for your next trip with our Points Planning Tool).

1. Earn credit card welcome bonuses

Credit card welcome bonuses offer one of the best ways to jump-start mileage earning. American Airlines is pretty good about offering high sign-up bonuses on its co-branded credit cards, with recent offers ranging from 10,000 to 75,000 miles.

American Airlines credit cards are issued by two banks: Citibank and Barclays. Current offers are as follows:

$0.

$99, waived for the first 12 months.

$595.

$99.

Earn 15,000 American Airlines AAdvantage® bonus miles after making $1,000 in purchases within the first 3 months of account opening.

Earn 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

For a limited time, earn 100,000 American Airlines AAdvantage® bonus miles after spending $10,000 within the first 3 months of account opening.

Earn 50,000 AAdvantage® bonus miles after making your first purchase and paying the $99 annual fee in full, both within the first 90 days.

In addition to the above, American Airlines also has three other cards that are no longer accepting new applicants: AAdvantage® Aviator® World Elite Silver Mastercard®, AAdvantage® Aviator® Blue Mastercard® and the Citi® / AAdvantage® Gold World Elite™ Mastercard®.

There is one business card that is still accepting new applicants: The CitiBusiness® / AAdvantage® Platinum Select® Mastercard® (annual fee: $0 intro for the first year, then $99), which has the following welcome offer: Earn 75,000 American Airlines AAdvantage® bonus miles after spending $4,000 in purchases within the first 4 months of account opening.

The AAdvantage® Aviator® World Elite Business Mastercard® (annual fee: $95) is not accepting new applicants.

» Learn more: The best travel credit cards right now

2. Spend strategically across credit card bonus categories

American Airlines credit cards allow you to not only earn AAdvantage miles each time you swipe your card but also to earn additional miles for spending in specific categories.

All of the above-mentioned credit cards earn 2 miles per $1 on American Airlines purchases, except for the Citi® / AAdvantage® Executive World Elite Mastercard®, which earns 4 miles per $1 on American Airlines purchases and 10 miles per $1 on eligible hotels and car rentals booked through American Airlines.

In addition, these cards earn 2 miles per $1 in the following categories:

CitiBusiness® / AAdvantage® Platinum Select® Mastercard®: Gas stations and restaurants.

American Airlines AAdvantage® MileUp®: Grocery stores.

CitiBusiness® / AAdvantage® Platinum Select® Mastercard®: Cable, satellite, telecommunications, car rental and gas stations.

AAdvantage® Aviator® World Elite Business Mastercard®: Office supply stores, telecom and car rental merchants.

If you want a credit card with no annual fee that earns extra points at grocery stores, consider the American Airlines AAdvantage® MileUp®.

If you'd rather earn the bonus points at office supply stores or on communication expenses, consider either the AAdvantage® Aviator® World Elite Business Mastercard® or the CitiBusiness® / AAdvantage® Platinum Select® Mastercard®, as they offer extra points in those categories.

Many people pay their phone bill using their bank account, which usually earns no rewards points. However, if you put a $100 monthly phone bill on a card that earns bonus points, that's an extra 2,400 AAdvantage miles per year.

Although it may seem like a relatively small number of miles, they add up quickly. An extra 2,400 miles are worth about $40, but that can be the difference between having enough miles for an award ticket or being slightly short on miles and needing to top-up your account through a miles purchase (which can be rather expensive).

Get into the habit of thinking strategically about which credit cards you use for purchases.

Save a note in your phone showing which credit cards earn bonus miles in specific categories so you can refer back to it when shopping and maximize the number of miles you earn from everyday purchases.

3. Transfer points from Marriott Bonvoy to American Airlines

While American Airlines is not a transfer partner of any bank's transferrable points program (e.g. Chase Ultimate Rewards®, American Express Membership Rewards, Capital One Miles), you can transfer points at a decent ratio from Marriott to American Airlines.

