How to Pick the Right Rewards Credit Card

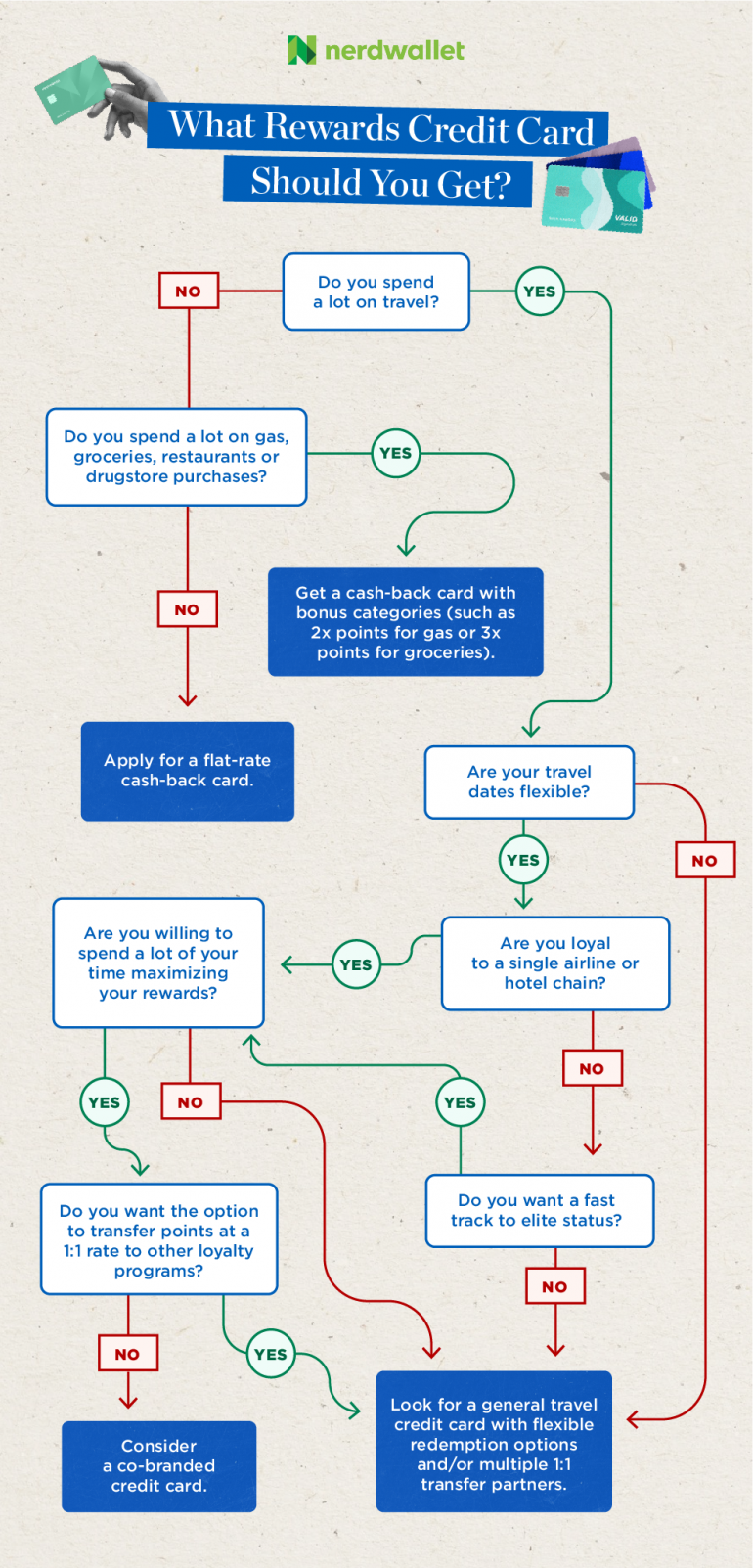

Not every rewards card is right for every user. Think about how you spend and how you'd like to use rewards.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Airline miles. Hotel points. Cash back. When choosing a rewards credit card, no one size fits all. Before pouncing on a card offer, though, here are five things to consider:

How do you want to redeem rewards?

