Business Loan Requirements: 7 Things You’ll Need to Qualify

Understanding a lender's requirements before you apply for a small-business loan can help set you up for success.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Concerned about tariffs?

Many small-business owners are under increased economic stress and uncertainty following the latest tariff announcements. NerdWallet is here to help you find answers for whatever you're looking for. Here are some resources to help you get started:

- Need emergency funding? Consider a business line of credit.

- Looking for fast access to working capital? Discover the best working capital loans.

- Want tips on how to mitigate the impact of tariffs? Read our guide.

Finding and applying for a small-business loan can be time-consuming. By knowing lenders' typical business loan requirements ahead of time, you can streamline the process and avoid potential frustration.

Here are seven things lenders generally look at to decide whether you qualify for a loan.

How much do you need?

We'll start with a brief questionnaire to better understand the unique

needs of your business.

Once we uncover your personalized matches, our team will consult you

on the process moving forward.

Find the right loan for your business

Tell us how much you need and see your options in minutes.1. Personal and business credit scores

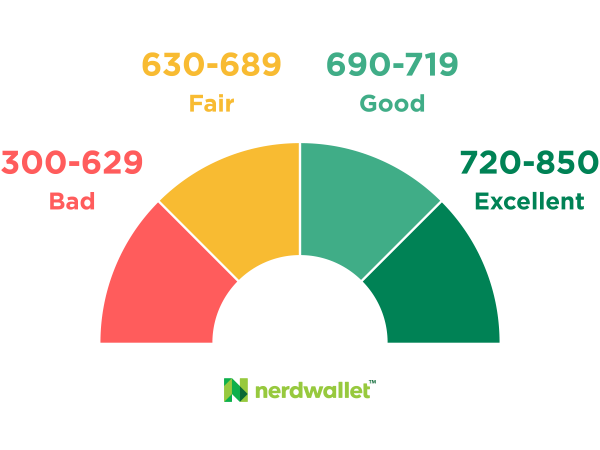

You’ll likely need good personal credit (typically a score of 690 or higher) or excellent business credit to qualify for a government-backed SBA loan or traditional bank small-business loan.

Online lenders, on the other hand, can be more lenient with credit scores, instead placing greater emphasis on your business’s cash flow and track record. Some online lenders and nonprofit organizations offer business loans for bad credit and may accept personal credit scores as low as 500.

Personal credit scores indicate your ability to repay personal debts, such as credit cards, car loans and mortgages. Small-business lenders require a personal credit check because they want to see how you manage debt.

FICO scores, commonly used in lending decisions, range from 300 to 850 (the higher, the better). You can get a free credit score on NerdWallet and a free copy of your credit reports at AnnualCreditReport.com.

Fast ways to build your personal credit include disputing any inaccuracies in your report and paying bills on time and in full.

More-established companies will have business credit scores — generally ranging from 0 or 1 to 100 — with credit bureaus such as Experian, Equifax and Dun & Bradstreet. Steps to building business credit include opening a business bank account, using trade credit responsibly and keeping public records clean.

2. Annual revenue

Many lenders will only consider businesses that bring in at least a minimum monthly or annual revenue. Lenders look at your revenue to make sure that you have enough cash flow to afford your loan.

How much cash flow you’ll need depends on the individual lender — for example, online lender OnDeck requires $100,000 in annual revenue to qualify for its line of credit, while Bank of America’s minimum is $250,000 for its secured business loans.

If you don’t meet lender requirements for a business loan with low revenue, you’ll likely have to rely on alternative financing options, like invoice factoring.

Debt service coverage ratio

A similar financial metric your lender may consider is your debt service coverage ratio (also known as DSCR). This ratio compares your available operating income to your current debt obligations. To calculate your DSCR, you divide your annual operating income by your total annual debt payments.

For example, if your annual income is $150,000 and your total debt payments are $100,000, your debt service coverage ratio would be 1.5. Generally, lenders want to see a ratio higher than 1, typically a minimum of 1.25 , as this indicates that your cash flow is sufficient to cover your debt obligations.

Talk With a Loan Expert

No cost, no credit impact

Guidance at every step Your loan expert supports you from application to funding.

Proven expertise in business financing We help you understand your options and move forward confidently.

$6B+ in small business funding We’ve helped thousands of business owners secure financing.

3. Years in business

Lenders use your time in business as a quick measure of success. The longer you’ve been operating, the more likely you are to have money to repay your debts.

To qualify for a business loan from a bank, you’ll typically need at least two years in business. Similarly, many SBA lenders require you to have at least two years in business. Online business loans tend to have less stringent requirements but still usually require at least six months in business.

➡️ Ready to get funding?

- If you're a newer business, check out our list of the best startup business loans. Businesses with three months or more in operation may be able to qualify.

- If your business is established, compare the best overall business loans to see our top options across categories.

4. Business industry and size

Every industry has a different risk level — and some industries, like restaurants and beauty services, can be considered high risk because they’re more likely to have inconsistent revenue.

There are also certain industries that many lenders don’t work with at all. These typically include adult entertainment, drug dispensaries or products, gambling and money service businesses.