Marriott Bonvoy points convert to American Airlines miles at a 3:1 ratio. So if you transfer 60,000 Marriott points to American Airlines, you'll have 20,000 AAdvantage miles. Although Marriott offers a 5,000-point bonus on transfers of 60,000 points to certain airlines, American Airlines is no longer on the list of included airlines.

You'll want to consider the the dollar value of each program’s points or miles before doing a transfer. NerdWallet values American miles at 1.6 cents each and Marriott points are worth 0.9 cent each. When comparing the valuations, 60,000 Marriott points are worth more than 20,000 American Airlines miles, which is something to be mindful of when considering a transfer.

However, the actual value you get out of airline miles can vary depending on how you use them. If those 20,000 American Airlines miles can be redeemed toward a first class international flight, you’ll likely get way more than a $340 value out of them. In an instance like that, if you’re a few miles short of an AAdvantage award ticket and have some extra Marriott points, a points transfer may make sense.

» Learn more: Here's how much your points and miles are worth

Additionally, Marriott is a transfer partner of American Express Membership Rewards, which has run bonuses in the past on point transfers from AmEx to Marriott. If the stars align and your transfer timeline coincides with a transfer bonus, you could really maximize the transfer to get the most American miles.

When considering transferring points from Marriott, check to see if there are any transfer bonuses going on to maximize your miles.

4. Earn American Airline AAdvantage miles by flying

Ahh, the old-school way of earning frequent flyer miles. Even though earning miles by flying is one of the easiest ways to get them, so many people miss out because they simply forget to add their frequent flyer number to their reservation. To make sure this doesn’t happen, start by registering for an AAdvantage account.

After registering, you'll receive an AAdvantage number. Be sure to include this frequent flyer number on all of your American Airlines reservations, including upcoming flights you've already booked. Miles can be earned on flights with American Airlines, Oneworld and partner airlines.

On American Airlines

You earn AAdvantage miles by flying with American Airlines. The number of miles earned depends on the price of your ticket and your elite status level:

As of March 2023, AAdvantage elites earn 2 miles per dollar spent on basic economy fares.

To see how quickly the mileage bonus adds up, consider this chart from American Airlines. It shows how many AAdvantage miles can be earned on a round-trip main cabin flight from Dallas-Fort Worth to London-Heathrow.

The higher earning rate is one of the reasons it can be advantageous to aim for status with an airline you fly often.

On Oneworld and partner airlines

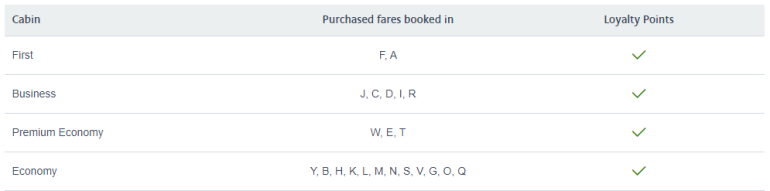

American Airlines allows you to earn AAdvantage miles while flying with about two dozen airline partners.

Each airline has an agreement with American that governs how miles are earned. The earn rate depends on the distance flown and the fare class of the ticket. For example, here's the earning rate on flights with British Airways.

For all flights on British Airways, you earn AAdvantage miles based on the ticket price rather than the distance flown. Your AAdvantage elite status provides a boost to the number of miles earned.

When booking a flight with an American Airlines partner, look to see which fare class your ticket books into and check the earning rate to calculate the number of miles you'll earn for the flight.

5. Mileage Multiplier

When buying an American Airlines or American Eagle ticket, you can purchase bonus miles through the Mileage Multiplier.

These bonus miles are available during the initial purchase, when checking in online or at the airport self-service check-in kiosks. If you want to earn those extra miles, just accept the Mileage Multiplier offer and use your credit card to pay.

These bonus miles do not count toward elite status.

6. Shop in the American Airlines eShopping mall

You can earn American Airlines AAdvantage Miles by shopping online at more than 1,200 merchants through the AAdvantage eShopping mall.

All you need to do is login with your AAdvantage number and password, then find a participating merchant. The mall offers bonuses for shopping at specified merchants.