How much effort will you put in to maximize the rewards you earn?

How do you spend your money?

Are you partial to any loyalty programs?

Are you willing to pay an annual fee?

We'll break it all down for you here.

How do you want to redeem rewards?

Rewards credit cards fall broadly into two categories: cash back and travel rewards. If you don’t travel, the choice is pretty straightforward. Otherwise, you have a decision to make.

Cash-back: best for simple redemption

Cash-back credit cards offer rewards with a fixed dollar value that you can redeem for cash. Redeeming rewards is usually very simple, but you won’t be able to optimize the rewards you earn like you can with a travel credit card.

Travel points and miles: best for rewards hackers

Unlike cash back, the value of travel rewards will vary depending on how you redeem them. Because of this, you can sometimes fly business class or international for much less in points than it might cost in cash.

There’s a big caveat though. Really optimizing your earnings might mean spending a lot of time navigating tedious loyalty program rules or experimenting with lots of different redemption options. If you’re looking for an uncomplicated card, you can still find a travel card that works for you. But it does narrow down the search a bit.

Terms and conditions apply. Credit products subject to lender approval.

A small number of rewards cards don’t fall into either cash back or travel rewards categories. For example: some store credit cards offer rewards in the form of discounts you can only use at the issuing store.

How much effort will you put in to maximize the rewards you earn?

Most cards earn different rates on different types of purchases. Get a card that’s a poor fit and you’ll likely end up missing out on a big chunk of the card’s value.

Fixed bonus categories

Most credit cards offer 2% or more on specific spending categories like grocery shopping, restaurants or gas stations. You’ll still be rewarded for other spending, but at a much lower rate, like 1% to 1.5%.

Rotating categories

Unlike cards with fixed bonus categories, cards with rotating categories will reward different spending categories periodically, usually once a quarter. These cards take the most effort to use, but they can also be the most rewarding since you can typically earn 5% back on these categories.

Flat rate rewards cards

If you’re not interested in keeping track of spending categories or prefer to keep just one card in your wallet, a card with flat-rate rewards might be a good option. For a while, 1.5% back was the standard for flat-rate rewards cards. But now, you can snag a card with 2% back or more.

» MORE: Best credit card tips right now

How do you spend your money?

Unless you decide to stick with a flat-rate rewards card, you'll want to find a card that matches how you spend your money. Besides travel purchases, grocery stores, restaurants and gas stations are some of the most common bonus categories. But you can also find cards that rewards other purchases, like online shopping or entertainment.

Are you partial to any loyalty programs?

If you decide to apply for a travel credit card, a co-branded credit card can give you additional perks with your preferred airline or hotel chain, plus greater earning power with that brand. But you will lose some flexibility: You’ll only be able to redeem these rewards with a few companies. Plus, you could run into limited seat availability or hotel rooms.

In exchange for fewer perks with a specific airline or hotel, general travel credit cards come with much greater flexibility. Depending on the card, you might be able to redeem points by transferring points to partner airlines or hotels, booking travel through your issuer’s travel portal, or receiving statement credits for travel purchases.

Are you willing to pay an annual fee?

Paying for a credit card might seem counterintuitive, but cards with an annual fee will come with higher rewards rates and a slew of perks.

A few cash-back credit cards come with an annual fee (usually $95 or less). But the real investment comes from travel credit cards, where annual fees can run anywhere from $95 to $695.

Most cards with high annual fees come with valuable perks like travel statement credits and airport lounge access, plus a high rewards rate. If you’re able to take advantage of what a card offers, it will usually make up for the annual fee.

But if you’re a thrifty traveler who values saving money over traveling in luxury, you can still find a valuable travel card with a low annual fee or none at all.

Choose with confidence

Choosing the best credit card for you will take some effort, but it’s well worth it. You’ll be able to find a credit card strategy that earns you solid rewards for years to come. So resist the urge to pick the first card you come across. Slow down, weigh the options and think about what you really want.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.