Government-backed loans from the U.S. Small Business Administration have specific size and industry criteria, among other unique requirements. If you want to qualify for SBA loans, you’ll need:

SBA loan requirements

- Your business must meet the SBA's definition of a "small" business, which varies by industry.

- You must be a for-profit company.

- You can’t operate in an ineligible industry, like real estate investing, gambling or political lobbying activities.

- You must be current on all government loans with no past defaults — you’ll be disqualified if you’ve been late (you haven’t paid within 90 days of the due date) on a federal student loan or government-backed mortgage, for instance.

5. Business plan and loan proposal

Lenders want to see that you’ll use the money wisely — and that you can repay it. You may need to submit:

- A business plan that explains your goals and how you’ll reach them.

- A loan proposal outlining how much money you’re requesting, what you’ll use it for and how you plan to repay it.

These documents should clearly demonstrate that you will have enough cash flow to cover ongoing business expenses and the new loan payments. This can give the lender more confidence in your business, increasing your chances at loan approval.

On the other hand, if you’re a new business that doesn’t have existing revenue to show a lender, a thorough business plan can help convince it that you will be successful in the future.

Use NerdWallet’s business loan calculator to estimate your monthly loan payments:

Estimate payments to understand the cost of a business loan

Over the course of the loan, expect to pay

$0.00/mo

Payment breakdown

Total principal

$0.00

Total interest

$0.00

Total principal & interest

$0.00

| Payment date | Principal | Interest | Balance |

|---|---|---|---|

| Today | $0 | $0 | $0.00 |

6. Collateral or personal guarantee

Many lenders require collateral or a personal guarantee to secure a small-business loan.

- Collateral is an asset, such as equipment, real estate or inventory, that can be seized and sold by the lender if you don’t repay your loan.

- A personal guarantee means you’re responsible for repaying the debt if your business can’t.

For example, SBA 7(a) loans above $50,000 typically require collateral plus a personal guarantee from every owner of 20% or more of the business .

Some lenders offer unsecured business loans, which don’t require physical collateral. However, they may still:

- Require a personal guarantee, or

- Take out a blanket lien on your business assets, which gives them the right to take business assets (real estate, inventory, equipment) to recoup an unpaid loan.

Each lender has its own rules, so ask questions if you're unsure about the loan requirements.

7. Business and financial documents

Banks and other traditional lenders typically require extensive documentation when you apply for a small-business loan. The financial and legal documents you may need to provide when applying for a small-business loan include:

- Personal and business income tax returns.

- Financial documents, such as profit and loss statements, balance sheets and cash flow statements.

- Personal and business bank statements.

- A photo of your driver’s license.

- Commercial leases.

- Business licenses.

- Articles of incorporation.

- Proof of collateral.

- Business plan.

- Existing debt schedule, if applicable.

- Legal contracts and agreements.

- A resume that shows relevant management or business experience.

- Financial projections if you have a limited operating history.

Online lenders may provide a streamlined application process with minimal documents and faster underwriting.

Nerdy Perspective

Double check your documentation to streamline loan approval

When I talked to commercial lending experts, they said one of the most common mistakes business owners make when applying for a loan is submitting incorrect or stale items to the lender.

Not only does this mistake slow down the application process, but it can also lead to automatic rejections. If a lender is using automated underwriting and you input incorrect information, it can result in an automatic rejection — even if you’re qualified.

As you’re completing your application, double check that your documentation is accurate and up to date. It can also be helpful to have a business partner, advisor or financial professional look over your application before you submit it.

Not only does this mistake slow down the application process, but it can also lead to automatic rejections. If a lender is using automated underwriting and you input incorrect information, it can result in an automatic rejection — even if you’re qualified.

As you’re completing your application, double check that your documentation is accurate and up to date. It can also be helpful to have a business partner, advisor or financial professional look over your application before you submit it.

Senior writer

Frequently asked questions

How do you qualify for a business loan?

Although business loan requirements vary from lender to lender, you’ll generally need good credit, strong finances and an established business history to qualify for a loan. Traditional lenders typically have the strictest requirements, whereas online lenders have relatively easy business loans to qualify for.

What do banks require for a small-business loan?

Banks generally require that you have good to excellent credit (score of 690 or higher), strong finances and at least two years in business to qualify for a loan. They’ll likely require collateral and a personal guarantee as well.

You’ll typically need to provide detailed paperwork as part of your application — and some banks will require you to apply in person.

What are the documents required for a business loan?

Each lender will have unique documentation requirements, but at the very least, you’ll likely need to provide:

- Business and personal bank statements.

- Business and personal tax returns.

- Financial statements, like balance sheets and income statements.

Traditional lenders typically require more paperwork than online lenders.

What disqualifies you from getting a business loan?

Common reasons for a business loan denial include:

- Too much existing debt.

- Poor credit history.

- Insufficient collateral.

- Not enough time in business.

- Weak cash flow or revenue.

- History of defaults or bankruptcy.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Chase for Business. Is your business financially fit? Your debt-service coverage ratio can tell you. Accessed Jan 5, 2026.

- 2. U.S. Small Business Administration. SOP 50 10 Lender and Development Company Loan Programs. Accessed Jan 5, 2026.

Related articles