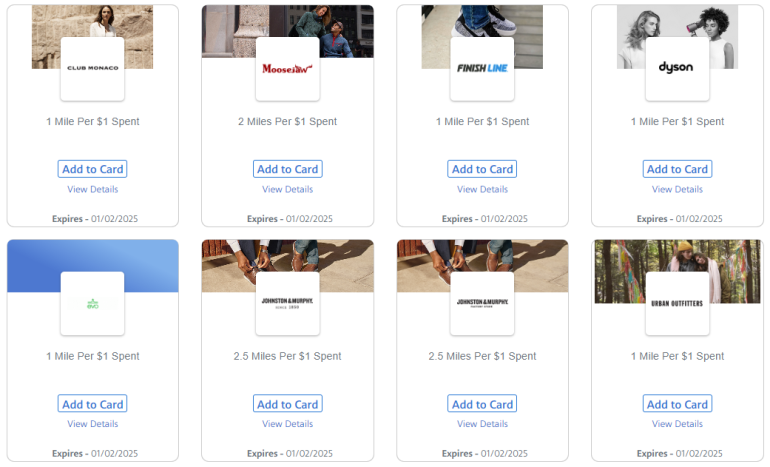

The image below shows various online merchants along with the earn rate (note that these rates change often, so you may see different offers):

So if you wanted to make a $100 purchase at Viator, you'd earn 400 AAdvantage miles by simply clicking on Viator in the AAdvantage eShopping mall and completing your purchase. It typically takes only a few days for the miles to post to your account, but it can take up to 15 days.

Buying flowers is also a great way to earn lots of American Airlines miles. Partners on the eShopping portal include 1-800flowers.com, FTD, ProFlowers and Teleflora. We've seen promotions of up to 25 miles per $1 spent.

The eShopping mall frequently runs bonuses for making purchases above a set amount (usually about $150), so check the site periodically to see if you can earn extra miles.

7. Shop through SimplyMiles

SimplyMiles offers extra AAdvantage miles for in-store purchases. To earn miles through SimplyMiles, register for an account with your AAdvantage number, then link an American Airlines co-branded credit card. You must manually activate targeted offers to earn bonuses through SimplyMiles.

8. Stay at hotels

American Airlines also allows you to earn AAdvantage miles when staying at participating hotels. There are several hotel partners, including some of the largest chains, like Marriott and IHG.

Hotels | Earn rate |

|---|---|

AAdvantage Hotels | Up to 10 times more base miles. |

Fiesta Americana Hotels and Resorts | 2,000 miles with a minimum 2-night stay. |

Hyatt Hotels and Resorts | 500 miles per stay. |

InterContinental Hotels | 1-2 miles for every $1 spent on all qualifying room rates. |

Langham Hospitality Group | 500 miles per night up to 1,500 miles per stay at The Langham Hotels and Resorts. |

Marriott Bonvoy | 1-2 miles for every $1 spent on all qualifying charges. |

Melia Hotels International | Rate unpublished. |

Millennium Hotels and Resorts | 500 miles at Millennium Hotels and 250 miles at Copthorne Hotels. |

Okura-Nikko Hotels and Resorts | 200 miles per stay at Hotel Jal City, 300 miles per stay at Okura Chiba Hotel and 500 miles per stay at all other properties. |

Shangri-La Hotels and Resorts | 500 miles per stay. |

Wyndham Hotels and Resorts | Platinum and Diamond Wyndham Rewards Members earn 2 miles for every $1 spent on a qualifying stay. Blue and Gold Wyndham Rewards Members earn 1 mile for every $1 spent on a qualifying stay. |

Generally, you could either earn hotel points or airline miles. Deciding whether to earn hotel points or AAdvantage miles is a matter of personal preference.

You can also book hotels through AAdvantage Hotels, powered by Rocket Travel Inc., which allows you to earn additional miles for hotel stays. Below is a screenshot for a two-night stay in Miami Beach, Florida.

If you were to stay at the Fountainebleau Miami Beach, you could earn up to a little over 18 AAdvantage miles per $1 spent. Your earn rate depends on your elite status level and whether you hold an eligible AAdvantage credit card. Even if you were just an AAdvantage member (the entry-level membership), you could still earn 1,300 miles for the stay by booking through the platform.

AAdvantage status members: Earn up to 5 times more base miles on hotels.

AAdvantage credit cardholders: Earn up to 5 times more base miles on hotels.

AAdvantage credit cardholders with status: Earn up to 10 times more base miles on hotels.

It is worth noting that hotel prices on AAdvantage Hotels can sometimes be higher than those offered by other online travel agencies (OTAs). This is probably because the site is trying to recoup the cost of the miles it needs to purchase to reward customers. It’s worth it to compare rates to make sure you’re getting the best deal possible.

Before making your reservation with a hotel or online travel agency, check the eShopping mall to see if there's an opportunity to earn extra AAdvantage miles on the booking.

9. Book car rentals

Similar to earning AAdvantage miles for hotel stays, you can also earn miles for car rentals.

Avis and Budget are preferred rental partners with AAdvantage, which means — depending on your AAdvantage elite status — you could earn up to 5 base miles per $1 spent. To earn the miles, click "Book now," and you'll be taken to the car rental company’s website. When making the reservation, you'll be prompted to input the relevant discount code and your AAdvantage number.

Check your printed rental agreement to ensure your AAdvantage number is included so you can earn miles.

10. Take a vacation

American Airlines Vacations is a booking platform that lets you earn AAdvantage miles when paying for airfare, hotels or car rentals. There are also opportunities to earn additional miles for booking vacation deals to select destinations. We've seen promotions of up to 30,000 bonus miles for booking at certain resorts.

11. Take a cruise

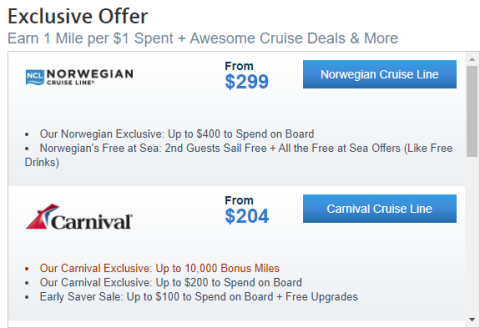

American Airlines makes it easy to earn AAdvantage miles through its cruise booking platform. You'll earn at least 1 mile per dollar spent on cruise vacations.

The site often runs promotions where you can earn extra AAdvantage miles, like a recent deal offering up to 10,000 bonus miles and up to $200 in ship credit on a Carnival cruise.

American offers a 110% price match guarantee. If you see a lower price on another website within 48 hours of booking your cruise, contact American Airlines, and it will refund 110% of the price difference.

12. Sign up with American AAdvantage Dining

American Airlines offers a dining rewards program where you can earn AAdvantage miles at participating restaurants (and it's considered one of the best dining rewards programs out there).

To earn miles, register for an account with AAdvantage Dining and add any credit or debit card to your online profile (you don't necessarily need an American Airlines credit card to participate). Every time you eat at a participating restaurant and swipe your card on file, you’ll automatically earn AAdvantage miles.

The number of points you earn depends on your AAdvantage Dining membership tier; it ranges from 1 point per $1 spent for basic members to 5 points per $1 spent for VIP members.

Plus, you can almost always double dip on rewards earned by paying with a dining rewards credit card. If your credit card earns bonus points for spending at restaurants, you’ll be able to collect those and the rewards you’d earn through AAdvantage Dining.

If you’re going out to eat, do a quick search on the AAdvantage Dining website to see if any restaurants near you participate in the program.

13. Use business partners of American Airlines

American Airlines allows you to earn miles with a selection of retailers offering business products, financial services, home insurance, electricity, flowers, wine purchases and concert tickets.

When you’re considering signing up for a service or purchasing something online (e.g., energy service, cell phone provider, flowers, etc.) do a search to see if your preferred airline is offering miles with that vendor. You never know when you can earn some extra miles.

14. Use American HomeMiles

American HomeMiles is an organization that offers services related to mortgages, real estate and moving. You can earn bonus miles when you buy a home, sell a home or arrange moving services through HomeMiles:

5,000 AAdvantage miles for every $25,000 of the sale or purchase price when you buy or sell a home.

1,250 AAdvantage miles for every $10,000 spent on a financed house.

5,000 AAdvantage miles when you complete an interstate move.

15. Open an account with Bask Bank

Bask Bank is an online bank that awards AAdvantage miles for depositing money and maintaining a specified average monthly balance. Account holders earn 2.5 AAdvantage miles for every $1 saved in a Bask Mileage Savings Account. Miles accrue on a daily basis based on the account's average daily balance, and they post to your AAdvantage account after every statement cycle.

The bank also runs promotions throughout the year for new and existing customers to earn bonus miles.

16. Take surveys with Miles for Opinions

Miles for Opinions works similarly to e-Rewards; it provides an opportunity to earn AAdvantage miles for taking surveys. When you first sign up, you may qualify to earn 250 bonus miles.

This can be a tedious way to earn miles in that you may spend 15 minutes of your time to earn 250 miles. But then it's fairly easy, and you might be able to do it while enjoying some TV on a lazy weekend.

17. Real estate services with Miles From Home

Miles From Home is a service that will match you with a real estate agent near you to help you sell your home. You can earn 2,000 AAdvantage miles for every $10,000 of your home’s sale and/or purchase price. To be eligible, you need to register with Miles From Home and meet certain criteria.

AAdvantage miles are not available for homes purchased or sold in Alabama, Alaska, Louisiana, Mississippi, New Jersey, Oklahoma or Oregon. The real estate program isn't available in Iowa.

18. Park at the airport with PreFlight

PreFlight Airport Parking offers an opportunity to earn 1 AAdvantage mile per $1 spent on airport parking. The company operates at five airports, including Atlanta Hartsfield-Jackson, Boston Logan, Houston Hobby, Chicago O'Hare and Phoenix Sky Harbor.

19. Book an airport shuttle

SuperShuttle provides shuttle service to and from airports. You can earn 50 AAdvantage miles for each one-way ride or 100-mile round trip. SuperShuttle operates in numerous domestic and international locations.

When booking a black car or SUV service through its sister company, ExecuCar, you'll earn 150 miles for one-way trips and 300 miles for round trips.

20. Reserve a car with transportation provider LAXcar

LAXcar is a car service provider in California that allows you to earn up to 3 AAdvantage miles per $1 for rides. You'll need to create an account and be logged into the website to earn the miles.

21. Use utility providers NRG, Reliant or Xoom

NRG Home is a supplier of electricity and gas. The company’s services are used with your existing utility provider. You can earn a bonus of 12,500 AAdvantage miles after 2 months as an NRG Home customer and an additional 2,500 miles if you add a natural gas account. In addition to the bonus AAdvantage miles, you'll get 2 miles per $1 spent on your monthly bill.

Reliant is an electricity provider in Texas. You could earn up to 27,000 AAdvantage miles for switching to Reliant. This includes 15,000 miles when you sign up, plus an extra 500 miles for each month you’re registered for the subsequent 24 months.

Xoom supplies electricity in Connecticut, Maine, New Hampshire and Rhode Island; it supplies natural gas in California, Georgia, Indiana, Kentucky, Michigan and Virginia. Two months after signing up for an account, you can earn 10,000 AAdvantage miles as an electric customer and 5,000 AAdvantage miles as a natural gas customer. Additionally, you'll earn 2 miles for every $1 on the supply portion of your energy bill.

Make sure to read each provider’s terms and conditions, because many of these independent energy providers offer electricity at variable rates, which can introduce volatility into your monthly bill.

22. Buy tickets to events through Vivid Seats

Vivid Seats is a ticket broker that lets you earn 3-5 AAdvantage miles per $1 spent on concert tickets, sporting events and comedy shows.

23. Join Fuel Rewards and buy gas at Shell

American Airlines has partnered with the Shell Fuel Rewards program to earn miles on gas purchases. When AAdvantage members link their account to Fuel Rewards, they'll receive 250 AAdvantage miles after their first fill-up at a Shell station. Shell offers 3x miles on every gallon of fuel purchased at its gas stations.

24. Donate to charity

American Airlines has partnered with Stand Up to Cancer to offer 10 AAdvantage miles for every $1 you donate to the charity, on donations of $25 or more.

25. Convert points from hotels to American Airlines

American Airlines has partnered with hotel rewards programs that allow you to convert your hotel points into AAdvantage miles. Although conversion from hotel points into airline miles is usually at a poor ratio and not advisable, it's something you'll have to judge on a case-by-case basis.

Current partners include:

Hyatt Hotels & Resorts.

IHG Hotels & Resorts.

Marriott Bonvoy.

Marriott Vacation Club.

26. Stay at Hyatt Hotels

World of Hyatt and the American Airlines AAdvantage program have teamed up to offer reciprocal benefits for elite status members.

The partnership allows everyone (regardless of status) to earn:

1 AAdvantage mile for every $1 you spend on Hyatt stays and experiences.

1 World of Hyatt point for every $1 spent on qualifying American Airlines flights.

These points and miles are earned in addition to the ones earned with each respective program, effectively doubling your rewards. You must log in and then link your American Airlines and Hyatt accounts to earn these points.

Those who have elite status with both Hyatt and American Airlines can earn 1 additional AAdvantage mile per $1 spent on Hyatt stays and 1 additional Hyatt point per $1 spent on American Airlines.

» Learn more: How the Hyatt-American status match works

27. Purchase American Airlines AAdvantage miles

Last (and certainly least) is purchasing American Airlines miles. Generally, miles purchases make sense only in very limited circumstances, such as: topping up your account to book an award ticket, purchasing miles for a premium award or buying miles as a transaction to keep your miles from expiring. (Members under age 21 are exempt from mileage expiration.)

Buying miles at a discount is the main instance in which it can make sense to purchase miles. The key is to get it as close to NerdWallet's valuation, currently 1.6 cents for American Airlines AAdvantage miles.

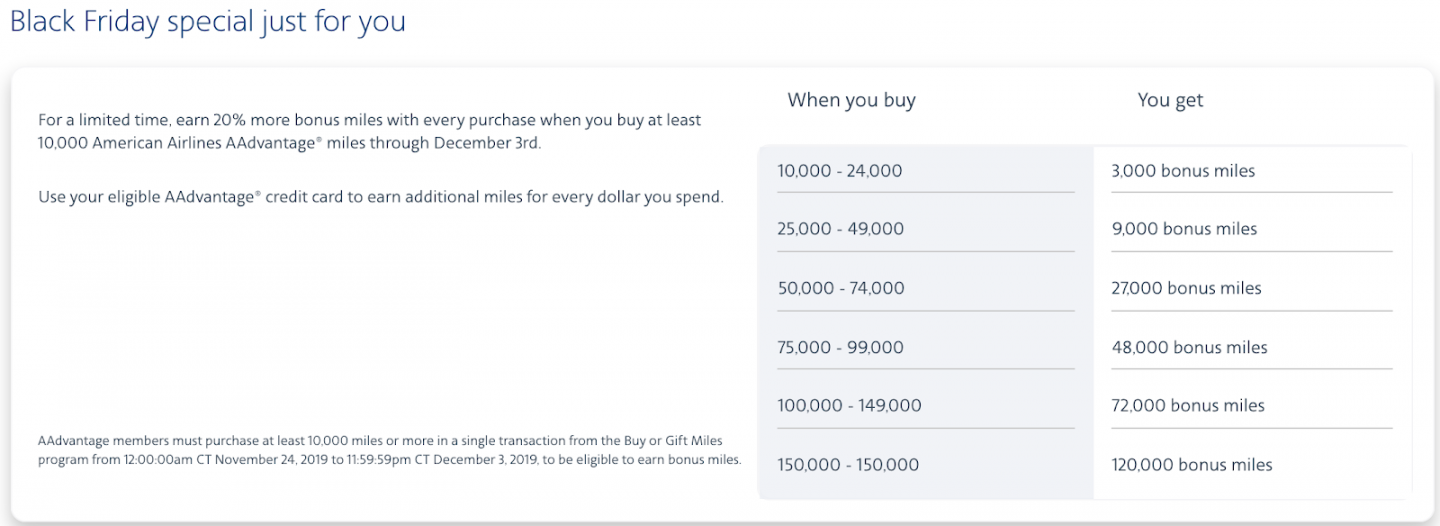

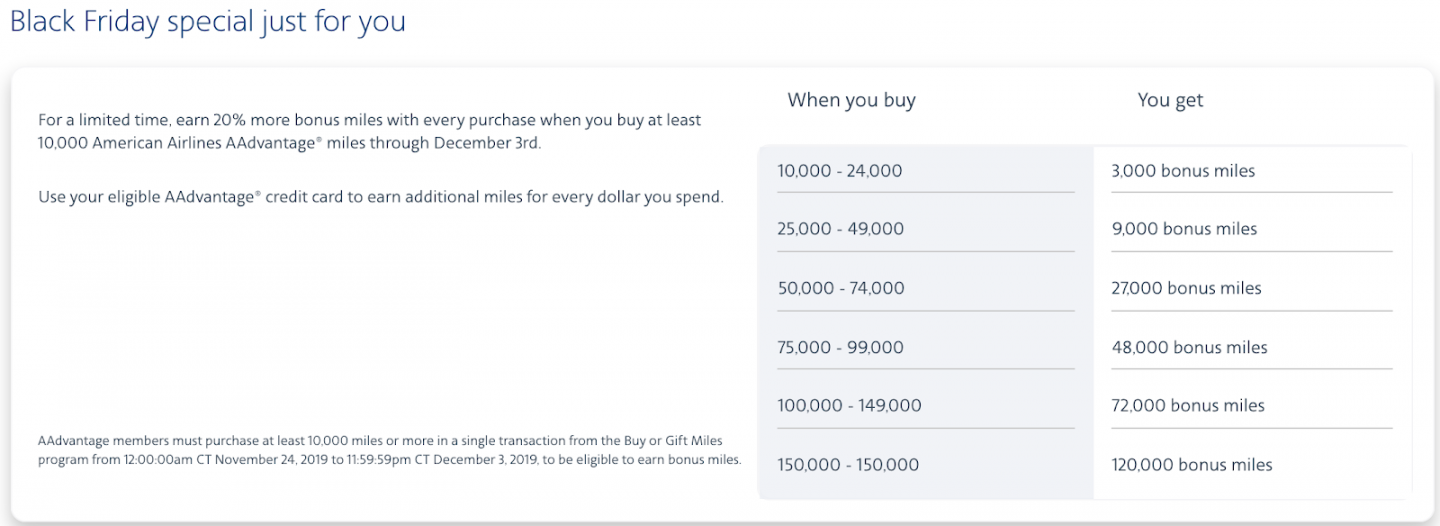

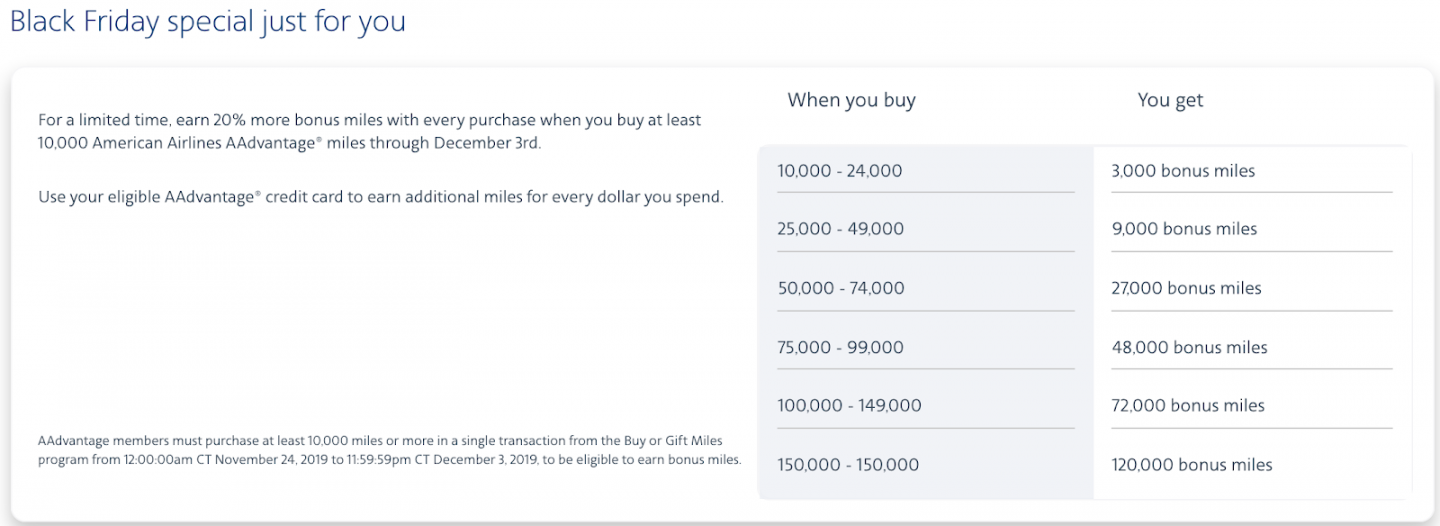

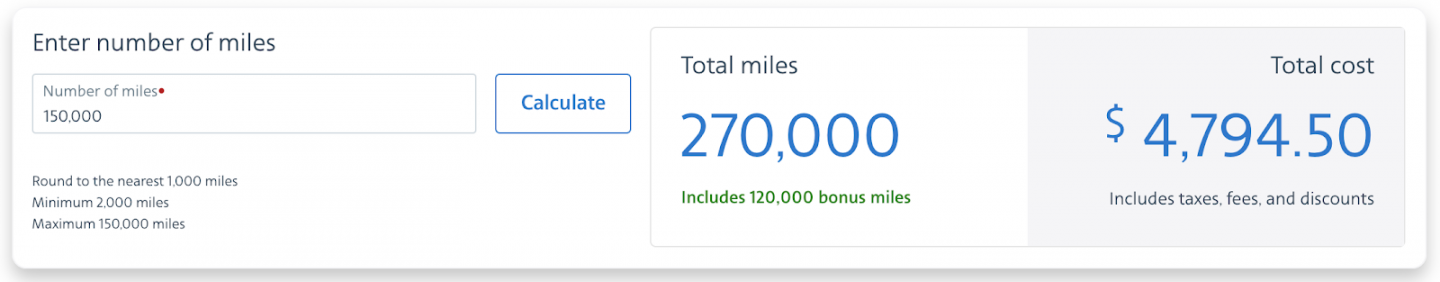

Here's an example of a past promotion that might make a miles purchase worthwhile:

If you purchased the maximum of 150,000 miles, you would get a 120,000-mile bonus, for a total of 270,000 miles.

This purchase would set you back $4,794.50, which comes out to 1.8 cents per mile. For the typical traveler, we’ve outlined many cheaper ways to acquire AAdvantage miles, so buying miles should be your last resort.

Ways to earn AAdvantage miles recapped

These mileage-earning opportunities won't apply to everyone, but try to incorporate the ways that work best for you.

Getting into the habit of earning miles for everyday activities can help grow your AAdvantage balance faster and bring you closer to that award ticket that you’ve been planning for.

The information related to AAdvantage® Aviator® Red World Elite Mastercard® has been collected by NerdWallet and has not been reviewed or provided by the issuer or provider of this product or service.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2025:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph® Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card